Right now, we’ll have a look at a totally risk-free choices collar commerce.

Danger-free collars will not be synonymous with zero-cost collars.

The zero-cost collar simply means that you would be able to add an choices collar round a inventory for zero further price.

These are widespread, however they aren’t risk-free.

The choices collar we’re discussing is much less widespread, and the complete commerce has no threat of loss.

Contents

A collar is when an investor owns 100 shares of inventory.

The investor then buys a put possibility to guard that inventory and sells a name possibility to soak up a credit score to pay for that put possibility.

If the credit score exceeds the price of the put possibility, then we’ve got a zero-cost collar.

If the credit score exceeds the price of the put possibility by a lot that it covers any losses from a declining inventory worth, then you might have a risk-free commerce.

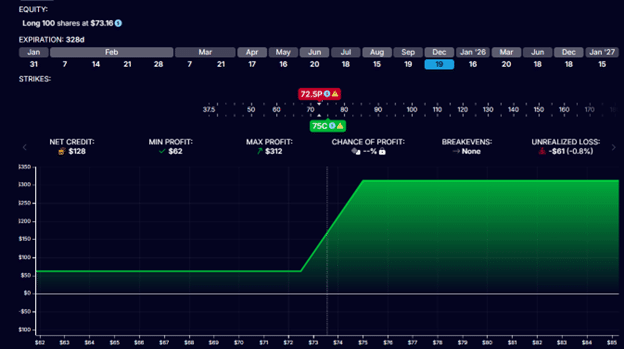

On January 23, 2025, an investor buys 100 Nike (NKE) shares for $73.16 per share.

He promptly buys a put possibility with a strike worth of $72.50, expiring on December 19, 2025.

This prices $710.

With commissions and charges, let’s say it prices $710.65.

He promptly sells a name possibility with a strike worth of $75, expiring on December 19, 2025.

This offers him a credit score of $839.33 (with commissions and charges taken out).

We see that is already a zero-cost collar as a result of the sale of the decision gave him extra money than it prices for the put possibility.

In reality, he nets a credit score of $128.68.

This credit score can compensate him for any potential loss within the inventory worth.

The put possibility entitles the investor to promote 100 shares of Nike at $72.50 (offered it’s earlier than the choice’s expiration date).

Probably the most that the investor can lose from the inventory then is $0.66 per share as a result of

$73.16 – $72.50 = $0.66

For 100 shares, essentially the most the investor can lose from a declining inventory is $66.

But when that had been to occur, the $128.68 credit score greater than compensates for this lack of $66.

Due to this fact, this funding shouldn’t lose cash – except the investor makes a buying and selling error.

In reality, this commerce ought to make not less than $62 it doesn’t matter what occurs to the Nike inventory worth.

If we had been to enter these costs into OptionStrat modeling software program, we’d see that the danger graph would at all times be above the zero revenue line.

The revenue of the commerce is proven on the vertical axis.

It calculates the minimal revenue to be $62 and the utmost revenue potential to be $312.

Free Wheel Technique eBook

If Nike is above $75 per share at expiration, the put possibility will expire nugatory.

The inventory can be known as away at $75.

With 100 shares, the investor would obtain $7500 at expiration to promote the 100 shares at $75 per share.

Due to this fact, the online revenue in that case could be

Buy of 100 shares: -$7316

Buy of put possibility: -$710.65

Sale of name possibility: $839.33

Sale of 100 shares: $7500

Internet revenue: $312

Those that are observant will observe that the expiry of the decision and put choices are 300 days out in time.

Which means it may take 300 days to make that $312 revenue.

Annualized to a 12 months that has one year, that might be equal to a revenue of $379.60 in a 12 months.

Since this commerce requires the acquisition of 100 shares, it ties up roughly, on common, $7316 of capital.

In share phrases, this comes out to be a 5.2% return on capital per 12 months.

$379.60 / $7316 = 5.2%

The final risk-free charge of return as of January 2025 is 4.2% based mostly on the three-month U.S. Treasury Invoice yield.

Due to this fact, our Nike risk-free collar makes about 1% greater than the risk-free charge of return.

Sure, it may.

And it may be crammed at such costs.

The slight misalignment of costs in far-expiry choices and a few random motion of the inventory worth can allow such costs to be realized.

These similar worth anomalies could cause an uninformed dealer to exit such risk-free commerce at a loss.

Zero-risk is assured on the time of expiration of the choices.

Earlier than expiration, the commerce can expertise P&L which can be destructive.

If a dealer had been to exit at an inopportune time when the P&L occurs to be destructive, then the commerce isn’t risk-free.

The chance could be the danger of human error.

By figuring out that $312 is the max revenue of the commerce, the investor might have the chance to exit the commerce in a a lot shorter period of time if he occurs to see the P&L being close to the max revenue as a result of worth swings and/or choices worth fluctuations.

This will allow the investor to get a barely better-annualized return and recycle the capital earlier.

Tying up capital for a lot of the 12 months additionally represents a possibility price as this cash cannot be used elsewhere the place the returns could be higher.

Generally the market may give us a free lunch.

That free lunch may be only a little bit of butter on un-toasted white bread as a result of it’s barely above the risk-free charge of return.

However a free lunch remains to be higher than no lunch.

In our subsequent article, we’ll present find out how to search for risk-free trades in case anyone desires to make these their bread-and-butter trades.

We hope you loved this text on how a lot you may make from a risk-free choices collar commerce.

When you have any questions, please ship an e mail or depart a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who will not be conversant in change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.