Merchants, I look ahead to sharing my prime concepts for the upcoming week, together with my entry and exit targets.

This can possible be my last weekly watchlist for the 12 months, so stick round as I am going over my prime concepts, together with plans for SOFI, TSLA, and RIVN.

Consolidation Breakout RIVN

There’s been a pleasant turnaround in a number of EV names, and with Tesla now starting to increase to the upside, it’s potential some FOMO and pleasure trickle down into RIVN, particularly as that is setup effectively for continuation from a technical perspective.

Earlier help close to $13 from mid-year has now once more shaped as help because the inventory consolidates in a bullish formation over rising key SMAs. Together with that bullish formation is a supportive market, sector, and elevated brief curiosity.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

So, retaining it easy with entries and exits, I’m in search of $ 14.50 to agency up with elevated RVOL, which might get me lengthy versus the LOD initially. Thereafter, I’d be focusing on an preliminary transfer over $15, towards $15.30s, to scale out a portion of the place right into a 1 ATR upmove. From that time, I might path my place on the 15-minute timeframe utilizing larger lows, focusing on a transfer towards 2 ATRs and $16, which could act as resistance as there’s possible some overheard in that area.

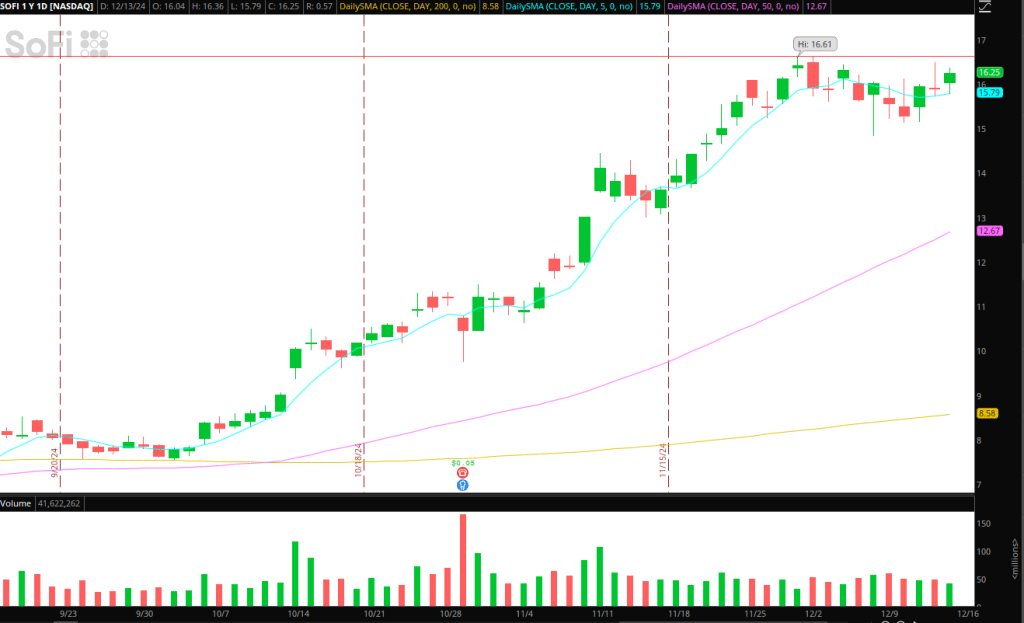

Consolidation Breakout SOFI

Whereas SOFI is prolonged from its rising 200d and 50d, it spent a number of weeks consolidating at 52-week highs and former resistance on a a lot larger timeframe. Now, with the inventory firming up over $16 on Friday, I’m considering continuation to the upside for a multi-day swing lengthy.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

If SOFI can take out final week’s excessive and agency up close to the 52-week highs or current a robust opening drive on quantity, I’ll get lengthy versus the LOD for a multi-day lengthy. Given the setup and momentum on the next timeframe, seeking to maintain for as much as 3 days momentum so long as the day gone by’s low doesn’t get taken out. I might be scaling out of the place on intraday extensions to the upside, totaling 1 ATR.

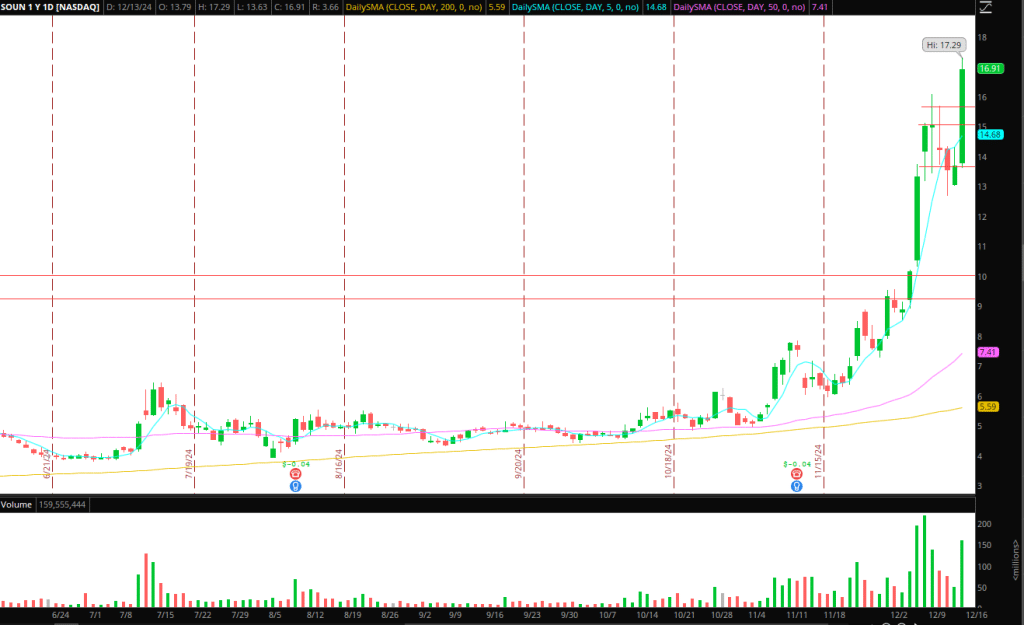

SOUN on Look ahead to Blowoff

After pulling again for many of final week, shorts that didn’t cowl into help bought wrong-sided on Friday. Given the value motion within the afternoon I’d think about there are nonetheless many short-term shorts left but to be blown out.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

Due to this fact, the perfect state of affairs, which stands out with the very best grading for me, could be additional continuation early subsequent week to the upside, over $18 and nearer to $20. Particularly, I’d wish to see excessive quantity churn within the excessive finish of the vary or an intraday blowoff sample, each of which might sign a major trade to weak fingers. If that transfer is adopted by a failure / engulfing draw back candle, I’ll place brief on a decrease excessive versus the HOD. From that second ahead, I’d commerce round a core place for as much as two days, holding the core place for a reversion again towards $16 – $14.

Extra Names on Watch

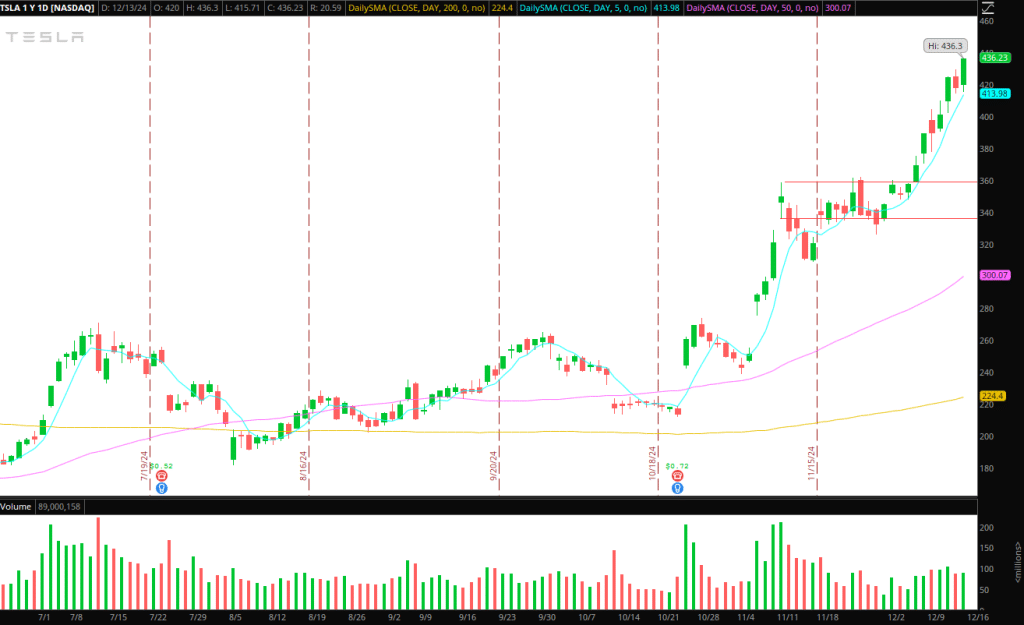

TSLA on Look ahead to Extension Larger: Just like what I discussed in my latest Inside Entry assembly, I’m not short-biased Tesla, nor am I seeking to be brief proper now. I’ve seen quite a few feedback/posts on-line calling for a reversion within the title. Ask your self, what’s the distinction between the reversion we noticed in PLTR, or MSTR, and even SMCI earlier within the 12 months? Right here’s a touch: take a look at ATR, consecutive hole days, vary growth, vol growth, and ATR and % expanded from key SMAs. Together with the truth that TSLA simply broke out to new all-time highs after consolidating. TSLA isn’t there but. But when TSLA experiences these talked about above and trades within the excessive $400s, it is likely to be.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

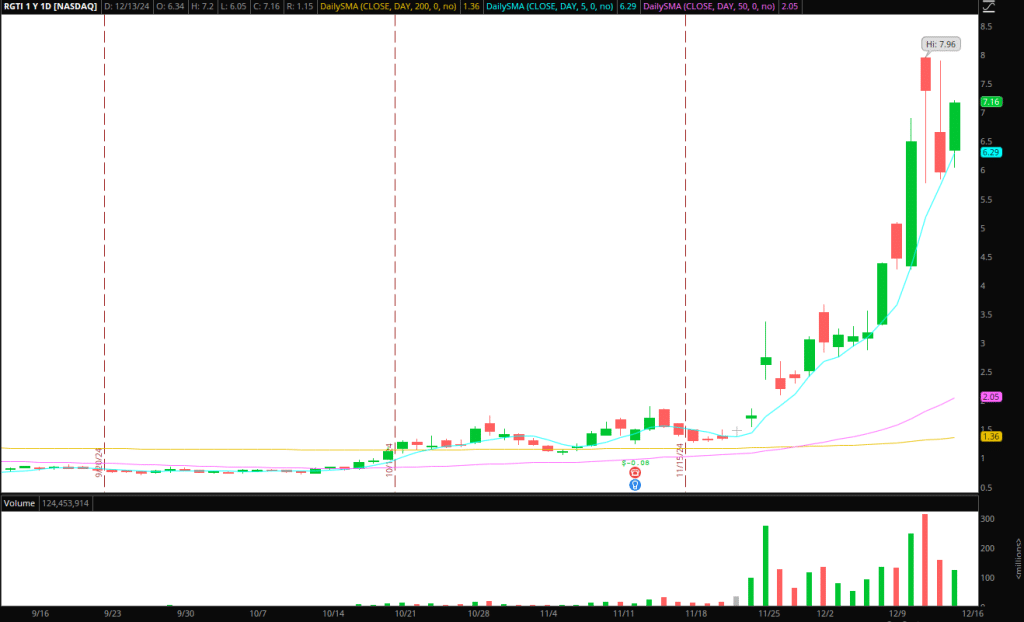

Reversion in RGTI: After topping out, much like SOUN final week, with the assistance of SSR and being a crowded title, the inventory has firmed as much as over $6s. So, going ahead, if RGTI pushes again towards $8 and fails, I might be considering a brief versusHOD. Nonetheless, if it breaks via that stage, i’ll be hands-off and even considering momentum-long scalps. With that being mentioned, the extra vital alternative within the days to come back could be an outlier brief squeeze exhausting cussed brief swings on a transfer towards $10 +.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

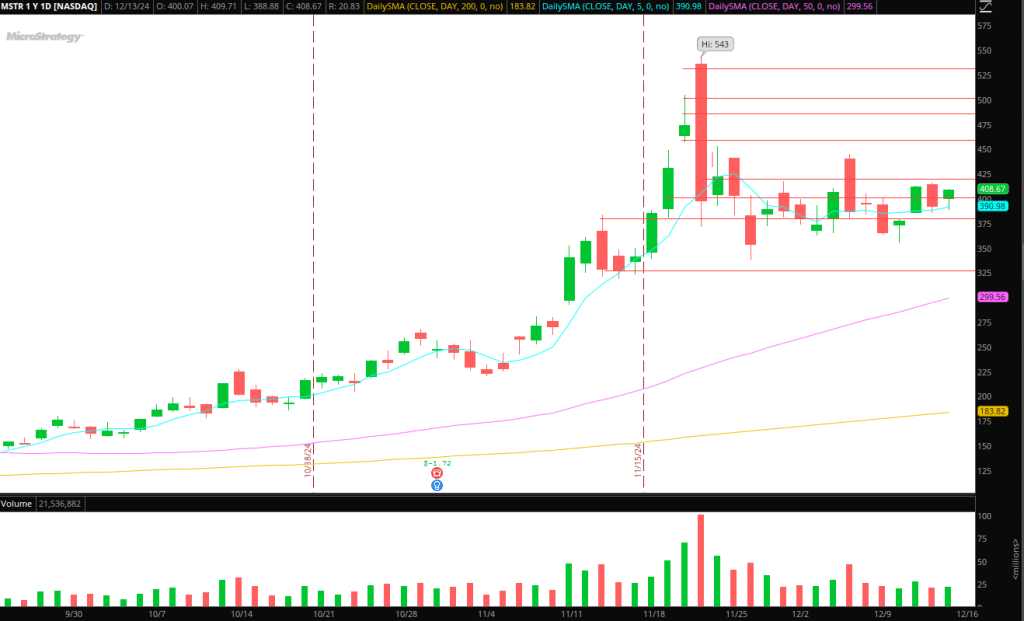

Continuation in MSTR: If Bitcoin continues to agency up over $100k and particularly $102 – $104k, I’d be considering MSTR over $420 resistance and final week’s excessive. I’d must gauge worth motion to see whether or not the persistent promoting and ATM promoting have subsided. If it bases over $420 with an intraday uptrend forming and shifting to relative power, I’d think about an extended swing versus the times low.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components akin to liquidity, slippage and commissions.

DXYZ: Similar ideas as final week within the title. It stays on look ahead to both a reactive commerce on breaking information (kind: EFFECT), or a serious relative weak point and consolidation breakdown via lows for momentum and core as a swing.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures