Merchants,

It actually was an eventful week, and lots of the changes and ideas shared final week proved helpful. Concerning my buying and selling, whereas I had some success with swing trades, notably with my place in NBIS, as outlined at nice size in my most up-to-date IA assembly, absolutely the consistency got here from momentum buying and selling. Whereas that may proceed to be my focus for the upcoming week, listed below are a few of my prime intraday and swing concepts for the week forward.

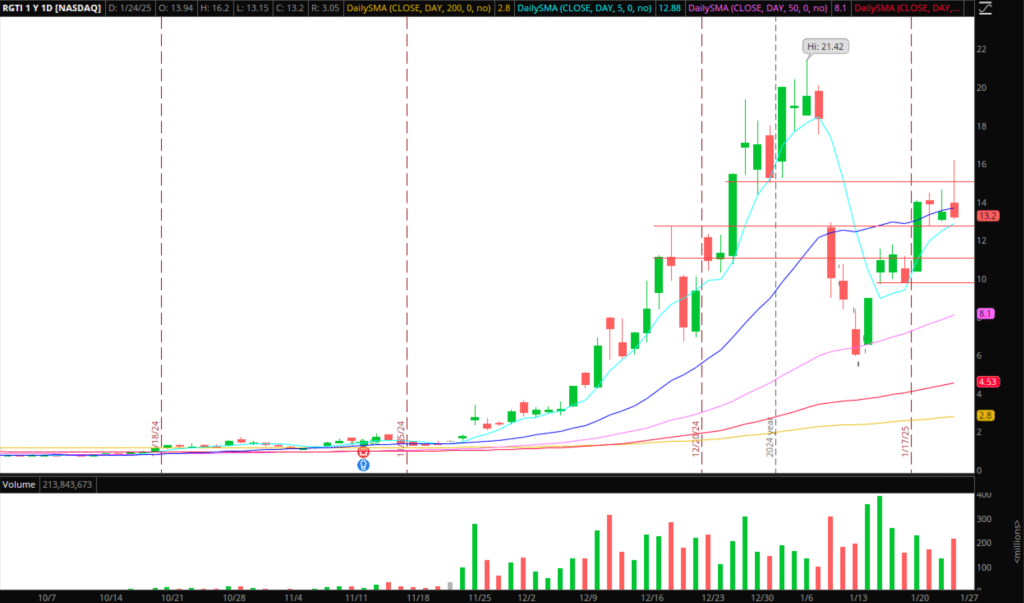

(NASDAQ: RGTI) Shook the tree and squeezed out some cussed shorts, as mentioned forward of time in my most up-to-date IA assembly. That push over $15 is exactly what I needed to see earlier than contemplating a re-short. For RGTI and the basket of different quantum names, Friday’s selloff supplied great alternative on the brief facet. The motion on Friday was a major shift in momentum and character change, given the relentless and chronic promoting.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

As I’ve stated earlier than, this theme is crowded, and due to this fact, I count on uneven motion and wider-than-expected strikes at occasions. Consequently, I’m not seeking to chase lows to ascertain a brief place. As a substitute, I’m in search of a push towards resistance and provide close to $14.5 – $15 and fail to get brief versus the HOD (RGTI). As soon as the decrease excessive is confirmed, I shall be positioned brief, focusing on a transfer towards $13 assist to trim my place and path my cease utilizing the day’s HOD, focusing on $11 – $10 as last targets over a number of days.

Then, to briefly define different watches for the week:

(NASDAQ: GOOGL) Much like the a number of sturdy opening drive performs we noticed final week, I’m maintaining a detailed eye on GOOGL for a gap drive by way of $200. If relative power and quantity are current off the open and thru the important thing degree, I’ll look to get lengthy with an LOD cease, focusing on an ATR upmove.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

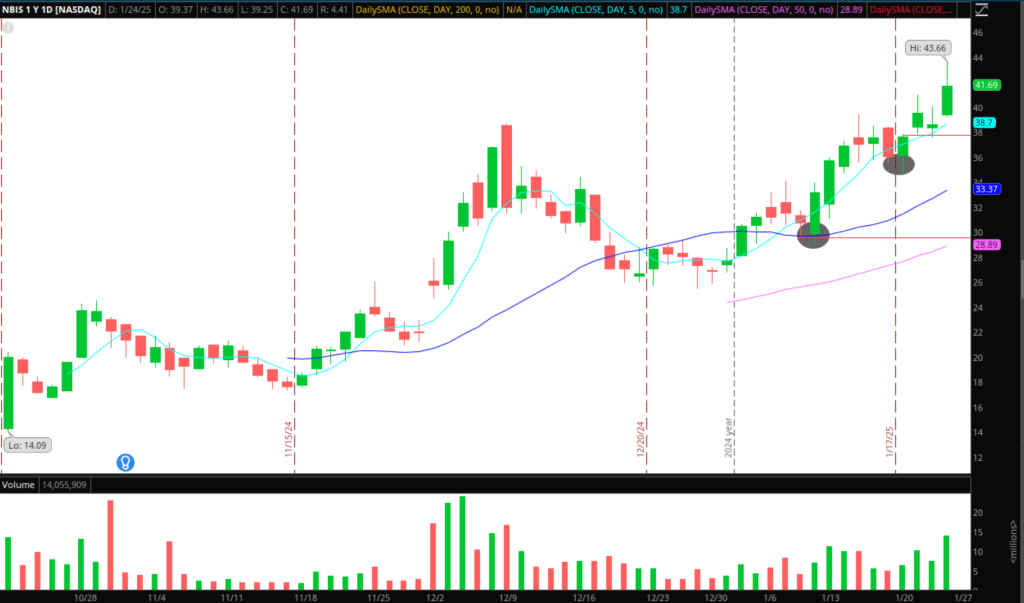

(NASDAQ: NBIS) Final week, this was a standout swing for me from $ 37’s preliminary entry and exited on the extension to excessive $43s on Friday. Going ahead, I might take into account a re-entry for a multi-day swing if the inventory can put in a couple of increased lows above $40 for entry versus the lows, focusing on a re-test of latest highs. So long as the uptrend and sample holds, I’ll preserve this on my radar for re-entries.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

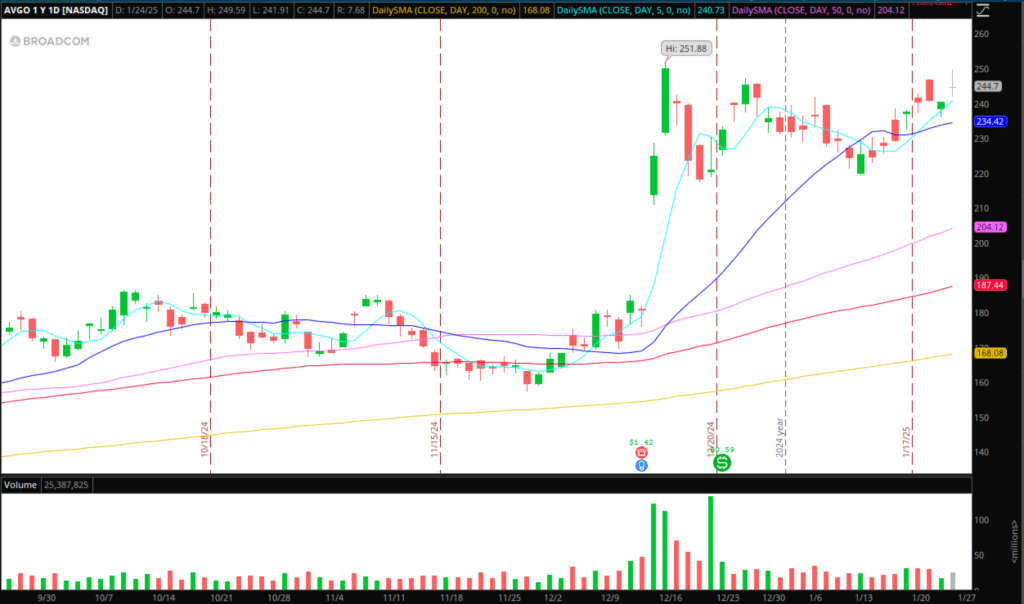

(NASDAQ: AVGO) Much like GOOGL, AVGO continues to consolidate close to 52-week highs. Suppose the inventory can break above final week’s excessive on elevated quantity and relative power. In that case, I’d search for an extended versus LOD or consolidation lows intraday, relying on the intraday setup, focusing on an ATR.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

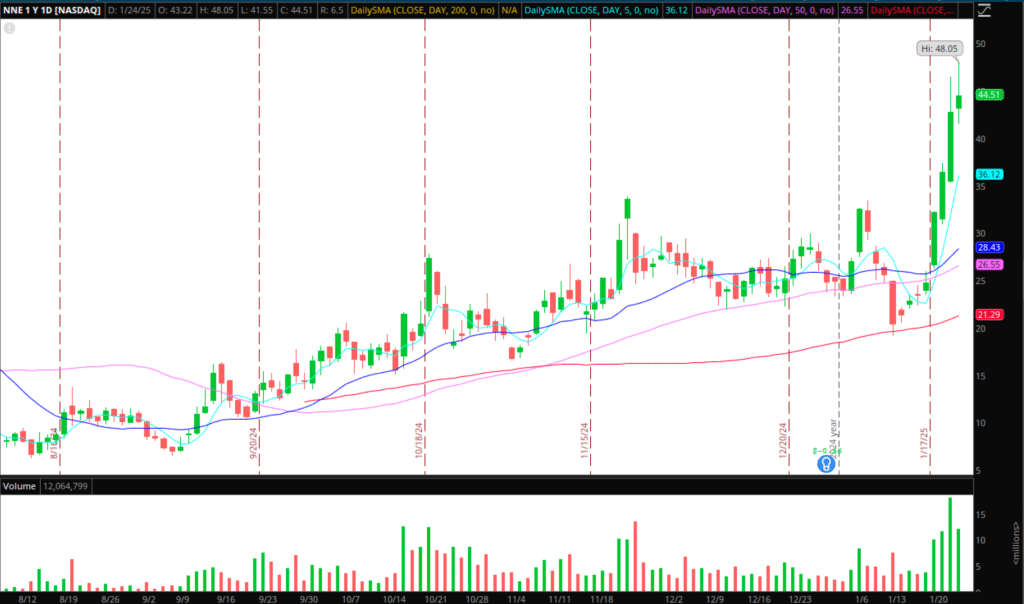

Nuclear Theme (NNE, OKLO) Main breakout this week with favorable tailwinds. In a really perfect world, they proceed to increase to the upside, establishing a major imply reversion A+ alternative later within the week. Nonetheless, I’m additionally open to the thought of failed follow-through in opposition to Friday’s excessive for intraday alternatives on the brief facet. In the event that they maintain up and have a pair extra days extension to the upside, they’ll shortly turn into my sole focus as I stalk the reversion alternative.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

Friday’s Small Cap Runners (NVNI, EVAX, ELAB, ALUR) Large quantity and vary on Friday in these names. Now that some overhead provide exists, I’ll have alerts set in all of them for potential pops again towards key ranges from Friday and 2-day VWAP. In the event that they push again towards key ranges and fail, I might search for reactive shorts versus the decrease excessive, strictly for an intraday brief scalp.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements akin to liquidity, slippage and commissions.

Additionally, It’s a giant earnings week forward, with META, TSLA, MSFT, AAPL, IBM, and lots of different market giants reporting.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures