Up to date on July twenty sixth, 2024 by Bob Ciura

Month-to-month dividend shares will be a pretty funding possibility for these searching for steady earnings. That’s as a result of month-to-month dividend shares present a predictable and constant stream of money circulate.

Month-to-month dividends enable traders to obtain extra frequent funds than shares which pay quarterly or semi-annual dividend payouts.

Because of this, month-to-month dividend shares can assist to cowl dwelling bills, or complement different sources of earnings.

There are simply ~80 month-to-month dividend shares that at present provide a month-to-month dividend fee.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

Nevertheless, not all month-to-month dividend shares are equally secure.

There are lots of examples of month-to-month dividend shares decreasing or eliminating their dividends. Total, regardless of the optimistic attributes hooked up to month-to-month dividend shares, their danger profile will be elevated as they try to take care of their extra frequent payouts.

On this article, now we have analyzed the ten month-to-month dividend shares from our Positive Evaluation Analysis Database with the most secure dividends primarily based on our Dividend Threat Rating score system.

The ten most secure month-to-month dividend shares under have been organized so as, primarily based on their Dividend Threat Scores. If there’s a tie, their rating is set by their payout ratio, with the bottom payout ratio incomes the next place.

Desk of Contents

Month-to-month Dividend Inventory #10: Agree Realty (ADC)

Dividend Yield: 4.5%

Payout Ratio: 74%

Agree Realty Corp. (ADC) is an built-in actual property funding belief (REIT) centered on possession, acquisition, improvement, and retail property administration. Agree has developed over 40 group procuring facilities all through the Midwestern and Southeastern United States.

On April twenty third, 2024, Agree Realty Corp. reported first quarter outcomes. The corporate invested $140 million in 50 retail web lease properties and initiated 4 improvement tasks with a complete dedicated capital of $18 million. Web earnings per share decreased by 2.4% to $0.43, whereas Core FFO per share elevated by 3.5% to $1.01, and AFFO per share rose by 4.6% to $1.03.

A month-to-month dividend of $0.250 per frequent share was declared for April, a 2.9% enhance year-over-year. The Firm ended the quarter with over $920 million in complete liquidity and maintained a powerful stability sheet.

Click on right here to obtain our most up-to-date Positive Evaluation report on Agree Realty Corp. (ADC) (preview of web page 1 of three proven under):

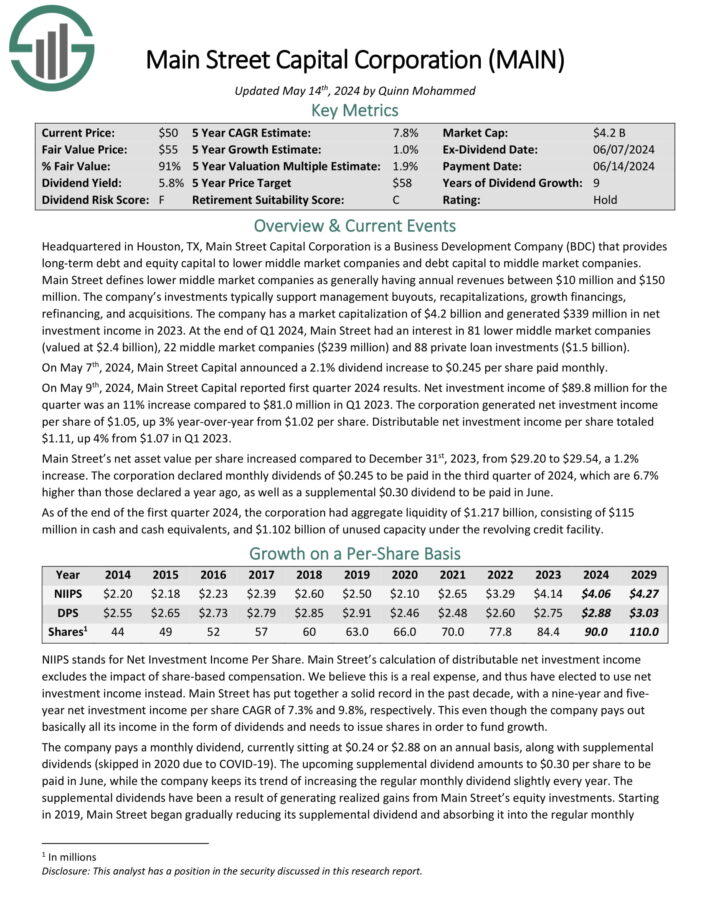

Month-to-month Dividend Inventory #9: Important Avenue Capital (MAIN)

Dividend Yield: 5.7%

Payout Ratio: 71%

Important Avenue Capital Company is a Enterprise Growth Firm (BDC) that gives long-term debt and fairness capital to decrease center market corporations and debt capital to center market corporations.

On the finish of Q1 2024, Important Avenue had an curiosity in 81 decrease center market corporations (valued at $2.4 billion), 22 center market corporations ($239 million) and 88 non-public mortgage investments ($1.5 billion).

On Might seventh, 2024, Important Avenue Capital introduced a 2.1% dividend enhance to $0.245 per share paid month-to-month. On Might ninth, 2024, Important Avenue Capital reported first quarter 2024 outcomes. Web funding earnings of $89.8 million for the quarter was an 11% enhance in comparison with $81.0 million in Q1 2023.

The company generated web funding earnings per share of $1.05, up 3% year-over-year from $1.02 per share. Distributable web funding earnings per share totaled $1.11, up 4% from $1.07 in Q1 2023.

Important Avenue’s web asset worth per share elevated in comparison with December thirty first, 2023, from $29.20 to $29.54, a 1.2% enhance.

Click on right here to obtain our most up-to-date Positive Evaluation report on MAIN (preview of web page 1 of three proven under):

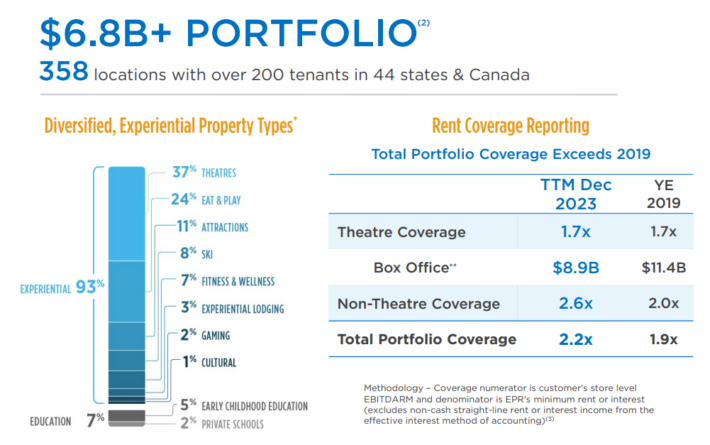

Month-to-month Dividend Inventory #8: EPR Properties (EPR)

Dividend Yield: 7.6%

Payout Ratio: 70%

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require business data to function successfully.

It selects properties it believes have sturdy return potential in Leisure, Recreation, and Schooling. The portfolio contains about $7 billion in investments throughout 350+ places in 44 states, together with over 200 tenants.

Supply: Investor Presentation

EPR posted first quarter earnings on Might 1st, 2024. The corporate posted adjusted funds-from-operations of $1.12 per share.

Within the year-ago interval, adjusted FFO-per-share was $1.30. Income was down 2.4% year-over-year to $167 million.

EPR enjoys excessive occupancy charges, which afford it pricing energy and better margins over time. Latest outcomes appear to point that the worst is behind EPR, and the Regal restructuring is an enormous step ahead.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPR (preview of web page 1 of three proven under):

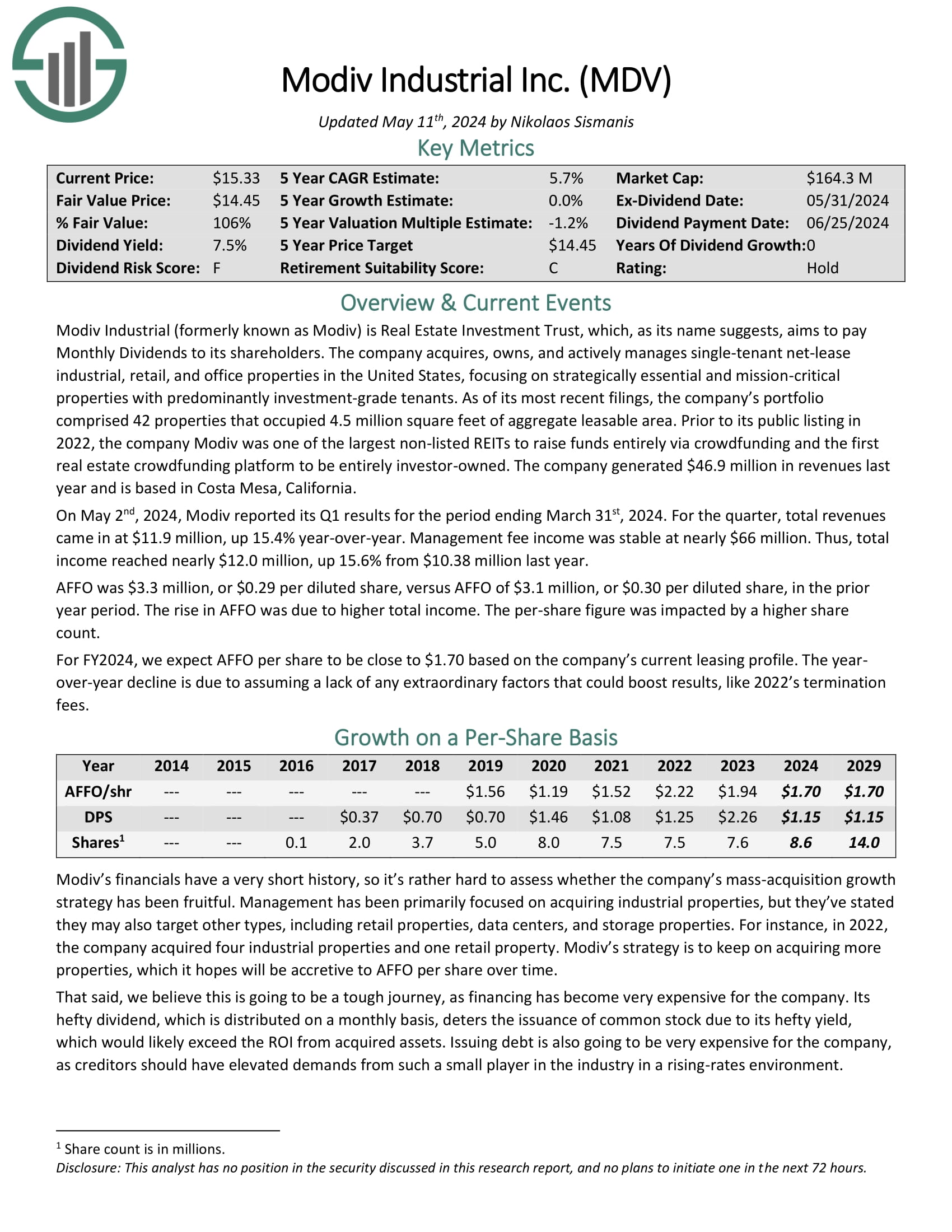

Month-to-month Dividend Inventory #7: Modiv Industrial (MDV)

Dividend Yield: 7.8%

Payout Ratio: 68%

Modiv Industrial acquires, owns, and actively manages single-tenant net-lease industrial, retail, and workplace properties in the USA, specializing in strategically important and mission-critical properties with predominantly investment-grade tenants.

As of its most up-to-date filings, the corporate’s portfolio comprised 44 properties that occupied 4.6 million sq. ft of combination leasable space.

On March 4th, 2024, Modiv reported its This autumn and full-year outcomes for the interval ending December thirty first, 2023. For the quarter, complete revenues got here in at $12.3 million, up 23% year-over-year, excluding the 2022 lease termination payment.

AFFO was $4.5 million, or $0.40 per diluted share, versus AFFO of $6.9 million, or $0.68 per diluted share, within the prior 12 months interval.

For the 12 months, AFFO declined to $1.94 from $2.22 in FY2022. The decline in AFFO for each intervals was on account of greater curiosity bills on account of rising rates of interest. For context, in This autumn, curiosity bills skyrocketed by 149% to $7.05 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDV (preview of web page 1 of three proven under):

