Over the previous decade, inexperienced financing for business actual property has been rising steadily. There at the moment are quite a lot of debt devices that permit property house owners and builders to entry capital for the aim of creating properties eco-friendlier and extra resilient. Tax credit for sure inexperienced investments are one other financing software.

And that bought me questioning: With President Trump taking intention at what he has referred to as “inexperienced new deal insurance policies” on the federal degree and casting doubt on local weather change usually, might the business actual property capital markets make a retreat from sustainability?

Time will inform, however two C-PACE lenders I spoke with final week are assured that their product will stay in demand regardless of the messages coming from Washington.

The Industrial Property Assessed Vitality Program, in any other case referred to as C-PACE, was launched in 15 years in the past to supply property house owners with low-cost, long-term (25 to 30 years) financing for sustainability and effectivity enhancements, with debtors repaying their loans via a particular tax evaluation. This system is permitted by state laws—not the federal authorities—and at the moment 40 states have C-PACE applications.

“C-PACE is non-public capital, not federal funds, so adjustments to budgets, incentives, and such have little to no affect on C-PACE operations,” mentioned Jessica Baily, president & CEO of Nuveen Inexperienced Capital.

Underneath the primary Trump administration, based on Bailey, cumulative C-PACE originations grew at a CAGR of roughly 160 p.c, and this system expanded from 5 to 18 states. “C-PACE has constantly been a purple coverage,” Bailey mentioned.

This system actually took off, nevertheless, throughout COVID after which when rates of interest spiked. By the top of 2023, $7 billion of C-PACE financing had been accomplished so far and $2 billion of that was accomplished that 12 months, based on C-PACE Alliance.

Demand-drivers

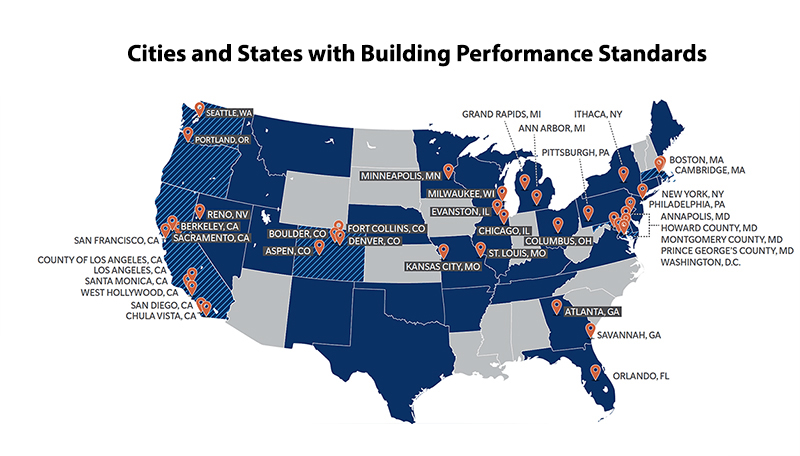

A giant driver of C-PACE exercise has been the necessity for property house owners to fulfill the wave of native and state constructing efficiency requirements geared toward decreasing GHG emissions from buildings. Based on PACE Fairness knowledge, at the moment 40-50 cities have rolled out or are within the strategy of rolling out constructing efficiency requirements. (See map)

“That to me is proof that that is actually a bottom-up, grassroots effort throughout the nation,” mentioned Beau Engman, president & founding father of PACE Fairness.

Engman additionally pointed to how constructing codes throughout the nation are altering to align with the objectives of the Paris Accord, which, by the way, President Trump withdrew the U.S. from (as soon as once more) on his first day in workplace.

“No matter what occurs there, there’s a trajectory that’s very constant on constructing codes bettering at a gentle charge,” Engman mentioned.

However the true seal of approval, Engman mentioned, comes from the lenders whose consent is required to make C-PACE a part of a undertaking’s capital stack.

C-PACE has expanded regardless of the anti-ESGE backlash from politicians and a few corners of the funding world. Will that sentiment be emboldened by Trump’s disdain for Biden-era sustainability initiatives? Maybe.

Nonetheless, Bailey pointed to C-PACE’s advantages past reducing emissions that can assist guarantee this system’s longevity. “Whereas the main focus could flip away from ESG,” she mentioned, “we consider there might be an emphasis on financial improvement and resiliency. C-PACE has funded many resiliency initiatives, and this quantity is steadily growing. As well as, so far, over 49,000 jobs have been created by NGC’s C-PACE financed initiatives.”

It would additionally proceed to be a “cost-effective” financing software in what seems to be to be an unsure charge atmosphere going ahead, she mentioned.