Up to date on February 14th, 2025 by Bob Ciura

Spreadsheet knowledge up to date each day

Return on invested capital, or ROIC, is a precious monetary ratio that buyers can add to their analysis course of.

Understanding ROIC and utilizing it to display screen for top ROIC shares is an effective approach to concentrate on the highest-quality companies.

With this in thoughts, we ran a inventory display screen to concentrate on the best ROIC shares within the S&P 500.

You possibly can obtain a free copy of the highest 100 shares with the best ROIC (together with essential monetary metrics like dividend yields and price-to-earnings ratio) by clicking on the hyperlink under:

Utilizing ROIC permits buyers to filter out the highest-quality companies which are successfully producing a return on capital.

This text will clarify ROIC and its usefulness for buyers. It can additionally record the highest 10 highest ROIC shares proper now.

Desk Of Contents

You should use the hyperlinks under to immediately bounce to a person part of the article:

What Is ROIC?

Put merely, return on invested capital (ROIC) is a monetary ratio that reveals an organization’s capability to allocate capital. The frequent system to calculate ROIC is to divide an organization’s after-tax web working revenue, by the sum of its debt and fairness capital.

As soon as the ROIC is calculated, it’s evaluated in opposition to an organization’s weighted common price of capital, generally known as WACC.

If an organization’s WACC is just not instantly accessible, it may be calculated by taking a weighted common of the price of an organization’s debt and fairness.

Value of debt is calculated by averaging the yield to maturity for an organization’s excellent debt. That is pretty simple to seek out, as a publicly-traded firm should report its debt obligations.

Value of fairness is usually calculated through the use of the capital asset pricing mannequin, in any other case often known as CAPM.

As soon as the WACC is calculated, it may be in contrast with the ROIC. Traders wish to see an organization’s ROIC exceed its WACC.

This means the underlying enterprise is efficiently investing its capital to generate a worthwhile return. On this approach, the corporate is creating financial worth.

Typically, shares producing the best ROIC are doing the very best job of allocating their buyers’ capital. With this in thoughts, the next part ranks the ten shares with the best ROIC.

The High 10 Highest ROIC Shares

The next 10 shares have the best ROIC within the Positive Evaluation Analysis Database. Shares are listed by ROIC, from lowest to highest.

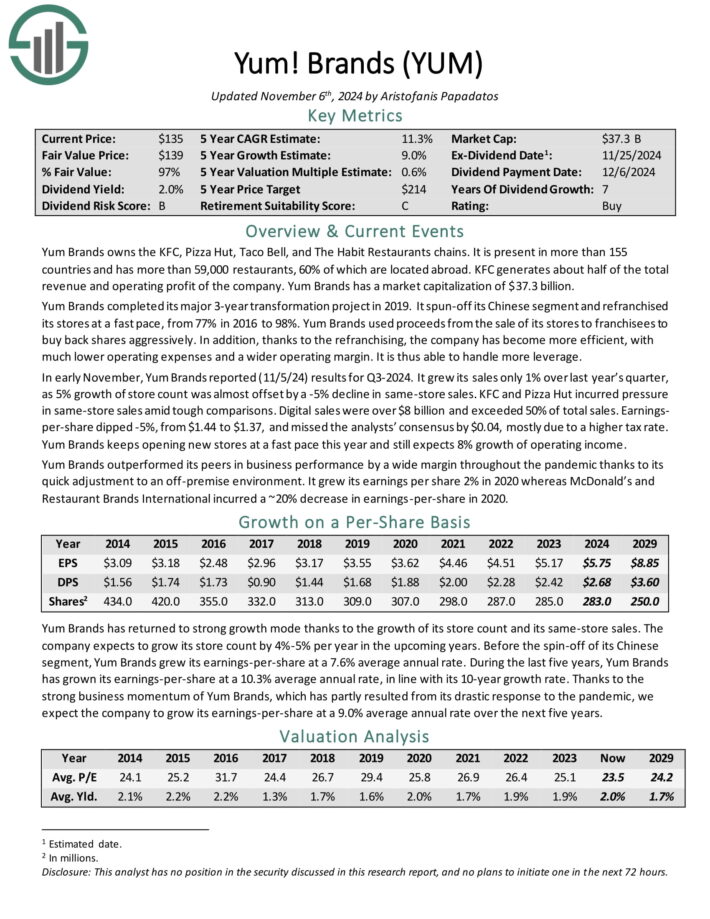

Excessive ROIC Inventory #10: Yum Manufacturers Inc. (YUM)

Return on invested capital: 44.6%

Yum Manufacturers owns the KFC, Pizza Hut, Taco Bell, and The Behavior Eating places chains. It’s current in additional than 155 nations and has greater than 59,000 eating places, 60% of that are situated overseas. KFC generates about half of the full income and working revenue of the corporate.