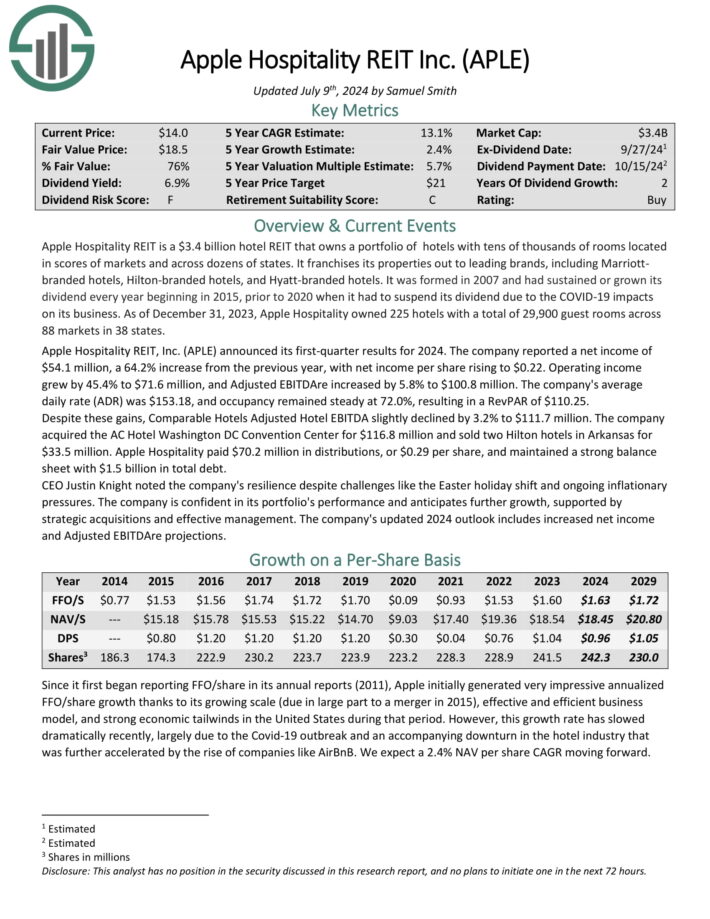

Month-to-month Dividend Inventory #6: Apple Hospitality REIT, Inc. (APLE)

Dividend Yield: 6.6%

Payout Ratio: 59%

Apple Hospitality REIT is a lodge REIT that owns a portfolio of lodges with tens of 1000’s of rooms positioned throughout dozens of states.

It franchises its properties out to main manufacturers, together with Marriottbranded lodges, Hilton-branded lodges, and Hyatt-branded lodges.

As of December 31, 2023, Apple Hospitality owned 225 lodges with a complete of 29,900 visitor rooms throughout 88 markets in 38 states.

Supply: Investor Presentation

Apple Hospitality REIT introduced its first-quarter outcomes for 2024. The corporate reported a web earnings of $54.1 million, a 64.2% enhance from the earlier 12 months, with web earnings per share rising to $0.22.

Working earnings grew by 45.4% to $71.6 million, and Adjusted EBITDAre elevated by 5.8% to $100.8 million. The corporate’s common day by day fee (ADR) was $153.18, and occupancy remained regular at 72.0%, leading to a RevPAR of $110.25.

Regardless of these beneficial properties, Comparable Accommodations Adjusted Lodge EBITDA barely declined by 3.2% to $111.7 million. The corporate acquired the AC Lodge Washington DC Conference Middle for $116.8 million and offered two Hilton lodges in Arkansas for $33.5 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on APLE (preview of web page 1 of three proven under):

