Up to date on August 1st, 2024 by Bob Ciura

Information up to date every day

Retirees who depend on a portfolio of high-quality dividend progress shares to cowl their dwelling bills have their work reduce out for them. Making a portfolio that pays an identical quantity of dividend revenue every month is more durable than it sounds.

That’s the place Positive Dividend is available in. We keep databases of shares that pay dividends in every month of the calendar 12 months.

You may obtain our full checklist of August dividend shares (together with essential monetary metrics like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

The checklist of shares that pay dividends in August out there for obtain above incorporates the next metrics for each safety within the database:

Final dividend fee date in August

Inventory value

Dividend yield

Dividend payout ratio

Market capitalization

Worth-to-earnings ratio

Worth-to-book ratio

Return on fairness

Preserve studying this text to be taught extra about our checklist of shares that pay dividends in August.

Observe: Constituents for the spreadsheet and desk above are from the Wilshire 5000 index, with information offered by Ycharts and up to date yearly. Securities outdoors the Wilshire 5000 index will not be included within the spreadsheet and desk.

How To Use The Listing of Shares That Pay Dividends in August to Discover Funding Concepts

Having a spreadsheet database with the names, tickers, and monetary info of each inventory that pays dividends in August could be very helpful.

This doc turns into much more highly effective when mixed with a working information of how one can use Microsoft Excel to seek out funding concepts.

With that in thoughts, this tutorial will show how one can implement two actionable investing screens to our checklist of shares that pay dividends in August.

The primary display that we’ll implement is for worth shares. Extra particularly, we’ll display for shares with price-to-earnings ratios under 11 and price-to-book ratios under 1.5.

Display 1: Worth-to-Earnings Ratios Beneath 11, Worth-to-E-book Ratios Beneath 1.5

Step 1: Obtain your free checklist of shares that pay dividends in August by clicking right here.

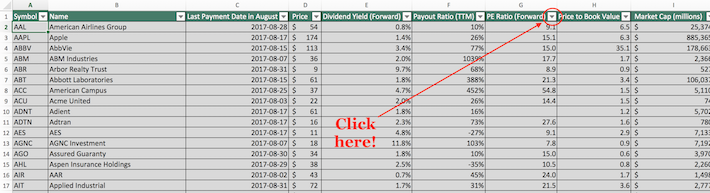

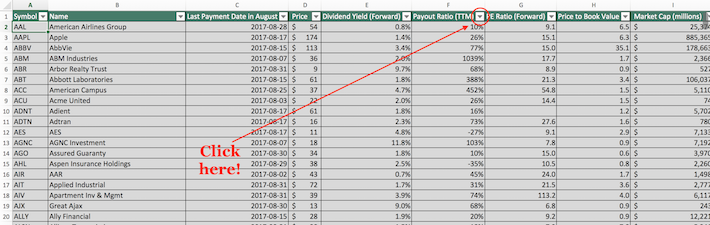

Step 2: Click on the filter icon on the prime of the price-to-earnings ratio column, as proven under.

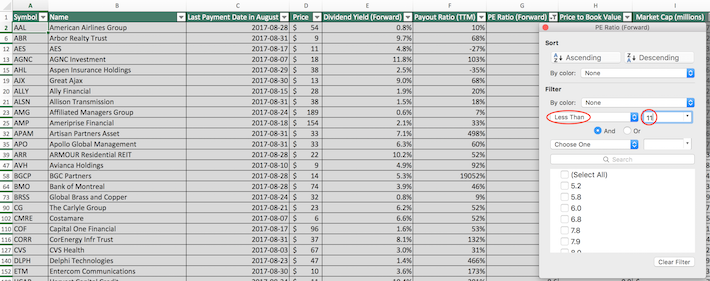

Step 3: Change the filter setting to “Much less Than” and enter 11 into the sector beside it, as proven under. It will filter for shares that pay dividends in August with price-to-earnings ratios under 11.

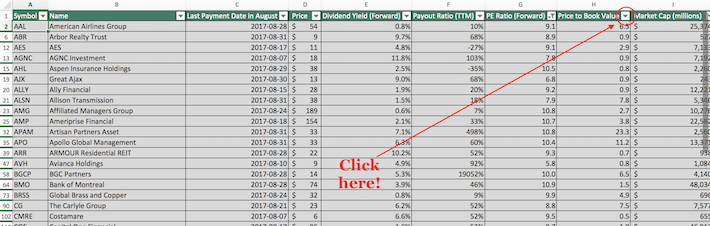

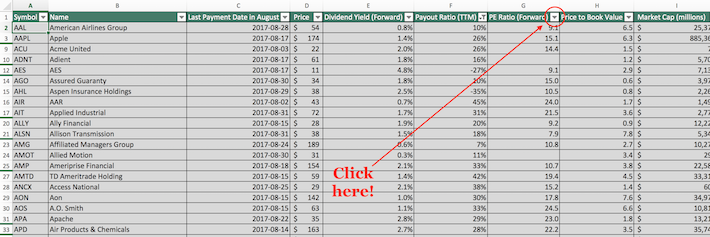

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on the filter icon on the prime of the price-to-book ratio column, as proven under.

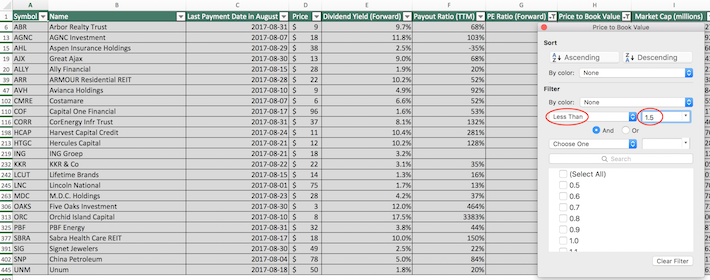

Step 5: Change the filter setting to “Much less Than” and enter 1.5 into the sector beside it. It will filter for shares that pay dividends in August with price-to-book ratios lower than 1.5.

The remaining shares on this spreadsheet are shares that pay dividends in August with price-to-earnings ratios lower than 11 and price-to-book ratios lower than 1.5.

The following display that we’ll show is for shares that retain the vast majority of their earnings to fund inner progress whereas concurrently buying and selling at low multiples of those earnings.

Extra particularly, we’ll filter for shares with payout ratios under 50% and price-to-earnings ratios under 15.

Display 2: Payout Ratio Beneath 50%, Worth-to-Earnings Ratios Beneath 15

Step 1: Obtain your free checklist of shares that pay dividends in August by clicking right here.

Step 2: Click on the filter icon on the prime of the payout ratio column, as proven under.

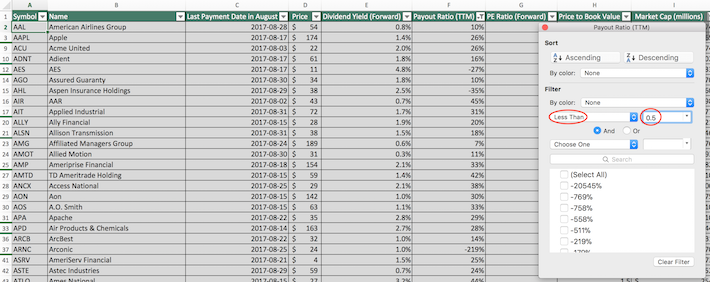

Step 3: Change the filter setting to “Much less Than” and enter 0.5 into the sector beside it, as proven under. Since payout ratio is measured in proportion factors, this may filter for shares that pay dividends in August with payout ratios under 50%.

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on the filter icon on the prime of the price-to-earnings ratios column, as proven under.

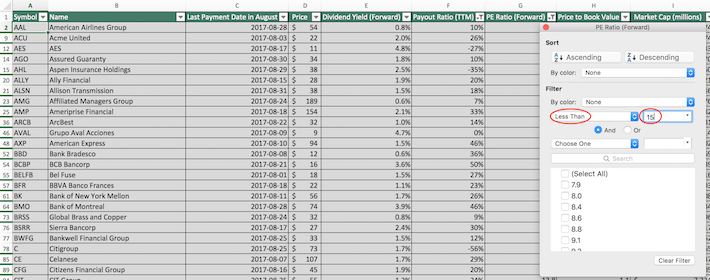

Step 5: Change the filter setting to “Much less Than” and enter 15 into the sector beside it, as proven under. It will filter for shares that pay dividends in August with price-to-earnings ratios under 15.

The remaining shares on this spreadsheet are shares that pay dividends in August with payout ratios under 50% and price-to-earnings ratios under 15.

You now have a strong, basic understanding of how one can use our checklist of shares that pay dividends in August to seek out funding concepts.

To shut out this text, we’ll introduce a number of different investing sources that you should use to enhance your portfolio administration decision-making.

Closing Ideas: Different Helpful Investing Sources

Having an Excel doc with the monetary info for each inventory that pays dividends in August turns into way more highly effective when mixed with comparable paperwork for the opposite 11 months of the calendar 12 months.

Thankfully, Positive Dividend maintains databases for each different month, which you’ll obtain under:

These databases will enable buyers to appropriately diversify their funding portfolio so {that a} comparable quantity of dividend revenue is generated throughout every month of the calendar 12 months.

One other essential facet of diversification is sector diversification. Clearly, having 500 completely different power shares is not going to defend your wealth if oil costs plunge.

Because of this, Positive Dividend maintains comparable inventory market databases for every of the ten main inventory market sectors. You may obtain these databases under:

Other than diversification, our analysis at Positive Dividend means that among the greatest returns within the inventory market will be achieved by investing in shares with lengthy histories of steadily rising dividend funds:

In actual fact, we have now two premium analysis publications whose content material relies on discovering the perfect companies for dividend progress into the long run. You may examine our two newsletters under:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

![The Full Listing of Shares That Pay Dividends in August [Free Download] The Full Listing of Shares That Pay Dividends in August [Free Download]](https://i3.wp.com/www.suredividend.com/wp-content/uploads/2022/11/August-Dividend-Stocks-e1667941437689.png?w=1024&resize=1024,1024&ssl=1)