Merchants,

I sit up for sharing my ideas with you this week. As I’m travelling this weekend, there might be a written watchlist and no video.

Following on from final week’s ideas, the market continues to grind larger, shrugging off unfavourable headlines, with leaders persevering with to steer. Like final week, while I’m most enthusiastic about lengthy swings in leaders, I’m definitely not trying to chase after a stretched transfer available in the market.

As a substitute, I’m monitoring value motion in SPY towards the 200-day, whether or not we reclaim and maintain, pullback and base towards the 50-day, and ensure a better low, or fail the 200-day and doubtlessly verify a brand new swing pivot excessive. This week might be telling. I’d like to see a multi-day pullback and stabilization above the 50d for higher risk-reward throughout the board.

So, with that being stated, and key emphasis on persistence and inventory choice for the upcoming week, together with figuring out continued relative energy in leaders, listed below are my prime focuses going into it:

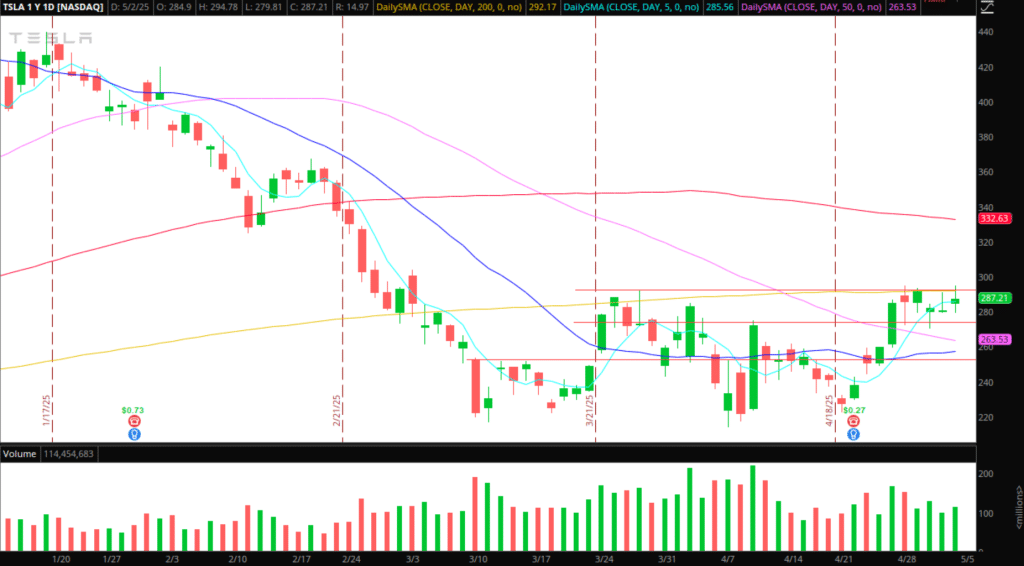

Consolidation Breakout in TSLA

A breakout in Tesla is my favourite setup for the upcoming week, relying on the general market’s route and relative energy in Tesla.

Particularly, I like how the $275 space of resistance has develop into assist, with a exact inflection and breakout stage close to final week’s excessive, round $295, appearing as the important thing stage. If the market continues to carry agency, I’d look to commerce this like I did final week: dip buys inside its vary versus assist, promoting round a core into resistance, and including on a breakout above the consolidation highs.

Alternatively, suppose we maintain agency intraday close to the breakout stage. In that case, I’ll look to provoke a protracted via the breakout stage throughout a number of timeframes, with a cease under the consolidation breakout intraday, for a multi-day swing. I’d be concentrating on as much as a full ATR as a goal.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements similar to liquidity, slippage and commissions.

