In This Article

Key Takeaways

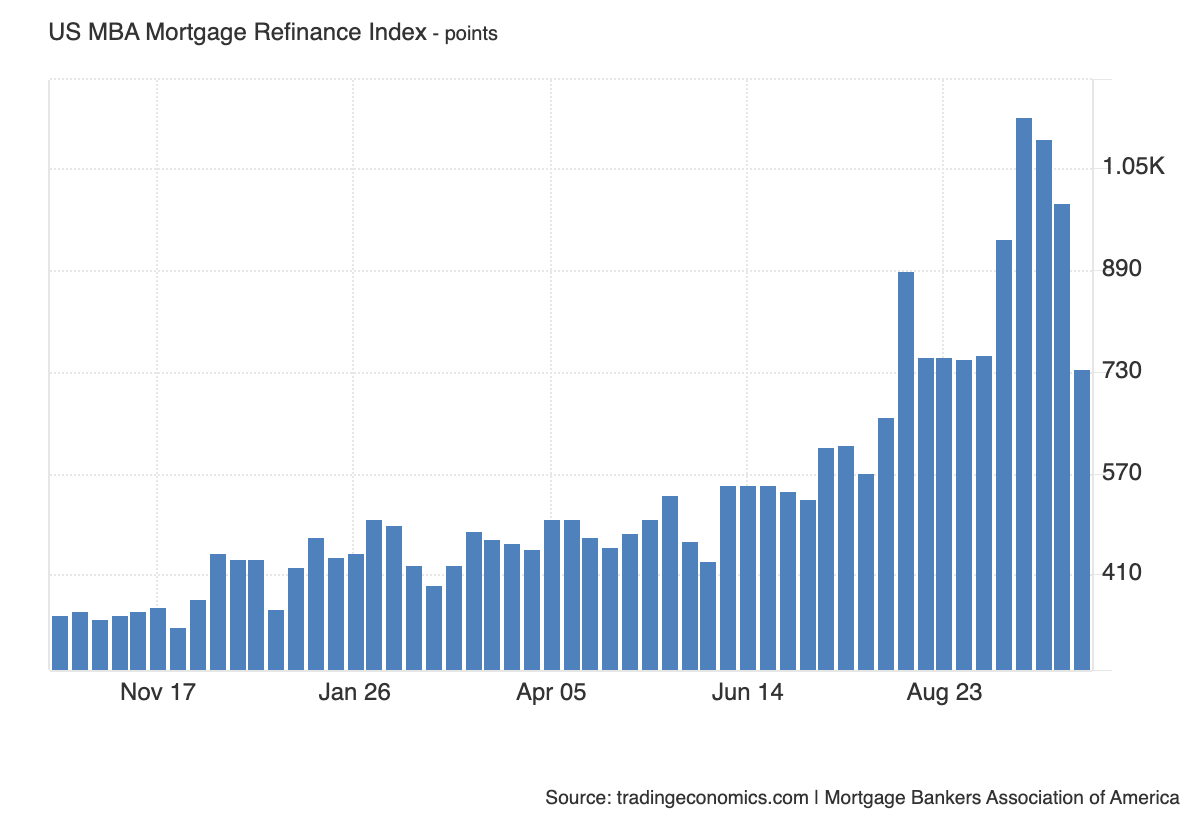

Whereas the Fed’s price cuts initially led to decrease mortgage charges, different components just like the labor market, Treasury yields, and geopolitical occasions have since brought on charges to rise once more.Though there was an preliminary 20% spike in refinancing exercise after the Fed’s September price minimize, refinance purposes dropped by 26.8% week over week as of October 11.Even with fluctuating charges, these with mortgages above 7% should still profit from refinancing if charges dip barely above 6%. Nonetheless, refinancing may not be smart for these with newer loans or these planning to promote within the brief time period as a consequence of related prices.

Anybody who’s had something to do with actual property has performed the “will they or gained’t they” guessing recreation surrounding the Federal Reserve’s choices concerning the federal funds price.

It appears to make sense on its face, since mortgage charges are inextricable from the Fed’s insurance policies. And but the truth that current reviews present that refinancing exercise (which proper now accounts for almost all of mortgage purposes within the U.S.) dipped 26.8% week over week as of the week ending Oct. 11, regardless of the much-anticipated price cuts, ought to give everybody pause.

What does this surprising flip of occasions inform us concerning the actuality of the mortgage market and its attainable future trajectories?

Key Charges Are Down, However Lenders Are Cautious

First, a recap: Mortgage charges went right down to a mean of 6.08% in late September, following the Fed’s half-point minimize announcement on Sept. 18. In truth, mortgage charges already had been on a downward trajectory since early September, however predictably, the Fed’s announcement delivered a powerful dip, from 6.20% to the just-above-6% many property house owners had been hoping for. Refinancing exercise surged accordingly, with a 20% spike week over week in late September.

To date, so good. Besides, by Oct. 3, mortgage charges had climbed proper again as much as 6.12%. On Oct. 10, they stood at 6.32%. It was as if the Fed announcement had by no means even occurred.

In any case, it didn’t ship the anticipated influence. In response to Zillow’s metrics, even the comparatively small fluctuations in charges translate into 275,000 debtors lacking out on potential refinance financial savings, or ‘‘a complete five-year lack of greater than $6 billion mixed for these owners.’’

The customarily-quoted rule of thumb in the actual property business is that if mortgage charges drop one share level, it’s price refinancing. Nonetheless, in actuality, even a price that’s ‘’one-half to three-quarters of a share level decrease than your present price’’ might be properly price it, in response to Bankrate. On condition that charges had been properly above 7% as lately as Could this 12 months (7.22%, to be actual), even the present charges might be price benefiting from for somebody who took out a mortgage at above 7%. Clearly, individuals who took out mortgages extra lately will need to wait, because the juice may not be well worth the proverbial squeeze simply now.

As for the explanations why mortgage charges started climbing once more, do not forget that the key charges set by the Fed are removed from the one issue affecting mortgage charges. To some extent, it could even be that the reductions that we noticed in September had been as a lot in anticipation of price cuts as ensuing from them.

Freddie Mac makes this level in its U.S. Financial, Housing and Mortgage Market Outlook: “The discourse across the timing and tempo of potential future price cuts will seemingly drive the near-term path of rates of interest reasonably than the precise coverage determination itself.”

It’s the good-old affirmation bias in impact right here: Everybody expects mortgage charges to return down as a result of everybody expects a base price minimize; charges do come down, at the very least within the brief time period. In the long term, although, mortgage lenders should be cautious when setting their charges. They bear in mind many extra components than simply the bottom price, together with the present state of the job market, the efficiency of 10-year Treasury yields, inflation charges, and different financial metrics which are extra dependable indicators of issues to return.

A sturdy labor market in addition to a sturdy efficiency from Treasury yields are simply two components spooking lenders. However there are different components that we have a tendency to not affiliate with mortgage price fluctuations, notably macroeconomic components. The Gaza battle, for instance, is one such issue that has an influence on the home economic system, however is way much less apparent than price minimize bulletins.

Sam Khater, Freddie Mac’s chief economist, factors to ‘’a mixture of escalating geopolitical tensions and a rebound in short-term charges’’ as the explanations behind the upshot in mortgage charges. ‘‘The market’s enthusiasm on market charges was untimely,’’ he famous in a assertion.

The place Are Mortgage Charges Headed Subsequent?

Buyers who had been hoping to refinance and enhance their month-to-month money circulate understandably could really feel at a loss at this level, questioning: Is it price ready for charges to start out declining once more, or will issues get solely worse from this level, wherein case now could be the time to behave?

The excellent news is that the majority mortgage consultants and economists agree that the general mortgage price trajectory for the remainder of this 12 months and going into 2025 continues to be downward. The distinction in opinion is simply by way of how a lot of a decline can be anticipated.

Freddie Mac’s view: “Whereas there may be more likely to be some volatility round any coverage statements,” mortgage charges will proceed to say no, “although remaining above 6% by year-end.”

Keith Gumbinger, vice chairman at mortgage data web site HSH.com, concurred with these predictions, telling Forbes Advisor, “Issues are altering quick—however for now, I’d say that 6% to six.4% is a extra seemingly vary for the following whereas.”

Mainly, charges that hover simply above the 6% mark are the best-case state of affairs. The predictions of charges within the 5% to six% vary that some consultants made earlier within the 12 months do appear unlikely at this level. Probably, that is nonetheless excellent news for anybody whose present mortgage is within the near-7% vary, as a result of they can lock in charges of simply above 6% later this 12 months or in 2025.

If charges proceed to hover across the 6.3% to six.4% mark, refinancing could develop into unwise for a lot of buyers. It’s all the time essential to recollect that refinancing comes with prices—primarily, you’re doing the entire mortgage software another time, together with value determinations and shutting charges.

You may also like

“Keep in mind that simply because you may get a decrease price doesn’t imply you must instantly refinance,” Matt Vernon, head of retail lending at Financial institution of America, informed Forbes Advisor. “Chances are you’ll be paying a decrease month-to-month mortgage, however you will have to additionally prolong the lifetime of your mortgage, and refinancing might value you extra in curiosity.”

This recommendation is for owners, however it holds for buyers contemplating rate-and-term refinances. Any buyers considering of promoting inside the subsequent 5 years in all probability shouldn’t hassle with a refinance. But when you’re planning on retaining the property for the following 15 to twenty years, that’s a distinct story.

You’ll additionally have to suppose otherwise for those who’re contemplating a cash-out refinance. These virtually invariably will include a better price, however the lump sum of money might be price it for buyers who need to repay money owed accrued from property upkeep and/or to buy one other funding property. Precisely calculating the return on that new funding is extra necessary than rates of interest on this case.

Remaining Ideas

Mortgage price fluctuations occur for quite a lot of causes, with the Fed key price bulletins taking part in a extra restricted function than it will possibly appear from the headlines. Buyers who had been hoping to refinance late this 12 months or subsequent should still be in luck since most economists are assured within the general downward trajectory for mortgage charges. Simply don’t anticipate miracles: A price of simply above 6% is the best-case state of affairs for the following few months.

Prepared to reach actual property investing? Create a free BiggerPockets account to find out about funding methods; ask questions and get solutions from our neighborhood of +2 million members; join with investor-friendly brokers; and a lot extra.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.