Up to date on April seventeenth, 2025 by Nathan Parsh

Traders searching for excessive yields could contemplate buying shares of Enterprise Improvement Firms, also referred to as BDCs. These shares steadily have a better dividend yield than the broader inventory market common.

Some BDCs even pay month-to-month dividends.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

Oxford Sq. Capital Company (OXSQ) is a Enterprise Improvement Firm (BDC) that pays a month-to-month dividend. Oxford Sq. can be a extremely yielding inventory, with a yield of almost 17% based mostly on anticipated dividends for fiscal 2025. That is 12 occasions the common yield of the S&P 500.

Nevertheless, buyers ought to at all times understand that the sustainability of a dividend is simply as essential, if no more so, than the yield itself.

BDCs usually present excessive ranges of earnings, however many (together with Oxford Sq.) have hassle sustaining their dividends, significantly throughout recessions. This text will study the corporate’s enterprise, development prospects, and consider the security of the dividend.

Enterprise Overview

Oxford Sq. Capital Corp. is a Enterprise Improvement Firm (BDC) specializing in financing early- and middle-stage companies via loans and Collateralized Mortgage Obligations (CLOs). You possibly can see our full BDC record right here.

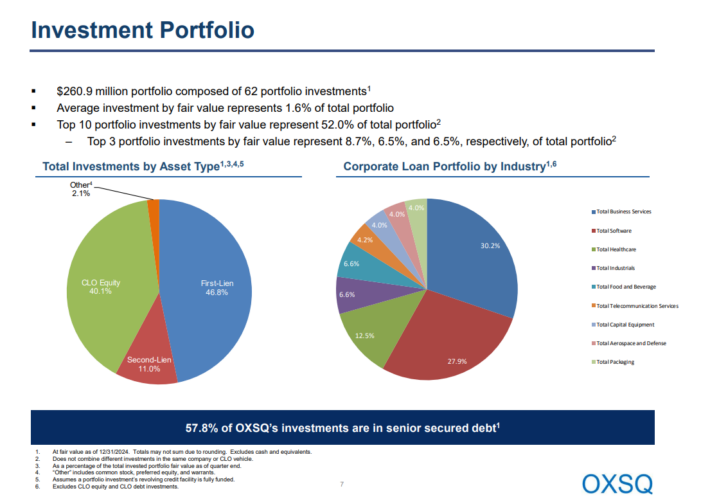

The corporate holds a well-diversified portfolio of First–Lien, Second–Lien, and CLO fairness property unfold throughout seven industries, with the best publicity in enterprise providers and software program, at 30.2% and 27.9%, respectively.

Supply: Investor presentation

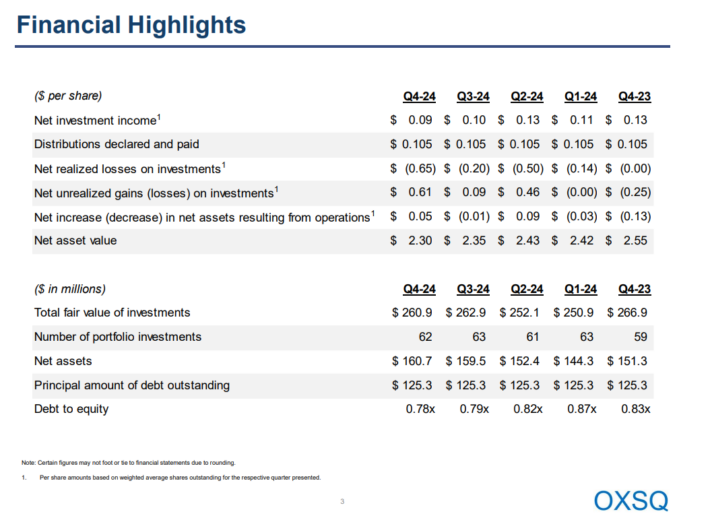

On February 28, 2025, Oxford Sq. introduced its This fall and 2024 outcomes for the interval ended December 31, 2024.

Supply: Investor presentation

The corporate reported whole funding earnings of $42.7 million for the yr, a lower of $9.1 million from the earlier yr. This decline was primarily resulting from a discount in curiosity earnings from debt investments.

The weighted common yield on debt investments improved to fifteen.8% from 13.3% within the earlier yr. The money distribution yield on money income-producing CLO fairness investments rose barely to 16.2% from 15.3% on a sequential foundation. The efficient yield on CLO fairness investments was 8.8%, down marginally from 9.6% in Q3 2024.

Whole bills had been $16.2 million for the yr, down considerably from $24.5 million within the prior yr because of the absence of incentive charges.

Because of this, internet funding earnings (NII) totaled $26.4 million, or $0.42 per share, in comparison with $27.4 million, or $0.48 per share, within the earlier yr. The corporate’s internet asset worth (NAV) per share of $2.30 was down from $2.55 a yr in the past. Based mostly on its present portfolio, Oxford Sq. tasks to have a full-year 2025 funding earnings per share (IIS) of $0.42.

Development Prospects

The corporate’s funding earnings per share had been declining at an alarming charge, as financing grew to become cheaper, stopping Oxford Sq. from refinancing at its earlierly greater charges. Moreover, the corporate has traditionally over-distributed dividends to shareholders, thereby eroding its NAV and future earnings technology resulting from diminished asset holdings.

Contemplating that the Fed has not lower rates of interest because of the present financial uncertainty, we anticipate Oxford Sq. to generate steady funding earnings per share within the close to time period.

The 2020 dividend lower ought to allow Oxford Sq. to retain some money, hopefully permitting it to start out regrowing its NAV. With charges unlikely to proceed moving any decrease for the second, earnings technology ought to stabilize.

With funding throughout a large breadth of various industries, Oxford Sq. has a fairly balanced portfolio. The corporate’s prime three industries do make up many of the portfolio, however they’re in several areas of the financial system. This gives some safety within the occasion of a downturn in a single trade.

Nevertheless, if charges decline over time, the corporate’s receivables could possibly be additional pressured, worsening its monetary efficiency yearly. Total, we imagine that the corporate’s future investment earnings technology carries substantial dangers, whereas a possible recession and an hostile financial setting might severely injury its curiosity earnings.

Dividend Evaluation

Oxford Sq. solely not too long ago started paying a month-to-month dividend, with the primary being distributed in April 2019. Whole dividends paid over the previous few years are listed under:

2015 dividends: $1.14

2016 dividends: $1.16 (1.8% improve)

2017 dividends: $0.80 (31% decline)

2018 dividends: $0.80 (no improve)

2019 dividends: $0.80 (no improve)

2020 dividends: $0.6120 (23.5% decline)

2021 dividends: $0.42 (31.4% decline)

2022 dividends: $0.42 (Flat)

2023 dividends: $0.54(28.5% improve)

2024 dividends: $0.42 (22% decline)

Shareholders acquired a small improve in 2016, adopted by three giant dividend reductions since 2017. This inconsistency in dividend payout is because of the firm’s unstable monetary efficiency. Final yr’s dividend whole was negatively impacted by the absence of a $0.12 per share particular dividend that occurred in 2023. The month-to-month fee has remained the identical for the reason that 2020 lower.

Oxford Sq. presently pays a month-to-month dividend of $0.035 per share, equaling an annualized payout of $0.42 per share.

Based mostly on a full-year payout of $0.42 per share, Oxford Sq. inventory yields 16.9%. Though the dividend cuts in recent times have been substantial, the dividend yield stays remarkably excessive. That stated, buyers mustn’t focus solely on yield; dividend security is an important consideration for earnings buyers, and on this regard, Oxford Sq. leaves lots to be desired.

Based mostly on our expectation of a full-year funding earnings per share of $0.42 for 2025, the corporate is projected to keep up a 100% dividend payout ratio for 2025. Nevertheless, if funding earnings declines from present ranges, one other dividend lower might consequence.

Ultimate Ideas

Oxford Sq. boasts a strong enterprise mannequin, characterised by diversification throughout numerous funding property and industries. The corporate has additionally taken steps to construct up its much less dangerous asset place whereas lowering its reliance on riskier CLOs.

That stated, Positive Dividend recommends that risk-averse buyers keep away from Oxford Sq.. We imagine that the dividend doesn’t provide sufficient security. The corporate distributes basically all of its funding earnings, leaving little room for maneuver. Any decline in funding earnings might result in additional dividend cuts, making Oxford Sq. a much less enticing funding choice for buyers searching for steady and safe sources of earnings.

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.