Printed on February 4th, 2025 by Bob CiuraSpreadsheet knowledge up to date day by day

The Dividend Aristocrats are a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

The necessities to be a Dividend Aristocrat are:

Be within the S&P 500

Have 25+ consecutive years of dividend will increase

Meet sure minimal measurement & liquidity necessities

There are presently 69 Dividend Aristocrats. You may obtain an Excel spreadsheet of all 69 (with metrics that matter reminiscent of dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Disclaimer: Positive Dividend just isn’t affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official data.

Annually in late January, Commonplace & Poor’s updates the checklist of Dividend Aristocrats with additions and/or deletions. For 2025, there are three additions to the Dividend Aristocrats checklist.

This text will present an in depth evaluation on the three new Dividend Aristocrats for 2025.

Desk of Contents

New Dividend Aristocrat For 2025: FactSet Analysis Techniques (FDS)

Dividend Historical past: 25 years of consecutive will increase

Dividend Yield: 0.9%

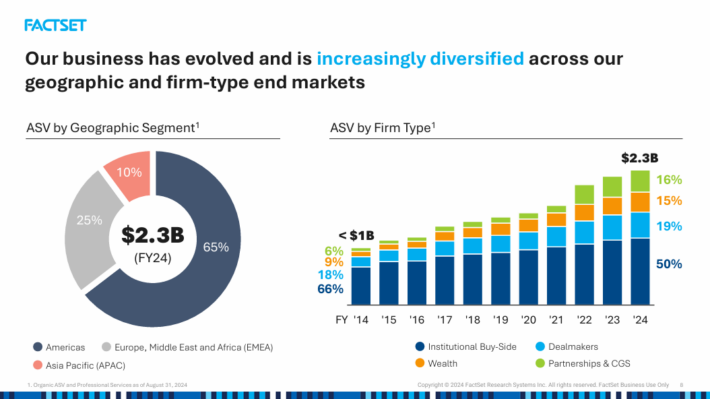

FactSet Analysis Techniques is a monetary knowledge and analytics agency based in 1978. It offers built-in monetary data and analytical instruments to the funding neighborhood within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate offers perception and data by way of analysis, analytics, buying and selling workflow options, content material and expertise options, and wealth administration.

Supply: Investor Presentation

On December nineteenth, 2024, FactSet Analysis Techniques introduced Q1 2025 outcomes, reporting non-GAAP EPS of $4.37 for the interval, beating market consensus by $0.09 whereas income rose 4.9% to $568.7 million.

FactSet Analysis Techniques kicked off fiscal 2025 with stable, but measured progress in Q1, reporting GAAP revenues of $568.7 million, a 4.9% year-over-year improve.

The income increase was pushed by sturdy efficiency throughout its wealth administration, asset proprietor, and institutional consumer segments.

Natural Annual Subscription Worth (ASV), a key efficiency metric, rose 4.5% to $2.25 billion, reflecting sustained demand for FactSet’s monetary knowledge and analytics options.

FactSet has grown its earnings-per-share by a mean compound progress charge of 10.3% over the past 10 years. Its investments and improved product choices might result in vital margin enlargement within the following years.

We have now elevated our EPS estimate for 2025 to $17.10, matching the midpoint of the administration’s steerage, however we now have maintained our 8.5% annual earnings progress forecast for the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on FDS (preview of web page 1 of three proven under):

New Dividend Aristocrat For 2025: Erie Indemnity (ERIE)

Dividend Historical past: 34 years of consecutive will increase

Dividend Yield: 1.3%

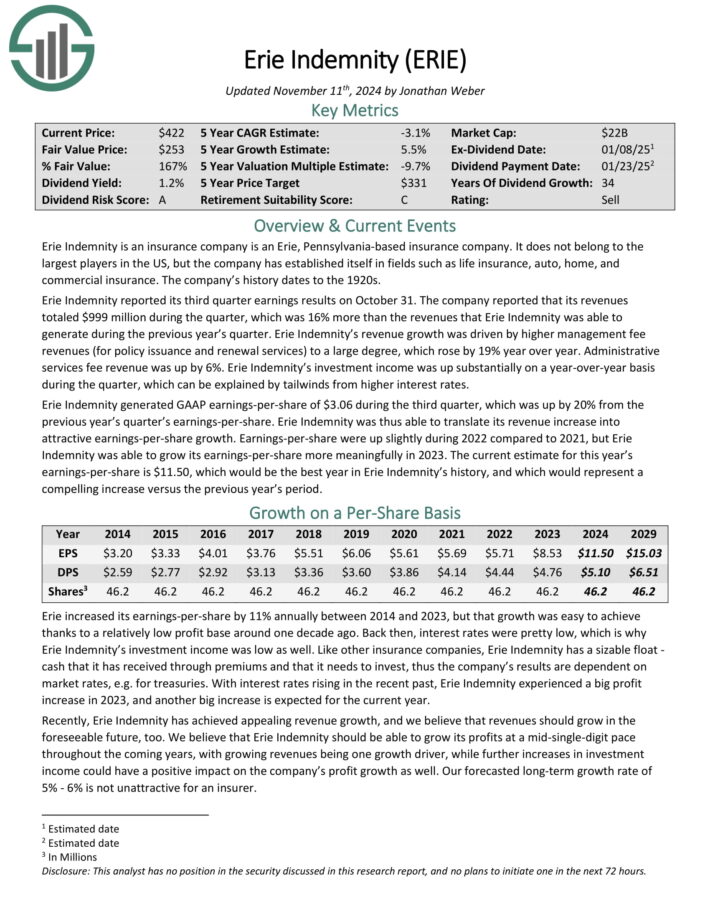

Erie Indemnity is an insurance coverage firm that has established itself in life insurance coverage, auto, dwelling, and industrial insurance coverage. The corporate’s historical past dates to the Nineteen Twenties.

Erie Indemnity reported its third quarter earnings outcomes on October 31. Income totaled $999 million in the course of the quarter, up 16% year-over-year.

Income progress was pushed by increased administration payment revenues (for coverage issuance and renewal providers), which rose by 19% year-over-year. Administrative providers payment income grew 6%.

Erie Indemnity’s funding earnings was up considerably on a year-over-year foundation in the course of the quarter, which may be defined by tailwinds from increased rates of interest.

Erie Indemnity generated GAAP earnings-per-share of $3.06 in the course of the third quarter, which was up by 20% year-over-year.

Like different insurance coverage corporations, Erie Indemnity has a large float–money that it has acquired by way of premiums that it invests. Subsequently, its monetary outcomes are considerably depending on market charges.

We imagine that Erie Indemnity ought to have the ability to develop its earnings at a mid-single-digit charge over the subsequent 5 years.

Progress can be pushed by increased premium income, whereas additional will increase in funding earnings might have a constructive influence on EPS progress as properly.

Click on right here to obtain our most up-to-date Positive Evaluation report on ERIE (preview of web page 1 of three proven under):

New Dividend Aristocrat For 2025: Eversource Power (ES)

Dividend Historical past: 27 years of consecutive will increase

Dividend Yield: 5.2%

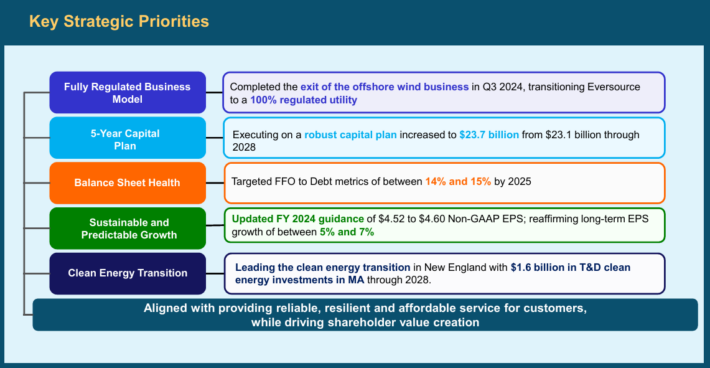

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million prospects after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gasoline in 2020.

Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a web lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the influence of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months.

Earnings from the Electrical Transmission section elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily as a result of the next degree of funding in Eversource’s electrical transmission system.

We count on the corporate to develop its earnings-per-share by 6% per 12 months on common over the subsequent 5 years.

The corporate has earnings observe file and can profit from charge hikes, transmission investments, and clear vitality initiatives.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven under):

Remaining Ideas

All Dividend Aristocrats are high-quality companies primarily based on their lengthy dividend histories. An organization can not pay rising dividends for 25+ years with out having a robust and sturdy aggressive benefit.

FactSet Analysis Techniques, Erie Indemnity, and Eversource Power are the three new additions to the Dividend Aristocrats checklist.

Whereas the three new Dividend Aristocrats have completely different enterprise fashions, progress catalysts, and dividend yields, all of them have confirmed to be dedicated to rising their dividends.

Moreover, the next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

When you’re searching for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.