Up to date on September 18th, 2024 by Bob Ciura

Month-to-month dividend shares have on the spot enchantment for a lot of revenue buyers. Shares that pay their dividends every month supply extra frequent payouts than conventional quarterly or semi-annual dividend payers.

Because of this, we created a full checklist of ~80 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

As well as, shares which have excessive dividend yields are additionally engaging for revenue buyers.

With the common S&P 500 yield hovering round 1.3%, buyers can generate rather more revenue with high-yield shares. Screening for month-to-month dividend shares that even have excessive dividend yields makes for an interesting mixture.

This text will checklist the 20 highest-yielding month-to-month dividend shares.

Desk Of Contents

The next 20 month-to-month dividend shares have excessive dividend yields above 5%. Shares are listed by their dividend yields, from lowest to highest.

The checklist excludes oil and gasoline royalty belief, which have excessive fluctuations of their dividend payouts from one quarter to the subsequent because of the underlying volatility of commodity costs.

You’ll be able to immediately leap to a person part of the article by using the hyperlinks under:

Excessive-Yield Month-to-month Dividend Inventory #20: Itau Unibanco Holding SA (ITUB)

Itaú Unibanco Holding S.A. is a financial institution headquartered in Sao Paulo, Brazil. The financial institution has operations throughout South America and different locations like the USA, Portugal, Switzerland, China, Japan, and so on.

On August fifth, 2024, Itaú Unibanco reported second-quarter outcomes for 2024. Within the second quarter of 2024, the recurring managerial consequence reached $1.8 billion, reflecting a 3.1% improve from the earlier quarter.

The consolidated recurring managerial return on fairness was 22.4%, with Brazil’s operations exhibiting a barely greater charge of 23.6%.

The consolidated mortgage portfolio grew by 5.9%, with a 4.3% improve in Brazil. When excluding trade charge variations, the consolidated mortgage portfolio rose by 2.7% for the quarter and seven.1% year-on-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven under):

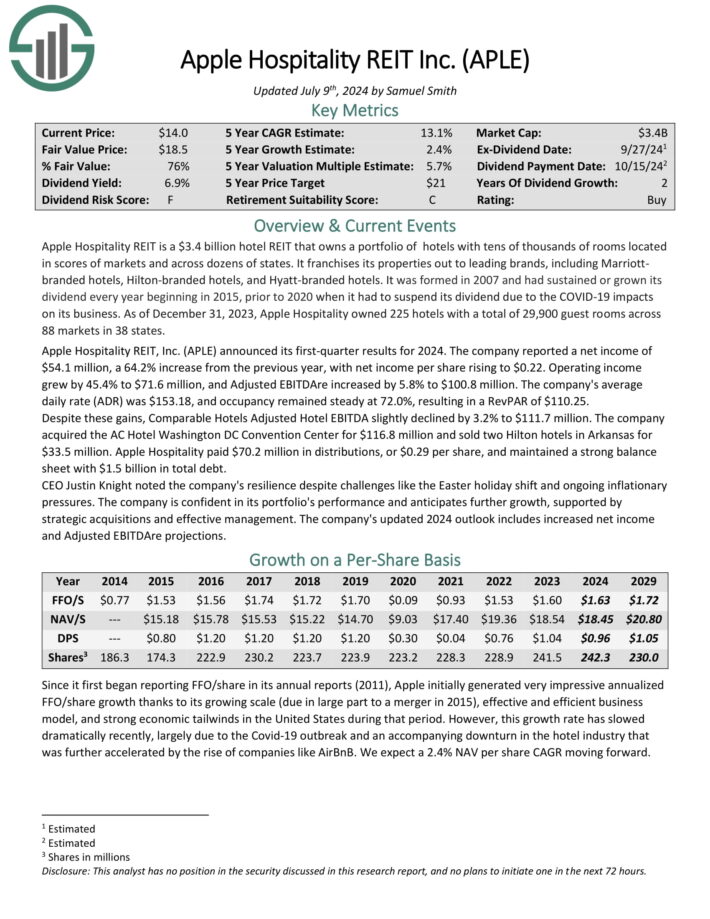

Excessive-Yield Month-to-month Dividend Inventory #19: Apple Hospitality REIT (APLE)

Apple Hospitality REIT is a lodge REIT that owns a portfolio of resorts with tens of hundreds of rooms positioned throughout dozens of states.

It franchises its properties out to main manufacturers, together with Marriott-branded resorts, Hilton-branded resorts, and Hyatt-branded resorts.

As of December 31, 2023, Apple Hospitality owned 225 resorts with a complete of 29,900 visitor rooms throughout 88 markets in 38 states.

Supply: Investor Presentation

Apple Hospitality REIT introduced its first-quarter outcomes for 2024. The corporate reported a web revenue of $54.1 million, a 64.2% improve from the earlier yr, with web revenue per share rising to $0.22.

Working revenue grew by 45.4% to $71.6 million, and Adjusted EBITDAre elevated by 5.8% to $100.8 million. The corporate’s common every day charge (ADR) was $153.18, and occupancy remained regular at 72.0%, leading to a RevPAR of $110.25.

Regardless of these positive aspects, Comparable Motels Adjusted Lodge EBITDA barely declined by 3.2% to $111.7 million. The corporate acquired the AC Lodge Washington DC Conference Middle for $116.8 million and bought two Hilton resorts in Arkansas for $33.5 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on APLE (preview of web page 1 of three proven under):

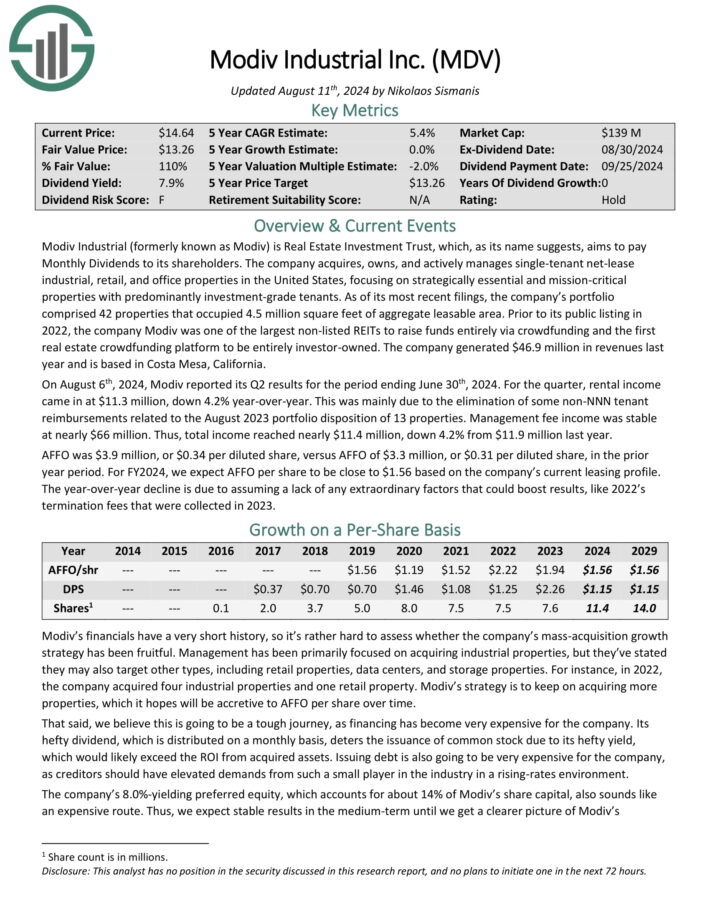

Excessive-Yield Month-to-month Dividend Inventory #18: Modiv Industrial (MDV)