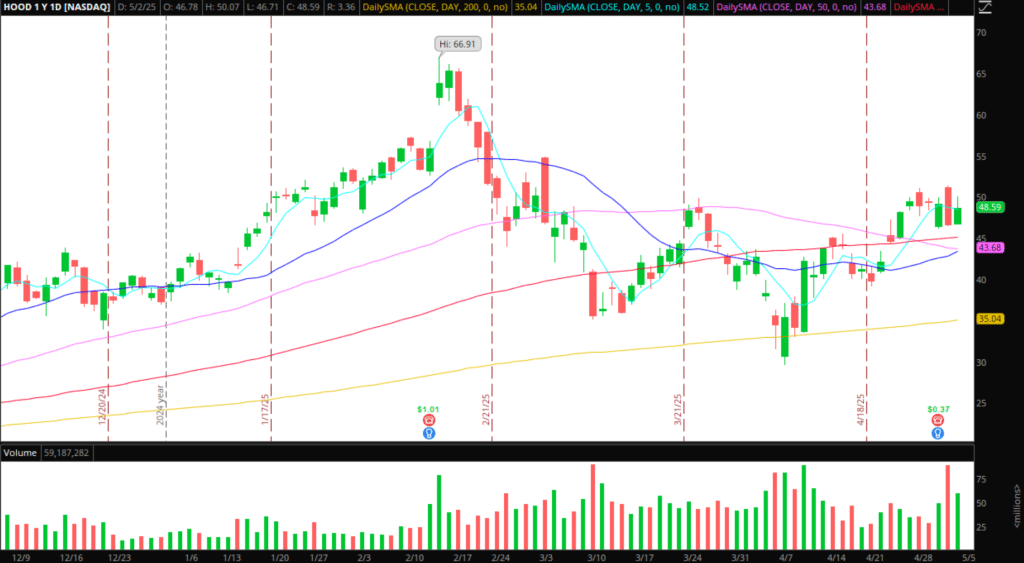

Creating Consolidation Breakout in HOOD

Earnings are out of the way in which in HOOD, and a gradual reclaim and consolidation are creating above all of its key MAs. There’s nothing for me to do immediately, and I doubt I’ll take motion on Monday or Tuesday.

As a substitute, I’d like to see a pullback or multi-day maintain available in the market, for HOOD to outperform throughout a market pullback, and for its vary to tighten. That will point out relative energy, institutional shopping for, and an absence of promoting. If that occurs and the vary tightens, I’d look to enter a place lengthy on a breakout above $50 if the market corporations up after a relaxation interval. This is able to be a swing commerce, concentrating on as much as a number of ATRs, taking danger off on extensions from intraday VWAP, and buying and selling round a core. It is determined by how it’s arrange intraday, however I’ll most probably be trailing the place within the 5-minute timeframe in opposition to larger lows or VWAP.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements similar to liquidity, slippage and commissions.

Further Massive Caps on Watch For Continuation / Pullback Entries are AI, CRWD, SPOT, UBER, TMDX, RKLB, and MELI.

Small-Caps on Watch:

KIDZ: Good failed follow-through close to $9 on Friday. Going ahead, I’ll search for pops into/close to $8 for comparable motion for a brief. Ideally, a push on Monday and failure to carry above $8s / 2-day VWAP for a brief in opposition to the HOD, with covers into $7 and $6. If quantity drastically dries up in it, it’s an keep away from.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements similar to liquidity, slippage and commissions.

FRGT: Glorious motion on Friday, just like the way it has traded intraday through the years after comparable pre-market strikes and quantity. Uncertain, however I’d love a push again towards its 2-day VWAP on Monday or $2.2 – 2.5 for a brief in opposition to the HOD as soon as it turns.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements similar to liquidity, slippage and commissions.

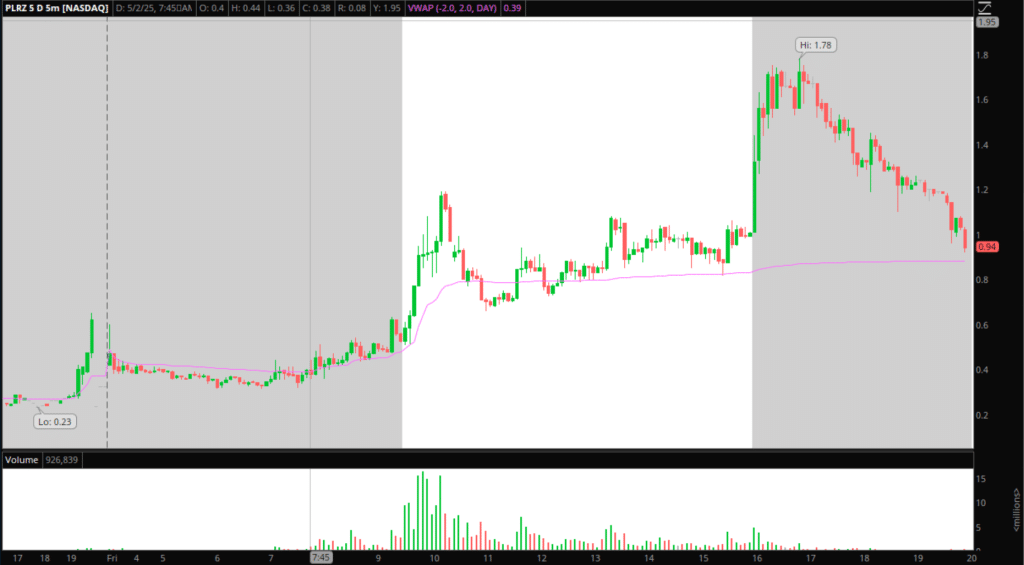

PRLZ: Good blowout Friday AHs. Not enthusiastic about chasing weak spot within the title after Friday’s motion. As a substitute, I’d be enthusiastic about failed follow-through between $1.2 – $1.5 for a brief in opposition to the highs, protecting extensions decrease, and trailing in opposition to 5-minute decrease highs.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements similar to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures