After studying arrange an iron condor choices technique, studying to regulate an iron condor is the subsequent step.

We are going to clarify all this through one lengthy instance protecting a number of adjustment strategies.

The secret is to grasp the basic ideas that underlie all the adjustment strategies.

These strategies are categorized as both an attacking adjustment or a defending adjustment.

Contents

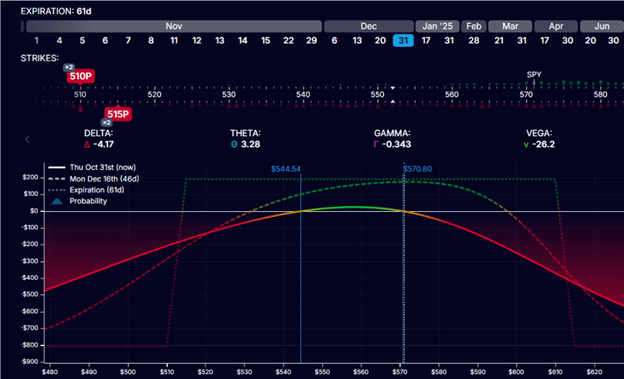

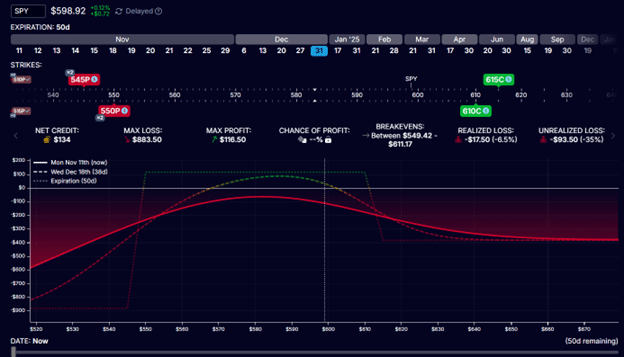

An iron condor includes promoting an out-of-the-money name unfold and an out-of-the-money put unfold, like the next iron condor on SPY (the S&P 500 ETF) initiated on Halloween day of 2024, about one week earlier than the 2024 United States presidential election.

So, this can doubtless transfer the market a bit and provides us some adjustment alternatives.

Date: Oct 31, 2024

Value: SPY @ $570

Purchase two Dec 31 SPY 615 name

Promote two Dec 31 SPY 610 name

Promote two Dec 31 SPY 515 put

Purchase two Dec 31 SPY 510 put

Credit score: $190

The investor receives a internet credit score of $190 for promoting two contracts with the chance graph trying as follows:

The vital issues to observe on the chance graph and modeling software program are:

The place the worth (indicated by the vertical white line) is positioned in relation to the 2 credit score spreads.

How far above zero is the max revenue of the expiration line (dotted straight line).

How far under zero is the utmost threat of the expiration line.

The delta of the quick put and the quick name.

The curvature of the T+0 present revenue line (the strong red-and-green curved line)

With the worth of the underlying on the horizontal backside axis and the P&L on the left vertical axis, we see that the present worth of SPY is $570.

The max revenue at expiration is $200, and the max loss is $800, giving us a condor with an preliminary risk-to-reward for 4-to-1.

The put credit score unfold has the quick put at $515, which is across the 12-delta on the choice chain.

The decision credit score unfold has the quick put at $610, additionally round 12-delta.

The curvature of the T+0 line is sloping barely however inside acceptable limits.

It’s sloping in such a route that if SPY will increase in worth, the P&L drops.

If the worth goes down, the P&L rises.

This implies the place has a unfavourable delta.

You’ll be able to see the positional delta within the modeling software program is displaying -4.17.

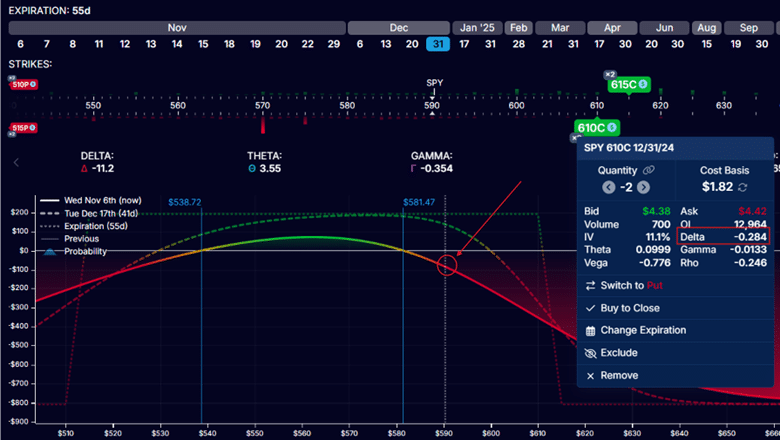

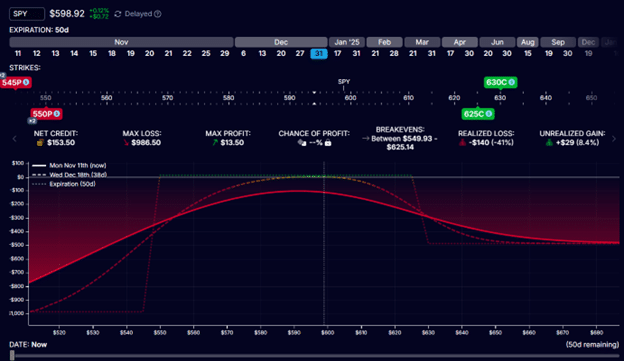

The market rallied after the election outcomes had been introduced on Nov 6, threatening the decision unfold. P&L is -$84.

The quick name is now at 28-delta, a major enhance from its authentic 13-delta.

Discover the place the white vertical line (worth of SPY) crosses the T+0 curve.

The slope has elevated, as proven by its extra unfavourable place delta of -11.2.

It’s time to modify.

We bought two contracts for the Iron Condors to present us a bit extra flexibility and allow us to reveal a defending adjustment.

The decision spreads are threatened as a result of the worth is shifting in direction of the decision spreads.

We decreased the variety of name spreads by closing one of many name spreads by paying a debit of $135.

Purchase one to shut $610 name

Promote one to shut $615 name

Debit: -$135

Subsequent, we see that the quick put could be very far-off on the 5-delta.

We will even carry out an attacking adjustment by rolling the unfold up nearer to the SPY worth for a internet credit score of $40.

Purchase two to shut $515 put

Promote two to shut $510 put

Debit: -$30

Promote two to open $550 put

Purchase two to open $545 put

Internet credit score: $70

Our new place has a decreased positional delta of -2.99.

You can too see that the slope of the T+0 line has decreased.

Bear in mind, the decision unfold is a bearish unfold.

The put unfold is a bullish unfold.

When the worth of the underlying strikes up, we have to make the commerce extra bullish.

Subsequently, we enhance the facility of the put unfold by shifting it nearer to cost.

And we lower the facility of the decision unfold by decreasing its contracts.

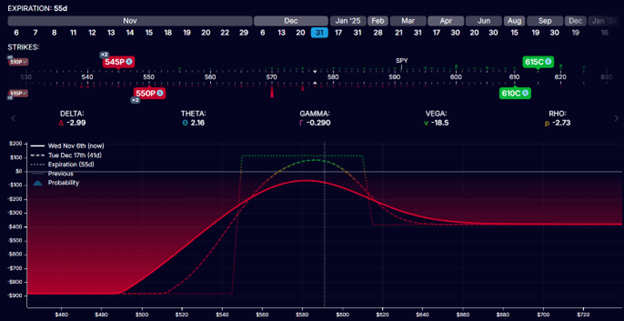

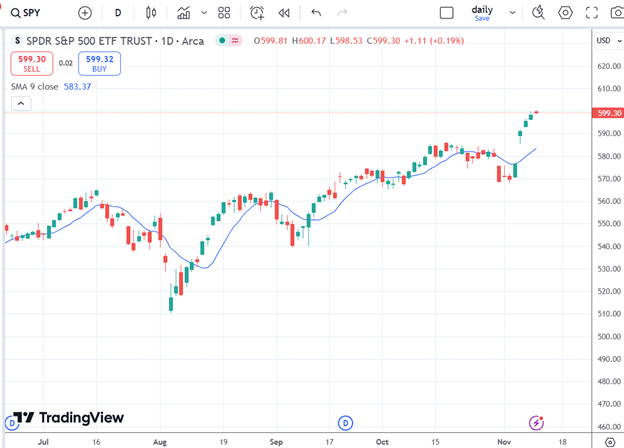

On Nov 11, SPY continued to go up, reaching 600.

Value is attacking the decision unfold once more.

See how a lot nearer the white vertical line is to the decision unfold in comparison with the put unfold.

Free Earnings Season Mastery eBook

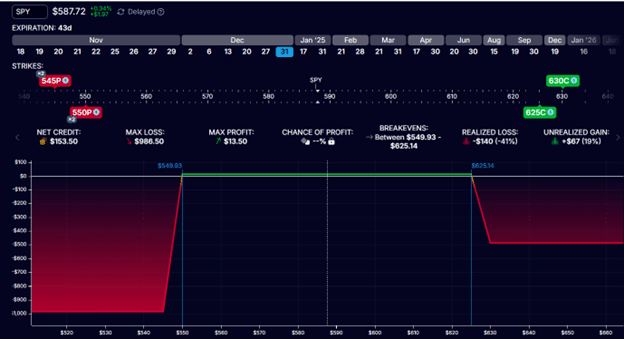

This time, we defend the decision unfold by rolling the decision unfold up away from the worth.

Date: Nov 11

Value: SPY @ $599

Purchase to shut one Dec thirty first SPY 610 name

Promote to shut one Dec thirty first SPY 615 name

Debit: -$186

Promote to open one Dec thirty first SPY 625 name

Purchase to open one Dec thirty first SPY 630 name

Credit score: $80

This can be a internet debit of -$106 for the rolling adjustment.

The ensuing graph exhibits we now have extra room for the decision unfold.

Additionally, we’ve a flatter T+0 curve.

One downside is that the utmost revenue of the expiration graph has dropped.

It’s getting very near the zero revenue horizontal.

However the commerce nonetheless has 50 extra days until expiration.

We are going to discover a possibility to lift this revenue potential later.

Whereas the quick $550 put is much out of the cash on the 9 delta, we opted to not make an attacking adjustment with the put unfold at the moment for worry that SPY would possibly pull again and drop in worth and the put unfold will turn into too shut.

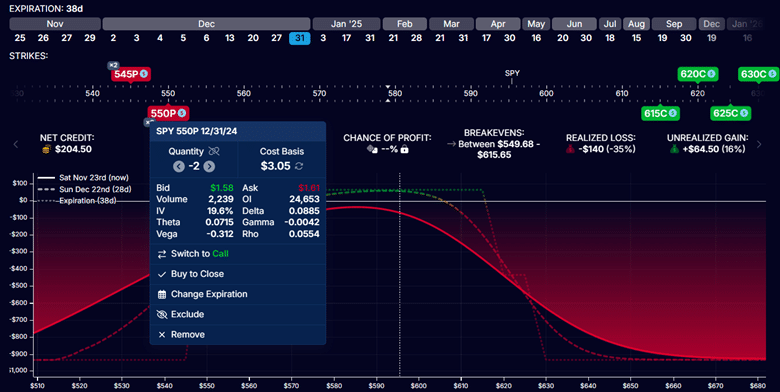

On Nov 18, the SPY worth dropped to $588, and the quick name was on the 5-delta.

Since we’ve two put spreads and just one name unfold in the intervening time, we will add again one other name unfold with out rising the max threat within the commerce:

Promote one Dec 31 SPY 615 name

Purchase one Dec 31 SPY 620 name

Credit score: $50

We positioned the quick name of the brand new name unfold at across the 15-delta for a credit score of $50.

That is an attacking adjustment as a result of we make the decision spreads extra highly effective.

Be aware that it has the impact of accelerating our most potential revenue within the expiration graph.

That is typical once we obtain a internet credit score for an adjustment.

AFTER:

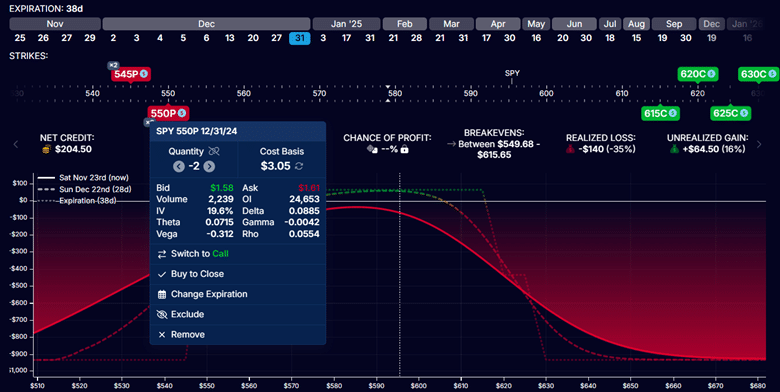

On Nov 22, the quick $550 put choice has moved far out of the cash on the 8-delta:

BEFORE:

Be aware that the max revenue is $65, and the max threat is $935 proper now earlier than we present you the subsequent adjustment.

This adjustment might be an attacking adjustment, making the put credit score unfold stronger with wider wings.

We are going to roll the quick places up with out shifting the lengthy places.

Purchase to shut two contracts Dec 31 SPY $550 put

Promote to open two contracts Dec 31 SPY $555 put

Credit score: $48

AFTER:

The max potential revenue elevated to $112.

It had elevated by the quantity of the credit score obtained.

Nevertheless, the max threat has risen to $1887, which some traders might not need to have.

By widening the wings of the put credit score unfold from 5 factors extensive to 10 factors extensive, we doubled the chance within the commerce.

There are a number of how to regulate iron condors, which contain lowering or rising the variety of contracts, rolling spreads, and altering wing widths.

These are the most typical changes; others have created much more inventive ones.

By realizing the Greeks and understanding the chance graph, you can too develop your individual changes.

All of them attempt to obtain the identical factor: maintain the directional threat of the commerce inside a sure tolerance whereas sustaining an honest revenue potential.

We’re attacking and getting a credit score by shifting spreads nearer to the worth.

We’re defending and paying a debit by shifting the threatened spreads away from the worth.

By lowering the variety of contracts in a selection or narrowing a selection, we’re defending by weakening the unfold.

We’re attacking and making the unfold stronger by rising the variety of contracts or widening the unfold.

As in any sport, generally you need to play offense and generally play protection.

We hope you loved this text on completely different iron condor adjustment methods.

In case you have any questions, please ship an e-mail or go away a remark under.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who will not be acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.