A inventory with good relative power merely implies that it’s performing higher than the overall market.

A inventory with poor relative power means it’s under-performing relative to the market.

By market, we imply the board inventory market normally.

The S&P 500 is usually used because the benchmark as a result of it consists of 500 massive firms representing roughly 80% of the overall market worth of the U.S. inventory market.

Contents

“Relative Energy” is to not be confused with the RSI, which is the “Relative Energy Indicator” that almost all charting platforms must point out momentum or overbought/oversold worth motion situations.

Relative power is totally different and isn’t typically discovered within the indicators panel of your charting platform.

Whether it is, it would typically be labeled as a “Relative Energy Comparator” (RSC) to keep away from confusion about RSI.

Gilead Science (GILD) is an instance of a inventory with sturdy relative power:

Sure, the chart goes up. However that’s not the standards for relative power.

The chart must be going up higher than the overall market.

If we have been to plot GILD and SPY (the S&P 500 ETF) throughout the identical look-back interval of the final twelve months:

We see that GILD is up 60% whereas the S&P 500 is flat.

As of April 2025, the S&P 500 is about the place it was 12 months in the past.

Goal (TGT) has weak relative power on the present time…

TGT is down 40% within the final twelve months, whereas the crimson SPY line is above it.

Once we converse of relative power, we should point out the time-frame.

Whereas Goal is weak on the present time, it had sturdy relative power up to now.

In the event you simply scroll the charts again to March 2021:

The relative power will likely be totally different relying on the look-back interval.

A shorter-term dealer might have a look at relative power over the previous three months and see that NVIDIA (NVDA) has poor relative power…

Nevertheless, a longer-term investor might even see its relative power has been sturdy over the past two years.

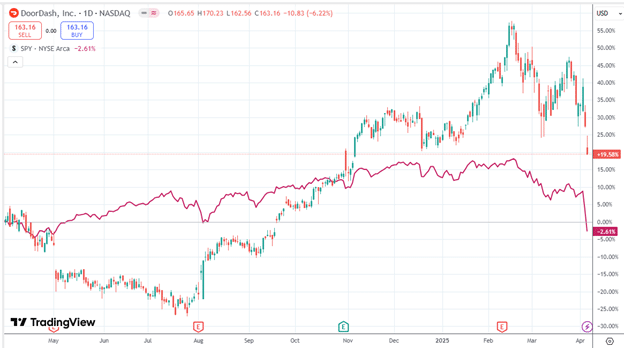

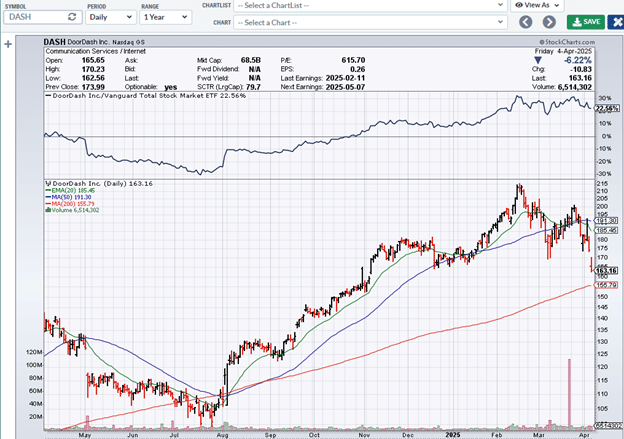

Within the case of DoorDash (DASH):

It was under-performing the market from April to November.

Then it out-performed the market in November.

Drawing one chart overlaid on prime of one other is helpful for seeing this.

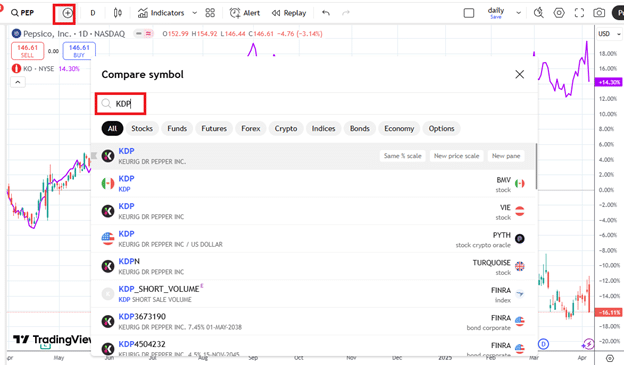

In TradingView, click on on the examine image icon subsequent to the ticker, and you’ll add a number of further graphs to the chart:

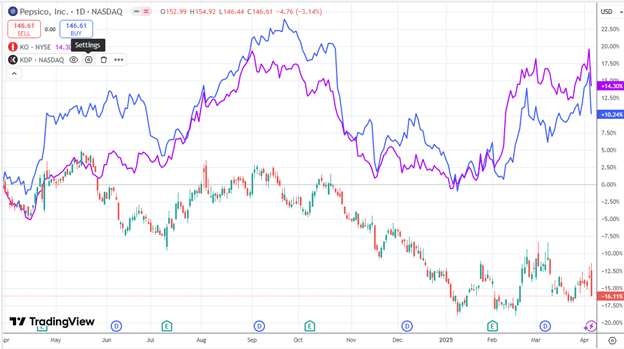

Beneath, we see that Pepsico (PEP) is underperforming each Coca-Cola (KO) and Dr. Pepper (KDP):

You may change the colour of the strains with the Settings icon subsequent to the ticker.

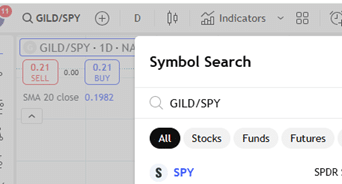

Plot worth ratios are one other strategy to see the development in relative power.

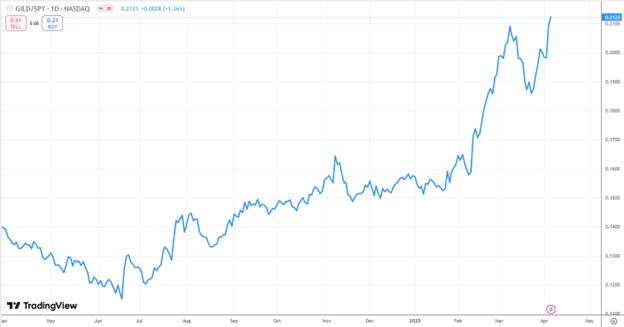

To chart the value ratio of GILD over SPY, we will merely sort “GILD/SPY” because the image in TradingView:

The software program will take the value of GILD, and divide that by the value of SPY, and chart the outcomes:

We switched the graph to a line graph as a result of these usually are not candlesticks of worth motion.

The graph plots the numeric worth of 1 worth divided by one other.

The precise numerical values on the vertical axis usually are not related.

We wish to see if the chart is sloping up or sloping down.

For essentially the most half, GILD is sloping up, indicating enchancment or improve in relative power.

The value of GILD is getting larger in relation to the value of SPY.

Doing the identical with TGT versus SPY confirms that TGT has poor relative power as a result of downward-sloping graph of their worth ratios.

Get Your Free Dividend Low cost Mannequin Excel Calculator

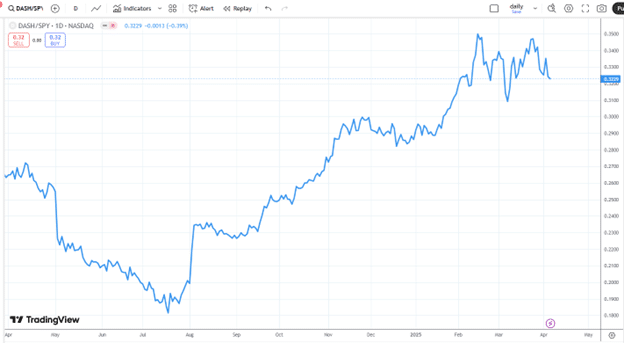

Proven under, DASH (DoorDash) divided by SPY had declining relative power from April to August:

Then, after the August earnings announcement, the inventory took off with rising relative power.

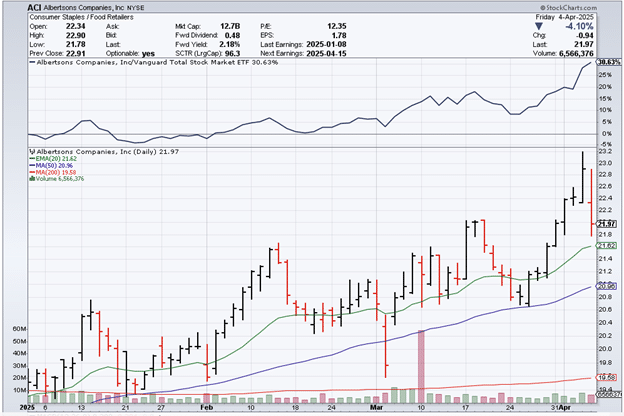

StockCharts could be configured to indicate the same relative power line within the prime panel:

Supply: StockCharts

By default, it makes use of Vanguard Whole Inventory Market ETF as a substitute of SPY because the benchmark comparator.

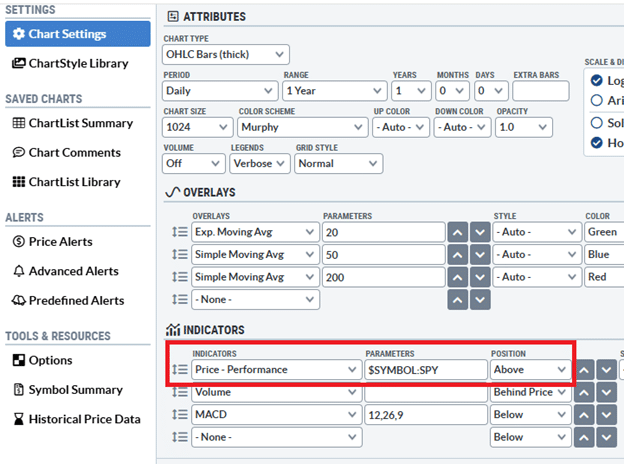

One can simply change it to SPY within the Parameters of the “Worth Efficiency” indicator underneath Chart Settings…

Now, the query is methods to discover shares with sturdy relative power.

IBD has a relative power ranking that ranges from 1, which is the worst, to 99, which is one of the best. Excessive-performing shares ought to have a ranking of 80 or higher.

The IBD 50 listing is one other good place to look since it’s their chosen prime 50 shares based mostly on sturdy relative power and a mixture of different metrics.

Nevertheless, this info requires an IBD paid subscription.

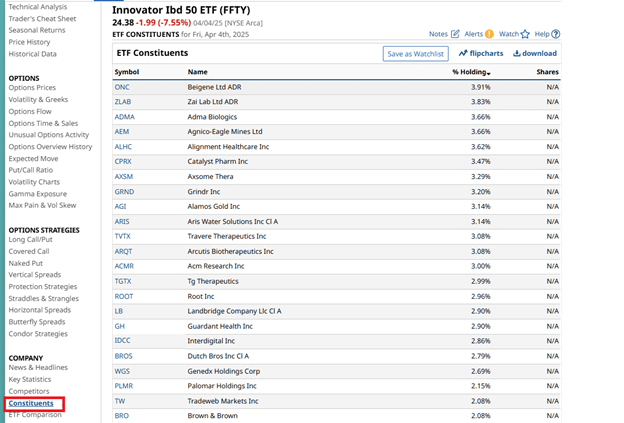

To determine which shares are on the IBD 50 listing, you may have a look at the constituents of Innovator IBD 50 ETF (FFTY) on barchart.com

Supply: barchart.com

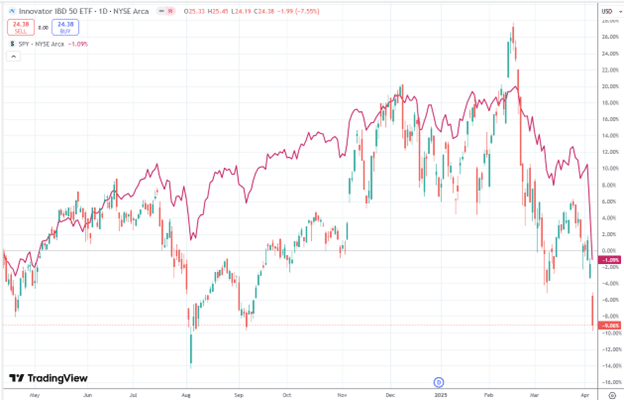

As an entire, the group of fifty may common out to carry out equally to the board market:

Buyers can carry out the relative power train on every of the fifty shares to pick one of the best amongst them.

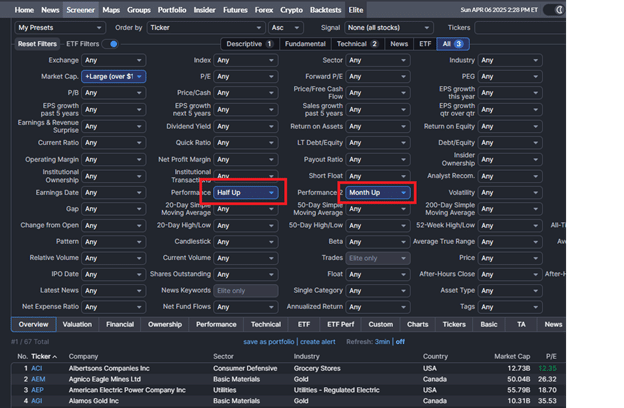

There usually are not that many inventory screeners that filter by relative power.

Even the large FinViz scanner doesn’t have it.

Supply: FinViz.com

Nevertheless, you will get a filtered listing that’s considerably shut by scanning for these shares which are up in worth up to now 6 months and in addition up the final month.

Then, you simply must undergo every of these shares manually.

If that listing is simply too massive, you may slender it down by filtering solely these with a big market cap, and so on.

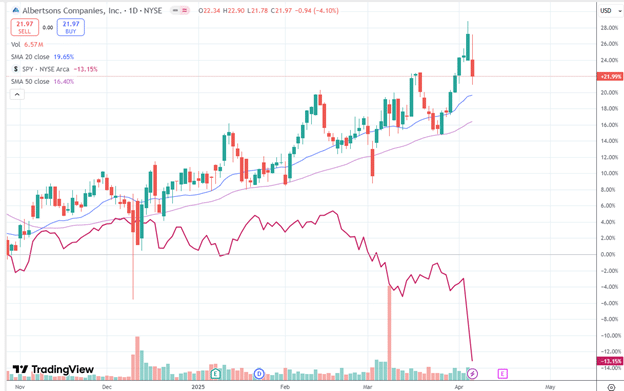

On this case, the primary one on the listing is a superb discover.

Albertson (ACI), the grocery retailer, remains to be in an uptrend with positively stacked upward-sloping transferring averages whereas the remainder of the market is dropping.

A have a look at its worth ratio in opposition to the VTI benchmark confirms that it has more and more sturdy relative power:

In search of relative power allows you to discover sturdy shares in a chaotic market.

This text launched a couple of instruments by which you are able to do this.

We hope you loved this text about methods to discover shares with good relative power.

When you’ve got any questions, ship an e mail or go away a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who usually are not aware of trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.