Key Takeaways

Ethereum brief positions have elevated by 500% since November 2024, reaching recent highs.

Whereas Bitcoin and different main crypto property have rebounded, Ethereum stays underperforming.

Share this text

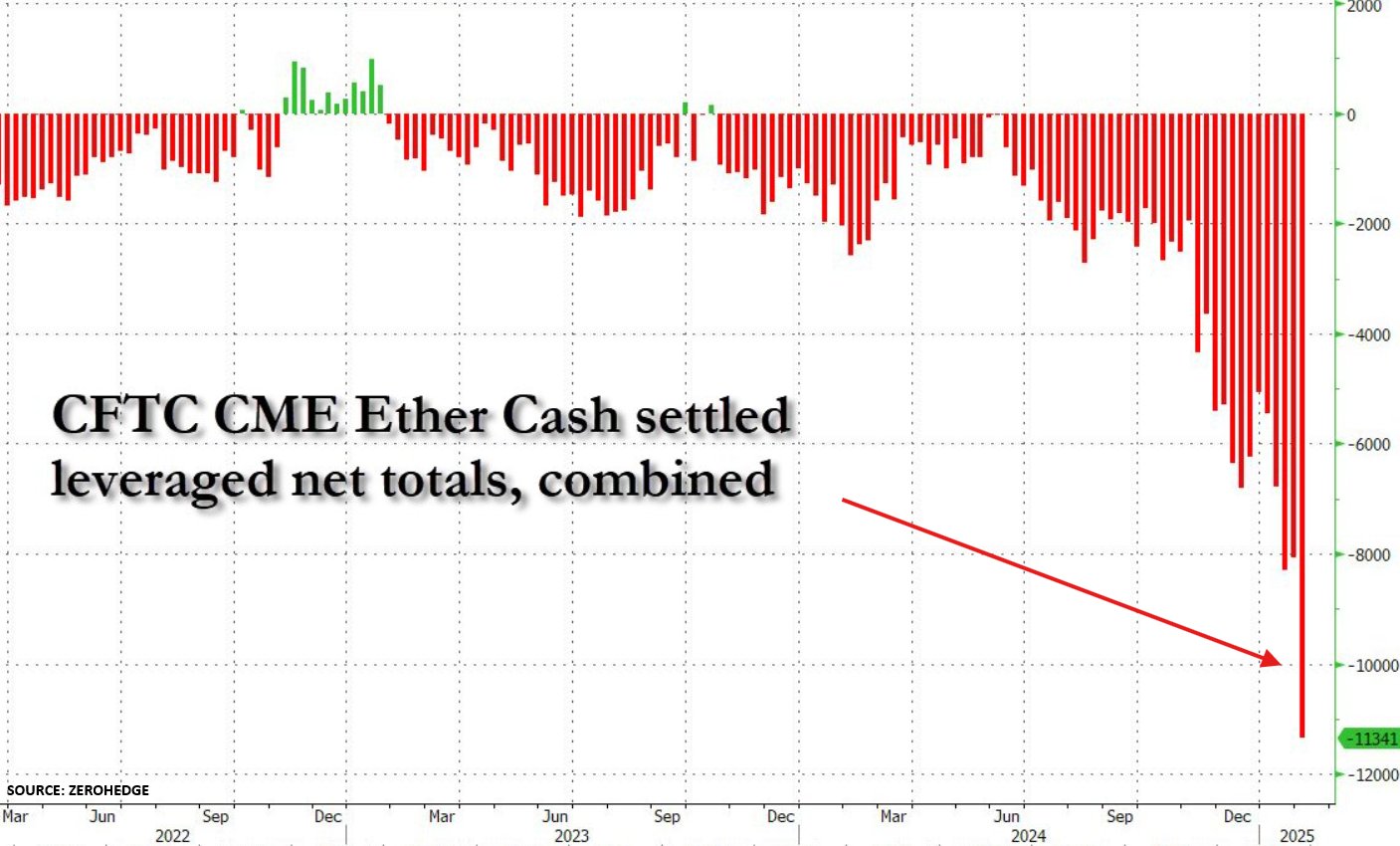

Ethereum is going through a file degree of brief promoting from hedge funds, with futures contracts on the CME reaching a brand new peak of 11,341, ZeroHedge’s new chart reveals.

Bearish bets have surged over 40% in every week and 500% since final November, as analyzed by The Kobeissi Letter. The aggressive shorting raises crimson flags about Ethereum’s near-term prospects.

The Kobeissi Letter’s evaluation notes that Ethereum’s historical past reveals a transparent correlation between giant brief positions and subsequent worth crashes. On Feb. 2, ETH skilled a significant decline, plummeting as a lot as 37% in 60 hours following President Trump’s tariff announcement.

“It felt virtually just like the flash crash seen in shares in 2010, however with no headlines,” stated the analyst, including that the selloff contributed to over $1 trillion being erased from the broader crypto market inside hours.

The surge briefly positions comes regardless of obvious assist from the Trump administration, with Eric Trump not too long ago stating “it’s a good time so as to add ETH,” which briefly boosted costs.

As of the most recent CoinGecko knowledge, ETH is hovering round $2,500, down 2% within the final 24 hours. The digital asset at present trades roughly 45% beneath its November 2021 file excessive.

Bitcoin has left Ethereum within the mud for the reason that begin of 2024, hovering over 100% whereas ETH eked out a mere 3.5% achieve. This disparity has ballooned Bitcoin’s market cap to 6 occasions the scale of Ethereum’s—a dominance not seen since 2020, in line with The Kobeissi Letter.

Ethereum’s underperformance amid a recovering crypto market raises considerations in regards to the elements driving destructive sentiment. Potential explanations embody anxieties about Ethereum’s underlying expertise, regulatory uncertainty, and macroeconomic headwinds.

The file brief place amplifies the potential for worth volatility. A sustained decline would validate the bearish outlook, however the sheer measurement of the brief place additionally will increase the probability of a brief squeeze if optimistic developments materialize.

Share this text