In early November, Yum Manufacturers reported (11/5/24) outcomes for Q3-2024. It grew its gross sales just one% over final 12 months’s quarter, as 5% development of retailer rely was nearly offset by a -5% decline in same-store gross sales. KFC and Pizza Hut incurred stress in same-store gross sales amid powerful comparisons.

Digital gross sales have been over $8 billion and exceeded 50% of whole gross sales. Earnings per-share dipped -5%, from $1.44 to $1.37, and missed the analysts’ consensus by $0.04, principally attributable to the next tax price.

Yum Manufacturers retains opening new shops at a quick tempo this 12 months and nonetheless expects 8% development of working revenue.

Click on right here to obtain our most up-to-date Positive Evaluation report on YUM (preview of web page 1 of three proven under):

Excessive ROIC Inventory #9: TJX Firms (TJX)

Return on invested capital: 46.9%

TJX Firms is a number one off-price retailer of attire and residential fashions within the U.S. and worldwide. As of November 2, 2024, the corporate operated 5,057 shops in 9 nations.

These embody 1,331 T.J. Maxx (26% of whole), 1,219 Marshalls (24%) and 941 HomeGoods (19%) in the USA. TJX additionally operates e-commerce websites. In a standard 12 months, the corporate generates ~$50 billion in annual income and ~$4 billion in web revenue.

On 11/20/24, TJX launched its fiscal Q3 2025 outcomes for the interval ending 11/02/24. For the quarter, web gross sales climbed 6% 12 months over 12 months to $14.1 billion. Consolidated comparable retailer gross sales rose 3%, pushed completely by a rise in buyer transactions.

It witnessed comparable retailer gross sales development throughout all its divisions with the strongest of seven% at TJX Worldwide (Europe & Australia), 3% at HomeGoods (U.S.), and a couple of% at each Marmaxx (U.S.) and TJX Canada.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBUX (preview of web page 1 of three proven under):

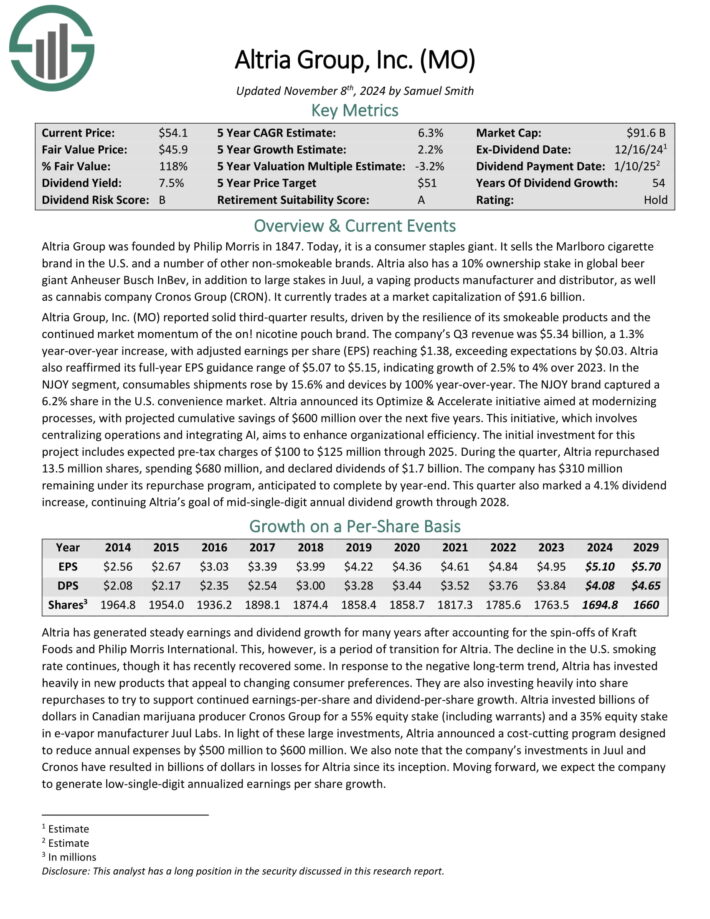

Excessive ROIC Inventory #8: Altria Group (MO)

Return on invested capital: 47.5%

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

Altria reported strong third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch model.

