Up to date on Might twelfth, 2025 by Bob Ciura

On this planet of investing, volatility issues. Traders are reminded of this each time there’s a downturn within the broader market and particular person shares which can be extra risky than others expertise monumental swings in worth.

Volatility is a proxy for threat; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio in opposition to a benchmark known as Beta.

Briefly, Beta is measured by way of a components that calculates the worth threat of a safety or portfolio in opposition to a benchmark, which is usually the broader market as measured by the S&P 500.

Right here’s learn inventory betas:

A beta of 1.0 means the inventory strikes equally with the S&P 500

A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

Curiously, low beta shares have traditionally outperformed the market… However extra on that later.

You possibly can obtain a spreadsheet of the 100 lowest beta S&P shares (together with vital monetary metrics like price-to-earnings ratios and dividend yields) under:

This text will focus on beta extra totally, why low-beta shares are inclined to outperform, and supply a dialogue of the 5 lowest-beta dividend shares within the Certain Evaluation Analysis Database.

The desk of contents under permits for simple navigation.

Desk of Contents

The Proof for Low Beta Shares Outperformance

Beta is useful in understanding the general worth threat degree for traders throughout market downturns particularly. The decrease the Beta worth, the much less volatility the inventory or portfolio ought to exhibit in opposition to the benchmark.

That is helpful for traders for apparent causes, significantly these which can be near or already in retirement, as drawdowns ought to be comparatively restricted in opposition to the benchmark.

Importantly, low or excessive Beta merely measures the dimensions of the strikes a safety makes; it doesn’t imply essentially that the worth of the safety stays practically fixed.

Securities might be low Beta and nonetheless be caught in long-term downtrends, so that is merely yet another software traders can use when constructing a portfolio.

The traditional knowledge would counsel that decrease Beta shares ought to underperform the broader markets throughout uptrends and outperform throughout downtrends, providing traders decrease potential returns in trade for decrease threat.

Nonetheless, historical past would counsel that merely isn’t the case.

Certainly, this paper from Harvard Enterprise College means that not solely do low Beta shares not underperform the broader market over time – together with all market situations – they really outperform.

An extended-term examine whereby the shares with the bottom 30% of Beta scores within the US have been pitted in opposition to shares with the best 30% of Beta scores urged that low Beta shares outperform by a number of share factors yearly.

Over time, this kind of outperformance can imply the distinction between a cushty retirement and having to proceed working.

Whereas low Beta shares aren’t a panacea, the case for his or her outperformance over time – and with decrease threat – is kind of compelling.

How To Calculate Beta

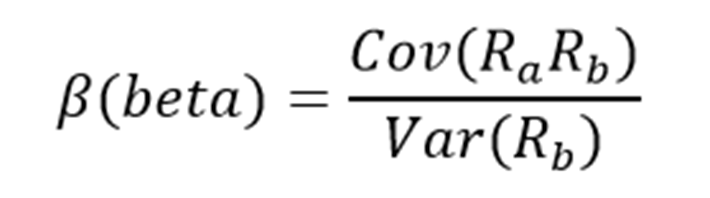

The components to calculate a safety’s Beta is pretty simple. The consequence, expressed as a quantity, exhibits the safety’s tendency to maneuver with the benchmark.

For instance, a Beta worth of 1.0 signifies that the safety in query ought to transfer in lockstep with the benchmark. A Beta of two.0 signifies that strikes within the safety ought to be twice as giant in magnitude because the benchmark and in the identical route, whereas a adverse Beta signifies that actions within the safety and benchmark have a tendency to maneuver in reverse instructions or are negatively correlated.

Associated: The S&P 500 Shares With Detrimental Beta.

In different phrases, negatively correlated securities could be anticipated to rise when the general market falls, or vice versa. A small worth of Beta (one thing lower than 1.0) signifies a inventory that strikes in the identical route because the benchmark, however with smaller relative adjustments.

Right here’s a have a look at the components:

The numerator is the covariance of the asset in query with the market, whereas the denominator is the variance of the market. These complicated-sounding variables aren’t truly that troublesome to compute – particularly in Excel.

Moreover, Beta may also be calculated because the correlation coefficient of the safety in query and the market, multiplied by the safety’s customary deviation divided by the market’s customary deviation.

Lastly, there’s a vastly simplified approach to calculate Beta by manipulating the capital asset pricing mannequin components (extra on Beta and the capital asset pricing mannequin later on this article).

Right here’s an instance of the info you’ll must calculate Beta:

Threat-free price (sometimes Treasuries not less than two years out)

Your asset’s price of return over some interval (sometimes one yr to 5 years)

Your benchmark’s price of return over the identical interval because the asset

To indicate use these variables to do the calculation of Beta, we’ll assume a risk-free price of two%, our inventory’s price of return of seven% and the benchmark’s price of return of 8%.

You begin by subtracting the risk-free price of return from each the safety in query and the benchmark. On this case, our asset’s price of return web of the risk-free price could be 5% (7% – 2%).

The identical calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 5% and 6%, respectively – are the numerator and denominator for the Beta components. 5 divided by six yields a price of 0.83, and that’s the Beta for this hypothetical safety.

On common, we’d anticipate an asset with this Beta worth to be 83% as risky because the benchmark.

Eager about it one other means, this asset ought to be about 17% much less risky than the benchmark whereas nonetheless having its anticipated returns correlated in the identical route.

Beta & The Capital Asset Pricing Mannequin (CAPM)

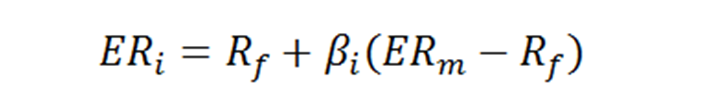

The Capital Asset Pricing Mannequin, or CAPM, is a typical investing components that makes use of the Beta calculation to account for the time worth of cash in addition to the risk-adjusted returns anticipated for a selected asset.

Beta is an integral part of the CAPM as a result of with out it, riskier securities would seem extra favorable to potential traders. Their threat wouldn’t be accounted for within the calculation.

The CAPM components is as follows:

The variables are outlined as:

ERi = Anticipated return of funding

Rf = Threat-free price

βi = Beta of the funding

ERm = Anticipated return of market

The danger-free price is identical as within the Beta components, whereas the Beta that you simply’ve already calculated is just positioned into the CAPM components. The anticipated return of the market (or benchmark) is positioned into the parentheses with the market threat premium, which can be from the Beta components. That is the anticipated benchmark’s return minus the risk-free price.

To proceed our instance, right here is how the CAPM truly works:

ER = 2% + 0.83(8% – 2%)

On this case, our safety has an anticipated return of 6.98% in opposition to an anticipated benchmark return of 8%. Which may be okay relying upon the investor’s targets because the safety in query ought to expertise much less volatility than the market because of its Beta of lower than 1.

Whereas the CAPM definitely isn’t good, it’s comparatively straightforward to calculate and offers traders a way of comparability between two funding options.

Now, we’ll check out 5 shares that not solely supply traders low Beta scores, however engaging potential returns as nicely.

Evaluation On The High 5 Low Beta Shares

The next 5 low beta shares have the bottom (however constructive) Beta values, in ascending order from lowest to highest. In addition they pay dividends to shareholders.

We targeted on Betas above 0, as we’re nonetheless on the lookout for shares which can be positively correlated with the broader market:

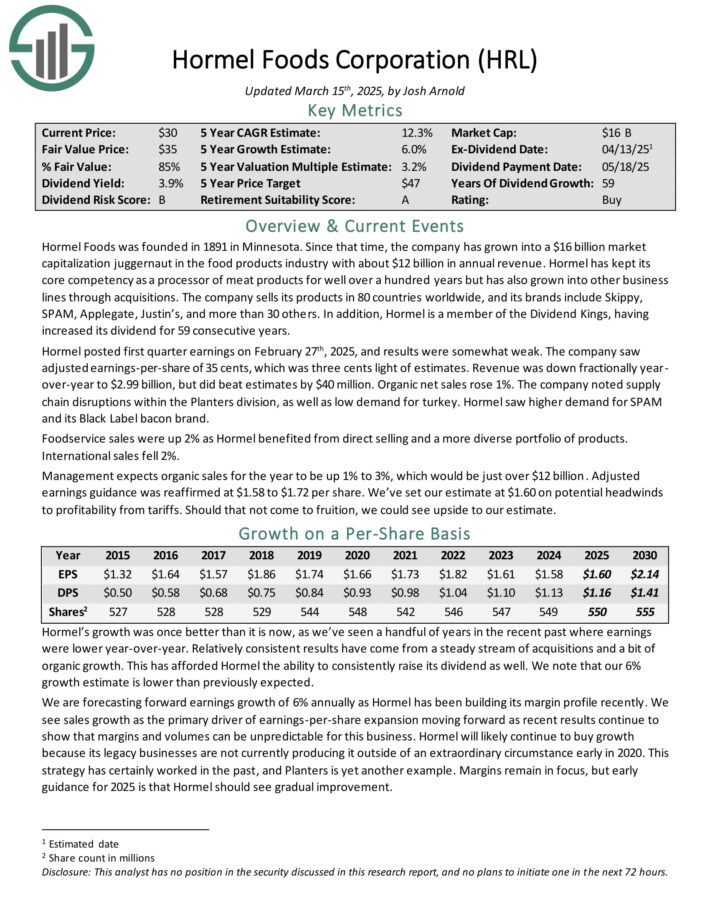

5. Hormel Meals (HRL)

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with practically $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for nicely over 100 years, however has additionally grown into different enterprise traces by way of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its high manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

The corporate has elevated its dividend for 59 consecutive years.

Supply: Investor Presentation

Hormel posted first quarter earnings on February twenty seventh, 2025, and outcomes have been considerably weak. The corporate noticed adjusted earnings-per-share of 35 cents, which was three cents mild of estimates.

Income was down fractionally year-over-year to $2.99 billion, however did beat estimates by $40 million. Natural web gross sales rose 1%.

The corporate famous provide chain disruptions inside the Planters division, in addition to low demand for turkey. Hormel noticed increased demand for SPAM and its Black Label bacon model.

HRL has a Beta rating of 0.26.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

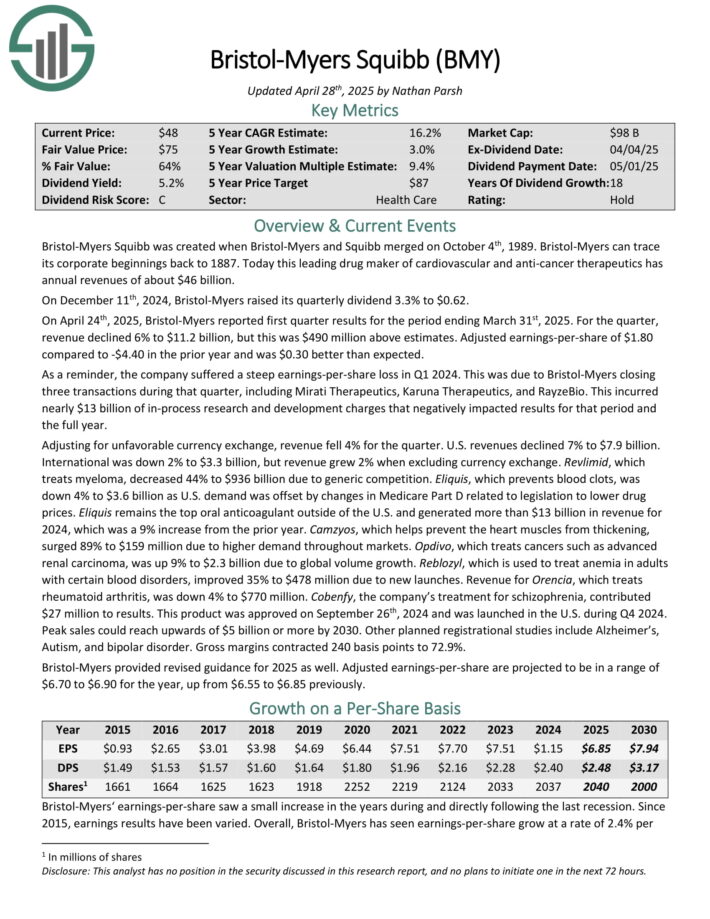

4. Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb was created when Bristol-Myers and Squibb merged on October 4th, 1989. This main drug maker of cardiovascular and anti-cancer therapeutics has annual revenues of about $46 billion.

On April twenty fourth, 2025, Bristol-Myers reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income declined 6% to $11.2 billion, however this was $490 million above estimates.

Adjusted earnings-per-share of $1.80 in comparison with -$4.40 within the prior yr and was $0.30 higher than anticipated. The corporate suffered a steep earnings-per-share loss in Q1 2024.

Adjusting for unfavorable foreign money trade, income fell 4% for the quarter. U.S. revenues declined 7% to $7.9 billion. Worldwide was down 2% to $3.3 billion, however income grew 2% when excluding foreign money trade.

Revlimid, which treats myeloma, decreased 44% to $936 billion resulting from generic competitors.

Bristol-Myers supplied revised steerage for 2025 as nicely. Adjusted earnings-per-share are projected to be in a variety of $6.70 to $6.90 for the yr, up from $6.55 to $6.85 beforehand.

BMY has a Beta rating of 0.24.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMY (preview of web page 1 of three proven under):

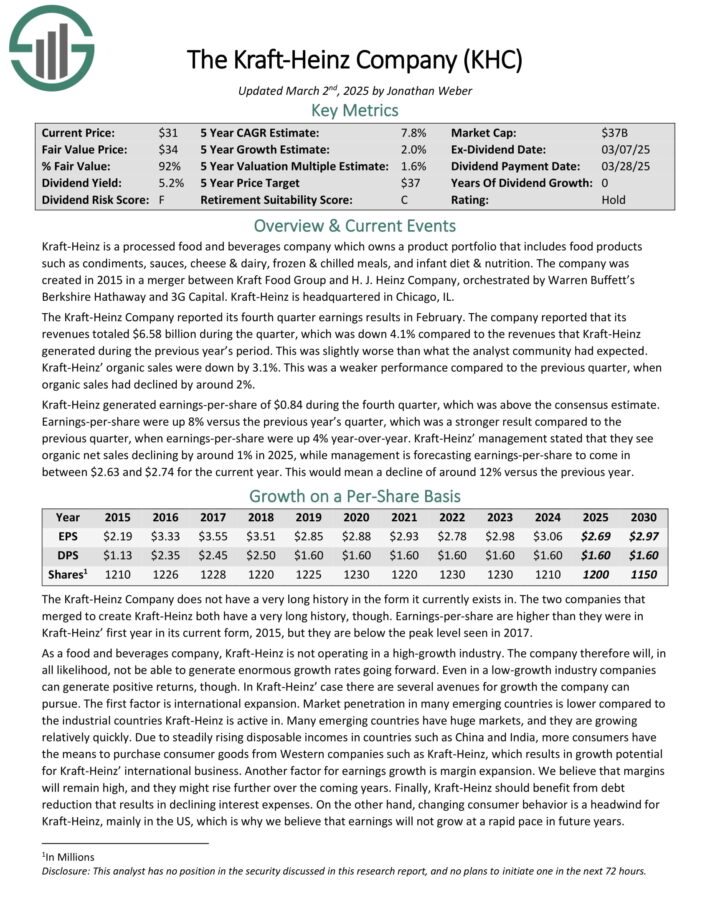

3. Kraft-Heinz (KHC)

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise equivalent to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight loss program & diet.

The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital. Kraft-Heinz is headquartered in Chicago, IL.

The Kraft-Heinz Firm reported its fourth quarter earnings ends in February. Revenues totaled $6.58 billion in the course of the quarter, which was down 4.1% year-over-year. This was barely worse than what the analyst neighborhood had anticipated.

Kraft-Heinz’ natural gross sales have been down by 3.1%. This was a weaker efficiency in comparison with the earlier quarter, when natural gross sales had declined by round 2%.

Kraft-Heinz generated earnings-per-share of $0.84 in the course of the fourth quarter, which was above the consensus estimate. Earnings-per-share have been up 8% year-over-year.

Administration expects natural web gross sales declining by round 1% in 2025, whereas administration is forecasting earnings-per-share to return in between $2.63 and $2.74 for the present yr.

KHC has a Beta rating of 0.22.

Click on right here to obtain our most up-to-date Certain Evaluation report on KHC (preview of web page 1 of three proven under):

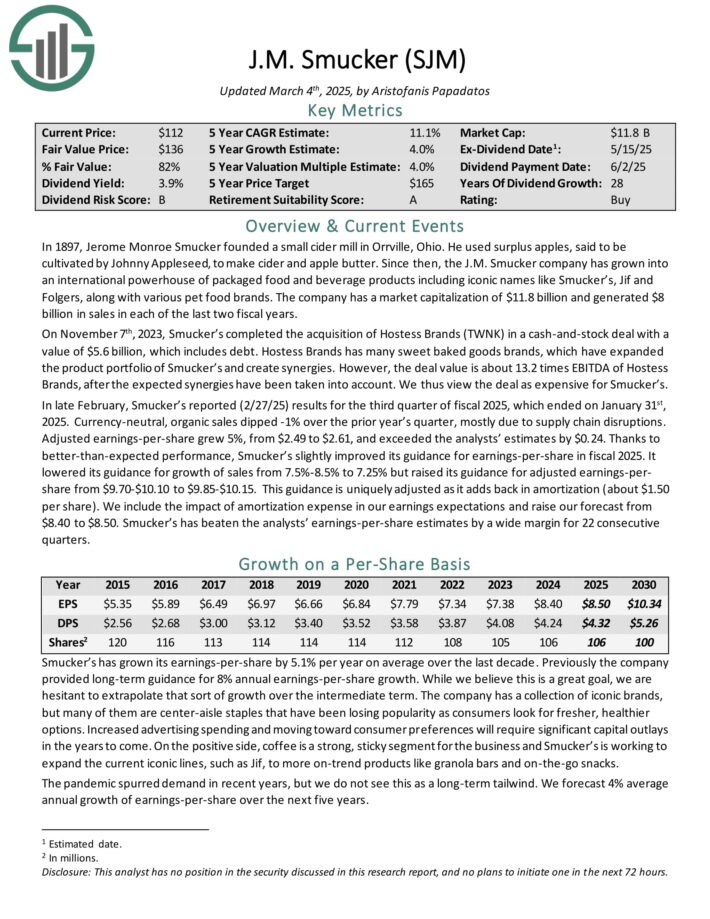

2. J.M. Smucker Co. (SJM)

The J.M. Smucker firm has grown into a global powerhouse of packaged meals and beverage merchandise together with iconic manufacturers like Smucker’s, Jif and Folgers, together with varied pet meals manufacturers.

The corporate generated $8 billion in gross sales in every of the final two fiscal years.

Supply: Investor Presentation

In late February, Smucker’s reported (2/27/25) outcomes for the third quarter of fiscal 2025, which ended on January thirty first, 2025. Forex-neutral, natural gross sales dipped -1% over the prior yr’s quarter, principally resulting from provide chain disruptions.

Adjusted earnings-per-share grew 5%, from $2.49 to $2.61, and exceeded the analysts’ estimates by $0.24. Due to better-than-expected efficiency, Smucker’s barely improved its steerage for earnings-per-share in fiscal 2025.

It lowered its steerage for progress of gross sales from 7.5%-8.5% to 7.25% however raised its steerage for adjusted earnings-per share from $9.70-$10.10 to $9.85-$10.15.

SJM has a Beta rating of 0.19.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJM (preview of web page 1 of three proven under):

1. Campbell Soup (CPB)

Campbell Soup Firm is a multinational meals firm headquartered in Camden, N.J. The corporate manufactures and markets branded comfort meals merchandise, equivalent to soups, easy meals, drinks, snacks, and packaged contemporary meals.

The corporate’s portfolio focuses on two particular companies: Campbell Snacks, and Campbell Meals and Drinks. Campbell generated annual gross sales of $9.6 billion in fiscal 2024.

On March 12, 2024, Campbell closed on its acquisition of Sovos Manufacturers (SOVO) for $23 per share in money, which represented a complete enterprise worth of $2.7 billion, and was funded by issuing new debt. Sovos is a frontrunner in excessive progress premium Italian sauces, and owns the market-leading Rao’s model.

Campbell Soup reported second quarter FY 2025 outcomes on March fifth, 2025. Internet gross sales for the quarter improved by 9% year-over-year to $2.7 billion. This enhance was principally a results of the Sovos Manufacturers acquisition. Adjusted EPS was 8% decrease year-over-year at $0.74 for the quarter, which beat expectations by two cents.

The corporate repurchased $56 million value of shares in H1. There stays $301 million remaining underneath the present $500 million share repurchase program, which is along with the prevailing $205 million remaining on its anti-dilutive share repurchase program.

Management up to date its full-year fiscal 2025 steerage. Administration now estimates that in fiscal 2025, Campbell’s adjusted earnings per share will likely be down 1% to 4%.

CPB has a Beta rating of 0.13.

Click on right here to obtain our most up-to-date Certain Evaluation report on CPB (preview of web page 1 of three proven under):

Last Ideas

Traders should take threat under consideration when choosing from potential investments. In any case, if two securities are in any other case related when it comes to anticipated returns however one presents a a lot decrease Beta, the investor would do nicely to pick the low Beta safety as they could supply higher risk-adjusted returns.

Utilizing Beta may also help traders decide which securities will produce extra volatility than the broader market and which of them might assist diversify a portfolio, equivalent to those listed right here.

The 5 shares we’ve checked out not solely supply low Beta scores, however additionally they supply engaging dividend yields. Sifting by way of the immense variety of shares accessible for buy to traders utilizing standards like these may also help traders discover the perfect shares to go well with their wants.

At Certain Dividend, we frequently advocate for investing in firms with a excessive likelihood of accelerating their dividends every yr.

If that technique appeals to you, it might be helpful to flick through the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.