Modiv Industrial acquires, owns, and actively manages single-tenant net-lease industrial, retail, and workplace properties in the USA, specializing in strategically important and mission-critical properties with predominantly investment-grade tenants.

As of its most up-to-date filings, the corporate’s portfolio comprised 44 properties that occupied 4.6 million sq. ft of combination leasable space.

On August sixth, 2024, Modiv reported its Q2 outcomes for the interval ending June thirtieth, 2024. For the quarter, rental revenue got here in at $11.3 million, down 4.2% year-over-year. This was primarily because of the elimination of some non-NNN tenant reimbursements associated to the August 2023 portfolio disposition of 13 properties.

Administration payment revenue was steady at practically $66 million. Thus, complete revenue reached practically $11.4 million, down 4.2% from $11.9 million final yr.

AFFO was $3.9 million, or $0.34 per diluted share, versus AFFO of $3.3 million, or $0.31 per diluted share, within the prior yr interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDV (preview of web page 1 of three proven under):

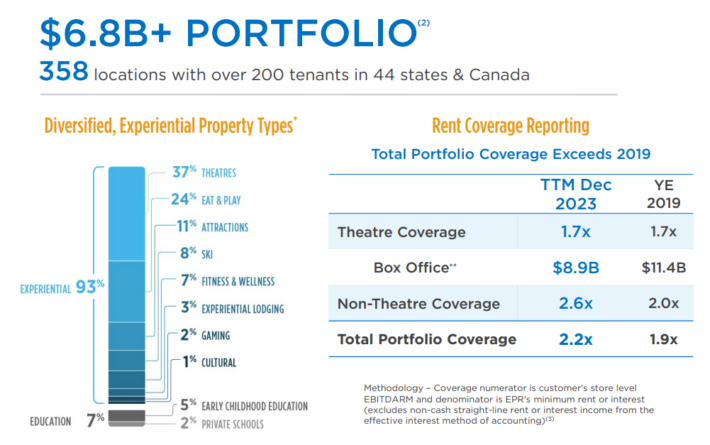

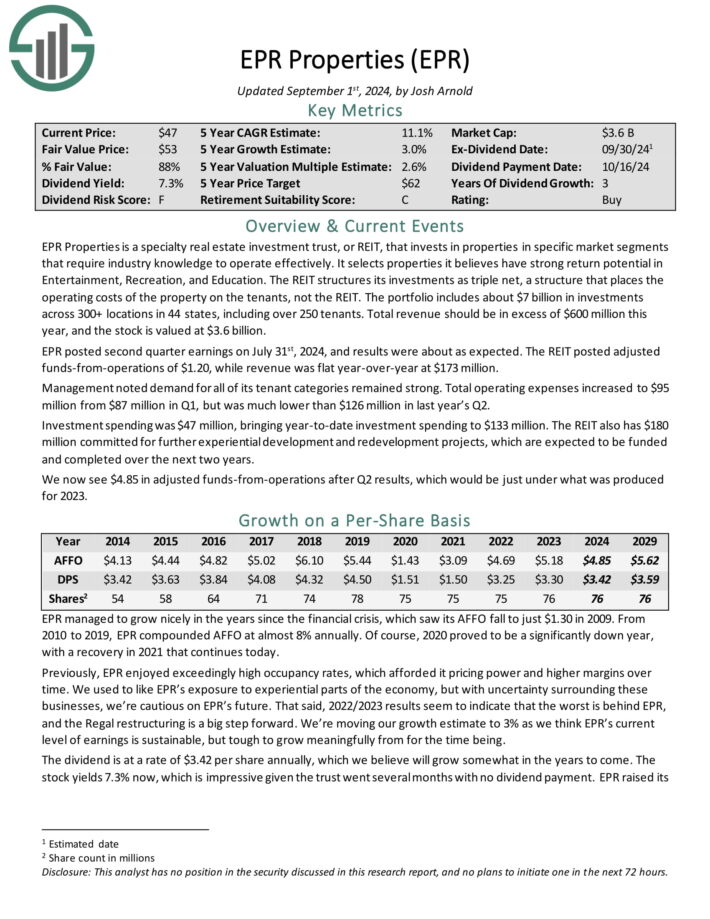

Excessive-Yield Month-to-month Dividend Inventory #17: EPR Properties (EPR)

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require business information to function successfully.

It selects properties it believes have sturdy return potential in Leisure, Recreation, and Training. The portfolio contains about $7 billion in investments throughout 350+ places in 44 states, together with over 200 tenants.

Supply: Investor Presentation

EPR posted second quarter earnings on July thirty first, 2024, and outcomes have been about as anticipated. The REIT posted adjusted funds-from-operations of $1.20, whereas income was flat year-over-year at $173 million.

Administration famous demand for all of its tenant classes remained sturdy. Whole working bills elevated to $95 million from $87 million in Q1, however was a lot decrease than $126 million in final yr’s Q2.

Funding spending was $47 million, bringing year-to-date funding spending to $133 million. The REIT additionally has $180 million dedicated for additional experiential growth and redevelopment tasks, that are anticipated to be funded and accomplished over the subsequent two years.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPR (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #16: Gladstone Funding Company (GAIN)

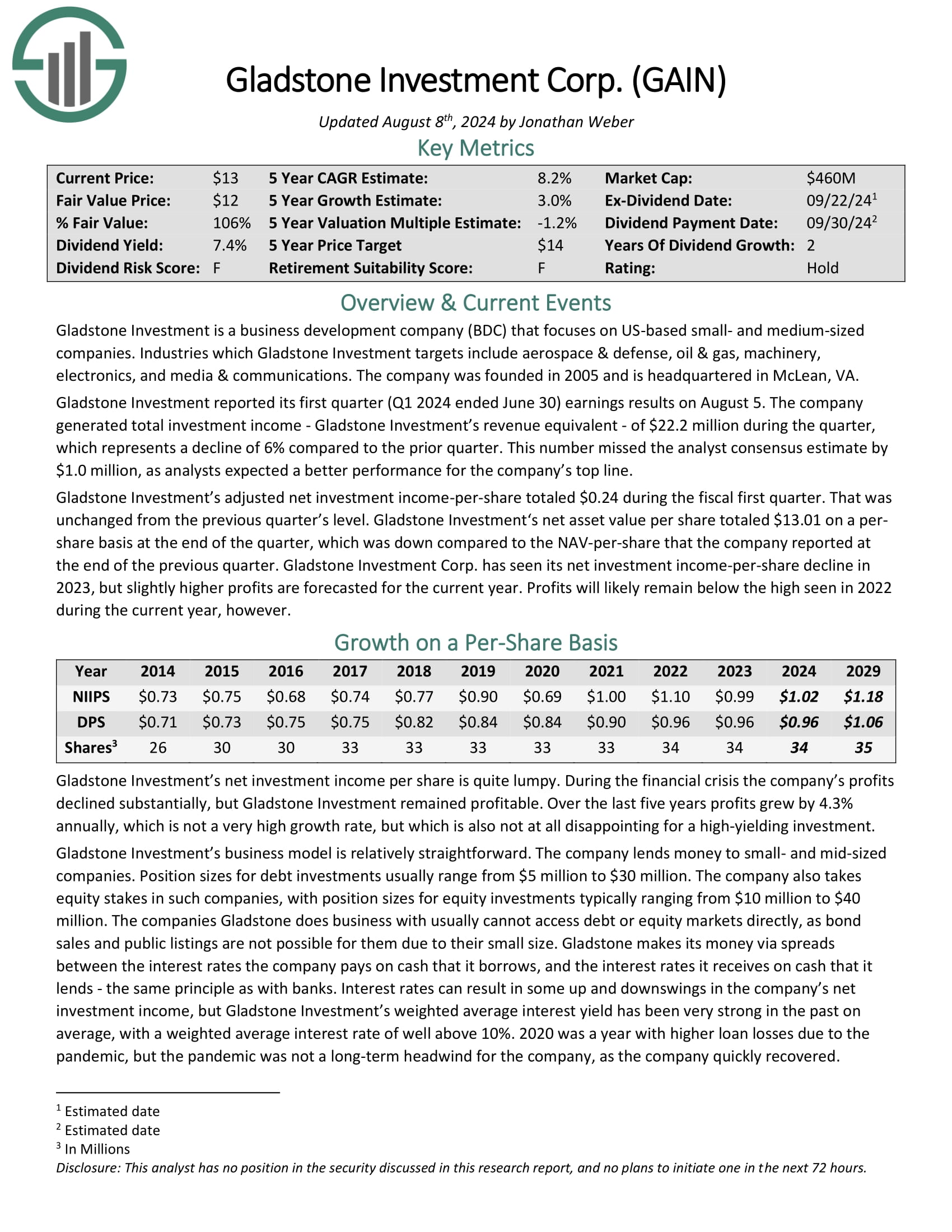

Gladstone Funding is a enterprise growth firm (BDC) that focuses on US-based small- and medium-sized firms. Industries which Gladstone Funding targets embody aerospace & protection, oil & gasoline, equipment, electronics, and media & communications.

Gladstone Funding reported its first quarter (Q1 2024 ended June 30) earnings outcomes on August 5. The corporate generated complete funding revenue – Gladstone Funding’s income equal – of $22.2 million through the quarter, which represents a decline of 6% in comparison with the prior quarter.

This quantity missed the analyst consensus estimate by $1.0 million, as analysts anticipated a greater efficiency for the corporate’s prime line.

Gladstone Funding’s adjusted web funding income-per-share totaled $0.24 through the fiscal first quarter. That was unchanged from the earlier quarter’s stage.

Click on right here to obtain our most up-to-date Positive Evaluation report on GAIN (preview of web page 1 of three proven under):

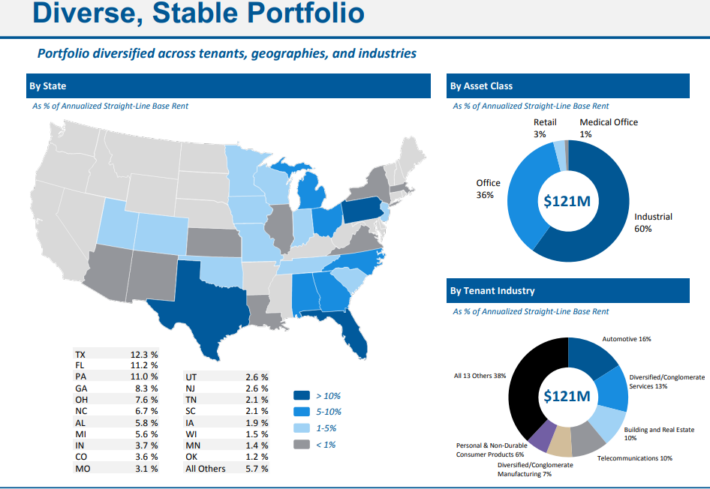

Excessive-Yield Month-to-month Dividend Inventory #15: Gladstone Industrial (GOOD)

Gladstone Industrial Company is an actual property funding belief, or REIT, that focuses on single-tenant and anchored multi-tenant web leased industrial and workplace properties throughout the U.S.

The belief targets major and secondary markets that possess favorable financial progress tendencies, rising populations, sturdy employment, and strong progress tendencies.

Supply: Investor Presentation

The belief’s said aim is to pay shareholders month-to-month distributions, which it has achieved for greater than 17 consecutive years. Gladstone owns over 100 properties in 24 states which might be leased to about 100 distinctive tenants.

Gladstone posted second quarter earnings on August sixth, 2024, and outcomes have been higher than anticipated on each the highest and backside strains. Funds-from-operations got here to 36 cents, which was a penny forward of estimates.

