Este artículo también está disponible en español.

Bitcoin (BTC) just lately reached a brand new all-time excessive (ATH) of $93,477, because the main digital asset inches nearer to the extremely anticipated $100,000 goal. Notably, the continued value rally has seen comparatively muted profit-taking, fueling hopes that BTC has additional room to surge.

Low Revenue-Taking For Bitcoin In Present Cycle

Based on a latest report by Glassnode, the present BTC value momentum is primarily pushed by sturdy spot demand and rising institutional curiosity. Significantly, the victory of Republican US presidential candidate Donald Trump has added optimism to the digital property trade.

Associated Studying

The report highlights that over 95% of Bitcoin’s provide is presently in revenue. Nevertheless, regardless of the excessive proportion of worthwhile holders, profit-taking has remained comparatively muted throughout this cycle.

Traditionally, month-to-month revenue realization has usually ranged between $30 and $50 billion throughout earlier Bitcoin ATH cycles. The present value discovery section has seen about $20.4 billion in realized revenue.

This comparatively low profit-taking degree within the present BTC ATH cycle suggests additional room for the BTC value to rise, doubtlessly reaching the $100,000 milestone earlier than demand wanes.

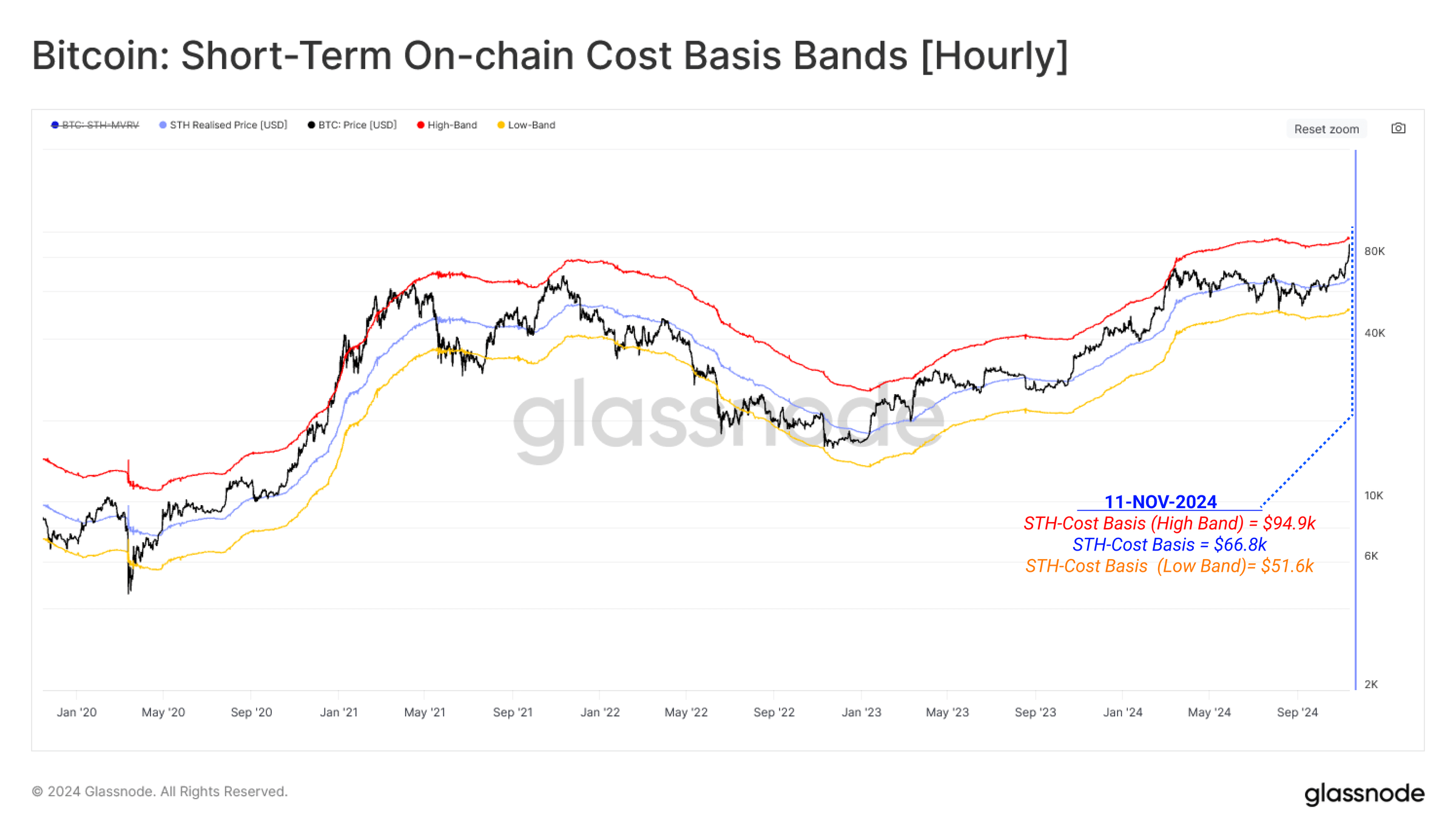

The chart under reveals the fee foundation of recent BTC traders, together with higher and decrease statistical bands. Based on the report, throughout an ATH section, BTC’s value repeatedly exams the higher bands as new traders enter the market at larger value factors.

As will be inferred from the above chart, BTC’s present spot value of $91,199 is just under its higher band of $94,900. Maintaining monitor of value motion between these bands can present when the market value may be excessive sufficient to pressure present holders to promote their holdings.

Extra Leverage Should Be Flushed Earlier than $100,000 BTC

Whereas BTC is buying and selling lower than 10% under the $100,000 degree, trade specialists opine that extra leverage have to be flushed out earlier than the highest digital asset makes an attempt to hit the 6-figure goal.

Associated Studying

Knowledge from Coinglass reveals that greater than $718 million price of crypto contracts had been liquidated prior to now 24 hours, impacting 202,074 merchants.

Notably, contract liquidations had been cut up fairly evenly between longs and shorts – 49.93% vs 50.07%, respectively – indicating that regardless of the sturdy bullish sentiment, there isn’t any clear buying and selling benefit.

Some trade leaders stay optimistic about BTC’s future value motion. In October, the BTC mining agency CleanSpark CEO mentioned that the premier digital asset might peak at $200,000 within the subsequent 18 months.

Equally, BitMEX co-founder Arthur Hayes just lately predicted that BTC might hit $1 million below the Trump administration. BTC trades at $91,199 at press time, up 3.9% prior to now 24 hours.

Featured picture from Unsplash, Charts from Glassnode and TradingView.com