Merchants,

On this replace, I’ll share a number of of my prime concepts for the upcoming week, as I did final week.

As an train, I urge you to assessment final week’s motion and my pre-determined plans shared within the watchlist to review the motion and setups and higher perceive my thought course of and why a number of names from the watchlist skilled the follow-through they did. I do that dwell as soon as per week, intimately, with members in Inside Entry.

Now, stick round as I share the ‘why’ behind the potential trades for the upcoming week and my perfect entry and exit situations and targets.

So, let’s get proper into it.

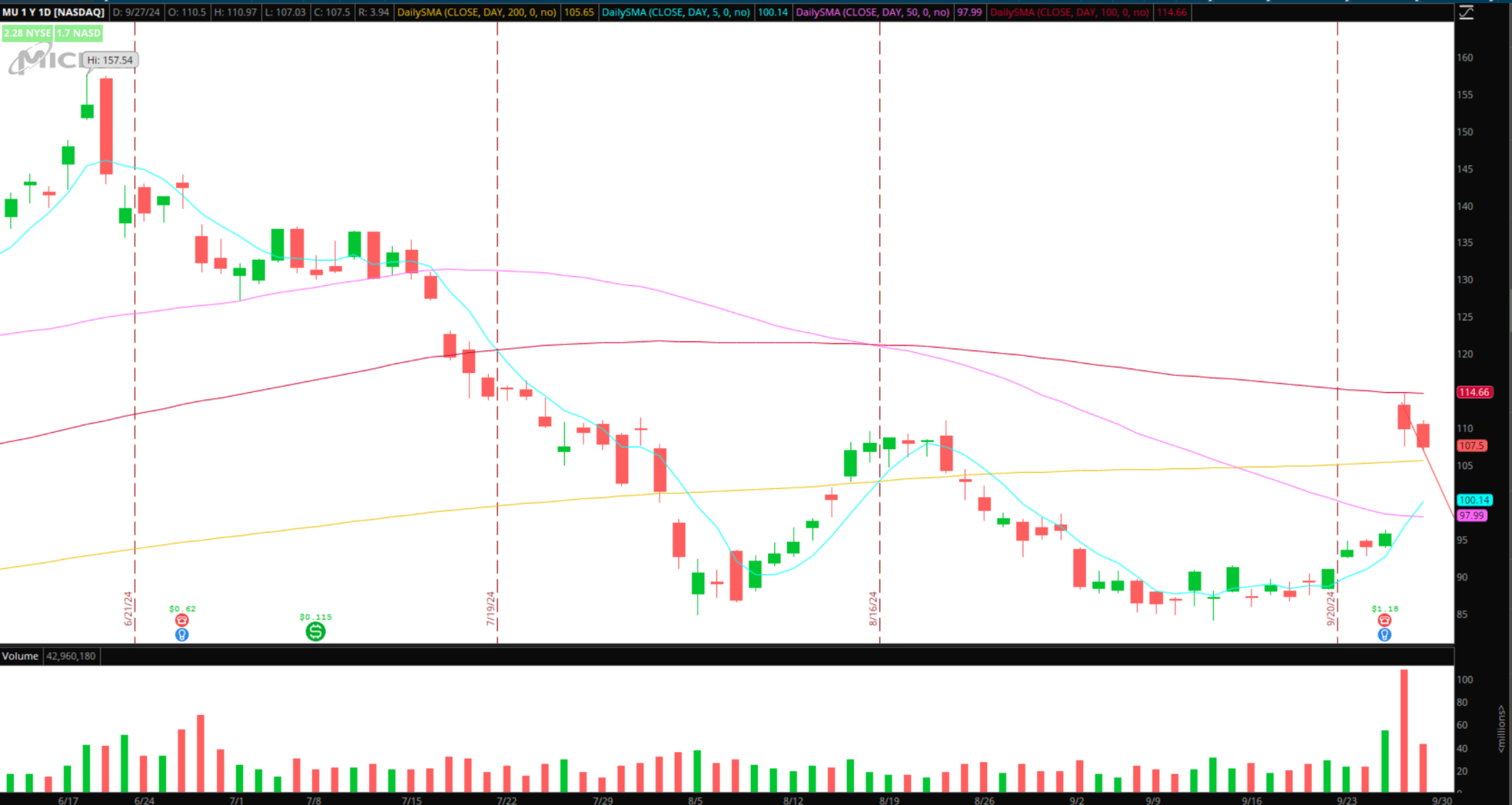

Comply with-Via in MU

The Thought: After a strong earnings hole, shares of Micron have pulled again steadily towards its rising 200-day SMA. Inside the pullback, a possible downtrend flag resistance develops as quantity decreases, creating a possibility for a second-leg worth and quantity breakout. Ideally, this continues to drag again and expertise additional consolidation for a day or two, nearer to its 200-day SMA, earlier than experiencing leg two larger.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