FFO was up from 34 cents in Q1, primarily on account of accelerated hire associated to a termination payment on a property bought through the quarter. Income was off 4% year-over-year, however nonetheless beat estimates by $1.1 million at $37.1 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on GOOD (preview of web page 1 of three proven under):

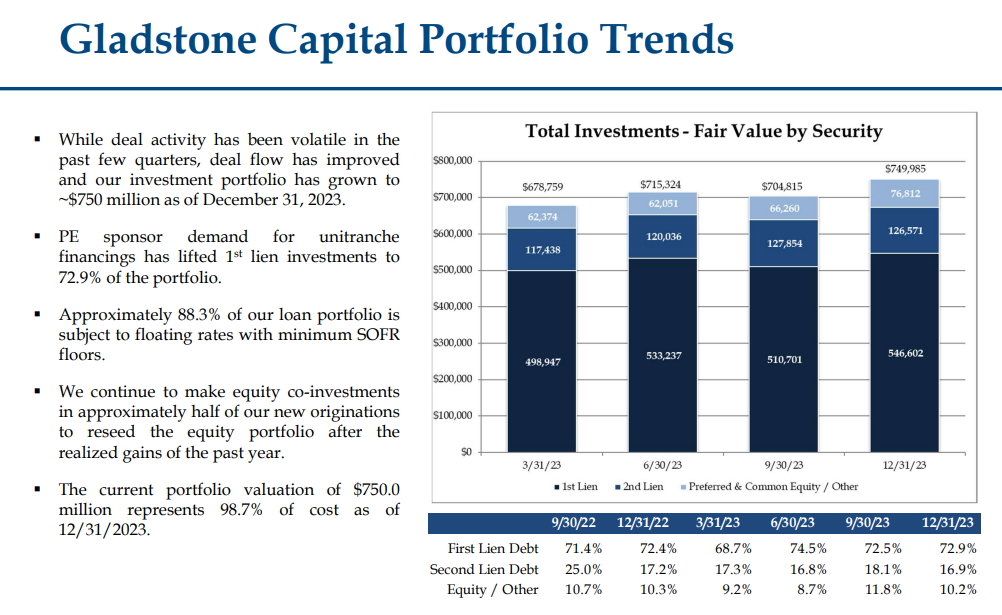

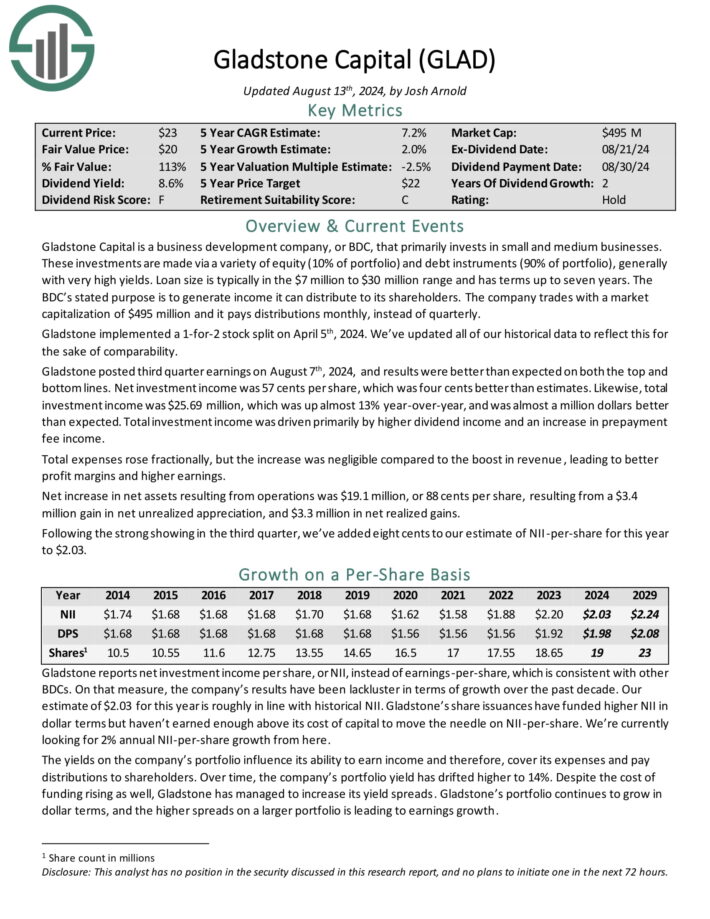

Excessive-Yield Month-to-month Dividend Inventory #14: Gladstone Capital (GLAD)

Gladstone Capital is a enterprise growth firm, or BDC, that primarily invests in small and medium companies. These investments are made through a wide range of fairness (10% of portfolio) and debt devices (90% of portfolio), usually with very excessive yields.

Mortgage measurement is usually within the $7 million to $30 million vary and has phrases as much as seven years.

Supply: Investor Presentation

Gladstone posted third quarter earnings on August seventh, 2024, and outcomes have been higher than anticipated on each the highest and backside strains. Internet funding revenue was 57 cents per share, which was 4 cents higher than estimates.

Likewise, complete funding revenue was $25.69 million, which was up nearly 13% year-over-year, and was nearly 1,000,000 {dollars} higher than anticipated. Whole funding revenue was pushed primarily by greater dividend revenue and a rise in prepayment payment revenue.

Click on right here to obtain our most up-to-date Positive Evaluation report on GLAD (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #13: Era Revenue Properties (GIPR)

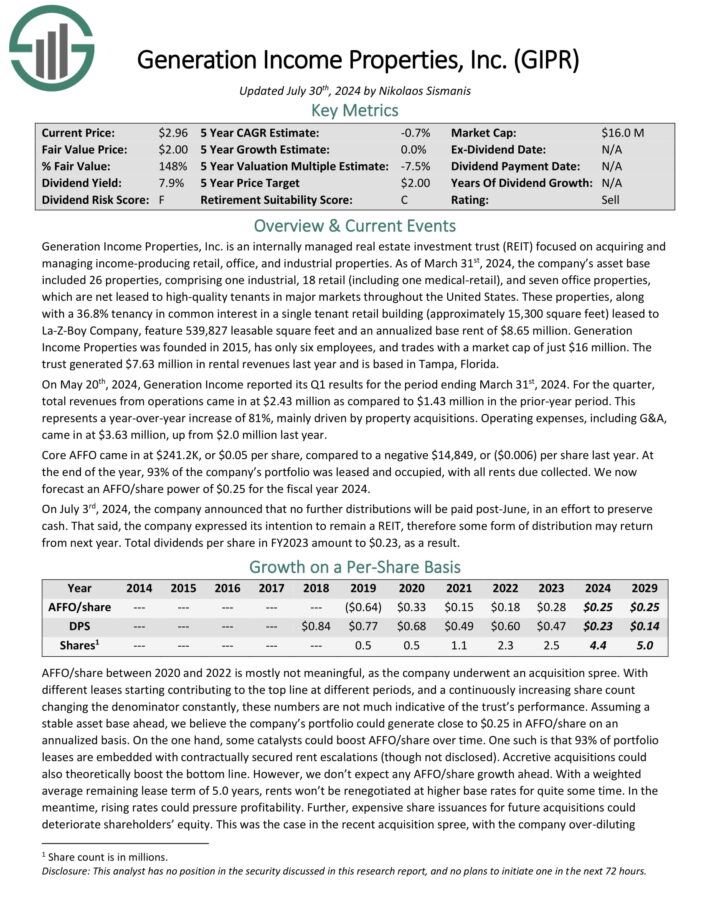

Era Revenue Properties, Inc. is an internally managed REIT centered on buying and managing income-producing retail, workplace, and industrial properties.

On the finish of the yr, 96% of the corporate’s portfolio was leased, with all rents due collected.

On Could twentieth, 2024, Era Revenue reported its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, complete revenues from operations got here in at $2.43 million as in comparison with $1.43 million within the prior-year interval. This represented a year-over-year improve of 81%, primarily pushed by property acquisitions.

Core AFFO got here in at $241.2K, or $0.05 per share, in comparison with a adverse $14,849, or ($0.006) per share final yr. On the finish of the yr, 93% of the corporate’s portfolio was leased and occupied, with all rents due collected. We now forecast an AFFO/share energy of $0.25 for the fiscal yr 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIPR (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #12: Fortitude Gold (FTCO)

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions. The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or better.

Its property portfolio at the moment consists of 100% possession in six high-grade gold properties. All six properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt.

Supply: Investor Presentation

On July thirtieth, 2024, Fortitude Gold posted its Q2 outcomes for the interval ending June 30st, 2024. For the quarter, revenues got here in at $9.6 million, 50.3% decrease in comparison with final yr.

The decline in revenues was pushed by a 58% drop in ounces of gold bought.

Nevertheless, a 19% improve in ounces of silver bought together with 18% greater gold and 19% greater silver costs barely offset this setback.

Shifting to the underside line, the corporate recorded a mine gross revenue of $4.8 million in comparison with $11.2 million final yr on account of decrease web gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #11: PennantPark Floating Price Capital (PFLT)

PennantPark Floating Price Capital Ltd. is a enterprise growth firm that seeks to make secondary direct, debt, fairness, and mortgage investments.

The fund additionally goals to take a position by floating charge loans in personal or thinly traded or small market-cap, public center market firms, fairness securities, most well-liked inventory, widespread inventory, warrants or choices obtained in reference to debt investments or by direct investments.

On August 7, 2024, PennantPark Floating Price Capital introduced its monetary outcomes for the third quarter ended June 30, 2024. The corporate reported an funding portfolio worth of $1,658.9 million and web property of $816.7 million, with a GAAP web asset worth per share of $11.34, representing a quarterly lower of 0.5%.

The corporate’s credit score facility was $218.9 million, whereas its 2036 and 2031 Asset-Backed Debt stood at $284.0 million and $209.9 million, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven under):

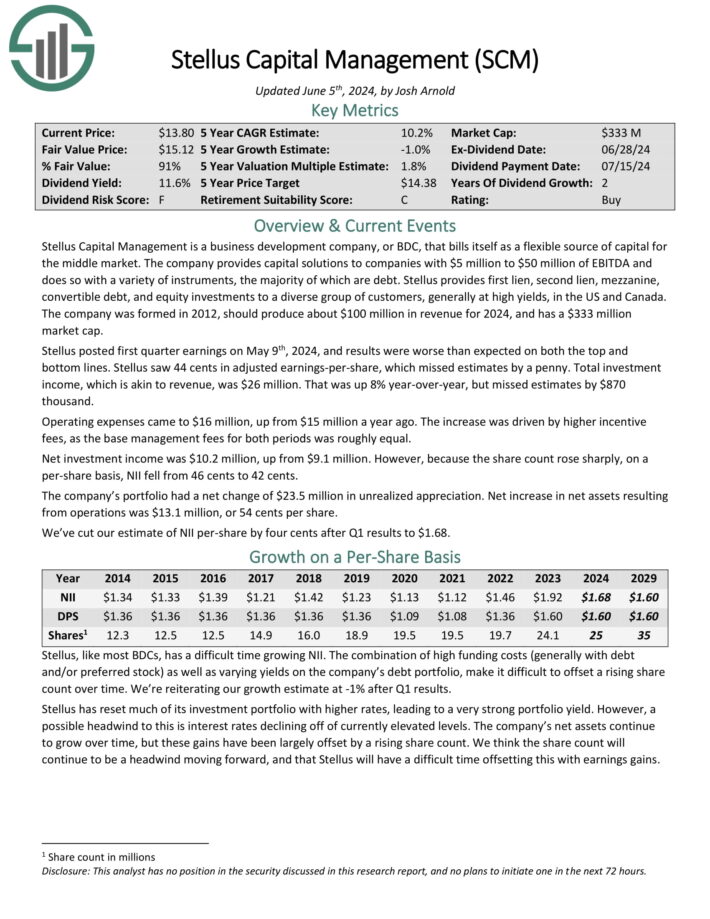

Excessive-Yield Month-to-month Dividend Inventory #10: Stellus Capital (SCM)

Stellus Capital Administration supplies capital options to firms with $5 million to $50 million of EBITDA and does so with a wide range of devices, nearly all of that are debt.

Stellus supplies first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of consumers, usually at excessive yields, within the US and Canada.

Supply: Investor Presentation

Stellus posted first quarter earnings on Could ninth, 2024. Stellus generated $0.44 in adjusted earnings-per-share. Whole funding revenue was $26 million, up 8% year-over-year.

Working bills got here to $16 million, up from $15 million a yr in the past. The rise was pushed by greater incentive charges, as the bottom administration charges for each durations was roughly equal. Internet funding revenue was $10.2 million, up from $9.1 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on Stellus (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #9: Ellington Monetary (EFC)

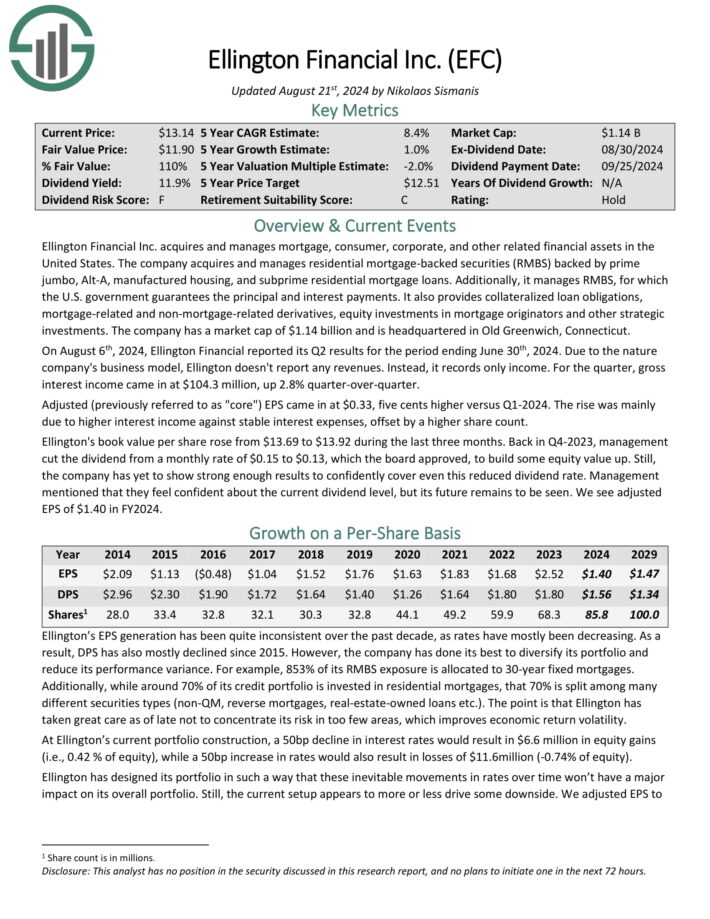

Ellington Monetary Inc. acquires and manages mortgage, client, company, and different associated monetary property within the United States.