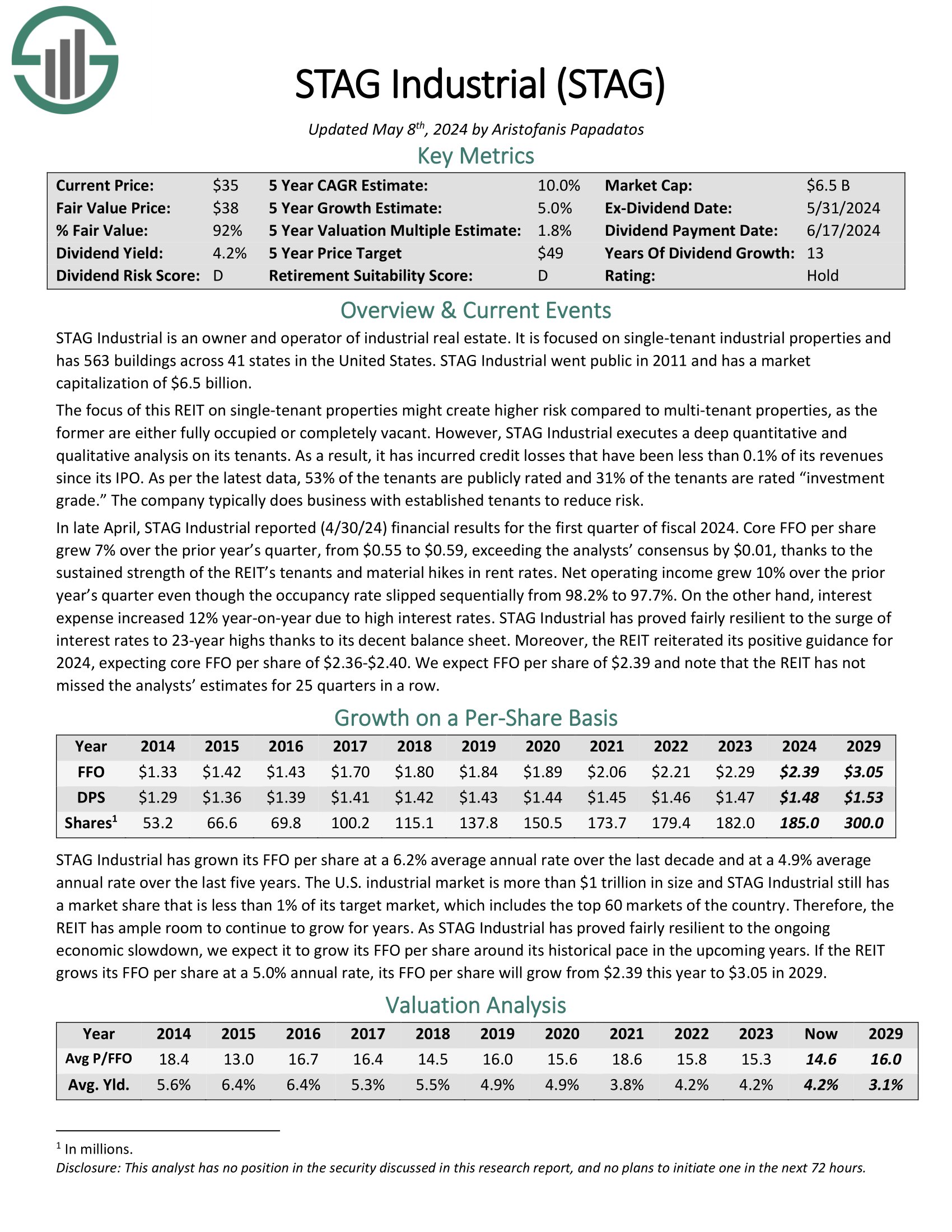

Month-to-month Dividend Inventory #5: STAG Industrial, Inc. (STAG)

Dividend Yield: 3.8%

Payout Ratio: 62%

STAG Industrial is an proprietor and operator of business actual property. It’s centered on single-tenant industrial properties and has ~560 buildings throughout 41 states in the USA.

The main target of this REIT on single-tenant properties may create greater danger in comparison with multi-tenant properties, as the previous are both totally occupied or fully vacant.

Nevertheless, STAG Industrial executes a deep quantitative and qualitative evaluation on its tenants. Because of this, it has incurred credit score losses which have been lower than 0.1% of its revenues since its IPO.

In late April, STAG Industrial reported (4/30/24) monetary outcomes for the primary quarter of fiscal 2024. Core FFO per share grew 7% over the prior 12 months’s quarter, from $0.55 to $0.59, exceeding the analysts’ consensus by $0.01, because of the sustained energy of the REIT’s tenants and materials hikes in lease charges.

Web working earnings grew 10% over the prior 12 months’s quarter although the occupancy fee slipped sequentially from 98.2% to 97.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on STAG Industrial Inc. (STAG) (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #4: Whitestone REIT (WSR)

Dividend Yield: 3.6%

Payout Ratio: 50%

Whitestone is a retail REIT that owns about 55 properties with about 5.0 million sq. ft of gross leasable space primarily in prime U.S. markets comparable to Texas and Arizona. Its tenant base may be very diversified consisting of 1,453 tenants with no single tenant exceeding 2.1% of annualized base rental income.

Whitestone reported its first quarter 2024 outcomes on Might 1st, 2024, throughout which it witnessed an occupancy fee of 93.6% versus 92.7% in Q1 2023. For the quarter, income progress was 3.7% to $37.2 million versus Q1 2023. Funds from operations per share (“FFOPS”) dropped 4.2% to $0.23. Similar-store web working earnings (“SSNOI”) rose 3.1% to $23.9 million.