The Plan: I’m monitoring worth and quantity with two potential entry situations in thoughts. First, a wash/pullback towards its rising 200-day SMA and VWAP reclaim, together with worth again within the vary over $107, could be sufficient to get me lengthy for a multi-day swing commerce with a cease on the LOD.

Secondly, A break and maintain above $108 with elevated RVOL and relative energy originally of the week. If MU bases above $108, with favorable market internals and relative energy, I’ll provoke an extended versus the earlier larger low on the 5-min, as I wouldn’t wish to see the inventory enter the low-end of the vary as soon as entered. 1 ATR goal for revenue goal 1, $112 – $113/ 100-day SMA. After that, trailing with larger lows on the 5-minute timeframe and utilizing my exit technique mentioned in Inside Entry weekly.

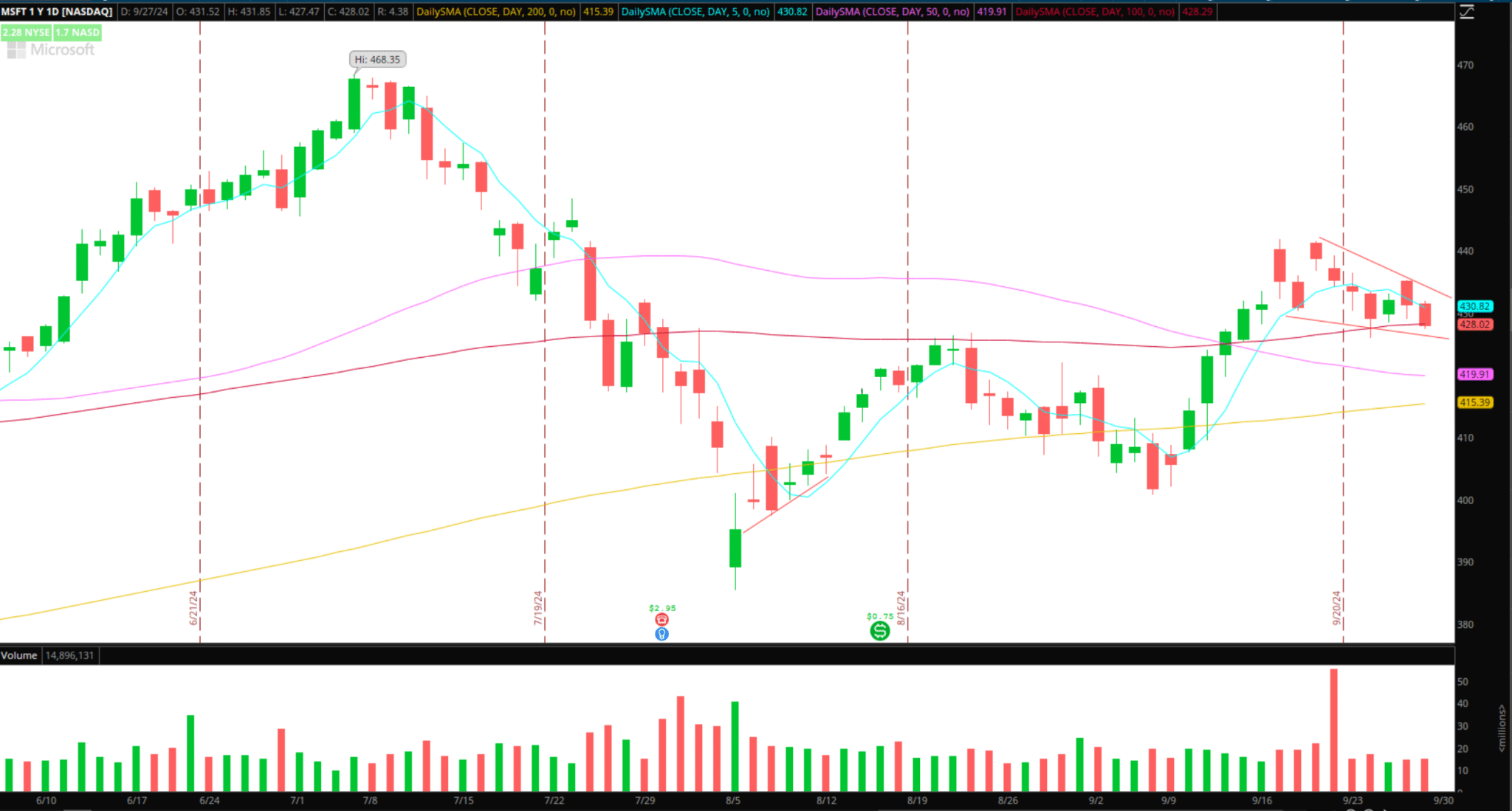

Greater-Low Breakout in MSFT

The Thought: Measured pullback, higher-low creating on the day by day in MSFT, close to converging SMAs. Concentrating on a maintain above the 5-day, close to the flag’s resistance, and pattern change. It probably wants a number of days to develop and conform to the setup.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

The Plan: Patiently monitor MSFT because the setup develops additional. I may also search for clues concerning the inventory, ideally turning into a relative energy participant within the quick time period after underperforming in current weeks. Suppose MSFT breaks above the low $430s and begins to intraday pattern with strong internals. In that case, I’ll provoke an extended swing versus the day low, with the $440 zone because the goal one for revenue, and after that path my cease utilizing larger highs and better low technique for path and revenue taking.