The corporate acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Supply: Investor Presentation

Moreover, it manages RMBS, for which the U.S. authorities ensures the principal and curiosity funds. It additionally supplies collateralized mortgage obligations, mortgage–associated and non–mortgage–associated derivatives, fairness investments in mortgage originators and different strategic investments.

On August sixth, 2024, Ellington Monetary reported its Q2 outcomes for the interval ending June thirtieth, 2024. Because of the nature firm’s enterprise mannequin, Ellington doesn’t report any revenues. As an alternative, it data solely revenue. For the quarter, gross curiosity revenue got here in at $104.3 million, up 2.8% quarter-over-quarter.

Adjusted (beforehand known as “core”) EPS got here in at $0.33, 5 cents greater versus Q1-2024. The rise was primarily on account of greater curiosity revenue towards steady curiosity bills, offset by the next share rely.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ellington Monetary (EFC) (preview of web page 1 of three proven under):

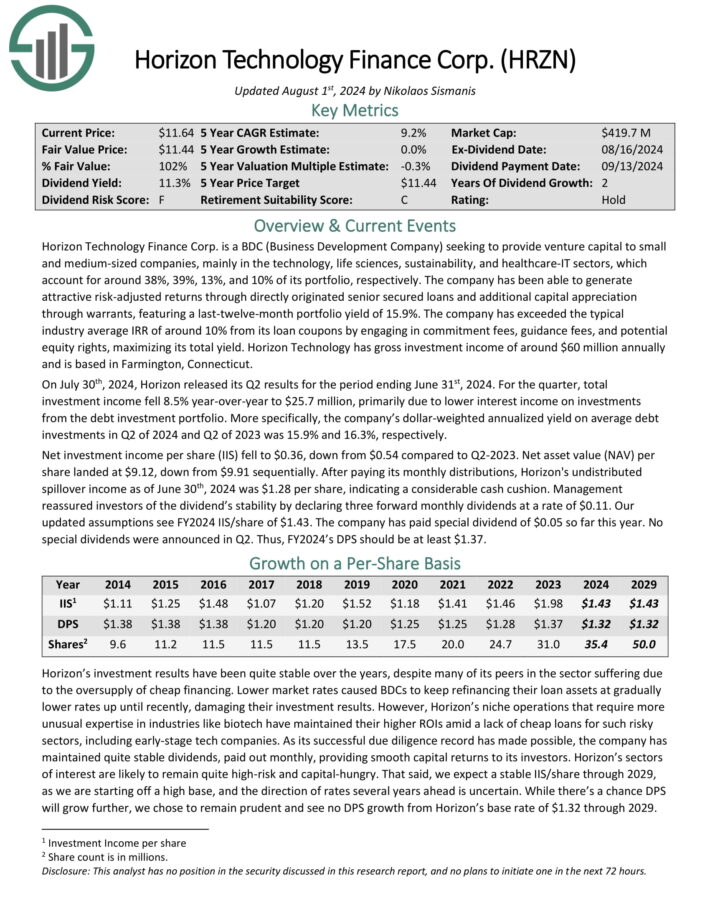

Excessive-Yield Month-to-month Dividend Inventory #8: Horizon Expertise (HRZN)

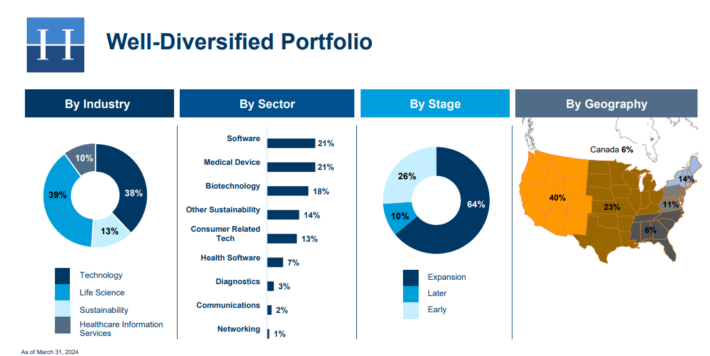

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated engaging threat–adjusted returns by instantly originated senior secured loans and extra capital appreciation by warrants.

Supply: Investor Presentation

On July thirtieth, 2024, Horizon launched its Q2 outcomes for the interval ending June thirty first, 2024. For the quarter, complete funding revenue fell 8.5% year-over-year to $25.7 million, primarily on account of decrease curiosity revenue on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in Q2 of 2024 and Q2 of 2023 was 15.9% and 16.3%, respectively.

Internet funding revenue per share (IIS) fell to $0.36, down from $0.54 in comparison with Q2-2023. Internet asset worth (NAV) per share landed at $9.12, down from $9.91 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover revenue as of June thirtieth, 2024 was $1.28 per share, indicating a substantial money cushion.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven under):

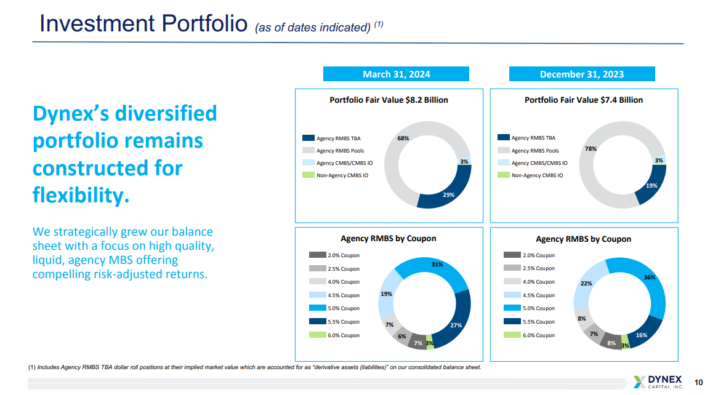

Excessive-Yield Month-to-month Dividend Inventory #7: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the USA. It invests in company and non–company MBS consisting of residential MBS, business MBS (CMBS), and CMBS curiosity–solely securities.

Supply: Investor Presentation

Within the first quarter of 2024, the corporate demonstrated stable monetary efficiency with a complete financial return of $0.28 per widespread share, equal to 2.1% of the start e-book worth. E-book worth per widespread share stood at $13.20 as of March 31, 2024.

Complete revenue amounted to $0.35 per widespread share, with web revenue reaching $0.65 per widespread share. Dividends declared for the quarter amounted to $0.39 per widespread share.

Click on right here to obtain our most up-to-date Positive Evaluation report on DX (preview of web page 1 of three proven under):

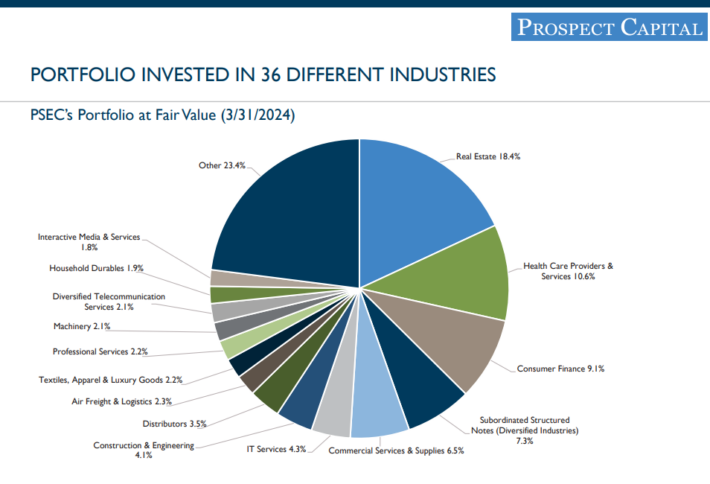

Excessive-Yield Month-to-month Dividend Inventory #6: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect posted fourth quarter and full-year earnings on August twenty eighth, 2024, and outcomes have been considerably weak. Internet curiosity revenue per share, which is akin to web earnings, was 25 cents.

This was down from 28 cents a yr in the past, however significantly better than the 18 cents anticipated. Whole funding revenue, which is Prospect’s type of income, was down year-over-year, falling from $221.5 million to $212.3 million.

Whole originations rose from $220 million to $242 million quarter-over-quarter. Whole repayments and gross sales have been $245 million, greater than double the prior quarter.

Prospect famous that quarter-to-date for fiscal Q1, originations have been $161 million, whereas repayments have been $253 million, implying ~$90 million of shrinkage within the portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

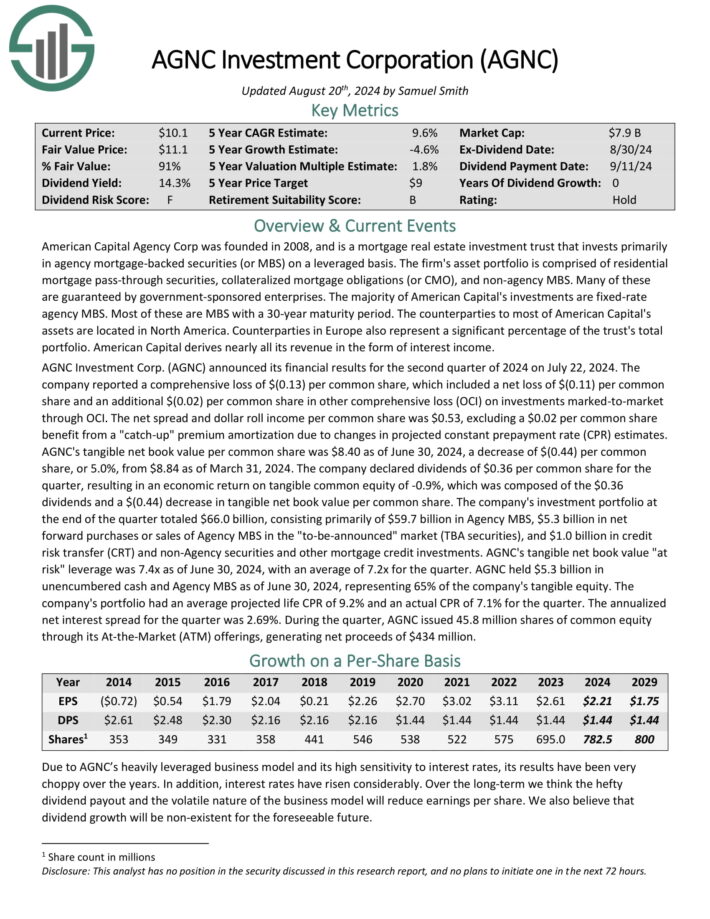

Excessive-Yield Month-to-month Dividend Inventory #5: AGNC Funding Company (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

AGNC Funding Corp. (AGNC) introduced its monetary outcomes for the second quarter of 2024 on July 22, 2024. The corporate reported a complete lack of $(0.13) per widespread share, which included a web lack of $(0.11) per widespread share and an extra $(0.02) per widespread share in different complete loss (OCI) on investments marked-to market by OCI.

The web unfold and greenback roll revenue per widespread share was $0.53, excluding a $0.02 per widespread share profit from a “catch-up” premium amortization on account of modifications in projected fixed prepayment charge (CPR) estimates.

AGNC’s tangible web e-book worth per widespread share was $8.40 as of June 30, 2024, a lower of $(0.44) per widespread share, or 5.0%, from $8.84 as of March 31, 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #4: Ellington Credit score Co. (EARN)

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On Could 14th, 2024, Ellington Residential reported its first quarter outcomes for the interval ending March thirty first, 2024. The corporate generated web revenue of $4.0 million, or $0.20 per share.

Ellington achieved adjusted distributable earnings of $5.3 million within the quarter, resulting in adjusted earnings of $0.27 per share, which lined the dividend paid within the interval. Ellington’s web curiosity margin was 3.03% general.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #3: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) equivalent to Fannie Mae and Freddie Mac.

It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate house loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different kinds of investments.

ARR reported its unaudited second-quarter 2024 monetary outcomes and monetary place as of June 30, 2024. The corporate introduced a GAAP web loss associated to widespread stockholders of $(51.3) million or $(1.05) per widespread share.

The corporate generated web curiosity revenue of $7.0 million and distributable earnings accessible to widespread stockholders of $52.5 million, equating to $1.08 per widespread share.

ARMOUR paid widespread inventory dividends of $0.24 per share per 30 days, totaling $0.72 per share for the second quarter. The typical curiosity revenue on interest-earning property was 5.00%, whereas the curiosity value on common interest-bearing liabilities was 5.52%. The financial curiosity revenue was 4.74%, with an financial web curiosity unfold of two.05%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #2: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC specializing in financing early and center–stage companies by loans and CLOs.

The firm holds an equally break up portfolio of First–Lien, Second–Lien, and CLO fairness assets unfold throughout a number of industries, with the best publicity in software program and enterprise providers.

Supply: Investor Presentation

On August thirteenth, 2024, Oxford Sq. reported its Q2 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate generated roughly $11.4 million of complete funding revenue, down from $13.5 million within the earlier quarter.

This was on account of decrease curiosity revenue from its debt investments and decrease revenue from its securitization autos.

Additional, the weighted common yield of the corporate’s debt investments was 13.7% at present value, down from 13.9% within the earlier quarter.

Nonetheless, the weighted common money distribution yield of the corporate’s money revenue producing CLO fairness investments at present rose sequentially from 13.7% to 16.2%. The weighted common efficient yield of the corporate’s CLO fairness investments at present value was 9.4%, down from 9.5% within the earlier quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven under):

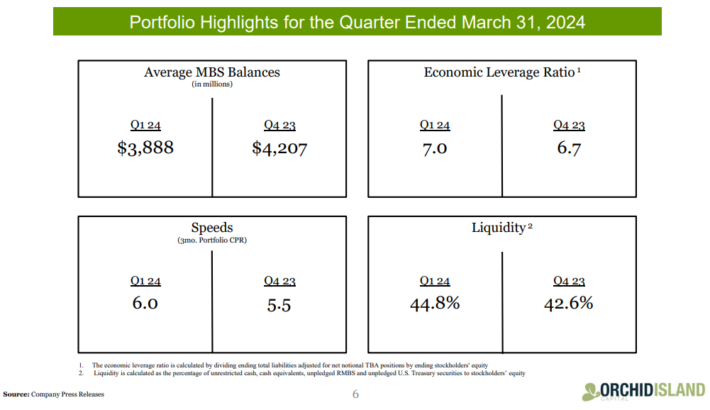

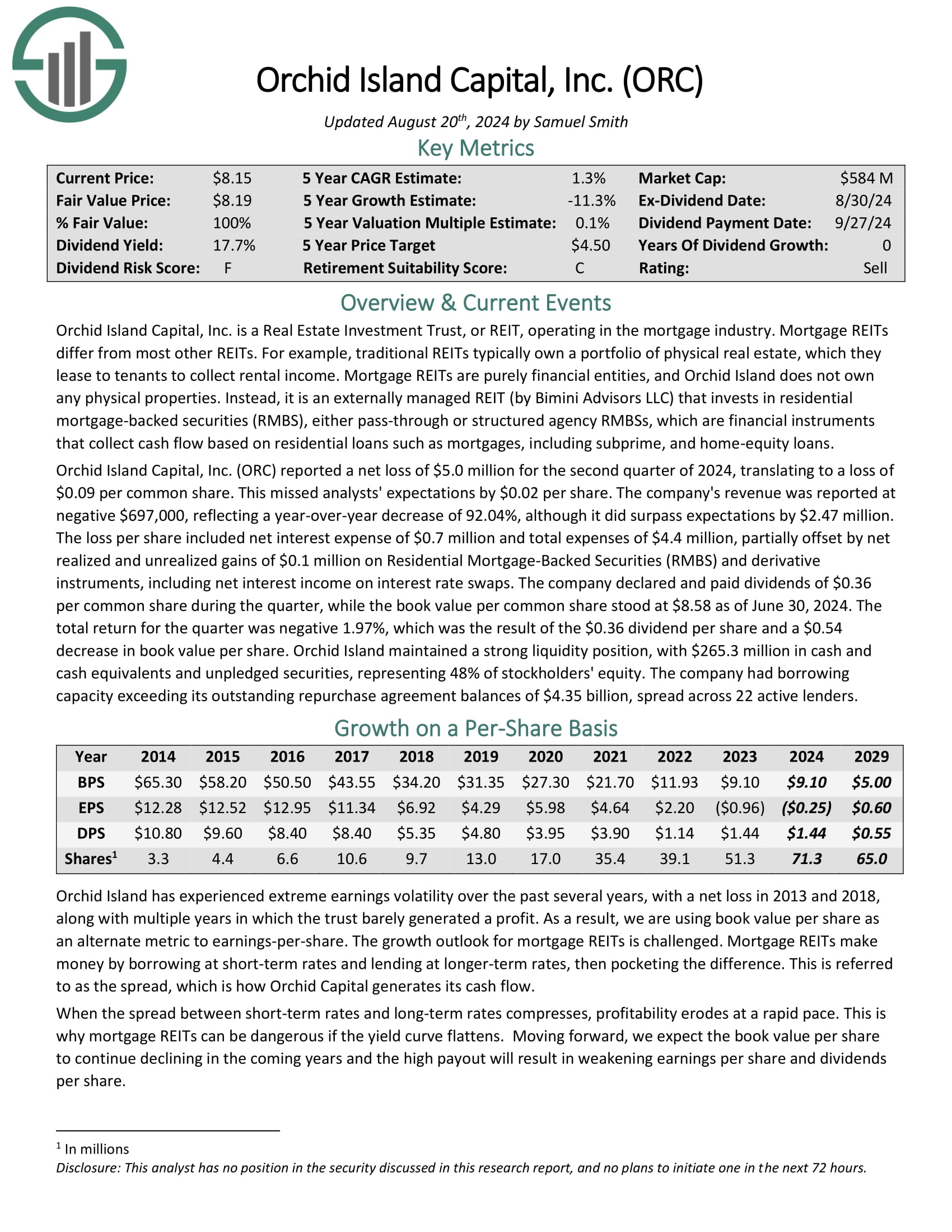

Excessive-Yield Month-to-month Dividend Inventory #1: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is a mortgage REIT that invests in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money circulation primarily based on residential loans equivalent to mortgages, subprime, and home-equity loans.

Supply: Investor Presentation

Orchid Island reported a web lack of $5.0 million for the second quarter of 2024, translating to a lack of $0.09 per widespread share. This missed analysts’ expectations by $0.02 per share. The corporate’s income was reported at adverse $697,000, reflecting a year-over-year lower of 92.04%, though it did surpass expectations by $2.47 million.

The loss per share included web curiosity expense of $0.7 million and complete bills of $4.4 million, partially offset by web realized and unrealized positive aspects of $0.1 million on Residential Mortgage-Backed Securities (RMBS) and by-product devices, together with web curiosity revenue on rate of interest swaps.

The corporate declared and paid dividends of $0.36 per widespread share through the quarter, whereas the e-book worth per widespread share stood at $8.58 as of June 30, 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

Last Ideas

Month-to-month dividend shares might be extra interesting to revenue buyers than quarterly or semi-annual dividend shares. It’s because month-to-month dividend shares make 12 dividend funds per yr, as a substitute of the standard 4 or 2.

Moreover, month-to-month dividend shares with excessive yields above 5% are much more engaging for revenue buyers.

The 20 shares on this checklist haven’t been vetted for dividend security, that means every investor ought to perceive the distinctive threat components of every firm.

That mentioned, these 20 dividend shares make month-to-month funds to shareholders, and all have excessive dividend yields.

Additional Studying

If you’re fascinated about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources can be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.