Up to date on Might twenty third, 2025 by Bob Ciura

Spreadsheet knowledge up to date each day

Utility shares could make wonderful investments for long-term dividend progress traders.

Sturdy, regulatory-based aggressive benefits enable these firms to constantly increase their charges over time. In flip, this enables them to boost their dividend funds 12 months in and 12 months out.

Even higher, many utility shares have above-average dividend yields, offering a compelling mixture of revenue now and progress later for long-term traders.

Due to these favorable {industry} traits, we’ve compiled an inventory of utility shares. The checklist is derived from the main utility sector exchange-traded funds JXI and XLU.

You’ll be able to obtain the checklist of all utility shares (together with vital monetary ratios comparable to dividend yields and payout ratios) by clicking on the hyperlink under:

Preserve studying this text to be taught extra about the advantages of investing in utility shares.

Desk Of Contents

The next desk of contents supplies for straightforward navigation:

How To Use The Utility Dividend Shares Record To Discover Funding Concepts

Having an Excel database of all of the dividend-paying utility shares mixed with vital investing metrics and ratios may be very helpful.

This instrument turns into much more highly effective when mixed with information of the right way to use Microsoft Excel to seek out the most effective funding alternatives.

With that in thoughts, this part will present a fast clarification of how one can immediately seek for utility shares with explicit traits, utilizing two screens for instance.

The primary display screen that we’ll implement is for utility shares with price-to-earnings ratios under 15.

Display 1: Low P/E Ratios

Step 1: Obtain the Utility Dividend Shares Excel Spreadsheet Record on the hyperlink above.

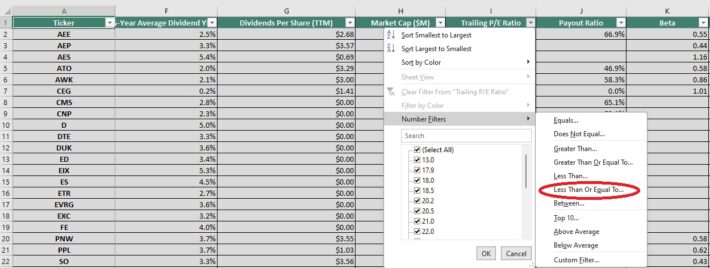

Step 2: Click on the filter icon on the prime of the price-to-earnings ratio column, as proven under.

Step 3: Change the filter area to “Much less Than” and enter “15” into the sector beside it.

The remaining checklist of shares incorporates dividend-paying utility shares with price-to-earnings ratios lower than 15. As you’ll be able to see, there are comparatively few securities (on the time of this writing) that meet this strict valuation cutoff.

The following part demonstrates the right way to display screen for large-cap shares with excessive dividend yields.

Display 2: Giant-Cap Shares With Excessive Dividend Yields

Companies are sometimes categorized primarily based on their market capitalization. Market capitalization is calculated as inventory worth multiplied by the variety of shares excellent and provides a marked-to-market notion of what individuals assume a enterprise is price on common.

Giant-cap shares are loosely outlined as companies with a market capitalization above $10 billion and are perceived as decrease threat than their smaller counterparts. Accordingly, screening for large-cap shares with excessive dividend yields might present fascinating funding alternatives for conservative, income-oriented traders.

Right here’s the right way to use the Utility Dividend Shares Excel Spreadsheet Record to seek out such funding alternatives.

Step 1: Obtain the Utility Dividend Shares Excel Spreadsheet Record on the hyperlink above.

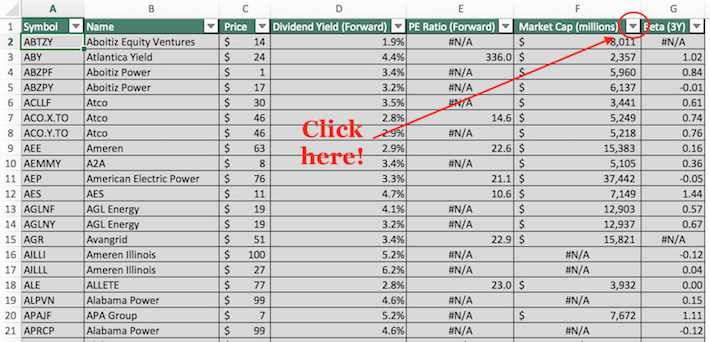

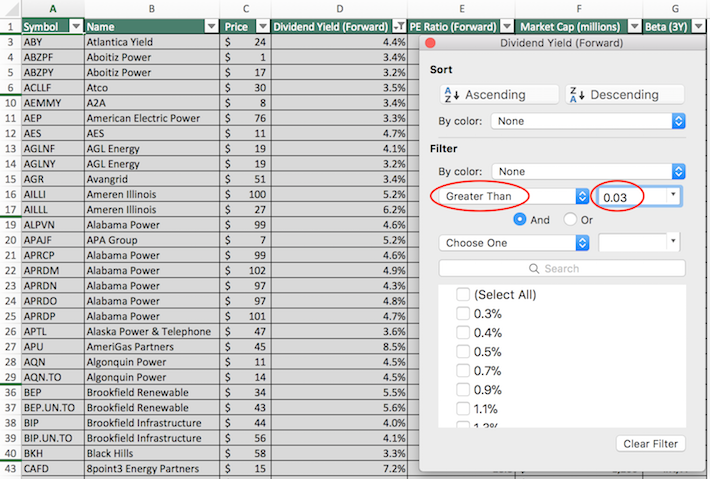

Step 2: Click on the filter icon on the prime of the Market Cap column, as proven under.

Step 3: Change the filter setting to “Higher Than”, and enter 10000 into the sector beside it. Be aware that since market capitalization is measured in hundreds of thousands of {dollars} on this Excel sheet, filtering for shares with market capitalizations larger than “$10,000 hundreds of thousands” is equal for screening for these with market capitalizations exceeding $10 billion.

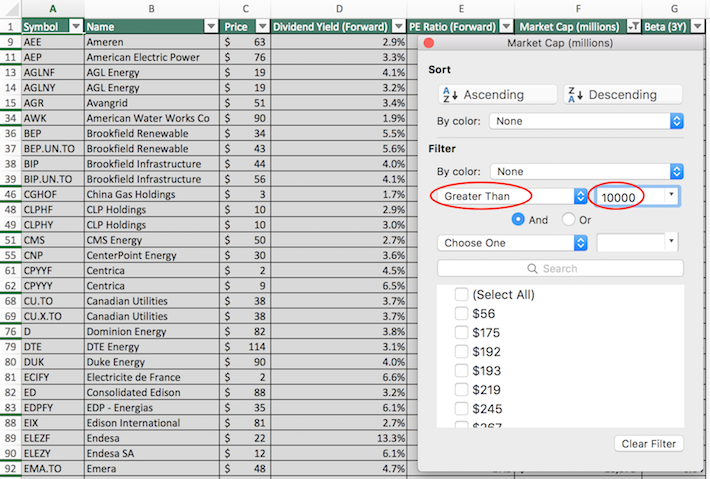

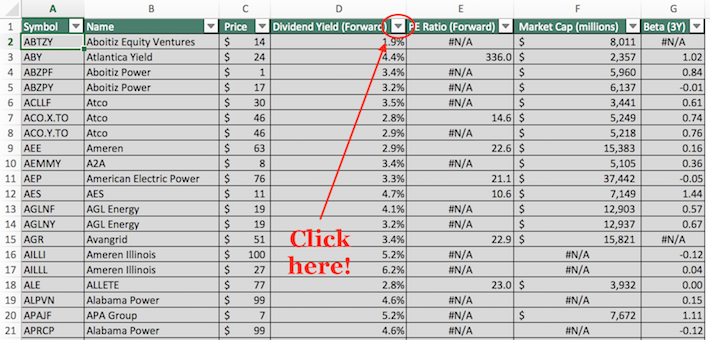

Step 4: Shut that filter window (by exiting it, not by clicking ‘clear filter’) and click on on the filter icon for the “dividend yield” column, as proven under.

Step 5: Change the filter setting to “Higher Than” and enter 0.03 into the column beside it. Be aware that 0.03 is equal to three%.

The remaining shares on this checklist are these with market capitalizations above $10 billion and dividend yields above 3%. This narrowed funding universe is appropriate for traders in search of low-risk, high-yield securities.

You now have a strong basic understanding of the right way to use the Utility Dividend Shares Excel Spreadsheet Record to its fullest potential.

The rest of this text will talk about the traits that make the utility sector enticing for dividend progress traders.

Why Utility Dividend Shares Make Enticing Investments

The phrase “utility” describes all kinds of enterprise fashions however is often used as a reference to electrical utilities — firms that have interaction within the technology, transmission, and distribution of electrical energy.

Different forms of utilities embody propane utilities and water utilities.

So why do these companies make for enticing investments?

Utilities often conduct enterprise in extremely regulated markets, complying with guidelines set by federal, state, and municipal governments.

Whereas this sounds extremely unattractive on the floor, what it means in observe is that utilities are principally authorized monopolies.

The strict regulatory surroundings that utility companies function in creates a powerful and sturdy aggressive benefit for present {industry} members.

Because of this, electrical utilities are among the many hottest shares for long-term dividend progress traders — particularly as a result of they have a tendency to supply above-average dividend yields.

Certainly, the regulatory-based aggressive benefits accessible to utility shares give them the consistency to boost their dividends commonly.

Merely put, utility shares are a number of the most reliable dividend shares round.

To supply just a few examples, the next utility shares have exceptionally lengthy streaks of consecutive dividend will increase:

Consolidated Edison (ED) — greater than 25 years of consecutive dividend will increase

American States Water (AWR) — a water utility — greater than 50 years of consecutive dividend will increase

SJW Group (SJW) — one other water utility — greater than 50 years of consecutive dividend will increase

The lengthy streak of consecutive dividend will increase is feasible solely due to their distinctive industry-specific aggressive benefits.

Clearly, the utility sector may be very steady. Individuals are going to want electrical energy and water in ever-increasing quantities for the foreseeable future.

One attribute that does not describe utility shares is excessive progress. One of many regulatory constraints imposed upon utility firms is the tempo at which they’ll improve the charges paid by their clients.

These fee will increase are often within the low-single-digits, which supplies a cap on the income progress skilled by these firms.

Utility shares sometimes don’t provide robust whole returns, however there are exceptions.

The Prime 10 Utility Shares Now

Taking the entire above into consideration, the next part discusses our prime 10 checklist of North American utility shares in the present day, primarily based on their anticipated annual returns over the subsequent 5 years.

The rankings on this article are derived from our anticipated whole return estimates from the Certain Evaluation Analysis Database.

The ten utility shares with the very best projected five-year whole returns are ranked on this article, from lowest to highest.

Associated: Watch the video under to discover ways to calculate anticipated whole return for any inventory.

Anticipated returns are calculated primarily based upon the mixture of present dividend yield, anticipated change in valuation, in addition to anticipated annual earnings-per-share progress.

This determines which utility shares provide the most effective whole return potential for shareholders.

The highest 10 checklist under contains the ten utility shares with the very best annual anticipated returns.

Additional, solely utility shares with a Dividend Danger Rating of ‘C’ or increased have been included, to deal with the utility shares with a excessive stage of dividend security.

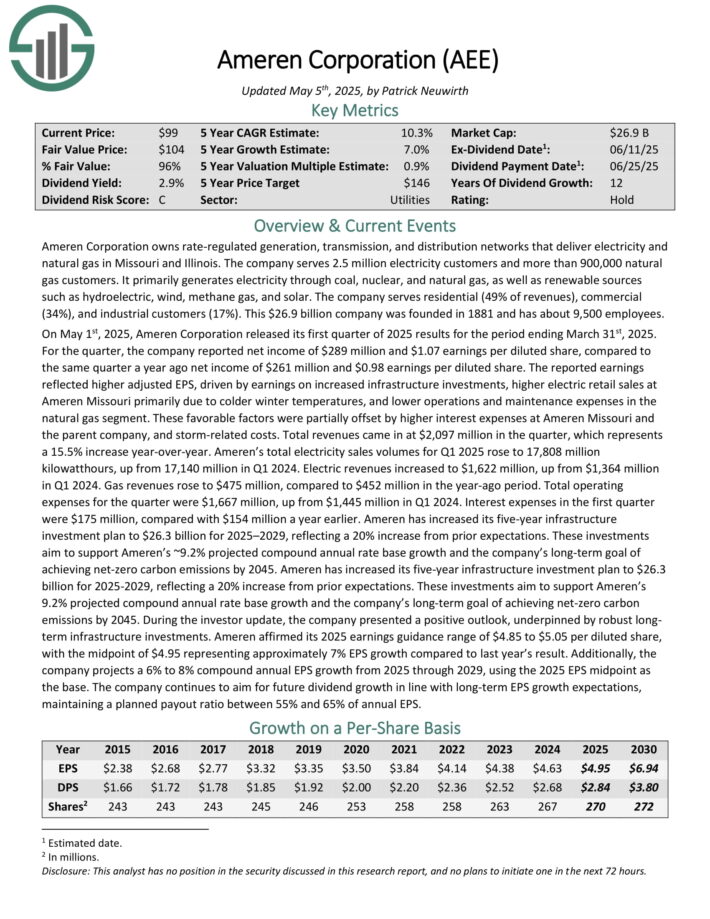

Prime Utility Inventory #10: Ameren Corp. (AEE)

5-year anticipated annual returns: 11.0%

Ameren Company owns rate-regulated technology, transmission, and distribution networks that ship electrical energy and pure gasoline in Missouri and Illinois. The corporate serves 2.5 million electrical energy clients and greater than 900,000 pure gasoline clients.

It primarily generates electrical energy by way of coal, nuclear, and pure gasoline, in addition to renewable sources comparable to hydroelectric, wind, methane gasoline, and photo voltaic. The corporate serves residential (49% of revenues), business (34%), and industrial clients (17%).

On Might 1st, 2025, Ameren Company launched its first quarter of 2025 outcomes for the interval ending March thirty first, 2025. For the quarter, the corporate reported internet revenue of $289 million and $1.07 earnings per diluted share, in comparison with the identical quarter a 12 months in the past internet revenue of $261 million and $0.98 earnings per diluted share.

The reported earnings mirrored increased adjusted EPS, pushed by earnings on elevated infrastructure investments, increased electrical retail gross sales at Ameren Missouri primarily on account of colder winter temperatures, and decrease operations and upkeep bills within the pure gasoline phase.

Click on right here to obtain our most up-to-date Certain Evaluation report on AEE (preview of web page 1 of three proven under):

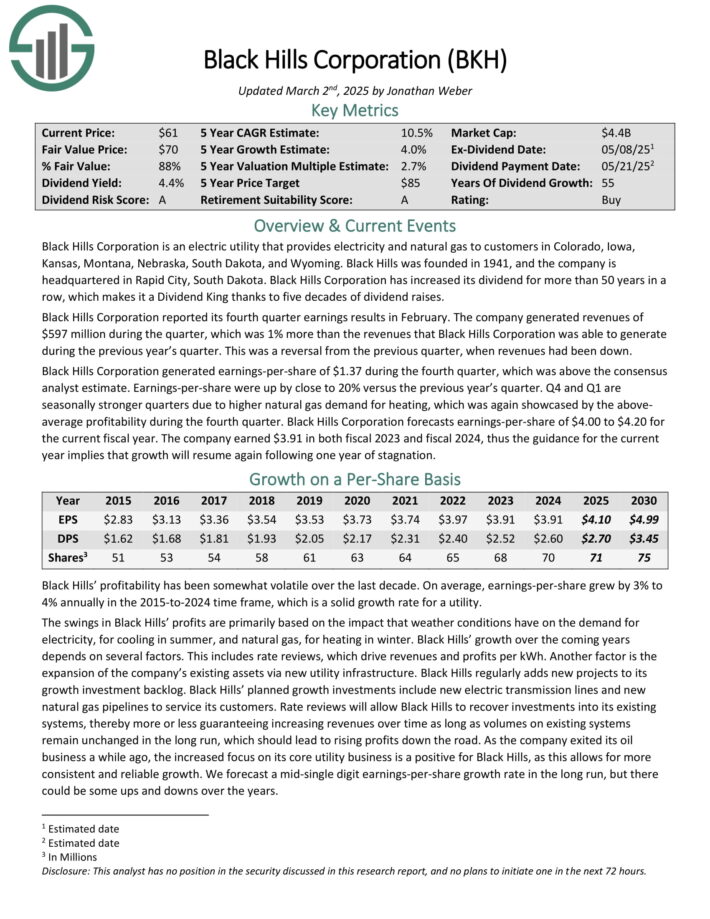

Prime Utility Inventory #9: Black Hills Corp. (BKH)

5-year anticipated annual returns: 11.6%

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was based in 1941, and the corporate is headquartered in Speedy Metropolis, South Dakota.

Black Hills Company reported its fourth quarter earnings leads to February. The corporate generated revenues of $597 million in the course of the quarter, which was 1% greater than the identical quarter final 12 months. This was a reversal from the earlier quarter, when revenues had been down.

Black Hills Company generated earnings-per-share of $1.37 in the course of the fourth quarter, which was above the consensus analyst estimate. Earnings-per-share have been up by shut to twenty% versus the earlier 12 months’s quarter.

This fall and Q1 are seasonally stronger quarters on account of increased pure gasoline demand for heating, which was once more showcased by the above common profitability in the course of the fourth quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven under):

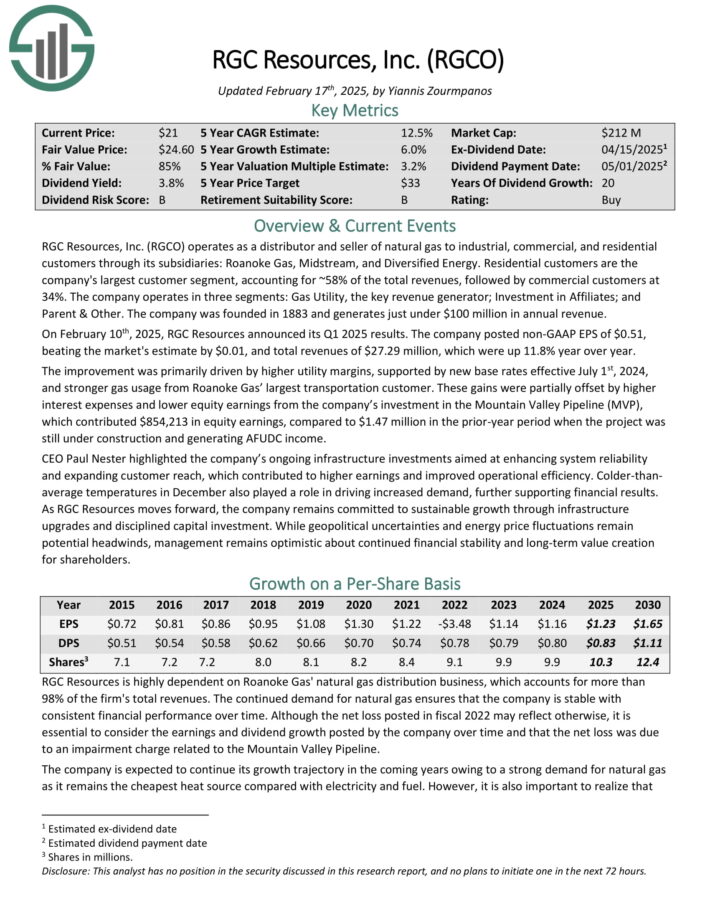

Prime Utility Inventory #8: RGC Assets (RGCO)

5-year anticipated annual returns: 12.4%

RGC Assets, Inc. (RGCO) operates as a distributor and vendor of pure gasoline to industrial, business, and residential clients by way of its subsidiaries: Roanoke Fuel, Midstream, and Diversified Vitality. Residential clients are the corporate’s largest buyer phase, accounting for ~58% of the entire revenues, adopted by business clients at 34%.

The corporate operates in three segments: Fuel Utility, the important thing income generator; Funding in Associates; and Guardian & Different. The corporate was based in 1883 and generates slightly below $100 million in annual income.

On February tenth, 2025, RGC Assets introduced its Q1 2025 outcomes. The corporate posted non-GAAP EPS of $0.51, beating the market’s estimate by $0.01, and whole revenues of $27.29 million, which have been up 11.8% 12 months over 12 months.

The advance was primarily pushed by increased utility margins, supported by new base charges efficient July 1st, 2024, and stronger gasoline utilization from Roanoke Fuel’ largest transportation buyer.

