The semiconductor bull run will persist till mid-2026, based mostly on earlier cycles, Financial institution of America stated.

It will profit three main business themes: cloud computing, automobiles, and complexity.

Nvidia, Broadcom, NXP Semiconductors, and KLA Company are amongst BofA’s prime picks.

The semiconductor bull run is a great distance away from really fizzling out, with synthetic intelligence momentum prone to carry it in the direction of a mid-2026 peak, Financial institution of America stated.

Ever since AI frenzy first took over markets, the semiconductor-tracking SOX index has shot previous benchmark indices, and is already up 26% year-to-date. In comparison with the S&P 500, it trades at a 4 to five occasions premium, the financial institution stated.

After all, a pullback may come from near-term triggers, such because the US election or financial coverage, however there’s good purpose to stay bullish, analysts wrote on Monday.

That is because the chip business usually undergoes 10 quarters of upside after experiencing a downcycle, a sample that has simply begun.

“The present upcycle began in late’23, so we’re solely in quarter 3, implying power possible until mid-26E. Nonetheless, chip shares (SOX) change course 6-9 months forward of cycle inflection, so semis may doubtlessly peak someday round 2H25, or one other yr+ from now,” Financial institution of America stated.

What’s extra, the sector is predicted to speed up in the direction of double digit annual gross sales progress in 2025, after final yr’s stock correction.

For traders making an attempt to seize this rally, the notice supplied three investing themes that can profit: cloud computing, automobiles, and complexity.

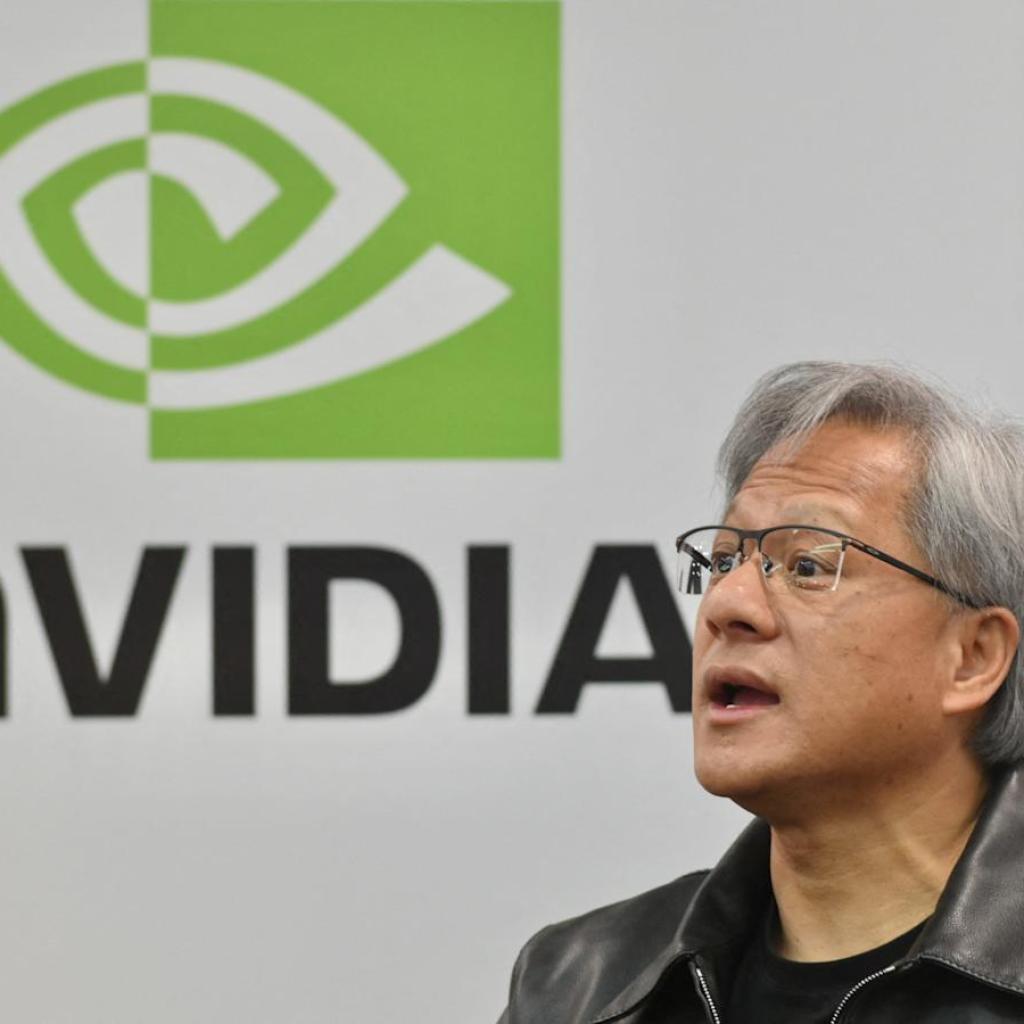

For the primary, Nvidia is a prime decide, in addition to Broadcom. Financial institution of America sees main upside potential for each, holding a $1,500 and $1,680 worth goal on every.

No less than for Nvidia, a few of this stems from bullish outlooks on AI knowledge heart expansions, which give robust demand for the agency’s {hardware}. Of immediately’s world IT spending, knowledge heart programs make up round 5%, or $260 billion, the financial institution stated. However by 2028, this might soar to $360 billion.

In the meantime, the rising significance of chips within the auto business ought to increase shares similar to NXP Semiconductors. This prime decide has worth goal of $320.

“Industrial/auto chip shares are much less crowded and provide diversification away from AI, with simpler compares going into CY25E,” the financial institution stated. “Finish of stock correction may help stable double gross sales progress into CY25E.”

Lastly, the rising complexity of semiconductor manufacturing ought to help the business’s climbing valuations, justifying the buying and selling vary of those shares, similar to KLA Company and Synopsis.

Story continues

Financial institution of America holds a worth goal of $890 and $650.

“The highest 5 world semicap tools shares are buying and selling at a 46% premium or 26x CY25 PE vs. 18x historic common,” analysts wrote. “We count on the premium to persist on leverage (elementary, sentiment) to AI pushed chip complexity, to world reshoring efforts, and to their stable 25%+ FCF margins even at trough of current [wafer fab equipment] cycle.”

Learn the unique article on Enterprise Insider