Merchants, given the present value motion and market setting, this week’s watchlist will differ in define and focus from earlier ones.

As at all times, I’ll define my high concepts for the upcoming week, however the nature of these concepts will vastly differ from the norm.

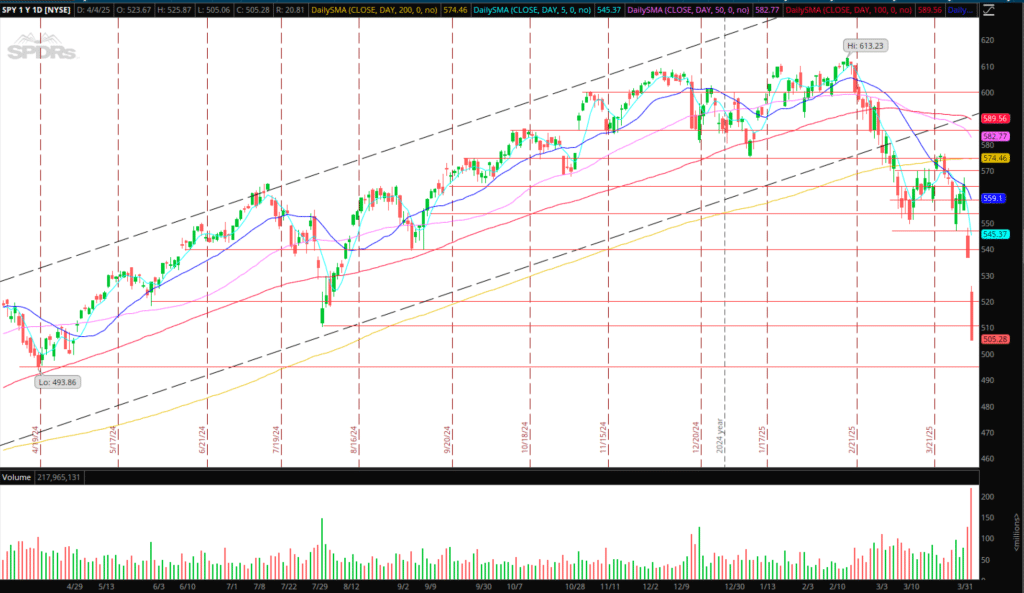

We now discover ourselves in an more and more unsure and fear-driven tape, with concern virtually close to March 2020 lows, and a heightened volatility setting, with VIX closing on the highs on Friday.

From a buying and selling perspective—and it’s important to distinguish between buying and selling and investing on this market—it’s not a time to have a bias. We might bounce, we might proceed to dump additional than we predict—something is feasible. In fact, it stays a headline-driven tape swamped with important uncertainty, so the pattern and sentiment can change a number of instances all through the day, off one headline. Keep in mind that. So can also my plans. That’s why it’s necessary to be nimble, and till there may be larger readability and certainty surrounding probably the most unsure insurance policies proper now, it’s greatest to not be married to an thought.

Now, given the place we’re and the place we now have come from, right here’s how I’ll strategy Monday.

Ideas and Plans for Monday

As outlined on Thursday in my IA assembly, during times of a market selloff and elevated VIX, my go-to devices and buying and selling autos are SPY, QQQ, and VXX. I even have a basket of market shares, comparable to AAPL, NVDA, and TSLA, for reactive trades to the market, relying on relative energy and weak point, and reactive trades to any outlier strikes for a reversion. However for probably the most half, I’m buying and selling the general market SPY / QQQ and VXX merely move2move.

Except an outlier scenario arises. Which brings me to Monday.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

In fact, this may depend upon whether or not we open flat, hole up, or down. On common, after two consecutive days of unfavourable 4.5% declines within the S&P 500, the market has returned 2.95% on day 3, primarily based on a pattern of 10 days in historical past, with 8 of the ten days returning a optimistic return on day 3.

The very best chance commerce that I see growing is that if we gapped decrease into Monday, flushed within the pre-market or off the open, after which put in a better low, signalling capitulation and a possible intraday rebound. Given oversold indicators, market internals, and everybody calling for a ’87-style crash whereas the concern index is close to 0, I’m most excited a couple of potential capitulation and bounce commerce intraday.

Equally, we might open flat or barely up, during which case the chance could be downgraded from an A+ to a B+. In that occasion, I might look to see how we commerce close to 2-day VWAPs and pre-market ranges to find out whether or not or not I’ll go lengthy on a better low or a consolidation breakout intraday.

Right here’s My Plan:

Traditionally, in comparable conditions (assume COVID March), I outperform in VXX and SPY, so that’s the place my focus can be. I’ll look to be brief VXX on both a capitulatory up transfer and solely scale as soon as a decrease excessive is confirmed, or on a lower-higher / failed follow-through, together with the market firming.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

Equally, as soon as we now have a better low out there following a flush, I’ll look to place lengthy, initially focusing on VWAP to take threat off, with a cease close to LOD and HOD for VXX. It is very important observe that I’m not searching for a restoration out there; I’m simply searching for an intraday rebound.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

I’ll have my basket of market-related former leaders (assume Magazine 7 shares) on look ahead to any potential important washouts which can be adopted by a snapback for lengthy entries as properly.

A number of different eventualities exist that warrant completely different plans and ideas. This is only one situation I’m most curious about and outlining. And it’s price mentioning once more—issues can go additional than you assume, so except there may be affirmation by way of value motion and internals, and my plan for motion materializes, I cannot be attempting to catch a falling knife. That’s the place you get burnt.

I’ll even be expecting breaking information regarding any of the numerous international locations with tariffs imposed, like Vietnam, the European Union, India, and China, and I’ll look to react to the associated sector and firms it impacts probably the most.

I don’t have any small-caps on look ahead to the upcoming week. It stays strictly a market-related tape, a move-to-move merchants’ setting, the place the vary and alternative have opened up. Now could be the time to carry out if it is a market in which you’ll be able to excel.

Keep in mind that with an elevated VIX, you don’t have to dimension up and attempt to be a hero; the volatility enhance is sizing you up naturally. Concentrate on that, and as at all times, place probably the most emphasis on threat administration and the place you really have optimistic expectancy. Let the trades fall into your lap.

Past sooner or later, I can not plan setups for all the week, given the market that we’re in, and the way rapidly sentiment and pattern can change. So the above is my plan for Monday, the best-case situation, however as talked about, I’m not married to the concept. Something can occur on this tape!

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures