What is named the ARK funds, or ARK ETFs, are a set of exchange-traded funds managed by ARK Funding Administration LLC, an American funding agency led and based by Cathie Wooden in 2014.

The acronym ARK stands for “Energetic Analysis Information”.

The funds give attention to investing in “disruptive innovation” resembling AI, blockchain, and genomics.

Every of the ARK funds has barely completely different specializations.

Listed here are a number of of the household funds.

ARKK: That is maybe the household’s most well-known ETF. The Innovation ETF invests in firms that the agency believes will profit from disruptive innovation. As of early 2025, the fund’s main holdings embody Tesla (TSLA), Coinbase (COIN), Roku (ROKU), Palantir (PLTR), Roblox (RBLX), Robinhood (HOOD), and others.

ARKQ: That is the Autonomous Expertise & Robotics ETF. Whereas the ARKQ choices might not be as liquid as one would really like. A few of the firms within the holding do have liquid choices.

The holdings embody, however will not be restricted to, the next:

Tesla (TSLA) for its autonomous driving.

Kratos Protection (KTOS) for its unmanned techniques and protection robotics.

Teradyne (TER) for its automated check gear.

Palantir (PLTR) for its industrial automation options used to check semiconductors.

Archer Aviation (ACHR) for its electrical vertical takeoff and touchdown (eVTOL) plane with the eventual objective of getting air-taxis.

Iridium (IRDM) for its low Earth orbit (LEO) satellites.

ARKW: The ARK Subsequent Technology Web ETF. The choices on this ETF will not be but liquid sufficient. However its prime ten holdings are all well-known and liquid. They’re Tesla (TSLA), Roku (ROKU), Robinhood (HOOD), Roblox (RBLX), Coinbase (COIN), Palantir (PLTR), Meta (META), Shopify (SHOP), Block (XYZ), and Crowdstrike (CRWD).

ARKG: The ARK Genomic Revolution ETF. The fund focuses on genomics, biotechnology, and healthcare innovation firms. Improvements that embody DNA sequencing, gene enhancing, CRISPR expertise, and precision drugs. CRISPR expertise utilized in gene enhancing relies on the identical technique that micro organism use to acknowledge and lower viral DNA.

ARKF: The ARK Fintech Innovation ETF. These embody firms that use AI in finance and corporations concerned in digital funds and blockchain. Blockchain is the underlying expertise for cryptocurrencies.

ARKX: The ARK House Exploration & Innovation ETF. ARK LLC likes the businesses Rocket Lab (RKLB) and Trimble Navigation (TRMB). I’m not saying that these are solely two firms on this fund. Different firms on this fund embody among the beforehand talked about. A few of the bigger cap firms have analysis that spans a number of areas.

In case you are in search of commerce concepts in firms concerned in innovation, then understanding these funds and their constituents could be a good place to start out.

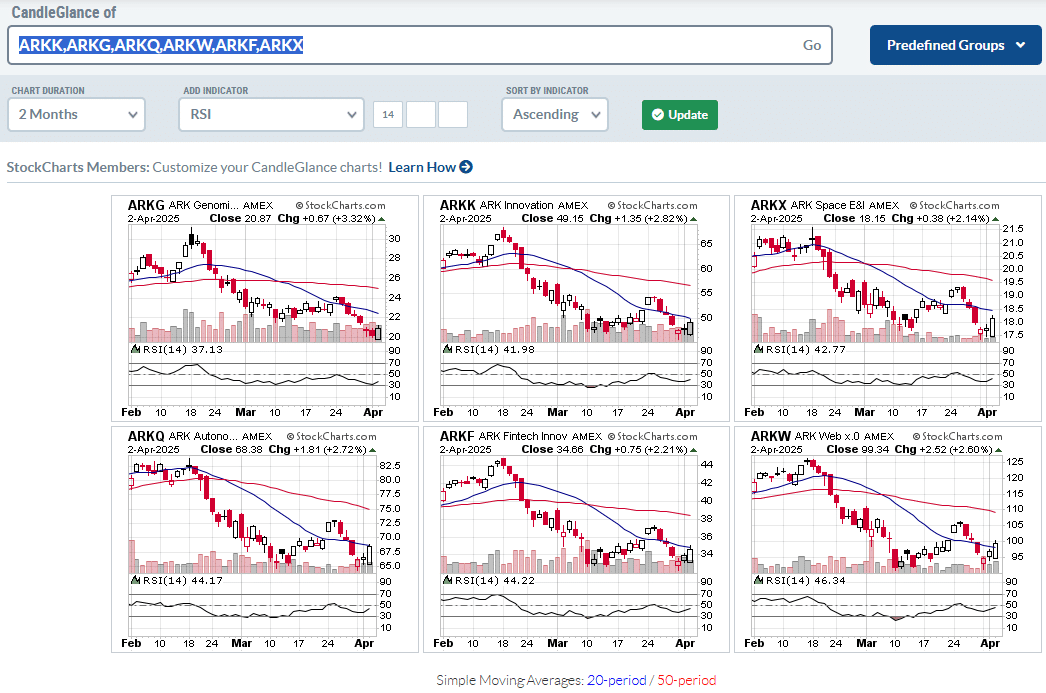

Utilizing CandleGlance in StockCharts, I’m sorting the six funds in descending RSI:

Free Coated Name Course

That means, it exhibits me the robust performers previously two months:

On this case, the “F” fund for fintech was listed first, adopted by the flagship “Ok” fund and the “G” genomics fund.

Or, in case you are in search of worth investing, you may search for a low RSI that’s about to return up.

The X fund for house and the ARKQ may match that function.

Traders desirous about FinTech may convey up the highest constituents of the ARKF fund and get some commerce concepts from there.

Have you ever memorized the symbols for the six funds but?

The final letter representing the specialization is pretty intuitive to recollect.

The 2 hardest ones to recollect may be the ARKW, the place “W” is for the Web.

I suppose you’ll be able to consider “wired” for the Web.

Keep in mind that ARKQ is for autonomous and robotics.

We hope you loved this text on the ARK ETFs.

If in case you have any questions, please ship an electronic mail or go away a remark beneath.

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who will not be aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.