Supply: Investor Presentation

The corporate’s Q3 income was $5.34 billion, a 1.3% year-over-year enhance, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria additionally reaffirmed its full-year EPS steerage vary of $5.07 to $5.15, indicating development of two.5% to 4% over 2023.

Throughout the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The corporate has $310 million remaining below its repurchase program, anticipated to finish by year-end.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven under):

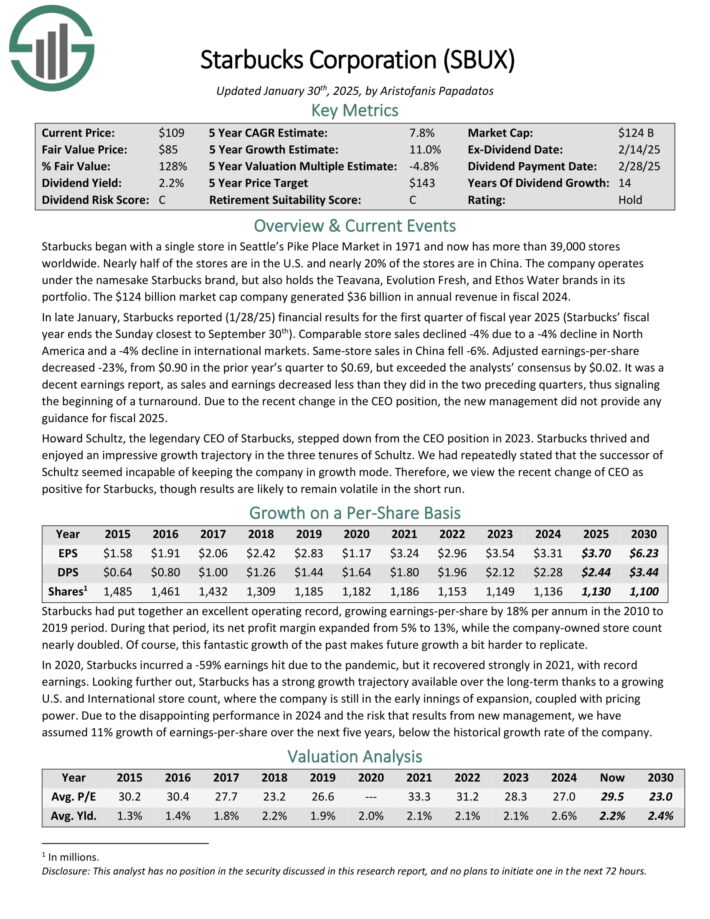

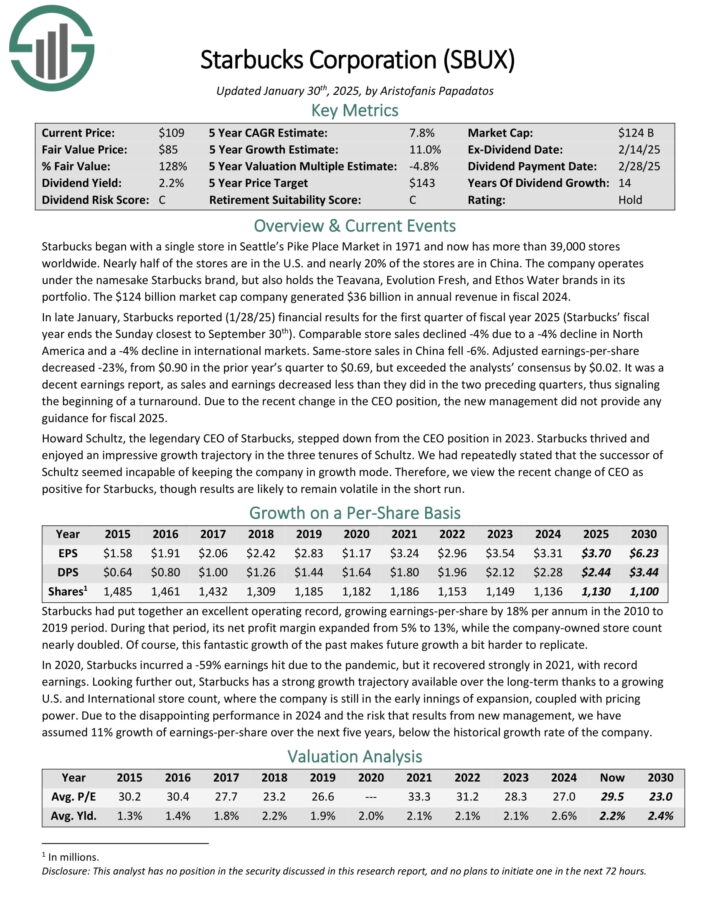

Excessive ROIC Inventory #7: Starbucks Company (SBUX)

