Up to date on October eleventh, 2024 by Bob Ciura

Enterprise Improvement Firms, in any other case often called BDCs, are extremely common amongst earnings traders. BDCs broadly have excessive dividend yields of 5% or larger.

This makes BDCs very interesting for earnings traders reminiscent of retirees. With this in thoughts, we’ve created an inventory of BDCs.

You may obtain your free copy of our BDC listing, together with related monetary metrics reminiscent of P/E ratios and dividend payout ratios, by clicking on the hyperlink beneath:

In fact, earlier than investing in BDCs, traders ought to perceive the distinctive traits of the sector.

This text will present an outline of BDCs. It should additionally listing our prime 5 BDCs proper now as ranked by anticipated whole returns within the Certain Evaluation Analysis Database.

Desk Of Contents

The desk of contents beneath gives for straightforward navigation of the article:

Overview of BDCs

Enterprise Improvement Firms are closed-end funding corporations. Their enterprise mannequin includes making debt and/or fairness investments in different firms, usually small or mid-size companies.

These goal firms might not have entry to conventional technique of elevating capital, which makes them appropriate companions for a BDC. BDCs spend money on quite a lot of firms, together with turnarounds, creating, or distressed firms.

BDCs are registered below the Funding Firm Act of 1940. As they’re publicly-traded, BDCs should even be registered with the Securities and Alternate Fee.

To qualify as a BDC, the agency should make investments no less than 70% of its belongings in personal or publicly-held firms with market capitalizations of $250 million or beneath.

BDCs make cash by investing with the purpose of producing earnings, in addition to capital beneficial properties on their investments if and when they’re offered.

On this manner, BDCs function related enterprise fashions as a non-public fairness agency or enterprise capital agency.

The foremost distinction is that non-public fairness and enterprise capital funding is often restricted to accredited traders, whereas anybody can spend money on publicly-traded BDCs.

Why Make investments In BDCs?

The apparent attraction for BDCs is their excessive dividend yields. It’s not unusual to search out BDCs with dividend yields above 5%. In some circumstances, sure BDCs present 10%+ yields.

In fact, traders ought to conduct a radical quantity of due diligence, to ensure the underlying fundamentals help the dividend.

As at all times, traders ought to keep away from dividend cuts every time attainable. Any inventory that has an abnormally excessive yield is a possible hazard.

Certainly, there are a number of threat elements that traders ought to know earlier than they spend money on BDCs. At the beginning, BDCs are sometimes closely indebted. That is commonplace throughout BDCs, as their enterprise mannequin includes borrowing to make investments in different firms. The tip result’s that BDCs are sometimes considerably leveraged firms.

When the financial system is powerful and markets are rising, leverage can assist amplify optimistic returns.

Nevertheless, the flip aspect is that leverage can speed up losses as nicely, which might occur in bear markets or recessions.

One other threat to pay attention to is rates of interest. For the reason that BDC enterprise mannequin closely makes use of debt, traders ought to perceive the rate of interest setting earlier than investing.

For instance, rising rates of interest can negatively have an effect on BDCs if it causes a spike in borrowing prices.

Lastly, credit score threat is an extra consideration for traders. As beforehand talked about, BDCs make investments in small to mid-size companies.

Due to this fact, the standard of the BDC’s portfolio have to be assessed, to ensure the BDC won’t expertise a excessive stage of defaults inside its funding portfolio.

This might trigger antagonistic outcomes for the BDC itself, which might negatively affect its skill to keep up distributions to shareholders.

One other distinctive attribute of BDCs that traders ought to know earlier than shopping for is taxation. BDC dividends are usually not “certified dividends” for tax functions, which is usually a extra favorable tax fee.

As an alternative, BDC distributions are taxable on the investor’s strange earnings charges, whereas the BDC’s capital beneficial properties and certified dividend earnings is taxed at capital beneficial properties charges.

After taking all of this under consideration, traders may resolve that BDCs are match for his or her portfolios. If that’s the case, earnings traders may think about one of many following BDCs.

Tax Issues Of BDCs

As at all times, traders ought to perceive the tax implications of varied securities earlier than buying. Enterprise Improvement Firms should pay out 90%+ of their earnings as distributions.

On this manner, BDCs are similar to Actual Property Funding Trusts.

One other issue to bear in mind is that roughly 70% to 80% of BDC dividend earnings is often derived from strange earnings.

In consequence, BDCs are broadly thought of to be good candidates for a tax-advantaged retirement account reminiscent of an IRA or 401k.

BDCs pay their distributions as a mixture of strange earnings and non-qualified dividends, certified dividends, return of capital, and capital beneficial properties.

Returns of capital cut back your tax foundation. Certified dividends and long-term capital beneficial properties are taxed at decrease charges, whereas strange earnings and non-qualified dividends are taxed at your private earnings tax bracket fee.

The High 5 BDCs Right now

With all this in thoughts, listed below are our prime 5 BDCs right now, ranked in accordance with their anticipated annual returns over the following 5 years.

BDC #5: Monroe Capital (MRCC)

5-year anticipated annual return: 10.5%

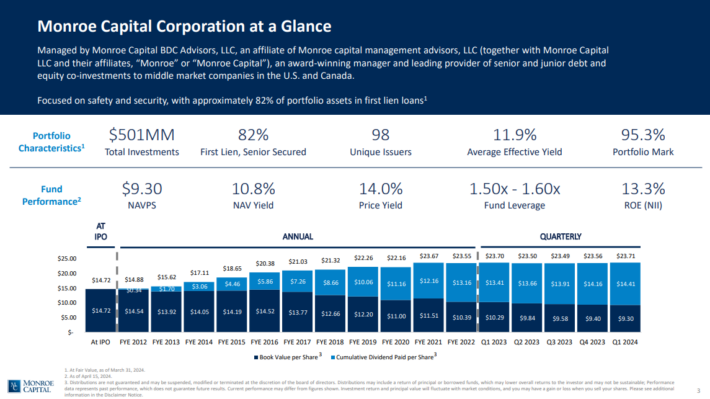

Monroe Capital Company gives financing options primarily to decrease middle-market firms in the USA and Canada.

The corporate primarily invests in senior and “unitranche” secured loans ranging between $2.0 million and $25.0 million every. It generates almost $57 million yearly in whole funding earnings.

Supply: Investor Presentation

On August seventh, 2024, Monroe Capital Company reported its Q2 outcomes for the interval ending June thirty first, 2024. Whole funding earnings for the quarter got here in at $15.6 million, in comparison with $15.2 million within the earlier quarter. The weighted common portfolio yield remained secure in the course of the quarter, standing at 11.9%.

Nonetheless, a decrease variety of portfolio firms, which fell from 98 to 94, negatively impacted whole funding earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on MRCC (preview of web page 1 of three proven beneath):

BDC #4: Nice Elm Capital Corp. (GECC)

5-year anticipated annual return: 11.7%

Nice Elm Capital Company is a enterprise growth firm that makes a speciality of mortgage and mezzanine, center market investments.

It seeks to create long-term shareholder worth by constructing its enterprise throughout three verticals: Working Firms, Funding Administration, and Actual Property.

The corporate favors investing in media, healthcare, telecommunication companies, communications tools, business companies and provides.

For the second quarter of 2024, GECC reported web funding earnings (NII) of $3.1 million, or $0.32 per share, in comparison with $3.2 million, or $0.37 per share, for the primary quarter of 2024.

Internet belongings have been $126.0 million, or $1.06 per share, down from $118.8 million, or $12.57 per share, on the finish of March 2024.

The decline in web belongings was partly resulting from further write-downs on illiquid investments. The corporate’s asset protection ratio stood at 171.0% as of June 30, 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on GECC (preview of web page 1 of three proven beneath):

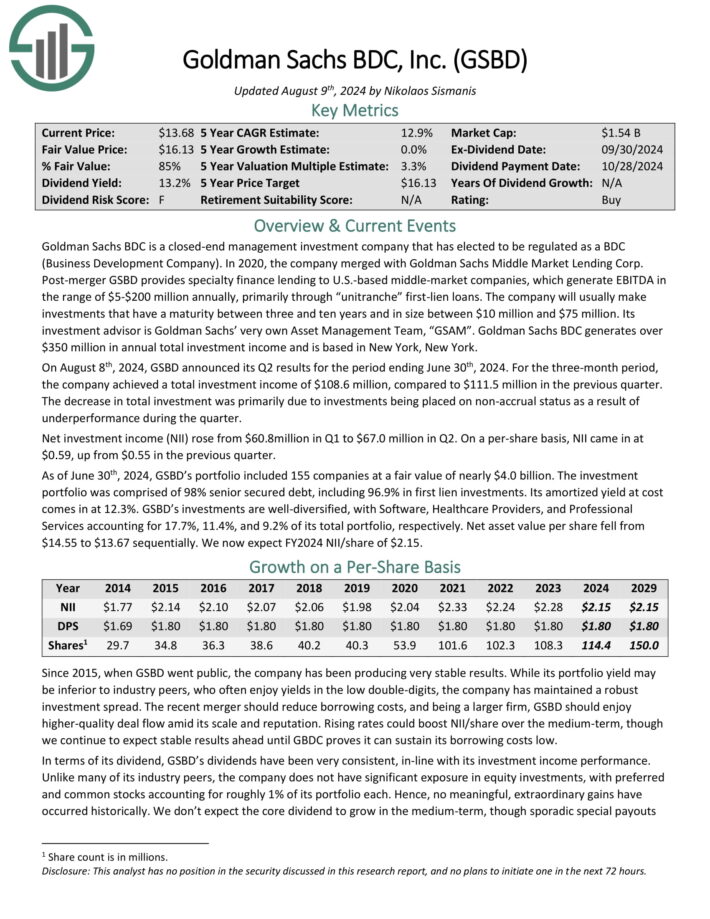

BDC #3: Goldman Sachs BDC (GSBD)

5-year anticipated annual return: 13.1%

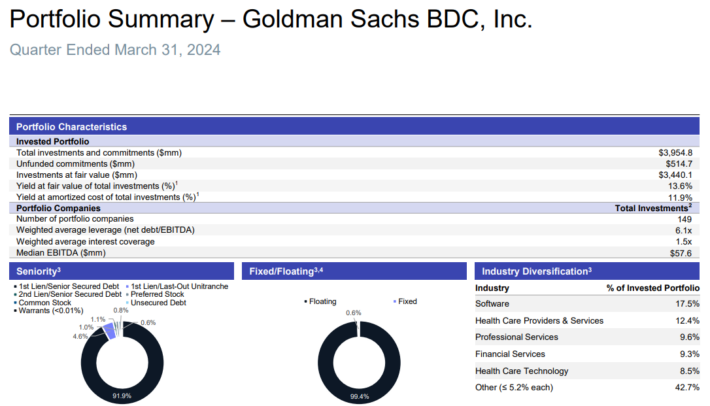

Goldman Sachs BDC is a closed-end administration funding firm. GSBD gives specialty finance lending to U.S.-based middle-market firms, which generate EBITDA within the vary of $5-$200 million yearly, primarily by “unitranche” first-lien loans.

The corporate will normally make investments which have a maturity between three and ten years and in measurement between $10 million and $75 million.

As of March thirty first, 2024, GSBD’s portfolio included 149 firms at a good worth of round $3.95 billion.

Supply: Investor Presentation

The funding portfolio was comprised of 97.5% senior secured debt, together with 96.5% in first-lien investments.

Within the 2024 first quarter, whole funding earnings of $115.5 million in comparison with $115.4 million within the earlier quarter.

The lower in whole funding earnings was primarily pushed by a lower in accelerated accretion of upfront mortgage origination charges and unamortized reductions.

Click on right here to obtain our most up-to-date Certain Evaluation report on GSBD (preview of web page 1 of three proven beneath):

BDC #2: TriplePoint Enterprise Progress BDC (TPVG)

5-year anticipated annual return: 16.9%

TriplePoint Enterprise Progress BDC Corp makes a speciality of offering capital and guiding firms throughout their personal progress stage, earlier than they ultimately IPO to the general public markets.

Supply: Investor Presentation

On August seventh, 2024, TriplePoint Enterprise Progress BDC slashed its dividend by 25% to $0.30. On the identical day, the corporate posted its Q2 outcomes for the interval ending June thirtieth, 2024.

For the quarter, whole funding earnings of $27.1 million in comparison with $35.2 million in Q2-2023. The lower in whole funding was primarily resulting from a decrease weighted common principal quantity excellent on the BDC’s income-bearing debt funding portfolio.

Particularly, the variety of portfolio firms fell from 49 final 12 months to 44. Nonetheless, the corporate’s weighted common annualized portfolio yield got here in at a powerful 15.8% for the quarter, up from 14.7% within the prior-year interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on TPVG (preview of web page 1 of three proven beneath):

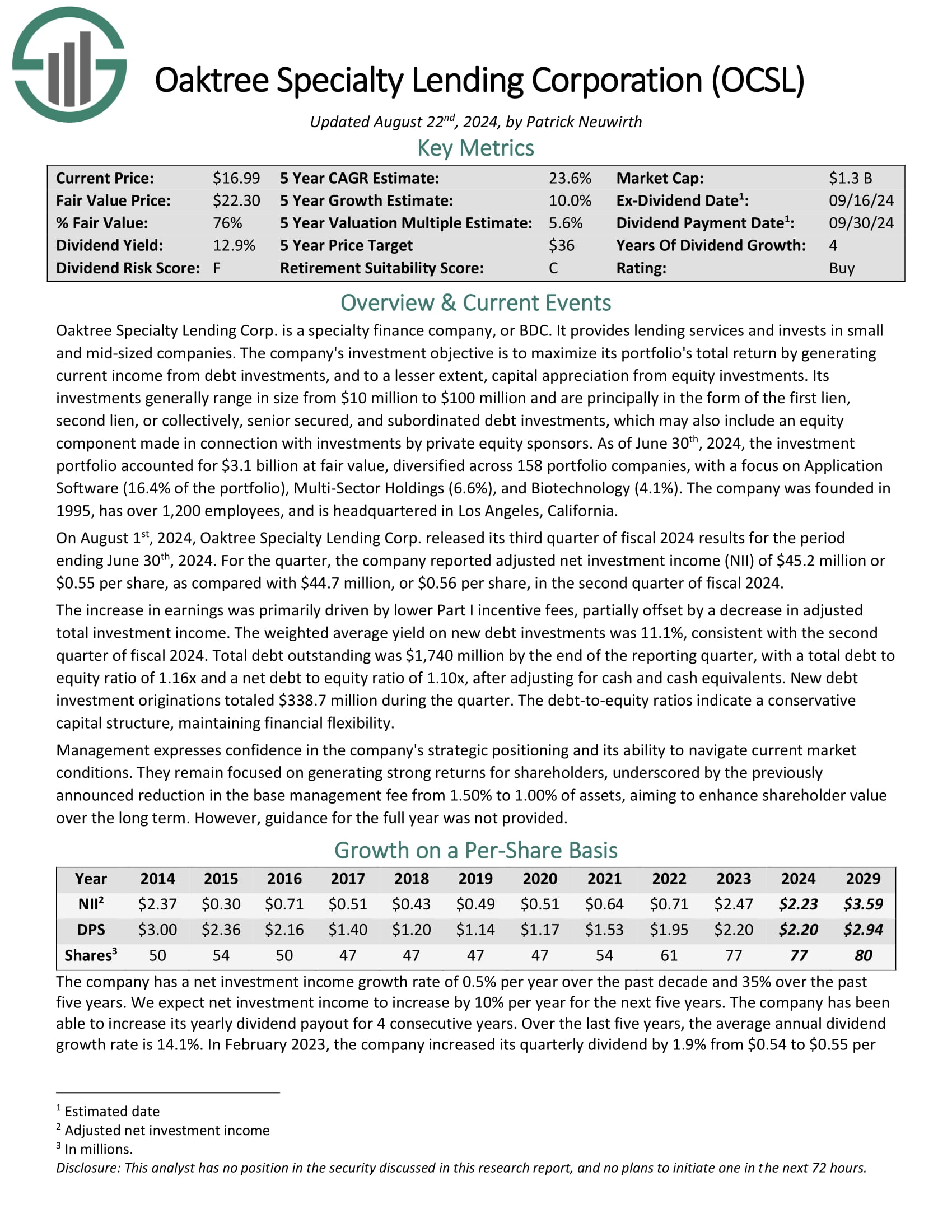

BDC #1: Oaktree Specialty Lending Corp. (OCSL)

5-year anticipated annual return: 24.6%

Oaktree Specialty Lending gives lending companies and invests in small and mid-sized firms. Its investments usually vary in measurement from $10 million to $100 million and are principally within the type of the primary lien, second lien, or collectively, senior secured, and subordinated debt investments.

As of March thirty first, 2024, the funding portfolio accounted for $3.0 billion at honest worth diversified throughout 151 portfolio firms.

Supply: Investor Presentation

On August 1st, 2024, Oaktree Specialty Lending Corp. launched its third quarter of fiscal 2024 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate reported adjusted web funding earnings (NII) of $45.2 million or $0.55 per share, as in contrast with $44.7 million, or $0.56 per share, within the second quarter of fiscal 2024.

The rise in earnings was primarily pushed by decrease Half I incentive charges, partially offset by a lower in adjusted whole funding earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on OCSL (preview of web page 1 of three proven beneath):

Closing Ideas

Enterprise Improvement Firms enable on a regular basis retail traders the chance to speculate not directly in small and mid-size companies. Beforehand, funding in early-stage or creating firms was restricted to accredited traders, by enterprise capital.

And, BDCs have apparent attraction for earnings traders. BDCs broadly have excessive dividend yields above 5%, and lots of BDCs pay dividends each month as an alternative of the extra typical quarterly fee schedule.

In fact, traders ought to think about the entire distinctive traits, together with however not restricted to the tax implications of BDCs. Buyers must also concentrate on the chance elements related to investing in BDCs, reminiscent of the usage of leverage, rate of interest threat, and default threat.

If traders perceive the assorted implications and make the choice to spend money on BDCs, the 5 particular person shares on this listing might present enticing whole returns and dividends over the following a number of years.

At Certain Dividend, we regularly advocate for investing in firms with a excessive chance of accelerating their dividends each 12 months.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend progress shares:

The Dividend Aristocrats Checklist: S&P 500 shares with 25+ years of dividend will increase.

The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 53 shares with 50+ years of consecutive dividend will increase.

The Excessive Dividend Shares Checklist: shares that attraction to traders within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per 12 months.

The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being within the S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.