Wall Avenue on Friday posted its worst week since mid-April, as a rotation out of expertise shares sparked by final Thursday’s shopper inflation report continued over the previous few days.

The tech-heavy Nasdaq Composite (COMP:IND) notched its first three-day dropping streak since June 24, slipping 0.81% to finish at 17,726.94 factors. The benchmark S&P 500 (SP500) fell 0.71% to shut at 5,505.09 factors, whereas the blue-chip Dow (DJI) shed 0.93% to settle at 40,287.53 factors.

Of the 11 S&P sectors, 9 ended within the crimson, with Power and Know-how rounding out the highest two losers. Well being Care and Utilities had been the 2 gainers.

For the week, the Nasdaq (COMP:IND) was down 3.65% and the S&P (SP500) 1.96%. Conversely, the Dow (DJI) was up 0.72%.

“The lazy days of summer time are right here, and the laziest people on the town are consumers, who’ve primarily headed to the shore with the fruitful features of their work since October 2022. We imagine there’s extra correction but to return as Q3 progresses,” Alex King, investing group chief of Cestrian Capital Analysis, instructed Looking for Alpha.

“We don’t suppose that is any form of Finish of Days or Grand Reckoning, merely a seasonal selloff into the election. We imagine all indices shall be up from right here by year-end; within the meantime, we imagine hedging is the investor’s good friend because the quarter continues,” King added.

As we speak’s headlines had been largely dominated by a worldwide outage skilled by companies that run Microsoft (MSFT) programs. The reason for the glitch was discovered to be a defect in a content material replace for Home windows hosts issued by cybersecurity supplier CrowdStrike (CRWD).

Shares of CrowdStrike (CRWD) plunged, with Oppenheimer calling the outage “a significant blow” to the corporate’s popularity and Wedbush highlighting a chance for opponents to step in and take benefit.

The “Magnificent 7” shares, which have been one of many foremost drivers of Wall Avenue’s bull run, put in one other combined efficiency on Friday, with the vast majority of them retreating. A number of members of the heavyweight membership are resulting from report quarterly outcomes over the subsequent two weeks amid extraordinarily excessive expectations.

Final Thursday’s comfortable shopper inflation report performed a giant function in cementing expectations for a 25 foundation level rate of interest minimize by the Federal Reserve in September. It additionally gave traders the arrogance to start out shifting out of megacap expertise names and into different property reminiscent of defensive and worth sectors and small-cap shares.

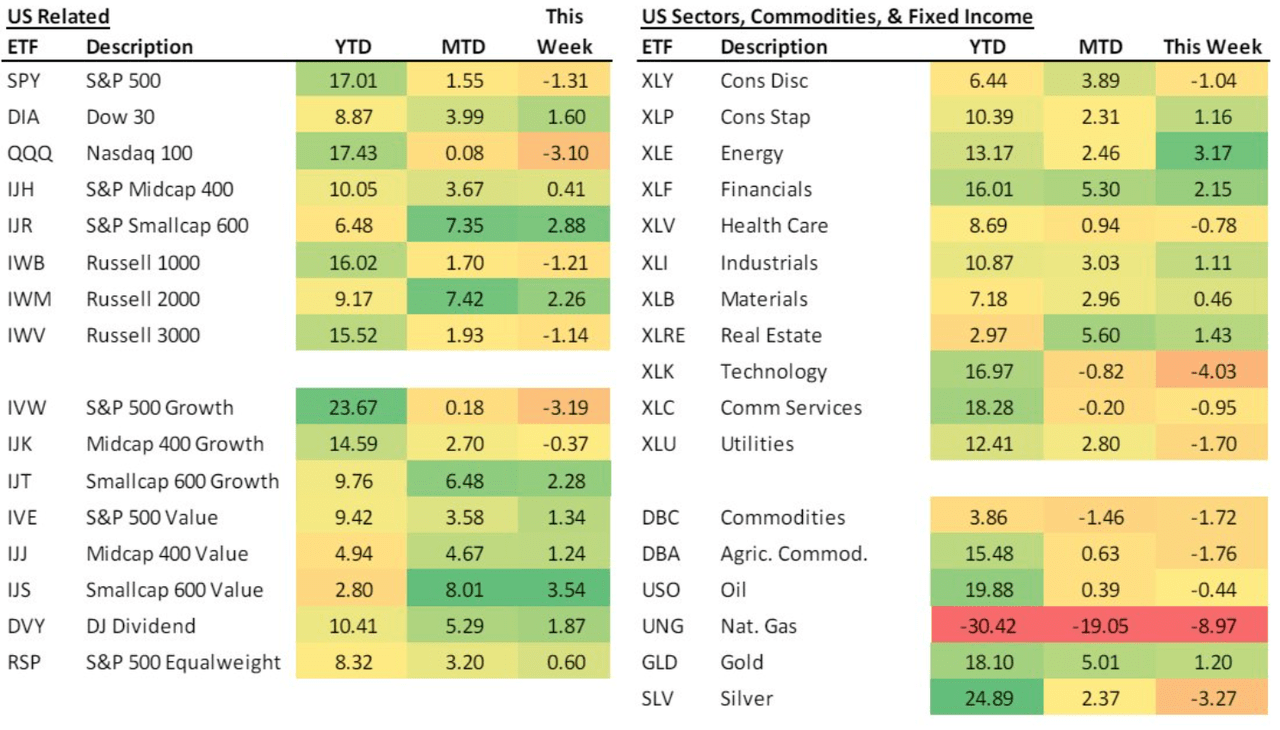

See under a chart from Bespoke Funding Group displaying this week’s rotation:

Netflix (NFLX) garnered some consideration on Friday, a day after the U.S. streaming large introduced quarterly outcomes. The corporate delivered a top- and bottom-line beat, whereas membership at its intently watched ad-supported tier grew 34% Q/Q. Executives on the convention name restated their dedication to rising margins.

Netflix (NFLX) garnered some consideration on Friday, a day after the U.S. streaming large introduced quarterly outcomes. The corporate delivered a top- and bottom-line beat, whereas membership at its intently watched ad-supported tier grew 34% Q/Q. Executives on the convention name restated their dedication to rising margins.

Talking of earnings, Dow 30 parts Vacationers (TRV) and American Categorical (AXP) reported their quarterly numbers. The insurer slumped, regardless of saying file Q2 internet earned premiums and offsetting vital disaster losses from extreme storms. In the meantime, the bank card issuer additionally declined after its income missed estimates on slowing tempo of shopper spending.

Turning to the fixed-income markets, U.S. Treasury yields had been greater. The longer-end 30-year yield (US30Y) was up 3 foundation factors to 4.45%, whereas the 10-year yield (US10Y) was up 4 foundation factors to 4.24%. The shorter-end, extra rate-sensitive 2-year yield (US2Y) was up 3 foundation factors to 4.51%.

See how Treasury yields have achieved throughout the curve on the Looking for Alpha bond web page.