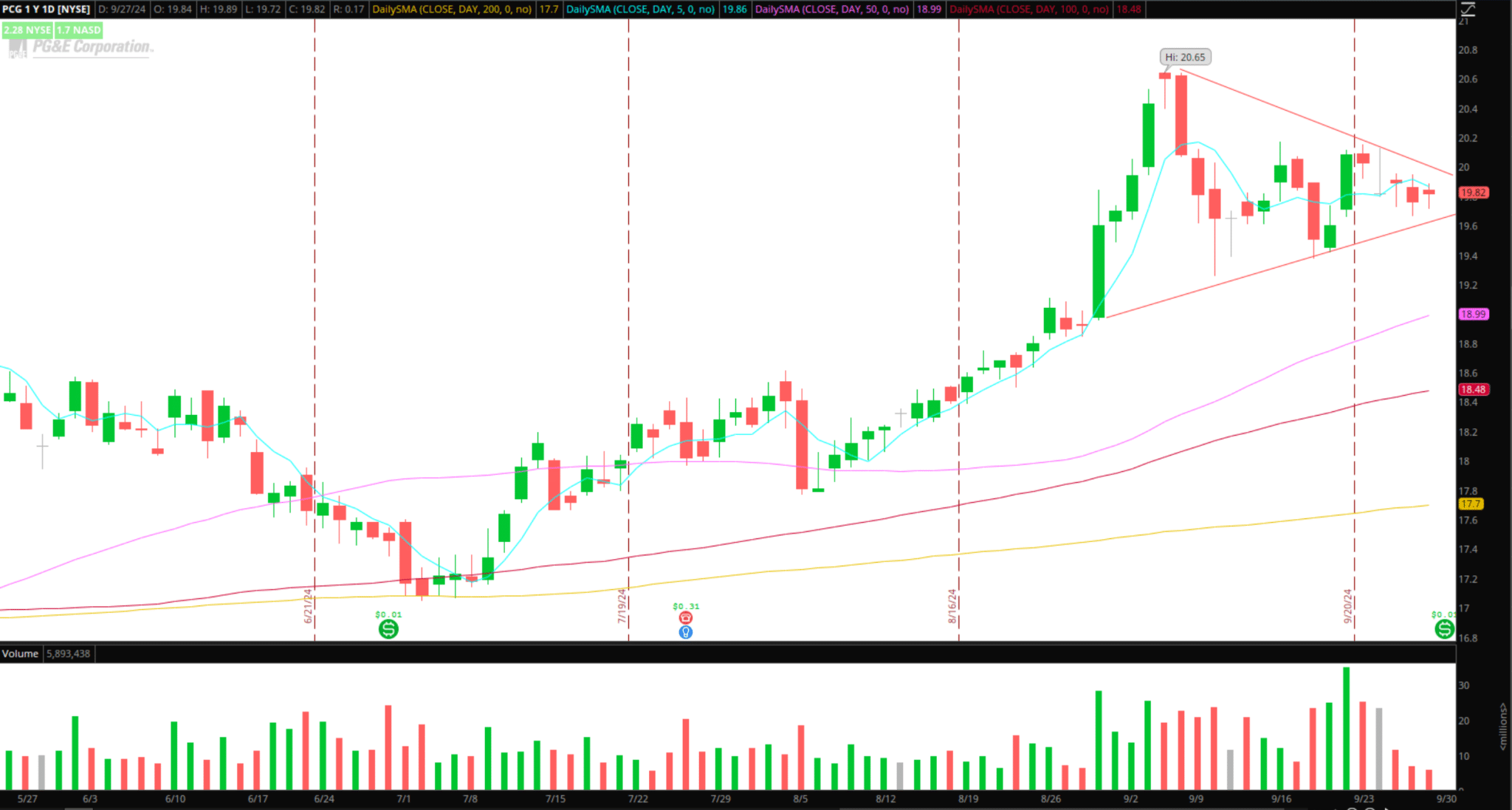

Consolidation Breakout in PCG

The Thought and Plan: Contracting vary and quantity in PCG because the consolidation builds close to its 52-week excessive. This can be a easy setup, in search of quantity and worth burst above $20 to substantiate a breakout.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

I might look to enter lengthy above $20 after quantity and worth affirm a breakout, with a cease beneath the earlier larger low on the 5-min. Thereafter, I’ll goal a transfer to the 52-week excessive as my primary goal, with a path left on to let the place trip.

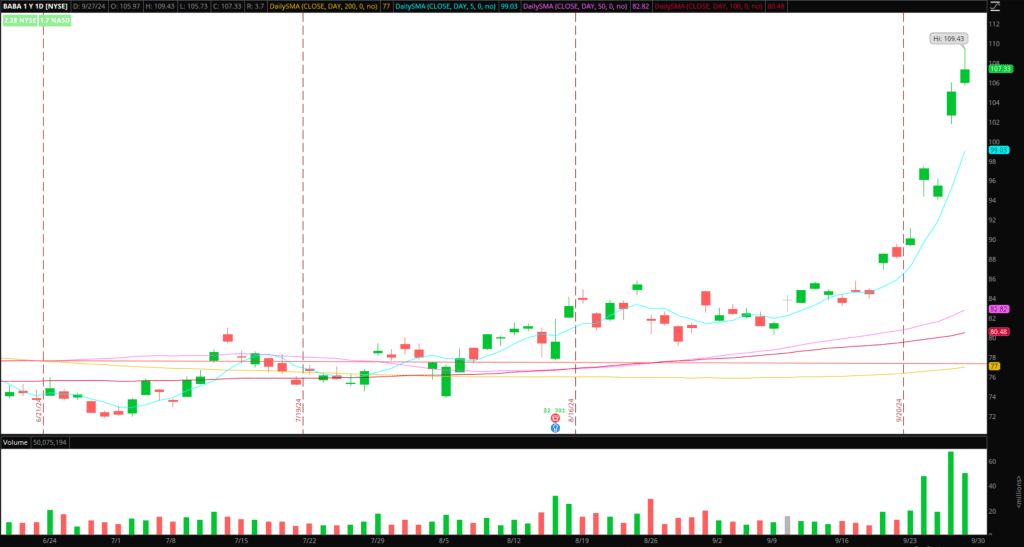

Pullback in China Names (BABA / FXI / PDD, and so on.)

The Plan and Thought: Greater image; I’m in search of a major pullback and consolidation to enter lengthy. Nonetheless, within the close to time period, a number of Chinese language names shall be in overbought territory and vulnerable to a pullback.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Due to this fact, with extra of an intraday mindset, I’m in search of both a push and fail in BABA, for instance, above Friday’s excessive, or a 2-day VWAP to behave as resistance and fail for brief versus the HOD, concentrating on an intraday transfer again towards Day 1 and Thursday’s assist close to $102.