Additionally, rental fee progress was 17.0%, down from 20.8% a 12 months in the past, supported by a bounce in rental fee progress in new leases of 25.9% vs. 9.5% a 12 months in the past. Renewal leases progress was 15.0% versus 23.0% a 12 months in the past. There have been 24 new leases and 46 renewal leases within the quarter.

Whitestone maintained the next forecast for its 2024 steerage: SSNOI progress of two.5%-4.0% and core FFOPS of $0.98-$1.04. It forecasts an ending occupancy of about 94.3%..

Click on right here to obtain our most up-to-date Positive Evaluation report on WSR (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #3: Phillips Edison & Firm, Inc. (PECO)

Dividend Yield: 3.5%

Payout Ratio: 49%

Phillips Edison & Firm is an skilled proprietor and operator that’s completely centered on grocery-anchored neighborhood procuring facilities. It’s a Actual Property Funding Belief (REIT) that operates a portfolio of 271 wholly-owned properties.

The corporate has a 30-year historical past, however it started buying and selling publicly solely in the summertime of 2021. Its administration owns 7% of the corporate, and therefore its pursuits are aligned with these of the shareholders.

On April twenty fifth, 2024, Phillips Edison & Firm launched its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, complete revenues got here in at $161.3 million, 6.8% greater year-over-year.

Similar-store NOI rose by 3.7% to $106.7 million, new and renewal leasing spreads landed at 29.1% and 16.9%, respectively, whereas occupancy was sturdy at 97.2% – all of which have been encouraging.

Together with solely marginally greater curiosity and working bills, Nareit FFO for the quarter superior by 5% to $80.1 million. Nareit FFO per share was $0.59, up from $0.58 final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on PECO (preview of web page 1 of three proven under):

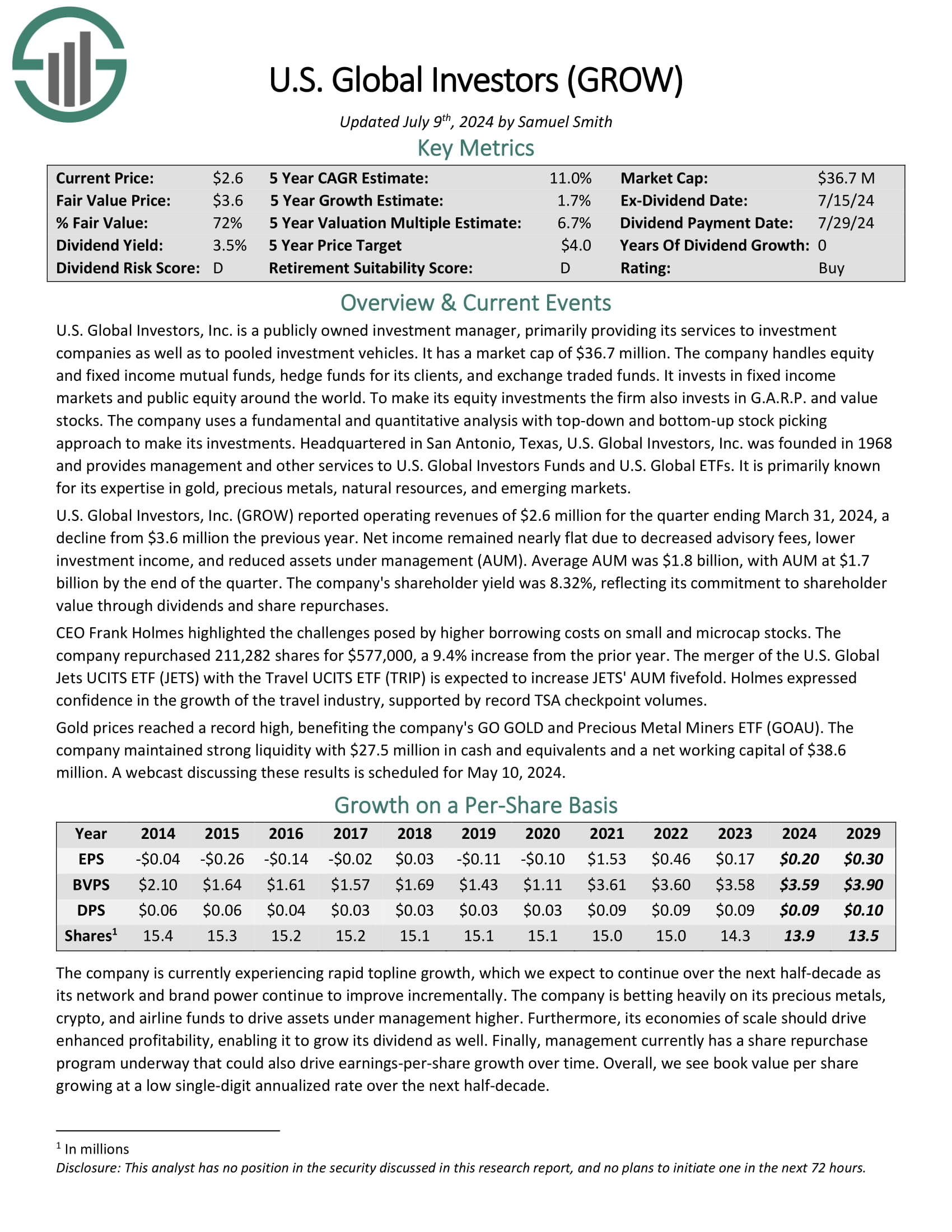

Month-to-month Dividend Inventory #2: U.S. World Buyers, Inc. (GROW)

Dividend Yield: 3.4%

Payout Ratio: 45%

U.S. World Buyers started greater than 50 years in the past as an funding membership. As we speak, it’s a publicly-traded registered funding advisor that appears to supply funding alternatives in area of interest markets world wide. The corporate gives sector-specific exchange-traded funds and mutual funds, in addition to an curiosity in cryptocurrencies.

U.S. World Buyers reported working revenues of $2.6 million for the quarter ending March 31, 2024, a decline from $3.6 million the earlier 12 months. Web earnings remained practically flat on account of decreased advisory charges, decrease funding earnings, and lowered belongings beneath administration (AUM).

Common AUM was $1.8 billion, with AUM at $1.7 billion by the top of the quarter. The corporate’s shareholder yield was 8.32%, reflecting its dedication to shareholder worth by way of dividends and share repurchases.

Click on right here to obtain our most up-to-date Positive Evaluation report on GROW (preview of web page 1 of three proven under):

Month-to-month Dividend Inventory #1: Realty Earnings Company (O)

Dividend Yield: 5.5%

Payout Ratio: 76%

Realty Earnings is an actual property funding belief, or REIT, that operates greater than 11,100 properties. The belief’s properties are standalone, which makes Realty Earnings’s places interesting to all kinds of tenants, together with authorities companies, healthcare companies, and leisure.

Realty Earnings had lengthy been centered totally on the U.S., however the belief has just lately expanded its operations internationally, with a presence now in each the U.Ok. and Spain. The belief’s tenants are unfold out over greater than 70 totally different industries.

In contrast to most corporations, Realty Earnings pays a month-to-month dividend, together with greater than 600 funds since going public in 1994.

and leisure.

Supply: Investor Presentation

Realty Earnings exceeded income expectations within the first quarter of 2023, reporting $1.26 billion in income following $598 million in funding quantity. Its earnings barely surpassed predictions, with normalized FFO per share reaching $1.05, a penny greater than the analyst estimate.

Realty Earnings has elevated its dividend for 27 years, and is on the unique record of Dividend Aristocrats. It’s the solely month-to-month dividend inventory on the record of Dividend Aristocrats, making it the most secure month-to-month dividend inventory in the present day.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Earnings (O) (preview of web page 1 of three proven under):

Ultimate Ideas

Month-to-month dividend shares will be a pretty possibility for traders searching for a gradual supply of earnings all year long.

Whereas no funding comes with out danger, some month-to-month dividend shares have demonstrated a historical past of monetary stability, constant earnings, and dependable dividend funds.

Our record of the ten most secure month-to-month dividend shares contains corporations from quite a lot of industries that rank extremely primarily based on their payout ratios and excessive yields.

However, there are quite a few different month-to-month dividend shares obtainable, every with its distinctive danger elements. Month-to-month dividend shares carry elevated dangers, so traders ought to make sure you conduct thorough analysis earlier than shopping for.

Further Studying

Don’t miss the assets under for extra month-to-month dividend inventory investing analysis.

And see the assets under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.