Merchants,

Whereas I proceed to have probably the most success with intraday move2move and momentum buying and selling, which accounts for my consistency recently, I’m starting to see early indicators of a shifting surroundings that may once more favor swing buying and selling. So, I’ll embody a mixture of intraday and swing setups on this week’s watchlist.

Beginning off with a few swing concepts.

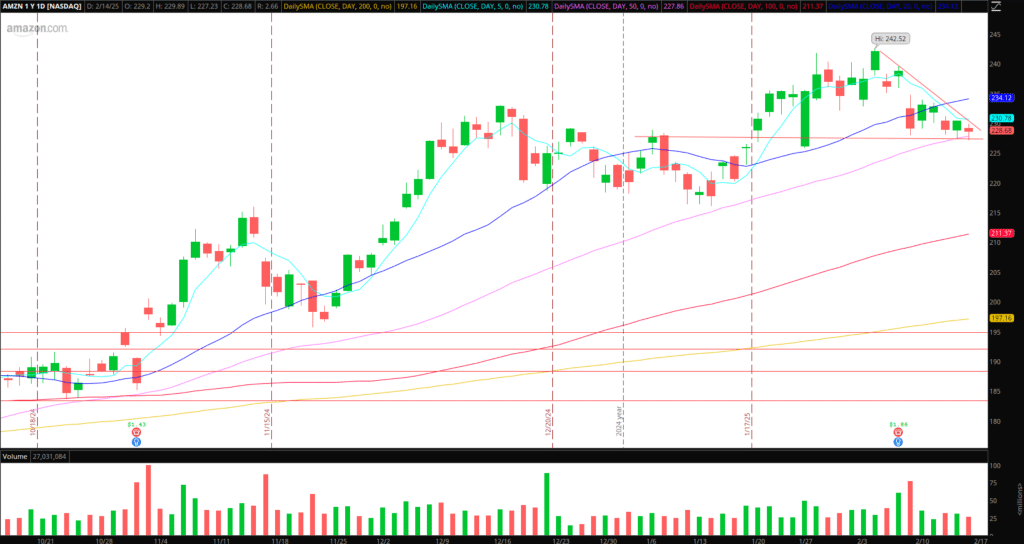

(NASDAQ: AMZN) Whether or not or not we get follow-through in a number of swing concepts will rely in the marketplace’s capacity to keep up its footing after Friday’s spectacular shut. AMZN presents a good R: R setup because the inventory consolidated above prior resistance between its 50 and 5-day SMA. I’m on the lookout for a breakout above its 5-day SMA for entry, with a LOD cease, concentrating on a transfer towards resistance 1 and its 20-day SMA to cowl half and path the remainder versus the day’s low.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

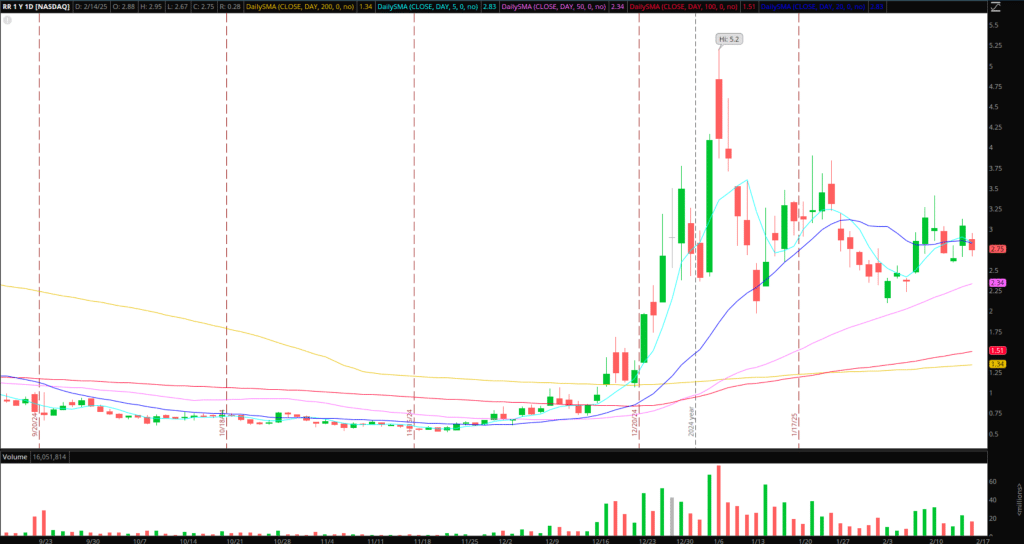

(NASDAQ: RR) A small-cap robotics firm that, regardless of SERV’s crash on Friday, maintained its bullish formation on a better timeframe, which I like. In consequence, I’ll be monitoring this carefully going ahead. One factor to concentrate on is potential dilution. I’d must see a agency breakout in value and quantity over $3 to get excited and have a place versus the day’s low. Under $2.5 the thought is now not legitimate and never value watching.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

(NASDAQ: GRAB) Earnings finish of subsequent week. The inventory has a powerful setup on the each day, and on a better timeframe. It broke out of a major base and located assist above prior resistance. I like the general look. It’s on watch for 2 major eventualities. First is a breakout forward of earnings over $5 on quantity, which I’d look to swing lengthy with a LOD cease. I’d absolutely exit earlier than earnings. Second, is a breakout following earnings, by which case, I’d search for a niche, give, and go setup or maintain of key prolonged hour ranges to provoke a protracted swing following earnings for continuation.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

(NYSE: SNOW) and (NASDAQ: RKLB), Which have earnings later within the month, are shaping up equally on a better timeframe, and I’ll be conserving that on the watch for the same alternative as effectively.

Lastly, because it pertains to swing concepts, AFRM labored completely from final week’s watchlist and continues to comply with by with Friday’s secondary breakout. So, I’ll proceed to search for highly effective earnings hole continuation swing alternatives, like DOCS and HOOD, that are probably organising now.

Alright, listed below are a few small-cap intraday alternatives:

(NASDAQ: MGOL) unbelievable dealer final week, and unbelievable sell-the-news alternative on Friday. After Friday’s transfer and a ton of overhead and luggage that now exist, I’d love a push / useless cat bounce quick alternative into $0.70s – $0.80s for one final commerce within the inventory. After plenty of stable trades in it final week, I’m not seeking to overstay or maintain coming again to the effectively. But when it pops on Tuesday or Wednesday, while there may be nonetheless some curiosity within the title, i’d be concerned with a brief into main resistance zones.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

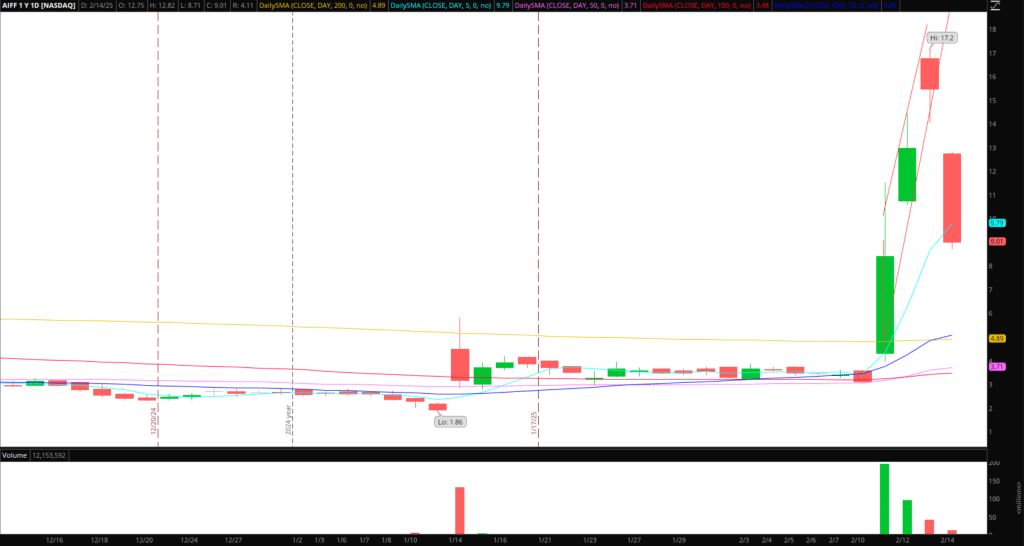

(NASDAQ: AIFF) Lastly broke the uptrend and bought off on Friday. Going ahead, I’d have some alerts set for $11 – $13 in case it pops up in an unsustainable method. If that occurs, I’d search for a reactive intraday quick alternative, not a swing.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

(NASDAQ: MBRX) If there are not any extra choices, then I shall be stalking this for a possible liquidity entice and squeeze increased above Friday’s excessive.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures