Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin’s bullish momentum has considerably pale after reaching an all-time excessive of $111,000 on Might 22, casting doubt on the sustainability of the rally. Bitcoin has pulled again barely after its record-setting push, and analysts are break up on what this implies for its value motion going ahead.

Curiously, not everyone seems to be satisfied the current all-time excessive displays real energy. Some of the notable voices difficult that is licensed crypto knowledgeable Tony “The Bull” Severino, who warned that Bitcoin’s transfer might not be as strong because it seems on the floor.

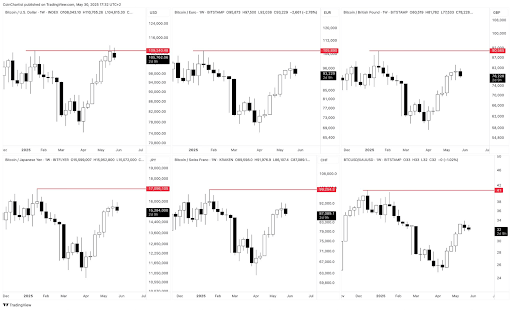

In his evaluation, Tony Severino argues that the breakout to $111,814 lacks the technical affirmation normally related to a real bullish breakout. He famous that whereas BTCUSD did print a brand new excessive, different main buying and selling pairs didn’t observe go well with.

Failed Breakout Signifies Weak point Quite Than Power

Significantly, Bitcoin failed to achieve a brand new all-time excessive in opposition to currencies such because the Euro, British Pound, Japanese Yen, and the Swiss Franc. The identical applies to BTC/XAU, Bitcoin’s value measured in opposition to gold, which at the moment lags far behind its former peak of 41 ounces per Bitcoin. On the time of writing, that pair continues to be hovering at 32 ounces, a major distinction that means the upward momentum is remoted to the US Greenback.

Associated Studying

This divergence leads Severino to argue that the transfer might be a byproduct of the USD’s weak point relatively than Bitcoin’s energy. A real bullish breakout, he says, would have been evident throughout a number of forex pairs and asset benchmarks. His skepticism is additional bolstered by the construction of the charts, as seen within the six comparative panels he shared on the social media platform X. Most of them present Bitcoin forming decrease highs or just failing to match the earlier all-time degree.

As an example, Bitcoin priced in euros continues to be effectively beneath its peak of €105,890, at the moment buying and selling round €93,229. Equally, Bitcoin has did not breach the 17 million mark in opposition to the Japanese Yen and now sits at ¥15.28 million. The identical pattern is repeated within the Swiss Franc and British Pound pairings, with BTC / Swiss Franc failing to cross 99,254 and BTCGBP forming a decrease excessive at $78,228. These value actions make it tough to argue that Bitcoin is in a universally sturdy place, notably when measured in something aside from USD.

Warning With Subsequent Month-to-month Candle Open

In conclusion, Tony Severino warns merchants and traders to not be misled by the surface-level optimism that comes with a brand new all-time excessive in BTCUSD. A single breakout, particularly one missing affirmation from cross-pair energy and elementary indicators, doesn’t essentially sign the beginning of a brand new wave 5 or a sustained bullish pattern for the Bitcoin value.

Associated Studying

Based on him, the Might month-to-month candle shut and the June month-to-month candle open will probably be vital in figuring out the subsequent route. If the present indecision tilts bearish, technicals might teeter again bearish in the direction of a bigger correction.

On the time of writing, Bitcoin is buying and selling at $104,850 after reaching a 24-hour low of $103,832. It is a temporary restoration from its June open of $104,646.

Featured picture from Getty Pictures, chart from Tradingview.com