The USA is dwelling to roughly a million companies that function automobile fleets, with a mean of 40 automobiles per fleet. Managing a business fleet entails quite a few issues, together with financing, upkeep, route optimization, insurance coverage, and fueling. Coast provides a complete fleet administration platform and built-in cost card system particularly designed for fleet automobile bills. This answer offers real-time visibility for gas purchases, seamless worker spend monitoring, and integration with present fleet administration instruments. Coast focuses on companies with subject service fleets like HVAC, plumbing, and development companies. The cost playing cards are accepted wherever Visa is accepted. On the income aspect, Coast earns an interchange price together with a $4 per 30 days price per issued card. Fleet operators earn a $.02 rebate per gallon of fuel bought whereas guaranteeing that worker automobile and gas spend are each aligned with expense insurance policies with elevated oversight.

AlleyWatch caught up with Coast Founder and CEO Daniel Simon to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, far more…

Who have been your traders and the way a lot did you elevate?We raised a $40M Collection B fairness financing, led by ICONIQ Progress. They have been joined within the spherical by present traders Accel, Perception Companions, Vesey Ventures, and Avid Ventures, in addition to new traders Thomvest. This brings Coast’s whole fairness funding to about $100M.

Inform us in regards to the services or products that Coast provides.Coast offers a contemporary, tech-forward expense administration software program platform with a business cost card – analogous to options from corporations like Ramp or Brex – however particularly designed for the huge and underserved sector of companies that function automobile fleets.Fleets like these have knowledge wants that common company playing cards don’t present. They want detailed visibility on the line-item degree into their staff’ spending. For instance, they wish to know what number of gallons of which gas grade are being purchased for which automobile, and to make it possible for their staff’ spending complies with firm insurance policies when these employees are within the subject.Coast offers a easy method for the workers of those companies to pay for fuel and different automobile bills after they’re on the job, wherever Visa is accepted. Coast provides finance and fleet administration groups highly effective instruments to regulate expense insurance policies and have insights into worker spending, to allow them to spend their time rising their companies sooner.

What impressed the beginning of Coast?

We began this enterprise on the peak of the COVID-19 pandemic, when logistics and cellular workforces, important employees on the entrance strains preserving the economic system functioning, have been beneath huge pressure. These “actual world” enterprise staff — supply folks, plumbers, HVAC installers, taxi and limo drivers — are generally ignored by the know-how trade. However they’re the hidden power that powers the digital age, making attainable each Amazon cargo or Shopify buy, each DoorDash supply or Uber journey. As our society demanded increasingly of those employees through the pandemic, their neighborhood’s wants and ache factors turned much more obvious to us. We got down to construct a enterprise that might enhance the working lives of cellular workforces whereas serving to their employers’ companies thrive.

We began this enterprise on the peak of the COVID-19 pandemic, when logistics and cellular workforces, important employees on the entrance strains preserving the economic system functioning, have been beneath huge pressure. These “actual world” enterprise staff — supply folks, plumbers, HVAC installers, taxi and limo drivers — are generally ignored by the know-how trade. However they’re the hidden power that powers the digital age, making attainable each Amazon cargo or Shopify buy, each DoorDash supply or Uber journey. As our society demanded increasingly of those employees through the pandemic, their neighborhood’s wants and ache factors turned much more obvious to us. We got down to construct a enterprise that might enhance the working lives of cellular workforces whereas serving to their employers’ companies thrive.

How is Coast completely different?Coast reimagines the product class with best-in-class safety and spend controls, real-time transaction knowledge and reporting, and integrations with fleet administration and telematics software program. Coast’s software program provides fleet managers highly effective insurance policies and controls that they’ll tailor to the on-the-job wants of various staff and automobiles of their fleets.

What market does Coast goal and the way massive is it?The fleet gas funds on these specialised playing cards add as much as a staggering estimated $120B transacted yearly within the US.Coast focuses on subject companies fleets, e.g. HVAC, plumbing, development companies, in addition to passenger transport and native supply fleets.

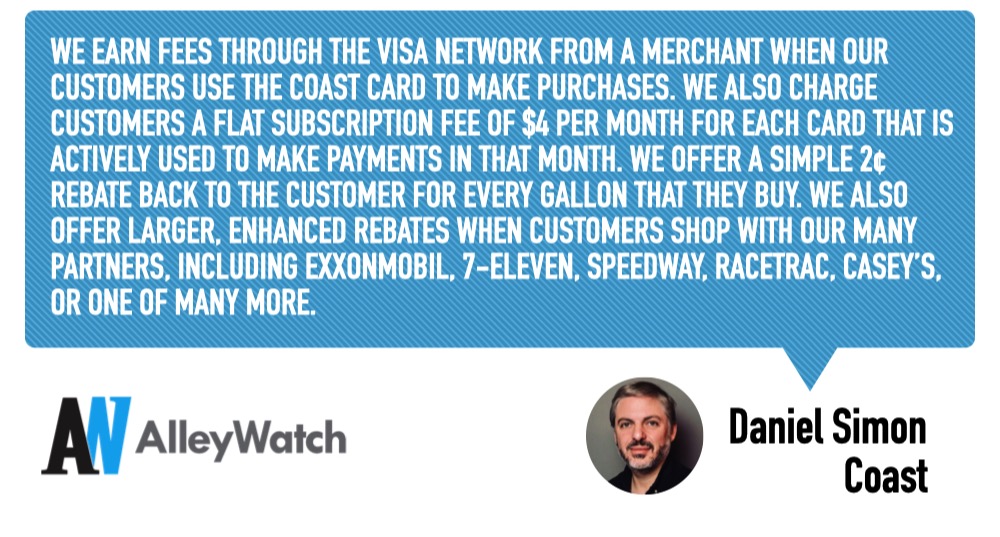

What’s your online business mannequin?We earn charges via the Visa community from a service provider when our clients use the Coast card to make purchases. We additionally cost clients a flat subscription price of $4 per 30 days for every card that’s actively used to make funds in that month. We provide a easy 2¢ rebate again to the shopper for each gallon that they purchase. We additionally supply bigger, enhanced rebates when clients store with our many companions, together with ExxonMobil, 7-Eleven, Speedway, RaceTrac, Casey’s, or one in every of many extra.

How are you getting ready for a possible financial slowdown?Initially, this fundraise ensures the corporate has the sources to climate any storm that could be coming, so long as Coast responsibly stewards its capital. Extra basically, Coast avoids focus in its buyer portfolio and serves 1000’s of companies throughout trade classes. Whereas Coast shares within the development of corporations that profit from growth instances, like development, we additionally serve corporations which have much less publicity to financial cycles, like these in residential companies for plumbing or electrical. This broad buyer base ensures the corporate can preserve income even in a downturn.

What was the funding course of like? As we began to construct a relationship with ICONIQ Progress over some months, each groups grew more and more excited in regards to the potential to work collectively. ICONIQ understood and believed in our imaginative and prescient, and knew we had the tenacity to make it occur, and we have been equally impressed with the sources and dedication with which ICONIQ helps its portfolio corporations to develop. With our bold development objectives and an unsure capital markets setting, it made sense to arm the corporate with extra capital, and ICONIQ appeared to us to be good companions in that function.

What are the largest challenges that you simply confronted whereas elevating capital?The enterprise capital markets have proven considerably decreased exercise after 2021 and capital isn’t as simply out there to startups because it was in prior years. That stated, Coast’s demonstrated development, sustainable enterprise mannequin, and dependable clients impressed the continued enthusiasm of our present traders and sparked the curiosity of our new lead investor, who dug deep into our product and market and have become excited to get entangled.

What elements about your online business led your traders to write down the verify?The large market alternative, quick development and business traction, and the event of a number of efficient channels for buying clients throughout advertising, gross sales, and distribution companions. However most of all, listening to from our clients that they love the Coast product and that it’s categorically higher than something they’ve used earlier than for fleet and gas funds.

![]()

What are the milestones you propose to realize within the subsequent six months?

Launching a first-of-its-kind cellular app that eases the gathering and verification of transaction knowledge for fleet funds.

Constructing out specialised expense administration performance that helps our clients’ monetary processes, together with job codes and integrations with subject companies administration software program.

Integrating with new platforms that our clients use, throughout fleet administration, telematics, accounting, and ERP platforms.

Launching extra partnerships with gas manufacturers, fleet administration corporations, subject service software program suppliers, and different vital distributors for our clients.

Rising the staff throughout our New York Metropolis headquarters and our increasing Utah workplace.

What recommendation are you able to supply corporations in New York that don’t have a contemporary injection of capital within the financial institution?Give attention to worthwhile and capital-efficient buyer acquisition and unit economics. however don’t neglect investing in development. If in case you have a really differentiated product and your clients are sticking along with your product, the capital is on the market to gas fast-growing merchandise that clients love.

The place do you see the corporate going within the close to time period?We intend to make use of the brand new capital to proceed to put money into constructing a best-in-class product for the fleets vertical, together with increasing to different monetary companies wants of its enterprise clients, equivalent to accounts payable automation and invoice funds. We at the moment have a staff of round 65 staff, largely headquartered in New York Metropolis, and a rising presence at our second workplace in Utah, which we opened earlier this yr. The corporate is actively hiring to develop headcount throughout its capabilities. We’ll concentrate on product growth, including new integration companions in addition to supporting enterprise bills past gas. Over time, with developments in different automobile vitality and facilitating the acquisition of fuel that fuels an inner combustion engine, we may also be powering the transaction that expenses an electrical automobile battery that will get the HVAC installer to his job or the package deal supply driver to her vacation spot.

What’s your favourite summer time vacation spot in and across the metropolis?The pond in Prospect Park in Brooklyn!