Share this text

Bitcoin’s perpetual futures markets are at the moment experiencing excessive funding charges, signaling a premium for lengthy positions and additional correction for spot costs, in response to the “Bitfinex Alpha” report’s newest version.

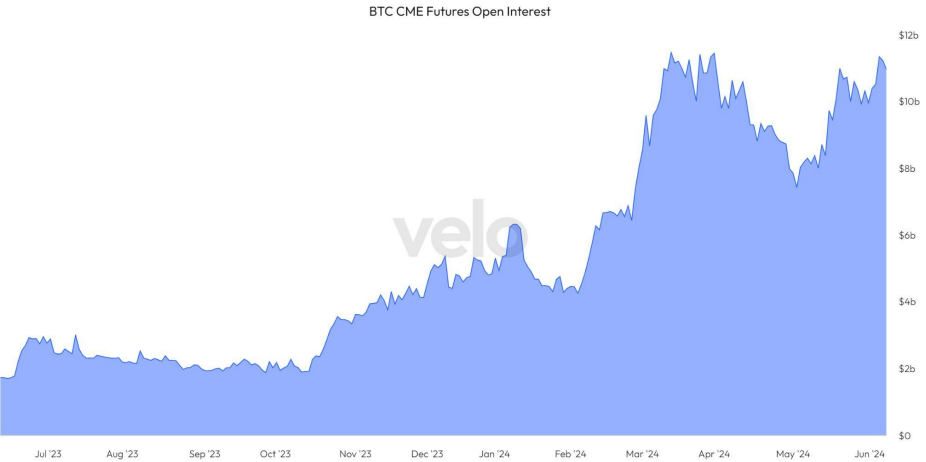

The rising Bitcoin CME futures open curiosity, reaching $11.4 billion as of June 4th, parallels the March all-time highs earlier than a notable worth correction. Merchants look like leveraging the idea arbitrage alternative, shorting Bitcoin on the open market whereas gaining spot publicity by way of ETFs, aiming to revenue from futures and spot market worth discrepancies.

Regardless of 20 consecutive days of ETF inflows since Could 10, potential disruptions loom with the upcoming US Client Worth Index report and the US Federal Open Market Committee’s rate of interest discussions set to occur this week.

Final week, Bitcoin’s worth fluctuated, reaching over $71,500 after which correcting to native lows round $68,500. Main altcoins skilled declines, with Ethereum (ETH) and Solana (SOL) dropping 7.5% and 12.1%, respectively.

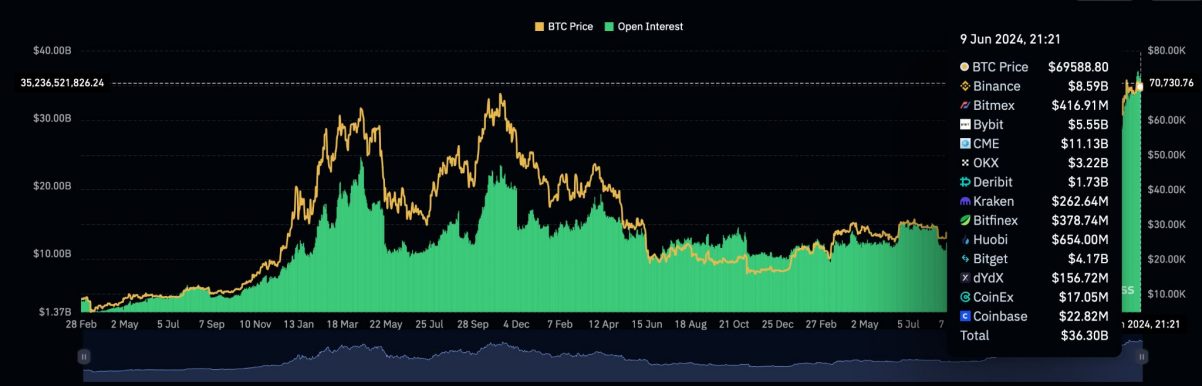

The latest “leverage flush” noticed vital liquidations in altcoin leveraged longs, with Coinglass information displaying Bitcoin open curiosity at an all-time excessive of $36.8 billion on June sixth.

Nonetheless, short-term holders have elevated their Bitcoin exercise, with holdings peaking at 3.4 million BTC in April. Lengthy-term holders, alternatively, are demonstrating confidence by accumulating Bitcoin, with the inactive provide for one-year holders remaining steady.

Bitcoin whales are additionally on an accumulation spree, with their steadiness reaching a brand new historic excessive.

Due to this fact, though derivatives information recommend a worth pullback within the brief time period, components comparable to elevated ETF shopping for exercise, diminished promoting strain from long-term holders, and improved liquidity may probably catalyze Bitcoin’s upward motion in the long run.

Share this text

The data on or accessed by way of this web site is obtained from impartial sources we imagine to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed by way of this web site. Decentral Media, Inc. will not be an funding advisor. We don’t give customized funding recommendation or different monetary recommendation. The data on this web site is topic to alter with out discover. Some or the entire data on this web site might develop into outdated, or it might be or develop into incomplete or inaccurate. We might, however are usually not obligated to, replace any outdated, incomplete, or inaccurate data.

Crypto Briefing might increase articles with AI-generated content material created by Crypto Briefing’s personal proprietary AI platform. We use AI as a device to ship quick, precious and actionable data with out dropping the perception – and oversight – of skilled crypto natives. All AI augmented content material is rigorously reviewed, together with for factural accuracy, by our editors and writers, and at all times attracts from a number of main and secondary sources when out there to create our tales and articles.

It’s best to by no means make an funding resolution on an ICO, IEO, or different funding based mostly on the data on this web site, and you need to by no means interpret or in any other case depend on any of the data on this web site as funding recommendation. We strongly suggest that you just seek the advice of a licensed funding advisor or different certified monetary skilled if you’re looking for funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any type for analyzing or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

See full phrases and situations.