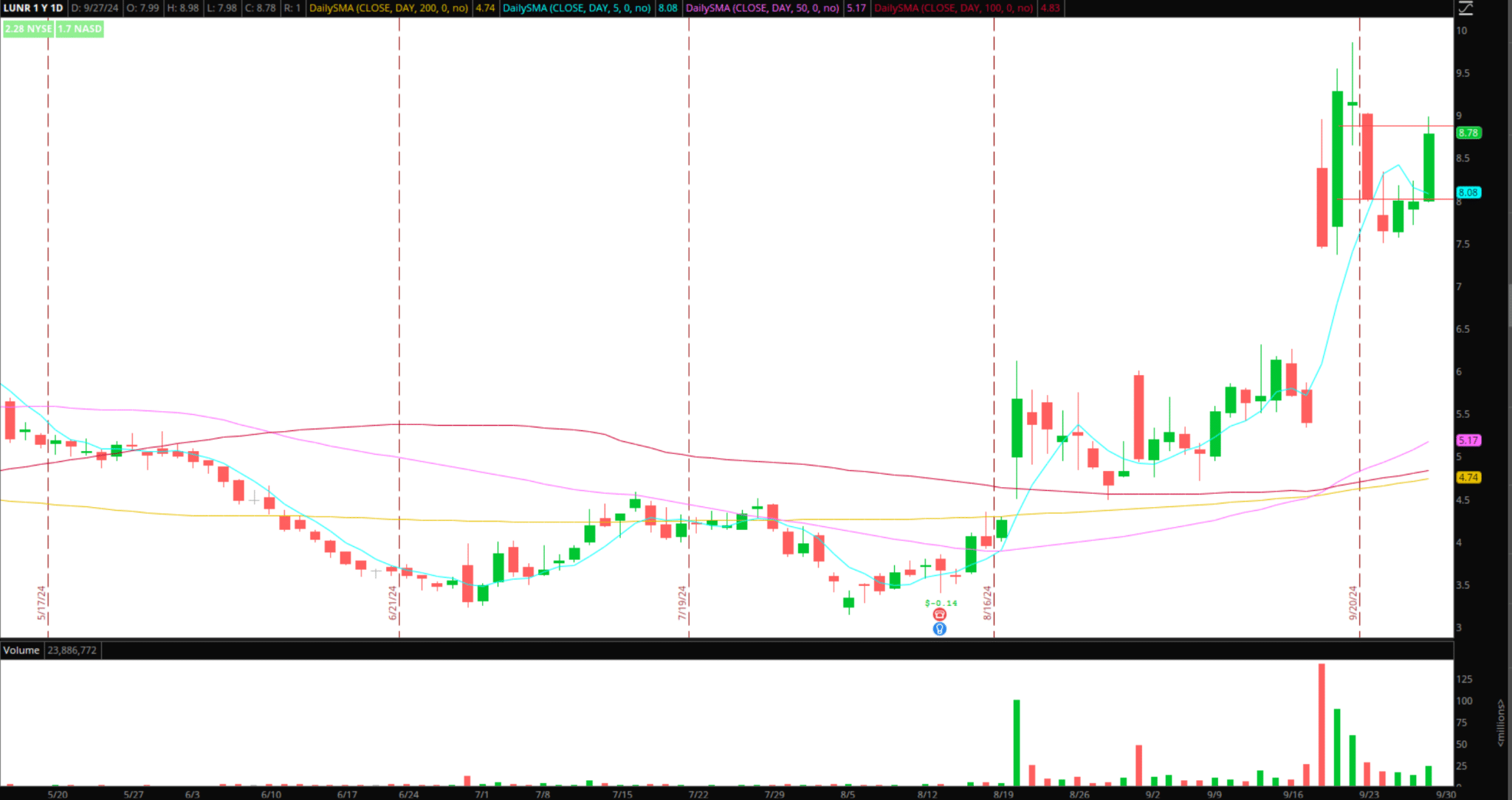

Consolidation Breakout in LUNR

The Thought and Plan: Bearish sentiment stays agency, with an elevated quick curiosity. The inventory has held up nicely after offering a strong quick alternative final week, as talked about within the watchlist. This motion has setup a possible liquidity lure and quick squeeze above current highs.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Retaining it easy, I’m in search of the worth to base above $9 earlier resistance and construct. I might search for a starter place above $9 after a consolidation interval, with a cease beneath the important thing space. I’m concentrating on follow-through above and an add, $9.5, for a breakout andsqueeze out over the highs.

Small-Cap Shares on Watch

For each names beneath, I might not look to quick in the event that they consolidate close to highs for a number of days, as this might setup a possible liquidity lure and squeeze larger.

CNEY: Targteting a push towards $1.10 and fail for a brief.

DUO: Concentrating on a push towards $1.4 – $1.5 and speedy stuff for a brief versus the HOD and transfer again sub $1.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures