Merchants,

Final week, the highest commerce concept that I shared in IWM performed out extraordinarily properly and was my finest swing commerce of the week. In my newest Inside Entry assembly, I reviewed it intimately, going over my executions and thought course of.

So stick round as I share my prime concepts for the upcoming buying and selling week. I’ll go over my commerce plans, thought course of, and entry and exit plans.

Beginning with small caps, but once more, for a 3rd straight week.

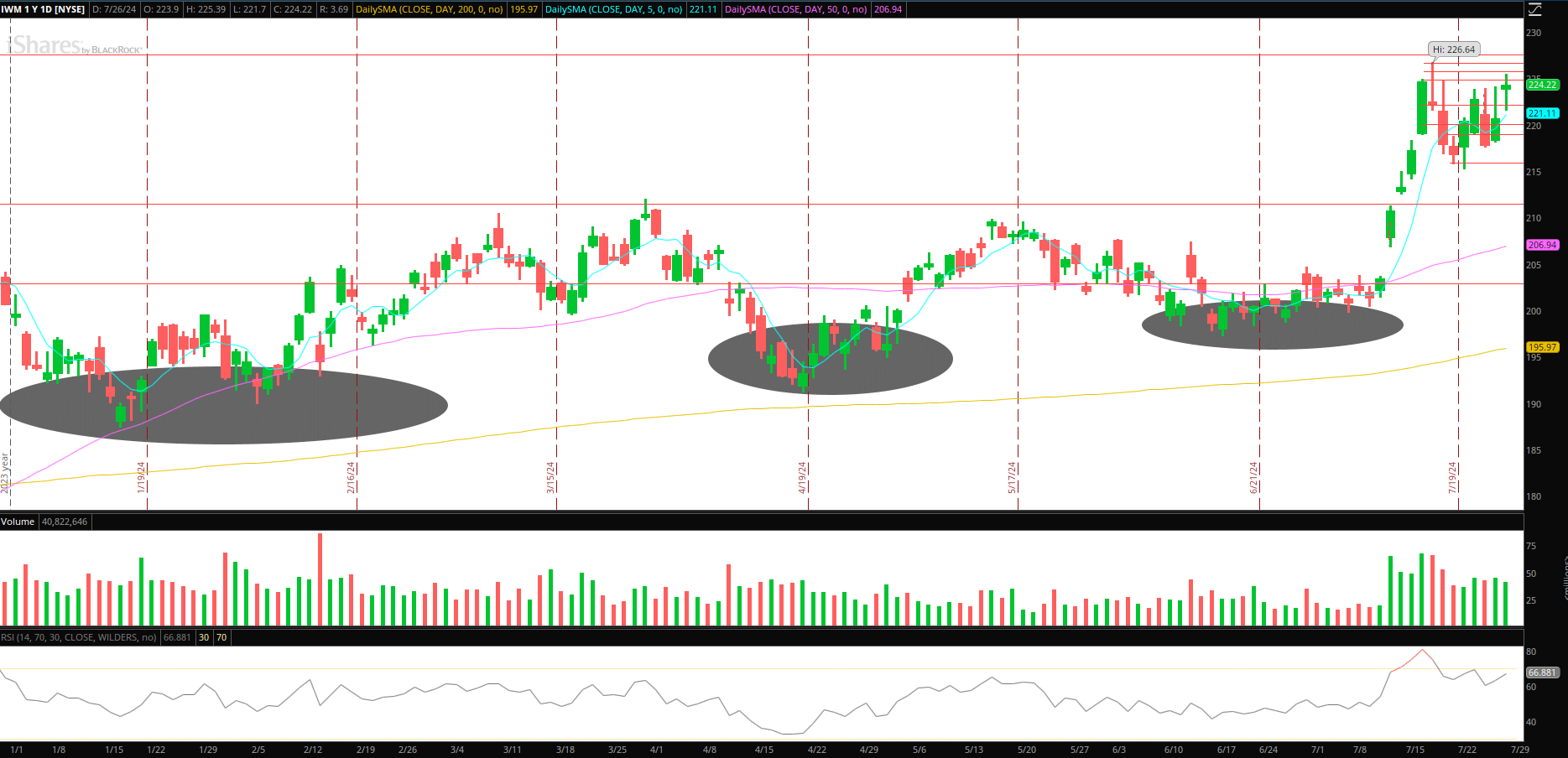

Continuation in Small-Caps (IWM)

Final week’s bounce-long swing performed out exceptionally properly per the watchlist plan. Nevertheless, a brand new setup presents itself going ahead: a consolidation breakout for a second leg larger. After the bounce earlier within the week, the IWM has spent a while displaying relative energy and consolidating close to highs, establishing a consolidation breakout alternative.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components equivalent to liquidity, slippage and commissions.

Right here’s my plan:

For entry, I’m in search of both a fast wash-out decrease and reclaim, thereby confirming a better low versus Friday’s low. Alternatively, because the IWM closed above the week’s resistance on Friday, I’m in search of a prolonged maintain above and would goal an intraday breakout for entry versus the day’s low.

After that, I’d goal comparable measured targets as I did with the earlier swing in IWM, utilizing ATR targets and higher-high extensions. My first goal can be a brand new 52-week excessive and extension above the earlier excessive of $226.64. After that, I’d look to path utilizing the identical strategy as outlined final week: 5-minute larger highs to scale out and better lows to path, concentrating on a multi-day leg larger.

In fact, it is going to be crucial to gauge total market sentiment, internals, and relative energy.

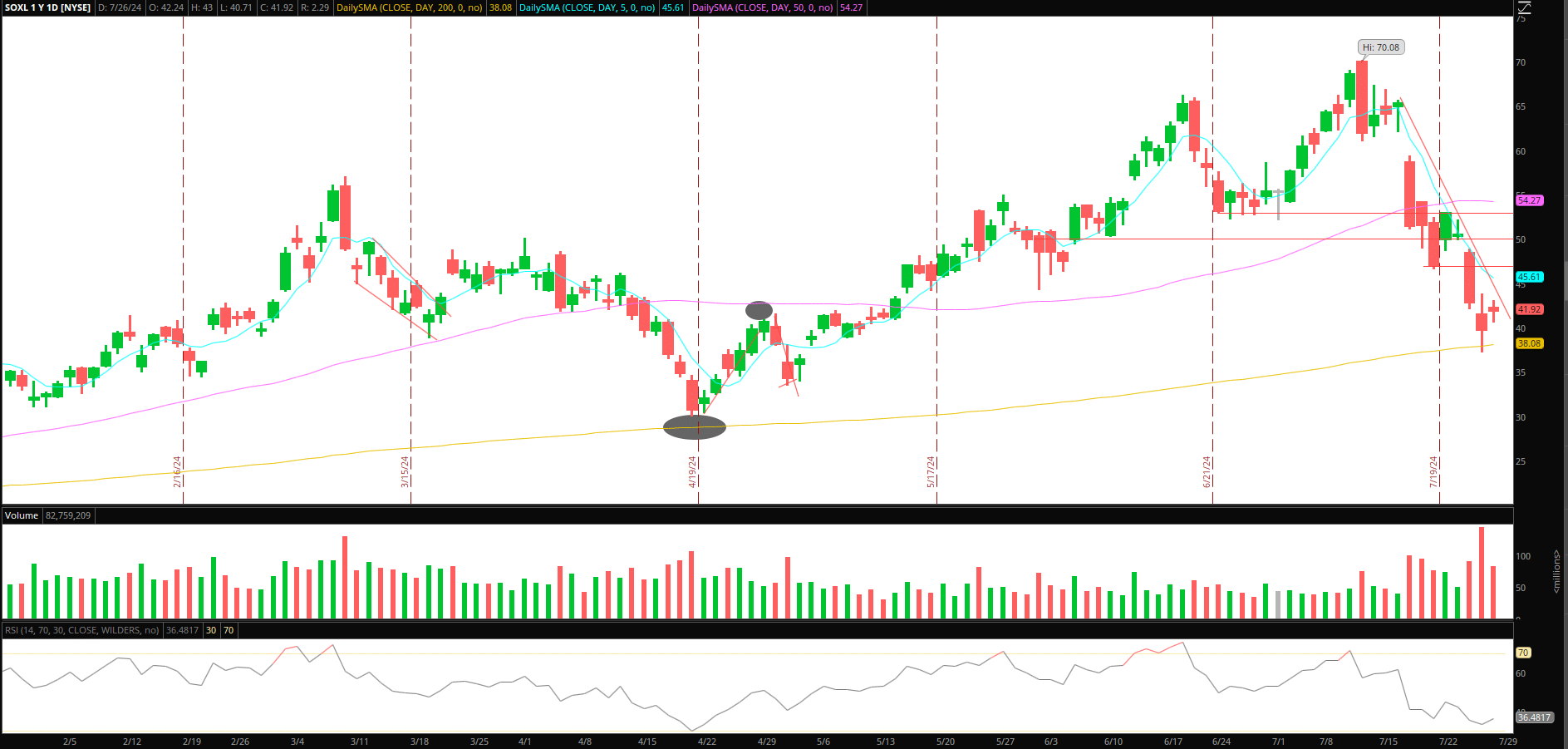

Aid Rally in Semis

The final time we noticed a selloff towards the 200-day mark in SOXL, we bounced sharply as soon as we broke the steep selloff’s downtrend over a number of days. I’m not saying the identical factor will occur; nonetheless, if SOXL / the sector can agency up over its multi-day VWAP and start to base above short-term / the prior week’s key resistance ranges, I’ll look to provoke a protracted on the precise facet of the downtrend.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components equivalent to liquidity, slippage and commissions.

Right here’s my plan:

SOXL has now fallen over 40% from its 52-week highs and tapped its 200-day on Thursday. For the upcoming week, If SOXL can break its steep downtrend and base above key multiday resistance, round $43, adopted by a push larger to interrupt its downtrend, I’ll look to place lengthy with a cease on the LOD.

I’d look to carry this place for 2 to a few days, trailing utilizing larger lows on the 5-minute timeframe or the prior day’s low, relying on the value motion and RVOL of the bounce/transfer. My first goal to lock in beneficial properties and start trailing my cease can be a measured transfer towards prior resistance and a 1 ATR up transfer between $47 and $50, with an final goal being a quick transfer towards $52.

Further Small-Cap Concepts:

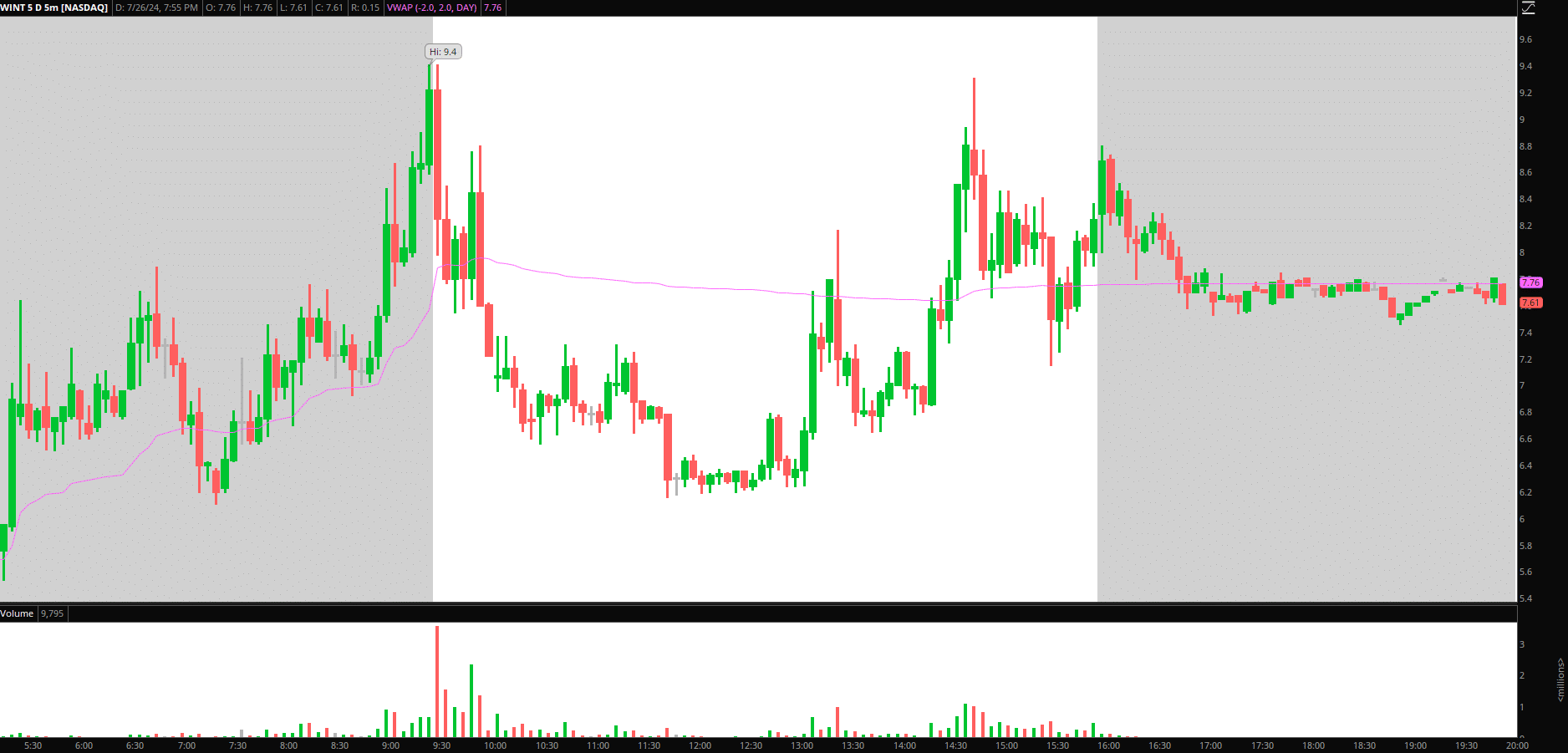

WINT: Small-cap liquidity traps have been enjoying out extraordinarily properly with T+1. WINT had a robust shut on Friday. Due to this fact, I can be monitoring this going ahead for a lure and reclaim over $8 and potential squeeze out over final week’s highs. As soon as it exhausts, I’ll shift my consideration to the brief facet. This one is a day dealer, not a swing candidate, just like my ideas on SERV the prior week.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components equivalent to liquidity, slippage and commissions.

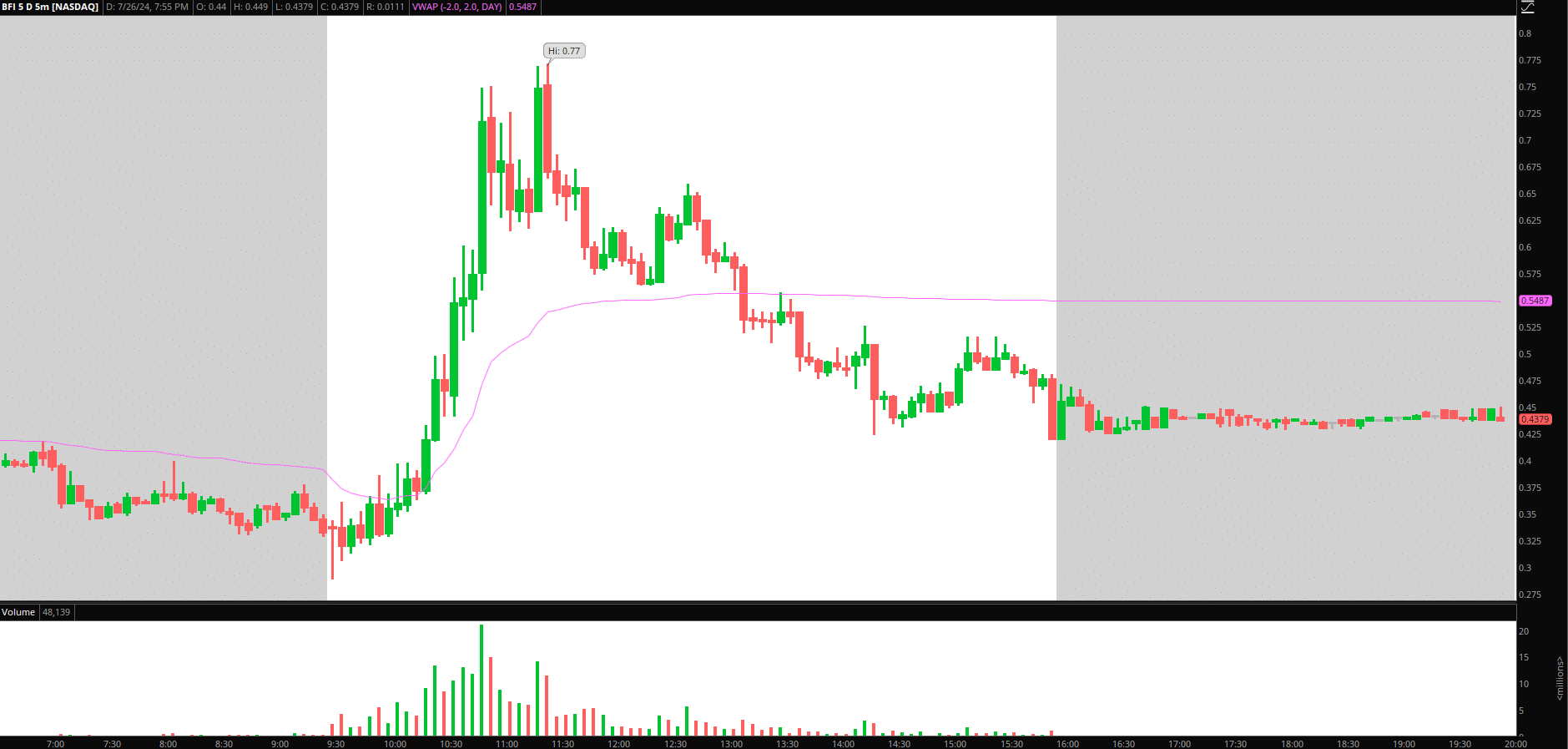

BFI: Friday noticed a gorgeous push and squeeze out, adopted by an important brief alternative as soon as the bottom was confirmed with the decrease excessive close to $0.65. I’ll set alerts within the title in case it pops again towards $0.60 – $0.65 for a failed transfer larger and bull-trap, in search of a brief versus that failed excessive and a transfer again towards $0.40.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components equivalent to liquidity, slippage and commissions.

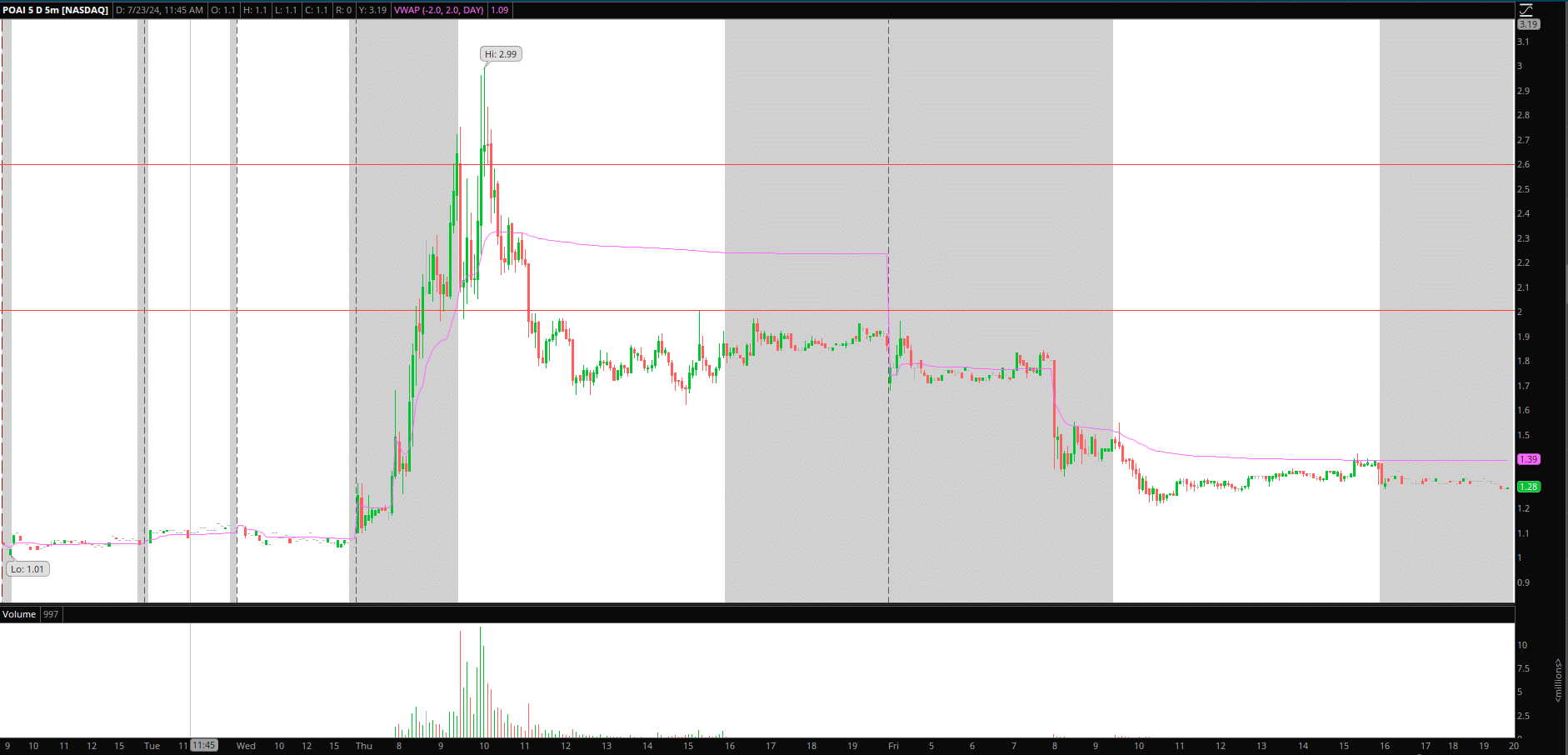

POAI: This was one of many prime intraday short-opps from final week concerning small caps. Alerts are set within the title in case it has a fast liquidity transfer again towards $2+ and fails for a brief again towards the low $1s.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components equivalent to liquidity, slippage and commissions.

Necessary Disclosures