In This Article

Within the first half of this collection, we regarded on the historical past of the infamously car-centric American suburb, and the second evaluated their desirability. On this ultimate half, we’ll flip to their fiscal impression and the query of sustainability.

Are the suburbs merely the much less dense outskirts of a metropolis, or are they—as their detractors prefer to say—a Ponzi scheme that’s swamping states and native municipalities with unrepayable debt whereas leeching off the cities that subsidize them?

Backed by the Cities?

The advocacy group Robust Cities is among the most ardent supporters of city densification and highlights the city of Lafayette, Louisiana, to make its case that cities unfairly subsidize their suburbs. As they describe it:

“Like most cities, Lafayette had the written stories detailing an enormously giant backlog of infrastructure upkeep. At present spending charges, roads had been going dangerous quicker than they may very well be repaired. With aggressive tax will increase, the charge of failure may very well be slowed, however not reversed. The story underground was even worse. That didn’t make sense to Kevin or to town’s mayor, a man named Joey Durel.

Joe, Josh, and I interviewed all town’s division heads and key workers. We gathered as a lot knowledge as we might (they’d quite a bit). We analyzed and then mapped out all of town’s income streams by parcel. We then did the identical for the entire metropolis’s bills. This was probably the most complete geographic evaluation of a metropolis’s funds that I’ve ever seen accomplished. Once we completed, we had a three-dimensional map displaying what elements of town generated extra income than expense.”

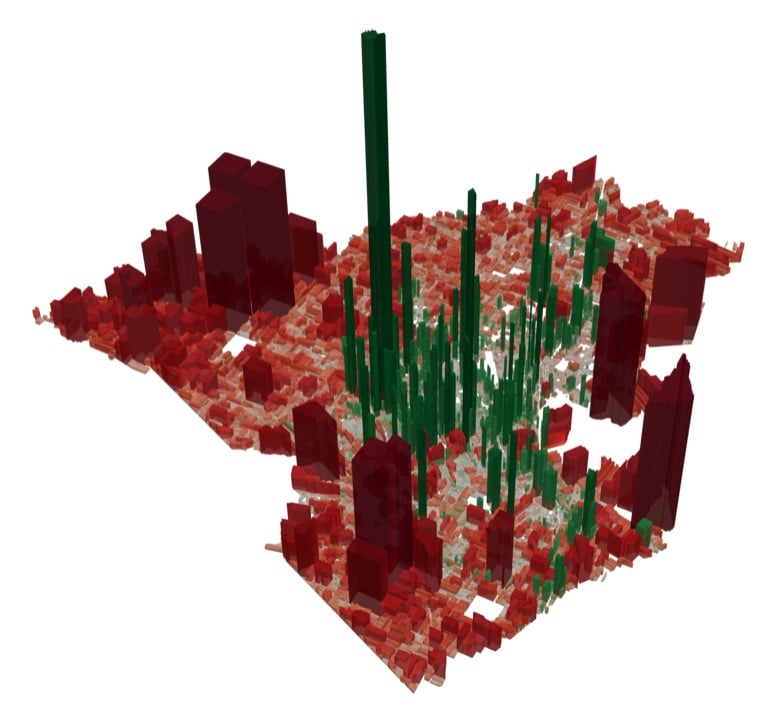

This is the map they got here up with:

Inexperienced areas herald cash, and pink are a web expense. The peak of the road exhibits how a lot of a web revenue/expense these areas are.

The article continues:

“The most important downside that jumped out was that the alternative price of town’s infrastructure was $32 billion, whereas the complete inhabitants’s wealth added to solely $16 billion! They estimated that the median family would must pay a minimum of $3,300 a 12 months and as a lot as $8,000 in taxes simply to take care of the infrastructure versus the roughly $150 they had been paying.”

We’ll get to the price range shortfalls quickly sufficient. For now, as you possibly can see, the denser city areas herald cash, whereas the outlying, much less dense (i.e., extra suburban) areas price cash.

Nonetheless, this evaluation is clearly skewed, because the downtown space seems to be like inexperienced skyscrapers. Downtowns are sometimes business hubs, each by way of work and retail. They’d be web boons even when nobody lived there in any respect, as many individuals from the suburbs and exurbs journey there to work and store. Merely densifying the outlying areas wouldn’t change this.

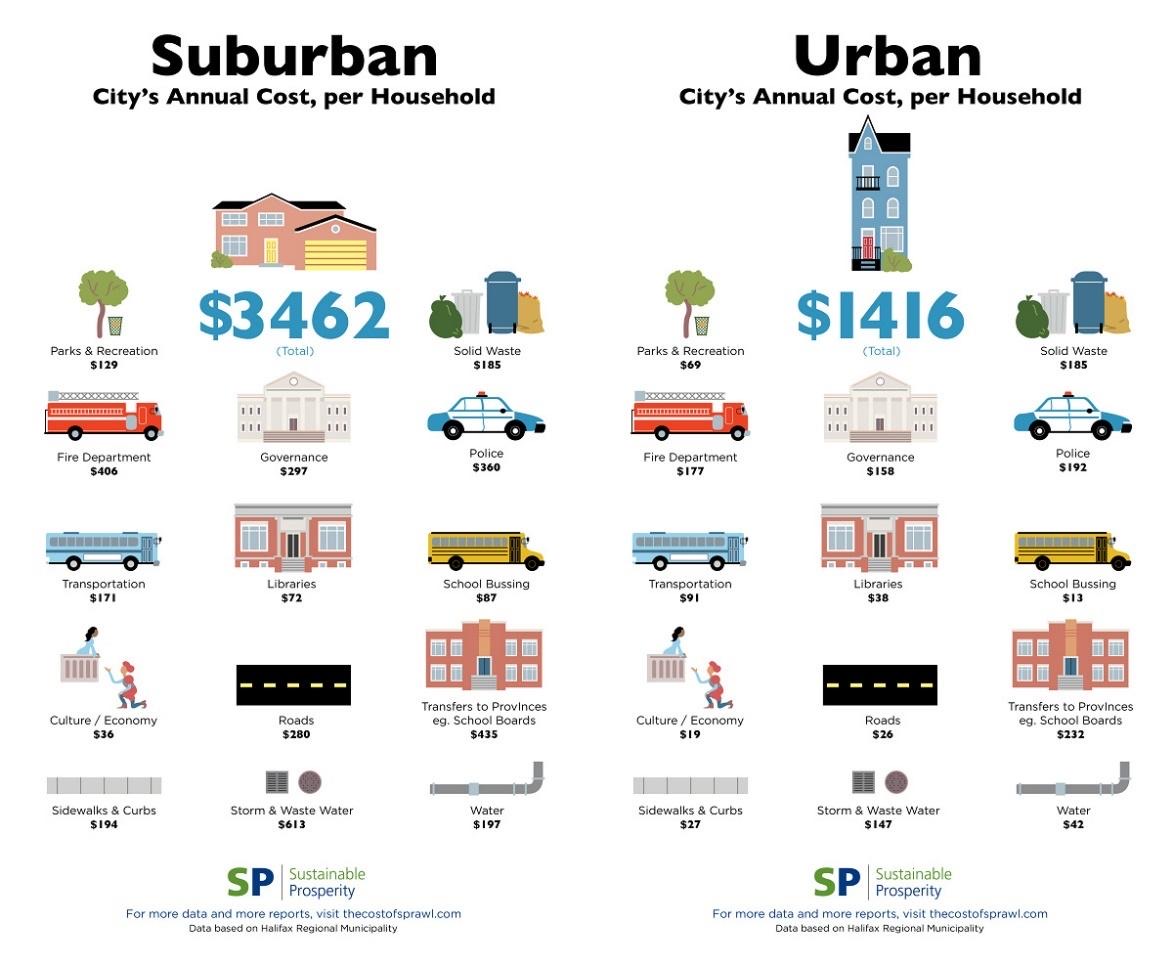

One other evaluation from the Canadian city of Halifax supplies what I believe is a greater (and positively much less dramatic) image. It discovered that the common annual price to town for an city family was $1,416, in comparison with $3,462 for a suburban family.

The very first thing to notice is that the numbers offered by Halifax don’t sq. with the scenario in Lafayette in any respect. Certainly, the price of all infrastructure (roads, sidewalks, curbs, water strains, and sewer strains) amounted to $1,284 for suburban properties—not even near the $8,000 Lafayette supposedly wanted. I think the Halifax numbers are extra consultant. In spite of everything, our cities have been sprawled for some time now and haven’t utterly collapsed.

We must also be very cautious about claims about who’s subsidizing whom. For instance, the Brookings Institute notes, “In the present day, practically 60% of all welfare instances could be present in 89 giant city counties,” whereas TIFs (Tax Increment Financing, a way of subsidizing actual property improvement) is, because the U.S. Division of Transportation states, “extra frequent in city areas than in rural areas.”

Different company tax incentives are usually for developments in city areas as properly. For instance, the Division of Transportation additionally notes that of Certified Alternative Zones (one other tax profit for improvement), “38% are in city tracts, and 22% are in suburban tracts.”

Rural areas have probably the most Alternative Zones, however this is nonetheless deceiving. In spite of everything, in 2018, there have been about 151 million folks in America’s suburbs and exurbs and solely 25 million within the city cores, which makes the distinction per capita within the variety of alternative zones for city areas versus the suburbs over 10 to 1.

In Kansas Metropolis, the place I dwell, town lately put in a streetcar that (will finally) go from downtown Kansas Metropolis to the favored Plaza space. In different phrases, it can go from the densest a part of the complete metro space to the second-densest a part of the metro space. The venture acquired a $20 million federal grant in August 2013 and is in search of $174 million extra in federal cash to finish.

In different phrases, on this case, the suburbs are subsidizing town.

You may also like

And this is true with nearly all public transit aside from buses. In 2018, authorities spending on public transit was $54.3 billion. Talking of getting old infrastructure, it had an over $100 billion upkeep backlog.

However that doesn’t change what appears to be a well-documented truth: Suburban infrastructure is costlier to take care of than city. The spotlight of this inefficient use of land and the pressured subsidization of the suburbs (and rural cities, for that matter) is the city of Backus, Minnesota. As the favored anti-suburb YouTuber Not Simply Bikes notes:

“An excessive case is the small city of Backus, Minnesota, which was on the finish of lifetime of its wastewater system. However as a result of this city was made up of sprawling, low-productivity, car-centric infrastructure, the wastewater system was sprawling and wasteful as properly. The alternative price was $27,000 per household, which was the median family revenue of the city.”

Not Simply Bikes notes that such cities ought to have septic programs and wells, not a “sprawling wastewater system.” And it’s laborious to argue with that logic. He’s proper right here.

Certainly, the case for this sort of prudence, in addition to rising density the place attainable and viable, is pretty robust. Clearly, densifying rural farming cities would defeat the aim of farming, however for probably the most half, infill is superior to additional sprawl. However the case being made is usually overstated or even wildly overstated, whereas the issues inflicting flight to the suburbs (just like the crime situation mentioned in Half 2 of this collection) get ignored.

There’s additionally a bizarre city bias at play. For instance, one other standard anti-suburb YouTuber named Alan Fisher has a video with the textual content on the thumbnail studying “I Don’t Care In regards to the $$$” in relation to one of many greatest boondoggles in American infrastructure historical past, specifically, California’s high-speed rail venture to attach San Francisco and Los Angeles.

Again in 2008, this venture was initially envisioned to price $40 billion in complete and be completed by 2020. Effectively, it’s 2024, the venture is now anticipated to go a cool $100 billion over price range (hopefully, this makes you’re feeling a bit higher about your final rehab venture), and there actually is not any finish in sight.

So, if we’re going to wag our finger at Backus, Minnesota, what ought to we make of this farce of a venture? And why ought to taxpayers—each city and suburban alike—be subsidizing it?

A Ponzi Scheme?

Regardless of my criticisms of city activists, the proof they supply does point out suburban infrastructure is notably costlier to take care of than city infrastructure. Thereby, we ought to be seeking to construct denser when attainable, even in outlying areas. This would additionally assist alleviate a number of the “soullessness” I complained about in Half 2 relating to business facilities in suburban areas.

However once more, the anti-suburb people take their arguments method too far. In truth, this time, they go overboard, claiming “the suburbs are a Ponzi scheme.” Charles Marohn with Robust Cities explains that the primary strategies of progress profit a metropolis instantly “from all of the allow charges, utility prices, and elevated tax assortment… [but] Cities additionally assume the long-term legal responsibility for servicing and sustaining all the brand new infrastructure, a promise that gained’t come totally due for many years.” The second half is the issue, as “the income collected over time doesn’t come close to to masking the prices of assembly these long-term obligations.”

This is the “progress Ponzi scheme” the car-centric suburbs have created, or extra precisely, are the product of. To ensure that a metropolis to remain solvent with this mannequin, they must proceed to develop till, like with Bernie Madoff and all Ponzi schemes, you possibly can’t get sufficient progress to finance the prices of the present infrastructure, and all of it comes crumbling down.

Marohn concludes that:

“To financially maintain itself, then, a metropolis or city using the American suburban improvement sample and making this tradeoff should consider one of many following two assumptions to be true:

1. The quantity of monetary return generated by the brand new progress exceeds the long-term upkeep and alternative price of infrastructure the general public is now obligated to take care of, OR

2. The town will at all times develop in ever-accelerating quantities in order to generate the money move essential to cowl long-term obligations.”

For the reason that monetary return generated by new progress with suburbs doesn’t exceed long-term upkeep prices, for a metropolis to be financially possible, it should develop perpetually to remain financially viable; thus, it’s a Ponzi scheme.

This is, nonetheless, the actual identical mistake that some libertarians make when describing Social Safety as a Ponzi scheme. Sure, like a Ponzi scheme, Social Safety takes cash from traders (or taxpayers, on this case) and pays out their principal to different traders (on this case, retirees). However that’s not sufficient to make for a great analogy. In spite of everything, a lot of your intestine flora and the bubonic plague are each micro organism, so ought to we assume they’re the identical?

A Ponzi scheme is inherently a closed system. The principal from new traders is used to pay the returns of earlier traders. Not solely that, however the returns have to be excessive sufficient to elicit new “funding.” With Social Safety, the returns could be diminished to ranges beneath that which the taxpayer put in (they usually have been to admittedly paltry ranges).

Infrastructure doesn’t want excessive returns; it simply must be maintained. Furthermore, American infrastructure, like Social Safety, shouldn’t be a closed system. Tax cash could be raised from different sectors of the economic system to fund it, as has been carried out to the chagrin of many city advocates.

Marohn admits this a lot himself in one other piece, the place he notes there are 4 methods American cities finance progress:

Authorities switch funds

Transportation spending

Debt

The expansion Ponzi scheme

The primary two of those might not be ultimate, however they’re sustainable.

The state of U.S. infrastructure is sort of dangerous total. Each the Trump and Biden administrations made infrastructure enchancment a key plank of their platform, for good motive. In 2021, the American Society of Civil Engineers launched a report concluding that, amongst different issues, 43% of U.S. roadways are in poor or mediocre situation, and the US faces a $2.59 trillion shortfall in infrastructure wants over the following 10 years.

Whereas this sounds daunting, that quantities to a “mere” $259 billion per 12 months. In 2024, the US GDP is over $28 trillion, and the federal government spent an obscene $916 billion per 12 months on “protection,” greater than the subsequent prime 10 international locations mixed.

I believe we might nonetheless defend our nation somewhat simply by slicing that in half. That might pay for all of the infrastructure wants with out ending the suburbs and nonetheless have sufficient left over to scale back the deficit or reduce taxes besides.

The entire “Ponzi scheme” argument would possibly make for a pleasant sound chunk, nevertheless it’s not true and doesn’t assist their case. Subsequently, the suburbs will not be a Ponzi scheme.

Unpayable Debt?

As an alternative of paying as they go, have American cities relied as an alternative on mountains of debt to take care of their overly sprawled infrastructure every time it requires an overhaul? As Not Simply Bikes places it:

“The town might get it constructed for reasonable, however the metropolis is in the end chargeable for sustaining that infrastructure perpetually. The massive downside begins if there isn’t sufficient tax income collected to cowl the alternative price of the infrastructure…while you get a few generations into the suburban experiment, the upkeep obligations of the previous begin to meet up with you.”

So what do our cities do? They tackle debt.

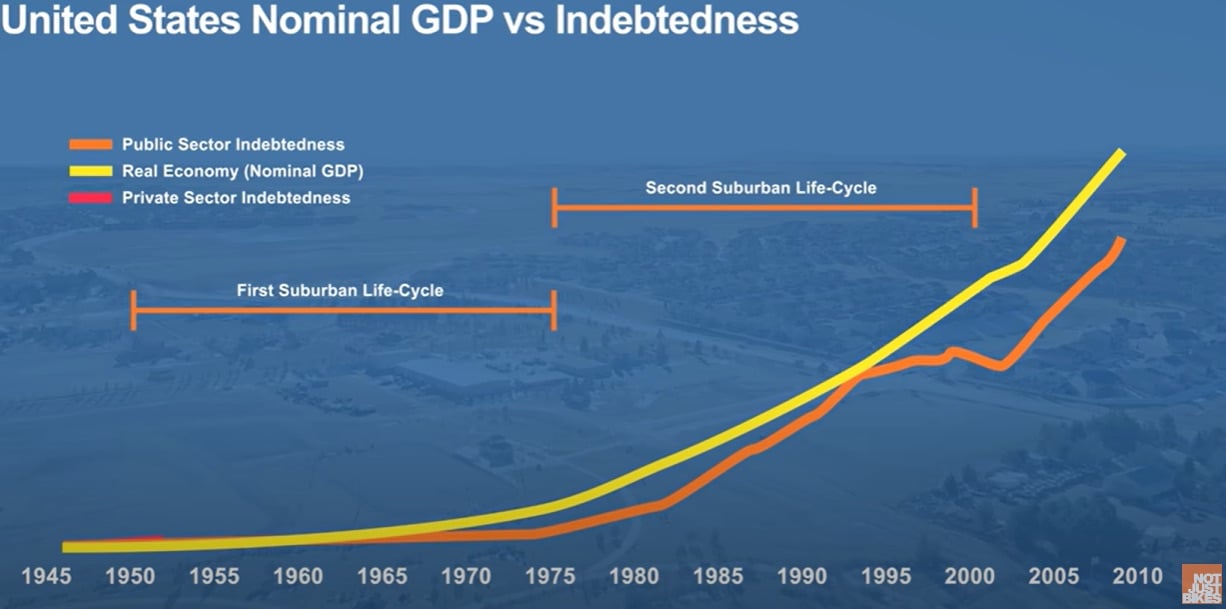

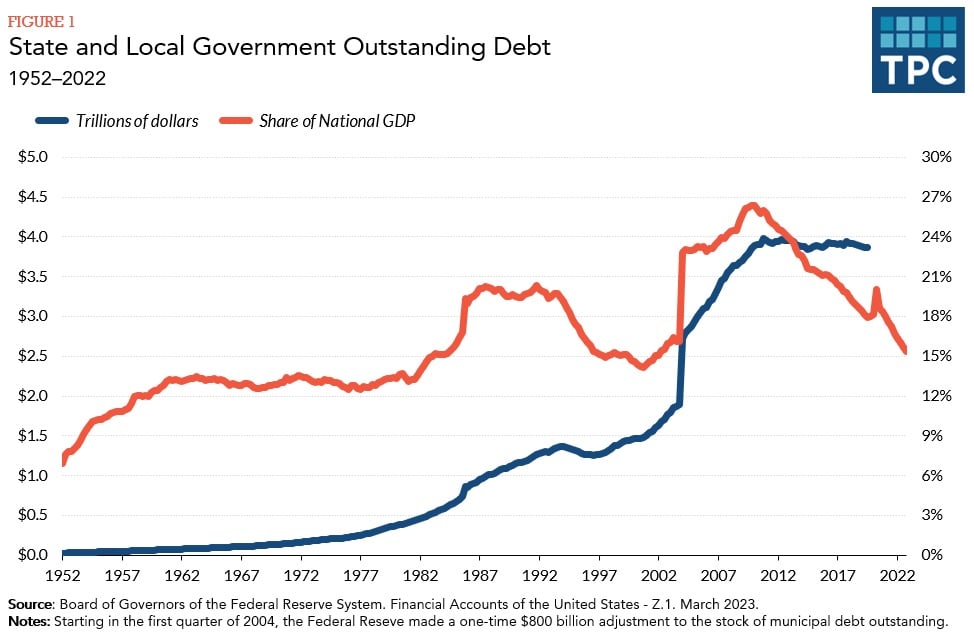

In one other video, Not Simply Bikes supplies this chart to point out that public sector indebtedness is very correlated to overhauling our infrastructure after every life cycle, which is closely correlated with the nation’s indebtedness.

The argument makes logical sense however doesn’t appear to be backed up by the chart he supplies, which exhibits debt rising at about the identical tempo after which nearly doing the other of what anti-suburb activists say it ought to in 2000 when the “second suburban life cycle” completed.

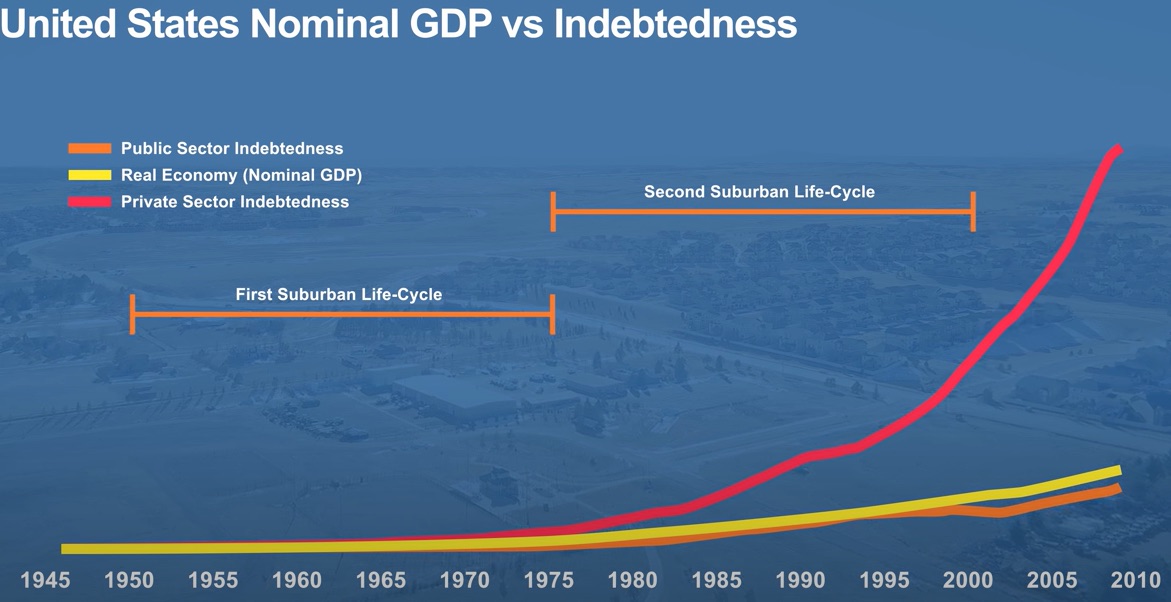

Not Simply Bikes then provides personal indebtedness to the image, and it’s ugly. However shouldn’t failing public infrastructure primarily have an effect on public debt, not personal?

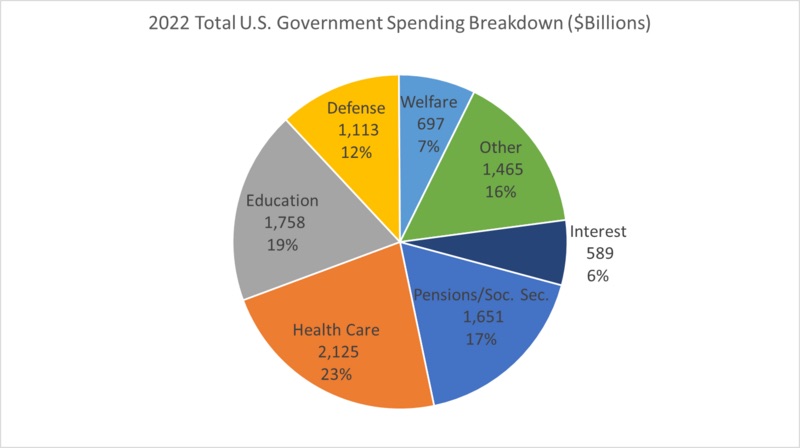

Moreover, if we have a look at what the U.S. authorities spends its cash on on the native, state, and federal ranges, infrastructure is a comparatively small piece of the puzzle.

Infrastructure would fall below “different,” making it considerably lower than 16% of public sector spending. In 2017, for instance, all ranges of presidency spent $5.6 trillion in complete and $309.2 billion on infrastructure and transportation. So 5.48%, to be actual.

Moreover, whereas municipal debt has grown to a whopping $4.1 trillion in 2022, it has leveled off during the last decade, and as a share of GDP, it has fallen from nearly 27% in 2012 to a little bit over 16% at present.

Last Ideas

It might appear that I have been fairly vital of the pro-urban, anti-suburb activists all through this three-part collection. And certainly, a lot of their claims, from the streetcar conspiracy to the suburban Ponzi scheme, don’t maintain water.

Certainly, even evaluating American suburbs to European ones is a little bit of a pink herring. The stereotype of dense, city European cities with unbelievable public transportation applies predominantly to its giant cities. There are loads of suburbs in Europe that look somewhat American, as you’ll find from any fast Google search.

However there are some good factors buried inside. Suburban improvement prices extra to take care of than city improvement, and it thereby is smart to construct denser when attainable. Moreover, the business facilities in suburbia are boring, car-dependent monstrosities. Walkable malls appear to have died, however making extra walkable “vacation spot factors” somewhat than infinite rows of strip malls can be a marked enchancment.

Single-use zoning must also be carried out away with in business areas and (a minimum of principally) changed with multi-use zoning, which provides vibrancy and prevents business zones from going useless and changing into crime magnets at evening.

However city advocates not solely exaggerate (typically wildly) their claims—additionally they have necessary blind spots. The obvious is crime. As an alternative, they have a tendency to deal with extra coercive strategies of stopping suburban sprawl than creating incentives for folks to remain in and transfer to city areas (like lowering crime). We see this course of in issues like city progress boundaries, which typically trigger actual property costs to extend dramatically and worth out the center class.

Higher options would embody incentives to infill versus constructing new subdivisions. Latest strikes towards permitting property homeowners to construct ADUs (accent dwelling items) in numerous cities is a great begin.

Total, suburbia was created predominantly by what the automotive allowed folks to do, not by conspiracies amongst automotive producers. And the suburbs haven’t been a catastrophe, though it comes with important downsides.

It’s common for the outlying areas of cities to be considerably much less dense than the city core. Whereas it is smart to maneuver towards extra densification total, it doesn’t make sense to desert the suburbs, pack folks into pods in dense cities like sardines, or attempt to section out the car with numerous coercive strategies.

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.