Return on invested capital: 51.2%

Starbucks started with a single retailer in Seattle’s Pike Place Market in 1971 and now has greater than 39,000 shops worldwide. Practically half of the shops are within the U.S. and practically 20% of the shops are in China.

The corporate operates below the Starbucks model, but in addition holds the Teavana, Evolution Contemporary, and Ethos Water manufacturers in its portfolio. The corporate generated $36 billion in annual income in fiscal 2024.

In late January, Starbucks reported (1/28/25) monetary outcomes for the primary quarter of fiscal 12 months 2025 (Starbucks’ fiscal 12 months ends the Sunday closest to September thirtieth).

Comparable retailer gross sales declined -4% attributable to a -4% decline in North America and a -4% decline in worldwide markets. Similar-store gross sales in China fell -6%. Adjusted earnings-per-share decreased -23%, from $0.90 within the prior 12 months’s quarter to $0.69, however exceeded the analysts’ consensus by $0.02.

Trying additional out, Starbucks has a robust development trajectory accessible over the long-term because of a rising U.S. and Worldwide retailer rely, the place the corporate remains to be within the early innings of growth, coupled with pricing energy.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBUX (preview of web page 1 of three proven under):

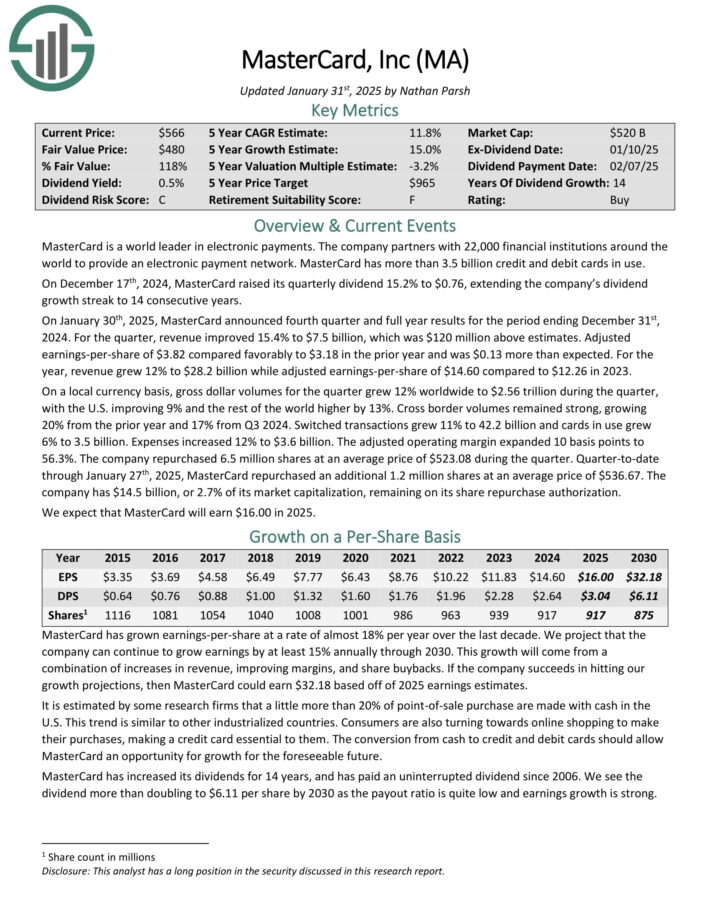

Excessive ROIC Inventory #6: Mastercard Inc. (MA)

Return on invested capital: 52.9%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments all over the world to offer an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On January thirtieth, 2025, MasterCard introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024.

For the quarter, income improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 in contrast favorably to $3.18 within the prior 12 months and was $0.13 greater than anticipated.

For the 12 months, income grew 12% to $28.2 billion whereas adjusted earnings-per-share of $14.60 in comparison with $12.26 in 2023.

On a neighborhood foreign money foundation, gross greenback volumes for the quarter grew 12% worldwide to $2.56 trillion throughout the quarter, with the U.S. bettering 9% and the remainder of the world larger by 13%.

Cross border volumes remained sturdy, rising 20% from the prior 12 months and 17% from Q3 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on Mastercard (preview of web page 1 of three proven under):

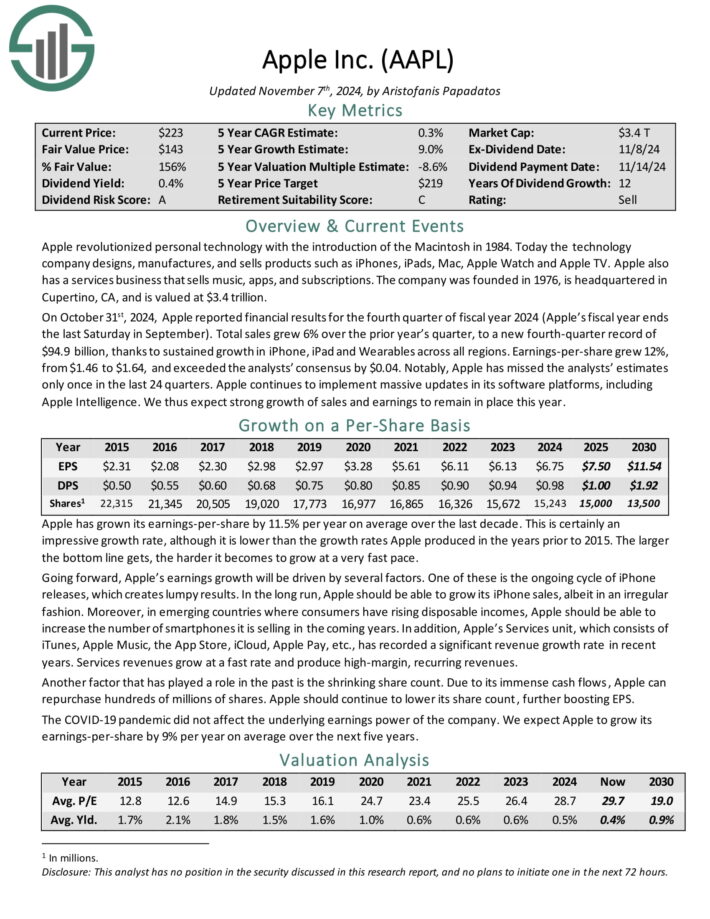

Excessive ROIC Inventory #5: Apple, Inc. (AAPL)

Return on invested capital: 54.1%

Apple designs, manufactures and sells merchandise comparable to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

On October thirty first, 2024, Apple reported monetary outcomes for the fourth quarter of fiscal 12 months 2024. Complete gross sales grew 6% over the prior 12 months’s quarter, to a brand new fourth-quarter report of $94.9 billion, because of sustained development in iPhone, iPad and Wearables throughout all areas.

Earnings-per-share grew 12%, from $1.46 to $1.64, and exceeded the analysts’ consensus by $0.04.

Going ahead, Apple’s earnings development can be pushed by a number of elements. One among these is the continued cycle of iPhone releases. In the long term, Apple ought to be capable to develop its iPhone gross sales, albeit in an irregular trend.

Furthermore, in rising nations the place shoppers have rising disposable incomes, Apple ought to be capable to enhance the variety of smartphones it’s promoting within the coming years.

As well as, Apple’s Providers unit, which consists of iTunes, Apple Music, the App Retailer, iCloud, Apple Pay, and so on., has recorded a major income development price in recent times.

Click on right here to obtain our most up-to-date Positive Evaluation report on AAPL (preview of web page 1 of three proven under):

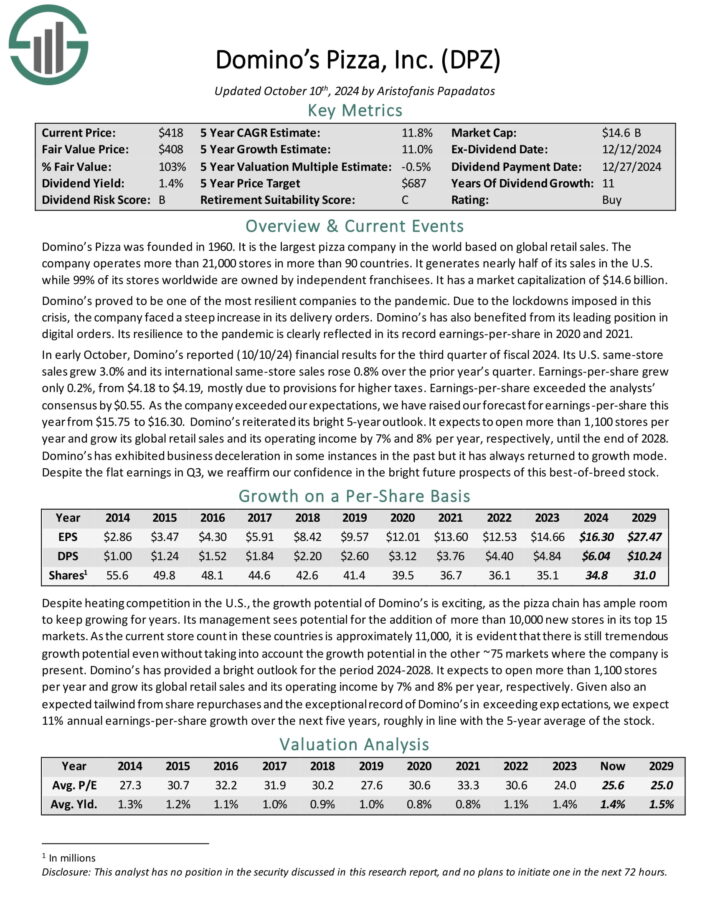

Excessive ROIC Inventory #4: Domino’s Pizza Inc. (DPZ)

Return on invested capital: 59.3%

Domino’s Pizza was based in 1960. It’s the largest pizza firm on the planet primarily based on world retail gross sales. The corporate operates greater than 21,000 shops in additional than 90 nations.

It generates practically half of its gross sales within the U.S. whereas 99% of its shops worldwide are owned by unbiased franchisees.

In early October, Domino’s reported (10/10/24) monetary outcomes for the third quarter of fiscal 2024. Its U.S. identical storesales grew 3.0% and its worldwide same-store gross sales rose 0.8% over the prior 12 months’s quarter.

Earnings-per-share grew solely 0.2%, from $4.18 to $4.19, principally attributable to provisions for larger taxes. Earnings-per-share exceeded the analysts’ consensus by $0.55.

Domino’s reiterated its vibrant 5-year outlook. It expects to open greater than 1,100 shops per 12 months and develop its world retail gross sales and its working revenue by 7% and eight% per 12 months, respectively, till the tip of 2028.

Click on right here to obtain our most up-to-date Positive Evaluation report on DPZ (preview of web page 1 of three proven under):

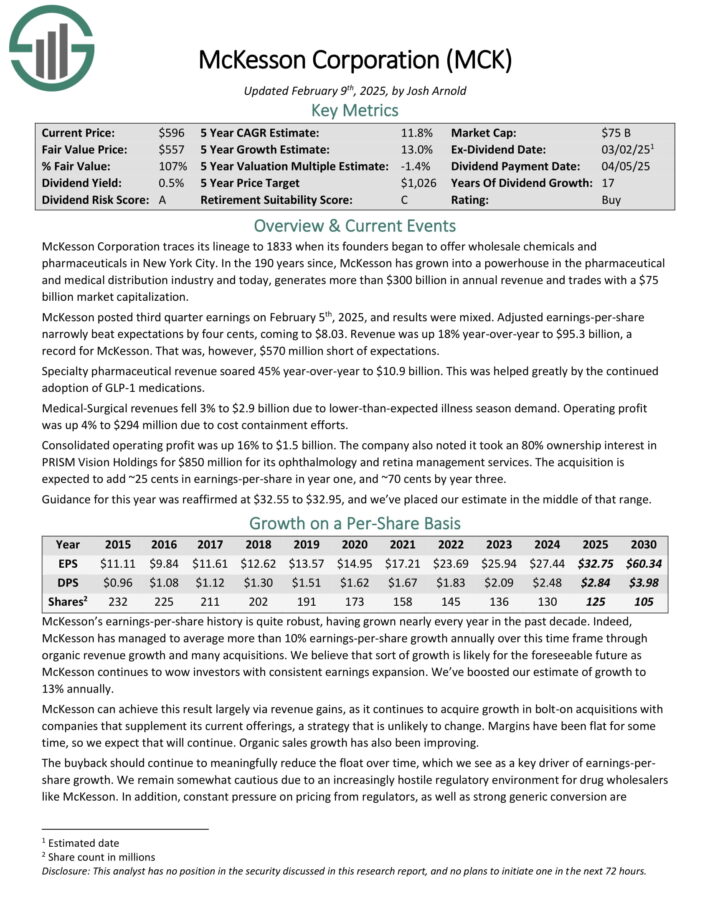

Excessive ROIC Inventory #3: McKesson Company (MCK)

Return on invested capital: 64.3%

McKesson Company traces its lineage to 1833 when its founders started to supply wholesale chemical compounds and prescription drugs in New York Metropolis.

Within the 190 years since, McKesson has grown right into a powerhouse within the pharmaceutical and medical distribution trade and at present, generates greater than $300 billion in annual income.

McKesson posted third quarter earnings on February fifth, 2025, and outcomes have been blended. Adjusted earnings-per-share narrowly beat expectations by 4 cents, coming to $8.03. Income was up 18% year-over-year to $95.3 billion, a report for McKesson. That was, nevertheless, $570 million in need of expectations.

Specialty pharmaceutical income soared 45% year-over-year to $10.9 billion. This was helped vastly by the continued adoption of GLP-1 drugs.

Medical-Surgical revenues fell 3% to $2.9 billion attributable to lower-than-expected sickness season demand. Working revenue was up 4% to $294 million attributable to price containment efforts.

Consolidated working revenue was up 16% to $1.5 billion. The corporate additionally famous it took an 80% possession curiosity in PRISM Imaginative and prescient Holdings for $850 million for its ophthalmology and retina administration providers.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCK (preview of web page 1 of three proven under):

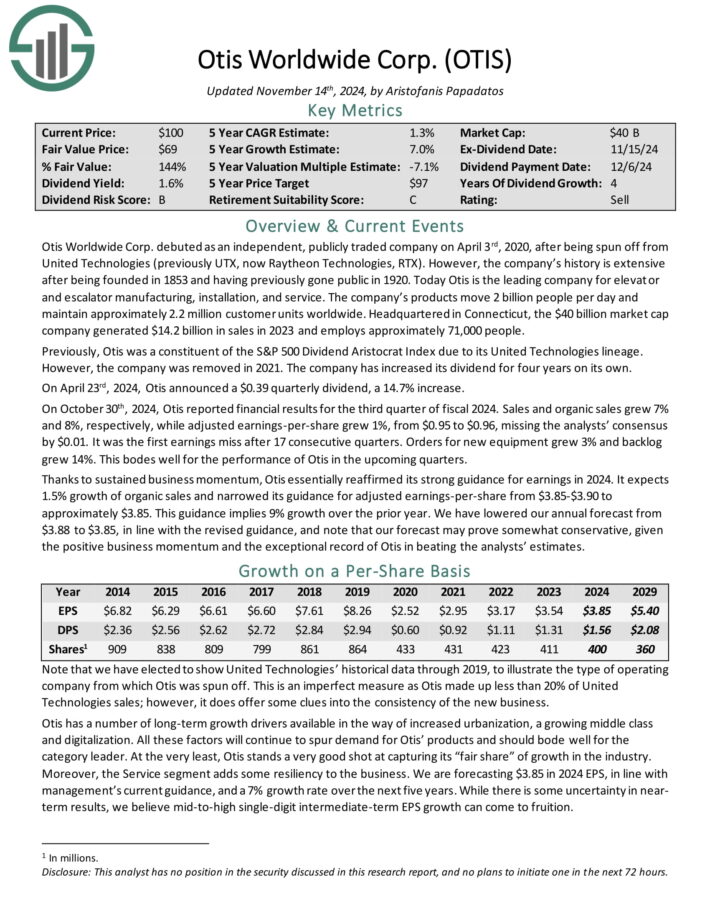

Excessive ROIC Inventory #2: Otis Worldwide (OTIS)

Return on invested capital: 69.0%

Otis Worldwide Corp. debuted as an unbiased, publicly traded firm on April third, 2020, after being spun off from United Applied sciences (beforehand UTX, now Raytheon Applied sciences, RTX).

Right this moment Otis is the main firm for elevator and escalator manufacturing, set up, and repair.