These positive factors have been partially offset by increased curiosity bills and decrease fairness earnings from the corporate’s funding within the Mountain Valley Pipeline (MVP), which contributed $854,213 in fairness earnings

Click on right here to obtain our most up-to-date Certain Evaluation report on RGCO (preview of web page 1 of three proven under):

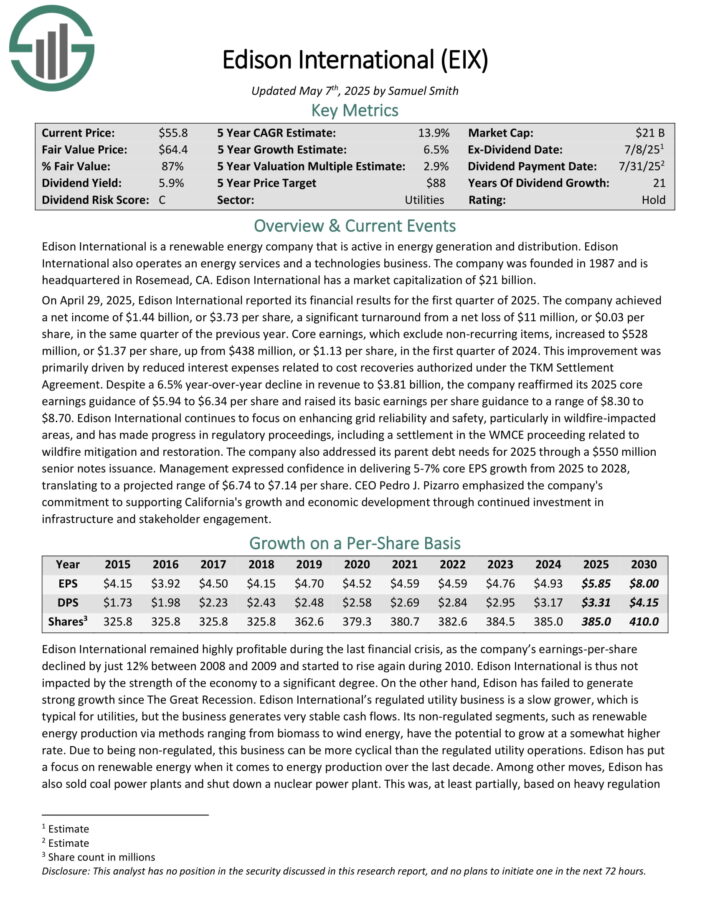

Prime Utility Inventory #7: Edison Worldwide (EIX)

5-year anticipated annual returns: 13.5%

Edison Worldwide is a renewable vitality firm that’s lively in vitality technology and distribution. Edison Worldwide additionally operates an vitality providers and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison Worldwide reported its monetary outcomes for the primary quarter of 2025. The corporate achieved a internet revenue of $1.44 billion, or $3.73 per share, a big turnaround from a internet lack of $11 million, or $0.03 per share, in the identical quarter of the earlier 12 months.

Core earnings, which exclude non-recurring objects, elevated to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, within the first quarter of 2024.

This enchancment was primarily pushed by decreased curiosity bills associated to price recoveries licensed below the TKM Settlement Settlement. Regardless of a 6.5% year-over-year decline in income to $3.81 billion, the corporate reaffirmed its 2025 core earnings steerage of $5.94 to $6.34 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on EIX (preview of web page 1 of three proven under):

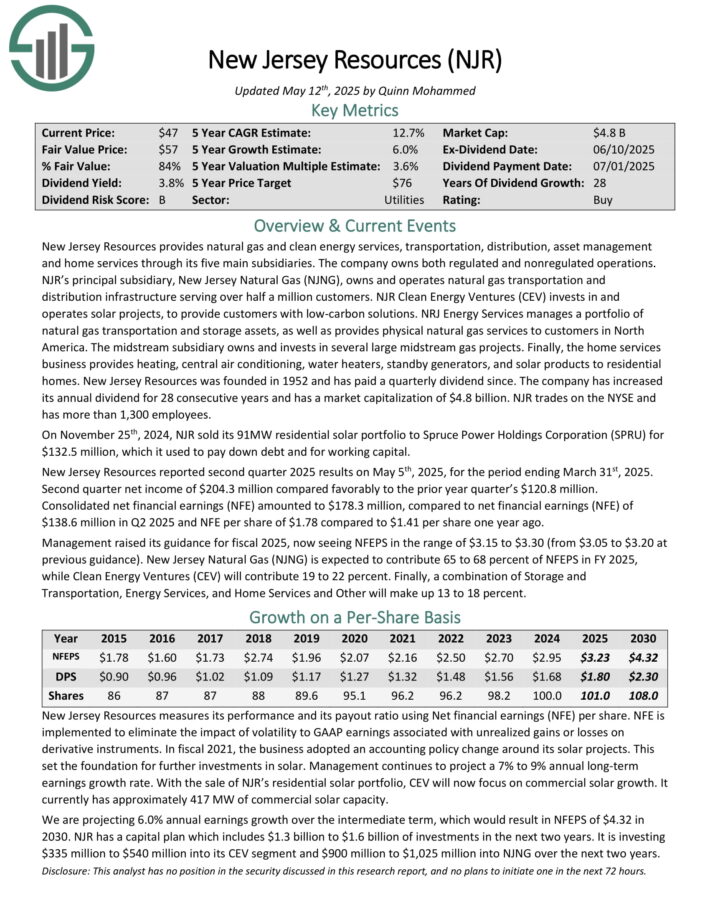

Prime Utility Inventory #6: New Jersey Assets (NJR)

5-year anticipated annual returns: 13.5%

New Jersey Assets supplies pure gasoline and clear vitality providers, transportation, distribution, asset administration and residential providers by way of its 5 essential subsidiaries. The corporate owns each regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Pure Fuel (NJNG), owns and operates pure gasoline transportation and distribution infrastructure serving over half one million clients. NJR Clear Vitality Ventures (CEV) invests in and operates photo voltaic tasks, to offer clients with low-carbon options.

NRJ Vitality Companies manages a portfolio of pure gasoline transportation and storage belongings, in addition to supplies bodily pure gasoline providers to clients in North America.

The midstream subsidiary owns and invests in a number of giant midstream gasoline tasks. Lastly, the house providers enterprise supplies heating, central air con, water heaters, standby mills, and photo voltaic merchandise to residential properties.

New Jersey Assets reported second quarter 2025 outcomes on Might fifth, 2025, for the interval ending March thirty first, 2025. Second quarter internet revenue of $204.3 million in contrast favorably to the prior 12 months quarter’s $120.8 million.

Consolidated internet monetary earnings (NFE) amounted to $178.3 million, in comparison with internet monetary earnings (NFE) of $138.6 million in Q2 2025 and NFE per share of $1.78 in comparison with $1.41 per share one 12 months in the past.

Administration raised its steerage for fiscal 2025, now seeing NFEPS within the vary of $3.15 to $3.30 (from $3.05 to $3.20 at earlier steerage).

Click on right here to obtain our most up-to-date Certain Evaluation report on NJR (preview of web page 1 of three proven under):

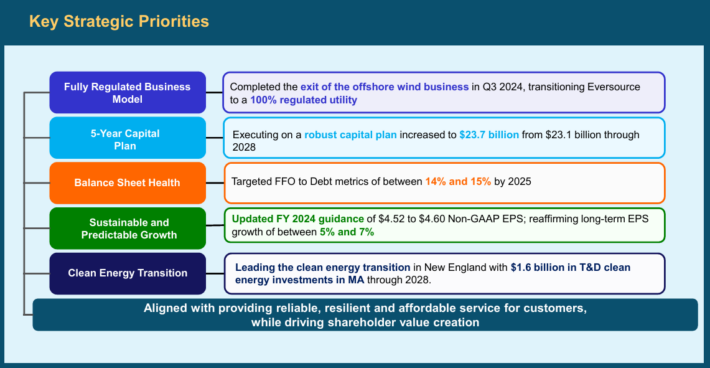

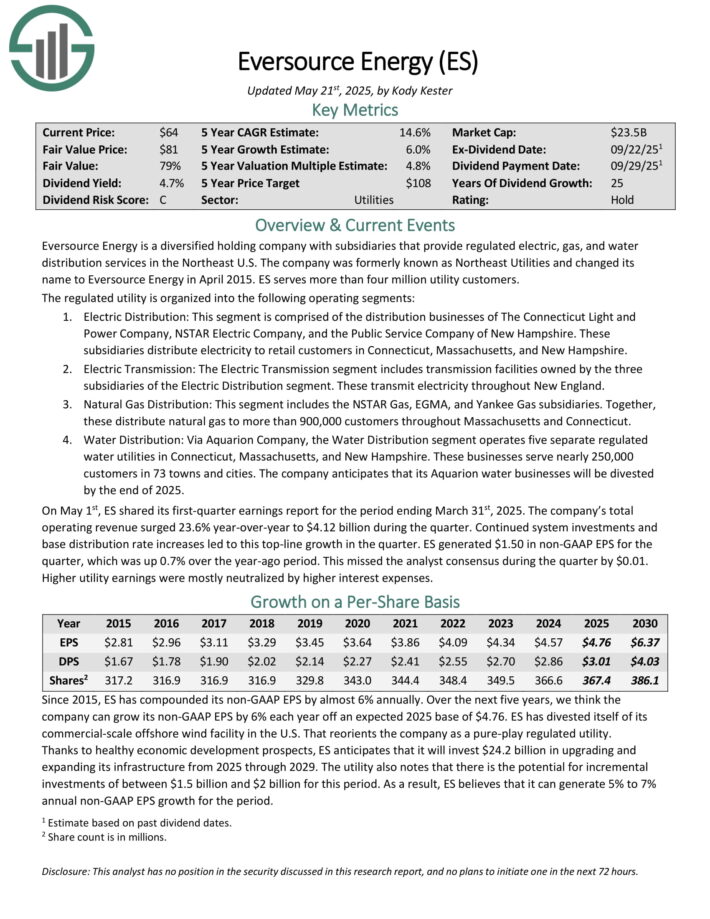

Prime Utility Inventory #5: Eversource Vitality (ES)

5-year anticipated annual returns: 14.5%

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Vitality are the three new Dividend Aristocrats for 2025.

The corporate’s utilities serve greater than 4 million clients. Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On February eleventh, 2025, Eversource Vitality launched its fourth-quarter and full-year 2024 outcomes. For the quarter, the corporate reported internet earnings of $72.5 million, a big enchancment from a internet lack of $(1,288.5) million in the identical quarter of final 12 months, which mirrored the impression of the corporate’s exit from offshore wind investments.

On Might 1st, ES shared its first-quarter earnings report for the interval ending March thirty first, 2025. The corporate’s whole working income surged 23.6% year-over-year to $4.12 billion in the course of the quarter.

Continued system investments and base distribution fee will increase led to this top-line progress within the quarter. ES generated $1.50 in non-GAAP EPS for the quarter, which was up 0.7% over the year-ago interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven under):

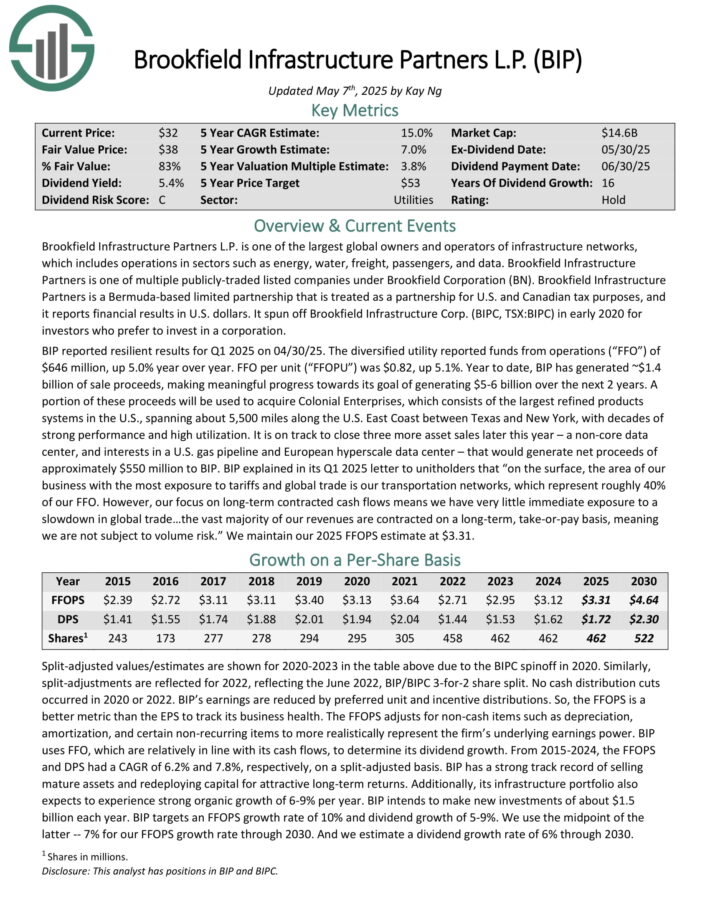

Prime Utility Inventory #4: Brookfield Infrastructure Companions (BIP)

5-year anticipated annual returns: 14.5%

Brookfield Infrastructure Companions L.P. is likely one of the largest international homeowners and operators of infrastructure networks, which incorporates operations in sectors comparable to vitality, water, freight, passengers, and knowledge.

BIP reported resilient outcomes for Q1 2025 on 04/30/25. The diversified utility reported funds from operations (“FFO”) of $646 million, up 5.0% 12 months over 12 months. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

12 months to this point, BIP has generated ~$1.4 billion of sale proceeds, making significant progress in direction of its objective of producing $5-6 billion over the subsequent 2 years.

A portion of those proceeds will likely be used to accumulate Colonial Enterprises, which consists of the most important refined merchandise methods within the U.S., spanning about 5,500 miles alongside the U.S. East Coast between Texas and New York.

BIP has a powerful monitor document of promoting mature belongings and redeploying capital for enticing long-term returns. Moreover, its infrastructure portfolio additionally expects to expertise robust natural progress of 6-9% per 12 months.

BIP intends to make new investments of about $1.5 billion every year. BIP targets an FFOPS progress fee of 10% and dividend progress of 5-9%.

Click on right here to obtain our most up-to-date Certain Evaluation report on BIP (preview of web page 1 of three proven under):

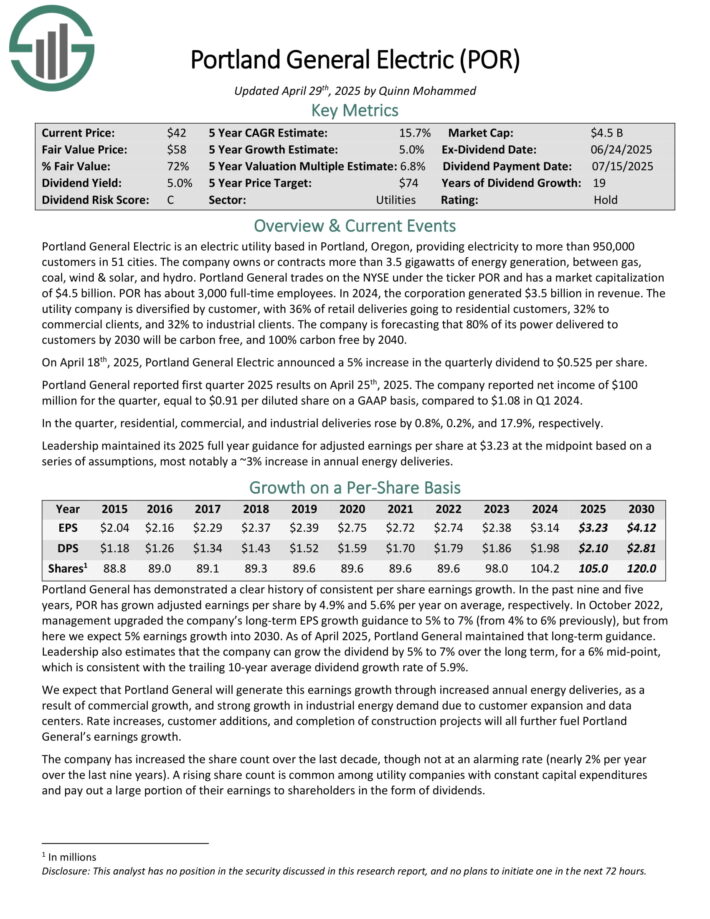

Prime Utility Inventory #3: Portland Basic Electrical (POR)

5-year anticipated annual returns: 15.6%

Portland Basic Electrical is an electrical utility primarily based in Portland, Oregon, offering electrical energy to greater than 950,000 clients in 51 cities. The corporate owns or contracts greater than 3.5 gigawatts of vitality technology, between gasoline, coal, wind & photo voltaic, and hydro.

In 2024, the company generated $3.5 billion in income. The utility firm is diversified by buyer, with 36% of retail deliveries going to residential clients, 32% to business shoppers, and 32% to industrial shoppers. The corporate is forecasting that 80% of its energy delivered to clients by 2030 will likely be carbon free, and 100% carbon free by 2040.

On April 18th, 2025, Portland Basic Electrical introduced a 5% improve within the quarterly dividend to $0.525 per share.

Portland Basic reported first quarter 2025 outcomes on April twenty fifth, 2025. The corporate reported internet revenue of $100 million for the quarter, equal to $0.91 per diluted share on a GAAP foundation, in comparison with $1.08 in Q1 2024.

Within the quarter, residential, business, and industrial deliveries rose by 0.8%, 0.2%, and 17.9%, respectively. Management maintained its 2025 full 12 months steerage for adjusted earnings per share at $3.23 on the midpoint.

Click on right here to obtain our most up-to-date Certain Evaluation report on POR (preview of web page 1 of three proven under):

Prime Utility Inventory #2: H2O America (HTO)

5-year anticipated annual returns: 18.5%

H2O America, previously SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $800 million in annual revenues.

On April twenty eighth, 2025, the corporate reported first quarter outcomes. For the quarter, income improved 18.2% to $176.6 million, which beat estimates by $16.1 million. Earnings-per-share of $0.50 in contrast favorably to earnings-per-share of $0.36 within the prior 12 months and was $0.14 greater than anticipated.

For the quarter, increased water charges general added $17.2 million to outcomes and better buyer utilization added $1.0 million. Working manufacturing bills totaled $131.7 million, which was an 8% improve from the prior 12 months. A lot of the improve in bills was as soon as once more associated to increased water manufacturing prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven under):

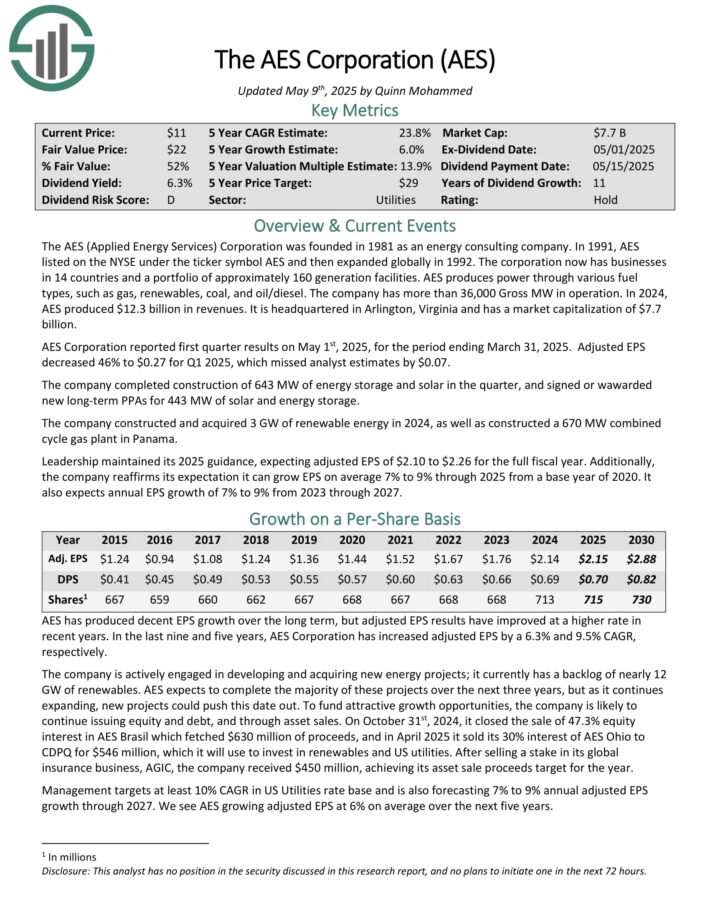

Prime Utility Inventory #1: AES Corp. (AES)

5-year anticipated annual returns: 26.5%

The AES (Utilized Vitality Companies) Company has companies in 14 nations and a portfolio of roughly 160 technology amenities. AES produces energy by way of varied gas varieties, comparable to gasoline, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported first quarter outcomes on Might 1st, 2025, for the interval ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The corporate accomplished development of 643 MW of vitality storage and photo voltaic within the quarter, and signed or wawarded new long-term PPAs for 443 MW of photo voltaic and vitality storage.

The corporate constructed and purchased 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. Management maintained its 2025 steerage, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven under):

Remaining Ideas

The utility sector is a superb place to seek out high-quality dividend shares appropriate for long-term funding.

It’s not, nevertheless, the solely place to seek out enticing investments.

In case you’re prepared to enterprise outdoors of the utility {industry} for funding alternatives, the next Certain Dividend databases are very helpful:

In case you’re in search of different sector-specific dividend shares, the next Certain Dividend databases will likely be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.