JHVEPhoto

On 02/08/2024, Engie (OTCPK:ENGIY) (OTCPK:ENGQF) launched its H1 numbers. Earlier than analyzing the corporate’s strong efficiency, it’s vital to report that French firms’ shares fell sharply in June 2024 after President Emmanuel Macron known as a shock snap election in response to his defeat within the EU elections. France’s renewable vitality business might have seen a pointy slowdown in photo voltaic and wind initiatives if the far proper had gained the election. Certainly, the occasion was anticipated to spice up France’s nuclear business. Engie is shifting its technique from Nuclear to Renewable Capability Addition. This was one in all Mare Proof Lab’s elementary thesis in Engie’s fairness story. Our purchase score was primarily influenced by the strong earnings profile of Engie’s community division and a tasty dividend per share with the appropriate capital allocation priorities.

H1 Earnings

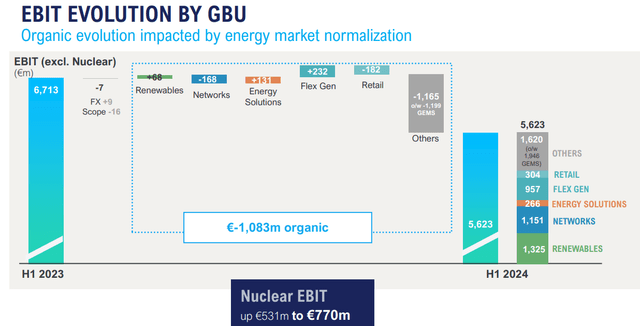

Engie reached an H1 2024 core working revenue (excluding nuclear) of €5.62 billion, 3% above Wall Avenue analyst estimates set at €5.45 billion. In comparison with final 12 months, the EBIT was down as a consequence of 1) decrease distributed volumes in France, 2) normalization of market circumstances in Germany and the UK, and three) decrease transit revenues between Germany and France. As well as, Engie gross sales had been down by 20.4% on an natural foundation because of the normalization of vitality costs. Trying on the firm’s section, the division known as GEMS (International Power Administration & Gross sales) EBIT was right down to €1.9 billion from €3.1 billion in H1 2023. GEMS is a important participant in vitality administration providers and supplies threat administration and procurement options to create worth throughout the vitality chain. The division helps a various clientele of over 200,000 companies of their decarbonization journey. There was a brief one-off in 2023, and the corporate confirmed a €2.0 billion core working revenue outlook for the Fiscal 12 months 2024.

Engie EBIT H1 outcomes

Supply: Engie H1 outcomes presentation – Fig 1

In keeping with the P&L evaluation, Engie’s internet revenue reached €1.9 billion. Final 12 months, the corporate was impacted by a non-recurrence damaging one-off as a consequence of nuclear provisions. Nevertheless, following the settlement signed with the Belgian authorities, Engie property are virtually derisked. There may be solely a provision of €100 million for the Nuclear property (Fig 2).

That stated, we positively report the CEO’s phrases. She defined how “in a market returning to regular circumstances, the corporate has as soon as extra delivered highly effective H1 outcomes, enabling us to lift our full-year 2024 steerage. This monetary efficiency demonstrates the facility of our built-in mannequin and showcases our operational capabilities.”

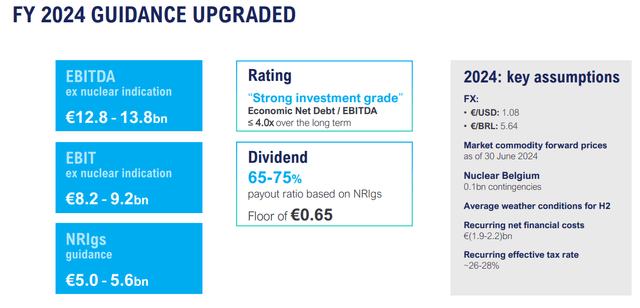

Certainly, because of the robust earnings efficiency and decrease anticipated recurring internet monetary prices, Engie raised its 2024 steerage and anticipates a 2024 core working revenue (ex-nuclear) between €8.2 and €9.2 billion. Beforehand, it was set between €7.5 and eight.5 billion (Fig 2). Seen Alpha consensus was estimating €8.23 billion. Engie’s internet earnings was additionally elevated and is now anticipated at €5.0 and €5.6 billion, in comparison with a earlier vary between €4.2 and €4.8 billion. In numbers, Engie lowered internet monetary value steerage to €1.9-2.2 billion from €2.4-2.7 billion. This considers the 2 years between 2024 and 2026. The outlook was based mostly on the commodity outlook at June-end. As well as, the corporate confirmed its dividend coverage at a 65-75% payout ratio with a minimal €0.65 DPS flooring.

Engie greater steerage

Fig 2

Why are we nonetheless optimistic?

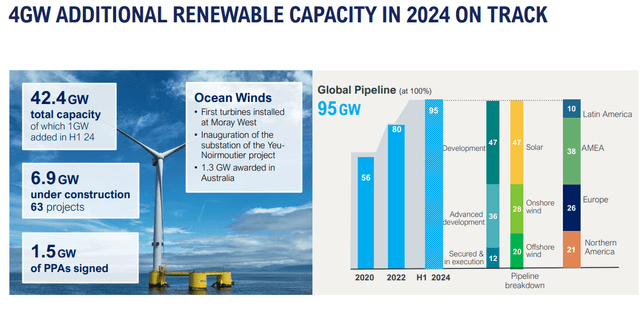

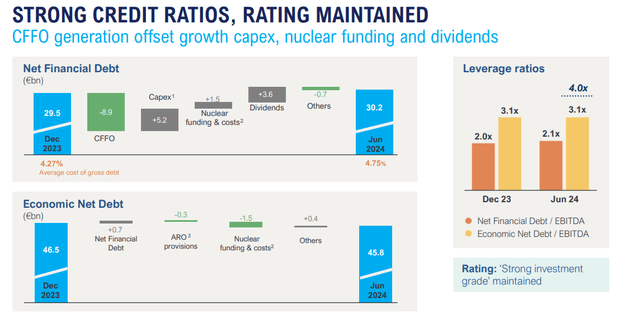

The corporate added over 1GW of renewable capability within the first semester and stays assured of attaining its annual goal of 4GW on common of further capability as much as 2025 (Fig 3). The corporate has 6.9GW of capability underneath building from 63 initiatives worldwide; In H1 2024, the corporate accomplished 800MW of Battery Power Storage Answer capability. BESS is instrumental and aggressive in grid reliability, and with the shift in renewable vitality manufacturing, we imagine it is going to play a significant position in a dynamic vitality system. BESS providers are useful to easy provide and demand peaks, improve grid growth, and restrict vitality worth volatility; On the core enterprise, aligned with our technique, we positively report the rise in transmission, fuel storage, and distribution tariffs (RAB). The French Power Regulatory Fee set this and is efficient till 2027; Key to the report is the corporate’s financial internet debt evolution, which reached €45.8 billion and was down €0.8 billion by year-end (Fig 4). Throughout this era, the corporate additionally paid the dividend.

Engie Ren. Power growth

Fig 3

Engie Debt Evolution

Fig 4

Adjusting Estimates and Valuation

After the Q1 outcomes, we forecast gross sales of €83.2 billion and a 2024 EBITDA of €14.54 billion. Resulting from greater internet monetary prices, we lowered our EBIT from €9.07 to €8.97 billion. After the Q2 outcomes, our working revenue numbers fell exactly within the firm’s vary (€8.2 and €9.2 billion). Due to this fact, we see help in our earlier forecast. As well as, we’re not shocked to see a optimistic inventory worth response, as Engie’s new earnings weren’t mirrored in consensus estimates. There was no change in technical steerage, akin to CAPEX and company tax. Due to this fact, we left the EPS steerage set at €1.79 unchanged. Engie’s fairness story stays intact.

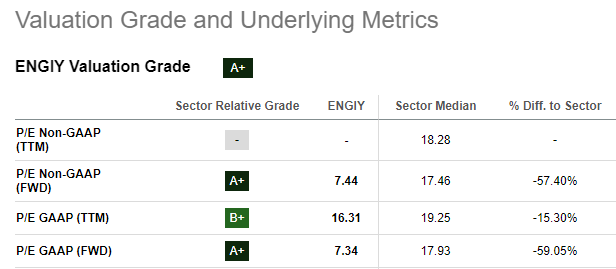

Relating to Engie’s valuation, the corporate trades at a P/E of 8.37x, and searching on the sector median (Fig 5), Engie is considerably undervalued.

Engie SA Valuation Knowledge P/E

Fig 5

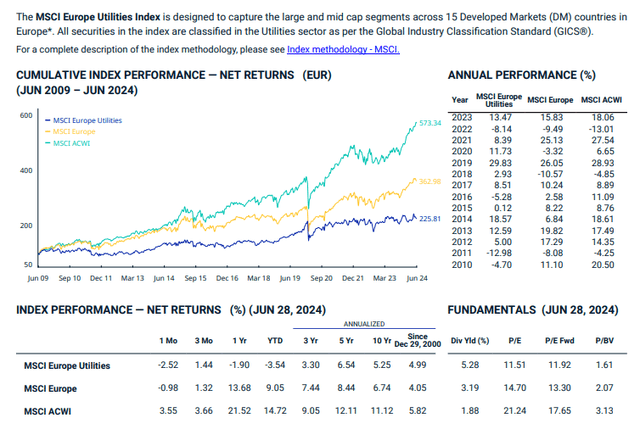

On the next degree, the MSCI EU utilities sector isn’t pricing in earnings development (Fig 6). The MSCI EU sector is flat year-to-date, and Engie’s inventory worth is down by roughly 6%. As well as, the business can also be underperforming in MSCI Europe.

MSCI EU Utilities in a Snap

Fig 5

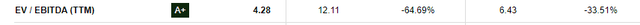

On the Lab, we worth Enel with a goal P/E of 12x. The corporate is considerably deleveraged, whereas Engie is presently investing for development. Because of this, we proceed to use a small low cost to Enel’s P/E and make sure a 10x P/E goal, which is aligned with an EV/EBITDA of 6.5x (Fig 6). Due to this fact, we worth Engie at €17.9 per share ($19.5 in ADR).

Engie SA Valuation Knowledge EV/EBITDA

Fig 6

Dangers

Utility firms, together with Engie, face a complete array of technical, working, industrial, regulatory, and political dangers. Draw back dangers embody CAPEX delays, given the bold capability addition set by Engie. These new investments are additionally topic to CAPEX inflation. In comparison with nuclear energy, renewable vitality property are uncovered to climate circumstances. Because of this, Engie is presently investing in battery vitality storage options. Larger and extended rates of interest would possibly negatively affect the corporate’s backside line. In quantity, Engie has recurring internet monetary prices between €1.9 and €2.2 billion.

Conclusion

We see help from Engie’s greater steerage, and extra importantly, we proceed to see a strong execution. Wall Avenue analysts will probably worth greater estimates going ahead. Due to this fact, we recommend to extend your place.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.