On October thirtieth, 2024, Otis reported monetary outcomes for the third quarter of fiscal 2024. Gross sales and natural gross sales grew 7% and eight%, respectively, whereas adjusted earnings-per-share grew 1%, from $0.95 to $0.96, lacking the analysts’ consensus by $0.01. It was the primary earnings miss after 17 consecutive quarters.

Orders for brand spanking new tools grew 3% and backlog grew 14%. This bodes nicely for the efficiency of Otis within the upcoming quarters.

Because of sustained enterprise momentum, Otis basically reaffirmed its sturdy steerage for earnings in 2024. It expects 1.5% development of natural gross sales and narrowed its steerage for adjusted earnings-per-share from $3.85-$3.90 to roughly $3.85. This steerage implies 9% development over the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on OTIS (preview of web page 1 of three proven under):

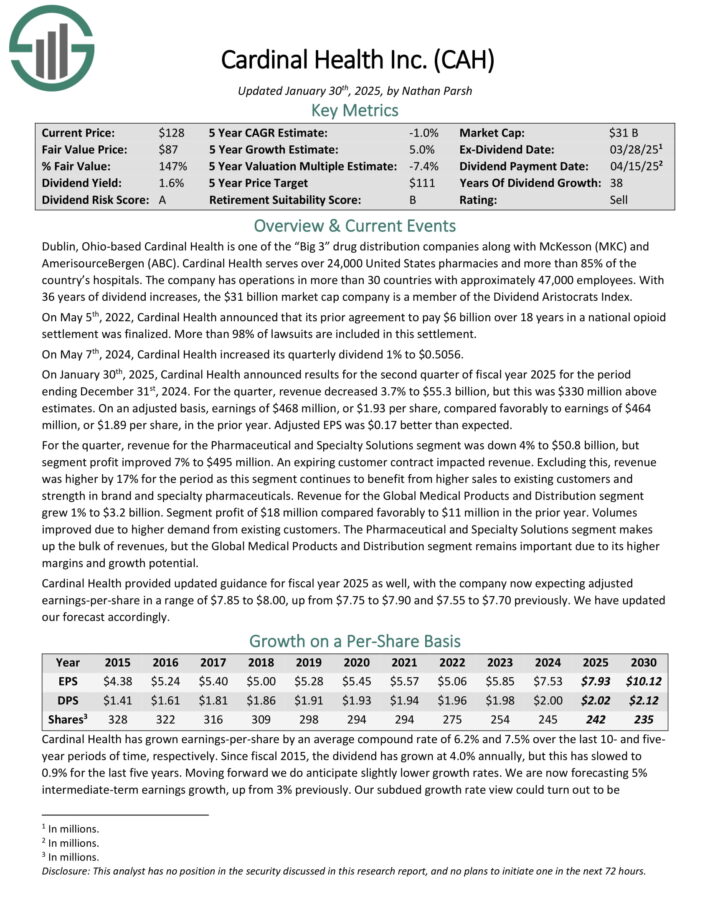

Excessive ROIC Inventory #1: Cardinal Well being (CAH)

Return on invested capital: 71.6%

Cardinal Well being is among the “Massive 3” drug distribution firms together with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Well being serves over 24,000 United States pharmacies and greater than 85% of the nation’s hospitals.

With 36 years of dividend will increase, the $31 billion market cap firm is a member of the Dividend Aristocrats Index.

On January thirtieth, 2025, Cardinal Well being introduced outcomes for the second quarter of fiscal 12 months 2025 for the interval ending December thirty first, 2024. For the quarter, income decreased 3.7% to $55.3 billion, however this was $330 million above estimates.

On an adjusted foundation, earnings of $468 million, or $1.93 per share, in contrast favorably to earnings of $464 million, or $1.89 per share, within the prior 12 months. Adjusted EPS was $0.17 higher than anticipated.

Click on right here to obtain our most up-to-date Positive Evaluation report on CAH (preview of web page 1 of three proven under):

Ultimate Ideas

There are a lot of other ways for buyers to worth shares. One in style valuation technique is to calculate an organization’s return on invested capital.

By doing so, buyers can get a greater gauge of firms that do the very best job of investing their capital.

ROIC is on no account the one metric that buyers ought to use to purchase shares. There are a lot of different worthwhile valuation strategies that buyers ought to take into account.

That stated, the highest 10 ROIC shares on this record have confirmed the power to create financial worth for shareholders.

Additional Studying

If you’re focused on discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.