Up to date on March twenty fifth, 2025 by Bob Ciura

Shares with low P/E ratios can supply engaging returns if their valuation multiples increase.

And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

We outline a high-yield inventory as one with a present dividend yield of 5% or greater.

The free excessive dividend shares checklist spreadsheet beneath has our full checklist of particular person securities (shares, REITs, MLPs, and so on.) with with 5%+ dividend yields.

You possibly can obtain a free copy by clicking on the hyperlink beneath:

On this analysis report, we focus on the prospects of 20 undervalued excessive dividend shares, that are at present buying and selling at P/E ratios below 10 and are providing dividend yields above 5.0%.

Worldwide shares have been excluded from this report.

We’ve got ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO instead of the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows).

These are comparable metrics much like earnings for frequent shares.

These 20 dividend shares haven’t been screened for dividend security. As a substitute, these are the 20 most undervalued shares within the Certain Evaluation Analysis Database with excessive dividend yields.

Desk of Contents

Maintain studying to see evaluation on these 20 undervalued excessive dividend shares.

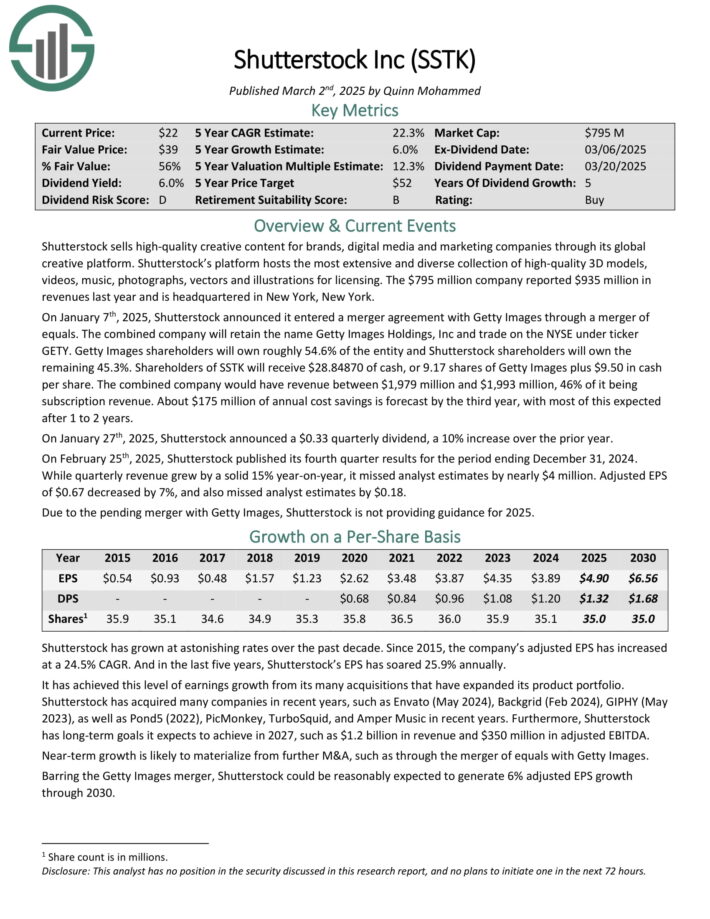

Undervalued Excessive Dividend Inventory #1: Shutterstock, Inc. (SSTK) – P/E ratio of 4.0

Shutterstock sells high-quality artistic content material for manufacturers, digital media and advertising and marketing firms by means of its international artistic platform.

Its platform hosts essentially the most in depth and various assortment of high-quality 3D fashions, movies, music, pictures, vectors and illustrations for licensing. The corporate reported $935 million in revenues final 12 months.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Photographs by means of a merger of equals. The mixed firm will retain the identify Getty Photographs Holdings, Inc and commerce on the NYSE below ticker GETY.

Getty Photographs shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Photographs plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual price financial savings is forecast by the third 12 months, with most of this anticipated after 1 to 2 years.

On January twenty seventh, 2025, Shutterstock introduced a $0.33 quarterly dividend, a ten% enhance over the prior 12 months.

On February twenty fifth, 2025, Shutterstock revealed its fourth quarter outcomes for the interval ending December 31, 2024. Whereas quarterly income grew by a strong 15% year-on-year, it missed analyst estimates by practically $4 million.

Adjusted EPS of $0.67 decreased by 7%, and in addition missed analyst estimates by $0.18.

Click on right here to obtain our most up-to-date Certain Evaluation report on SSTK (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #2: ARMOUR Residential REIT (ARR) – P/E ratio of 4.4

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) corresponding to Fannie Mae and Freddie Mac.

It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different kinds of investments.

Supply: Investor presentation

On October 23, 2024, ARMOUR Residential REIT introduced its unaudited third-quarter 2024 monetary outcomes, reporting a GAAP internet earnings accessible to frequent stockholders of $62.9 million, or $1.21 per frequent share. The corporate generated a internet curiosity earnings of $1.8 million and distributable earnings of $52.0 million, equal to $1.00 per frequent share.

ARMOUR achieved a median curiosity earnings of 4.89% on interest-earning property and an curiosity price of 5.51% on common interest-bearing liabilities. The financial internet curiosity unfold stood at 2.00%, calculated from an financial curiosity earnings of 4.44% minus an financial curiosity expense of two.44%.

Throughout the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of frequent inventory by means of an at-the-market providing program and paid frequent inventory dividends of $0.72 per share for Q3.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

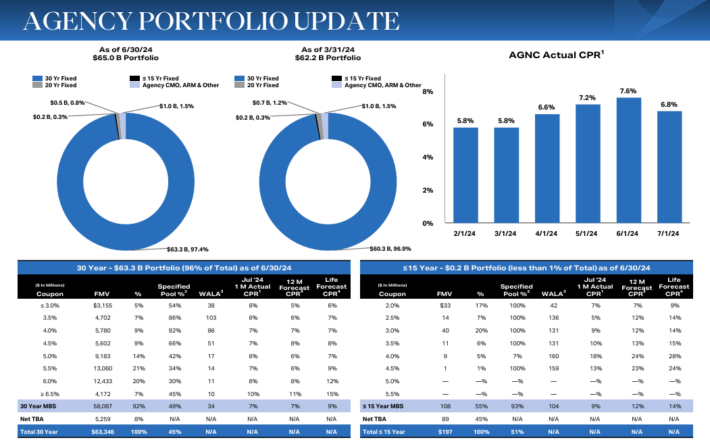

Undervalued Excessive Dividend Inventory #3: AGNC Funding Company (AGNC) – P/E ratio of 4.5

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by means of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Supply: Investor Presentation

AGNC Funding Corp. reported robust monetary outcomes for the third quarter ended September 30, 2024. The corporate achieved a complete earnings of $0.63 per frequent share, pushed by a internet earnings of $0.39 and different complete earnings of $0.24 from marked-to-market investments.

Internet unfold and greenback roll earnings contributed $0.43 per share. The tangible internet guide worth elevated by $0.42 per share to $8.82, reflecting a 5.0% development from the earlier quarter.

AGNC declared dividends of $0.36 per share, leading to a 9.3% financial return on tangible frequent fairness, which incorporates each dividends and the rise in internet guide worth.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #4: NewtekOne Inc. (NEWT) – P/E ratio of 5.4

Newtek Enterprise Companies Corp. was a enterprise growth firm (BDC) specializing in offering monetary and enterprise companies to the small- and medium-sized enterprise market in the USA.

What makes NewTek a novel firm is {that a} good portion of its earnings is derived from subsidiaries that present a big selection of enterprise companies to its giant shopper base.

The corporate additionally will get a major quantity of its earnings from being an issuer of SBA (Small Enterprise Administration loans), which solely only a few BDCs are licensed to do. This isn’t your typical BDC that solely generates earnings from rate of interest spreads, but additionally from a a lot wider vary of small enterprise companies.

On February twenty sixth, 2025, Newtek launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, Newtek reported internet earnings of $18.3 million, or diluted earnings per share (EPS) of $0.69, representing a 62.8% enhance over the prior 12 months. Internet curiosity earnings elevated to $11.3 million, up 36.1% from This fall 2023.

Its complete property reached $2.1 billion, marking a 50% rise year-over-year, with loans held for funding rising 23% to $991.4 million.

Newtek’s internet curiosity margin was 2.80%, a slight enhance from the prior 12 months.

Moreover, the corporate’s Different Mortgage Program mortgage closings skyrocketed by 199% to $91.4 million. Newtek additionally achieved important enhancements in return on tangible frequent fairness (ROTCE) and return on common property (ROAA), reaching 31.8% and 4.1%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NEWT (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #5: Western Union Firm (WU) – P/E ratio of 5.8

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations.

About 90% of brokers are exterior of the US. Western Union operates two enterprise segments, Client-to-Client (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported combined This fall 2024 outcomes on February 4th, 2025. Income elevated 1% and diluted GAAP earnings per share elevated to $1.14 within the quarter, in comparison with $0.35 within the prior 12 months on greater income and a $0.75 tax profit on reorganizing the worldwide operations.

Income rose, regardless of challenges in Iraq on greater Banded Digital transactions and Client Companies volumes.

CMT income fell 4% year-over-year even with 3% greater transaction volumes. Branded Digital Cash Switch CMT revenues elevated 7% as transactions rose 13%. Digital income is now 25% of complete CMT income and 32% of transactions.

Client Companies income rose 56% on new merchandise and enlargement of retail international alternate choices. The agency launched a media community enterprise, expanded retail international alternate, and grew retail cash orders.

Click on right here to obtain our most up-to-date Certain Evaluation report on WU (preview of web page 1 of three proven beneath):

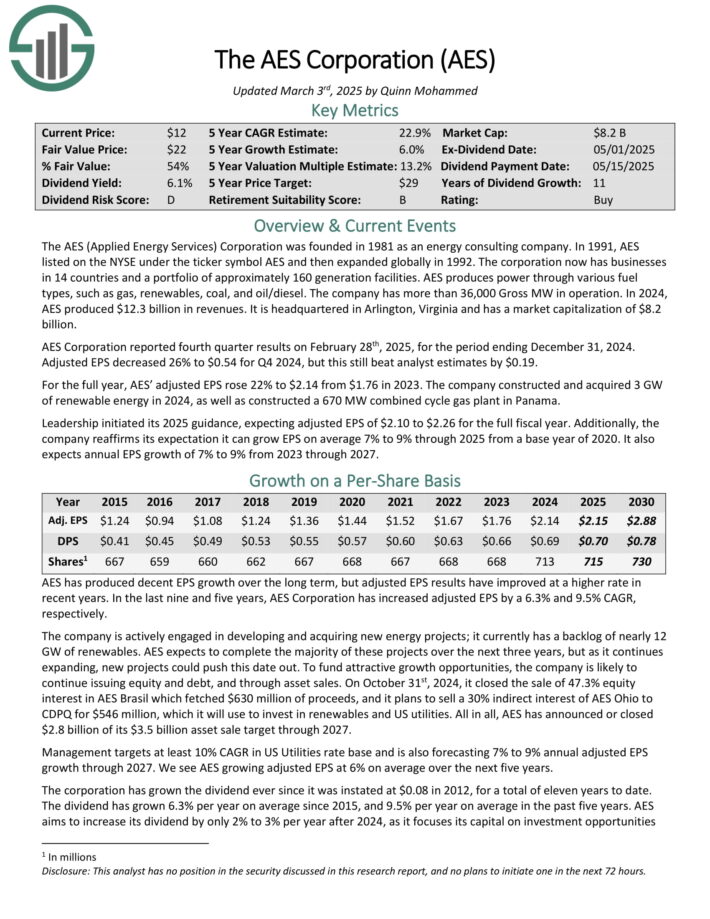

Undervalued Excessive Dividend Inventory #6: AES Corp. (AES) – P/E ratio of 5.8

The AES (Utilized Vitality Companies) Company was based in 1981 as an power consulting firm. It now has companies in 14 international locations and a portfolio of roughly 160 era amenities.

AES produces energy by means of numerous gasoline varieties, corresponding to fuel, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

Supply: Investor Presentation

The corporate is actively engaged in growing and buying new power tasks.

It at present has a backlog of 12.7 GW of renewables. AES expects to finish nearly all of these tasks by means of 2027.

AES Company reported fourth quarter outcomes on February twenty eighth, 2025, for the interval ending December 31, 2024. Adjusted EPS decreased 26% to $0.54 for This fall 2024, however this nonetheless beat analyst estimates by $0.19.

For the total 12 months, AES’ adjusted EPS rose 22% to $2.14 from $1.76 in 2023. The corporate constructed and purchased 3 GW of renewable power in 2024, in addition to constructed a 670 MW mixed cycle fuel plant in Panama.

Management initiated its 2025 steering, anticipating adjusted EPS of $2.10 to $2.26 for the total fiscal 12 months.

Moreover, the corporate reaffirms its expectation it could possibly develop EPS on common 7% to 9% by means of 2025 from a base 12 months of 2020. It additionally expects annual EPS development of seven% to 9% from 2023 by means of 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven beneath):

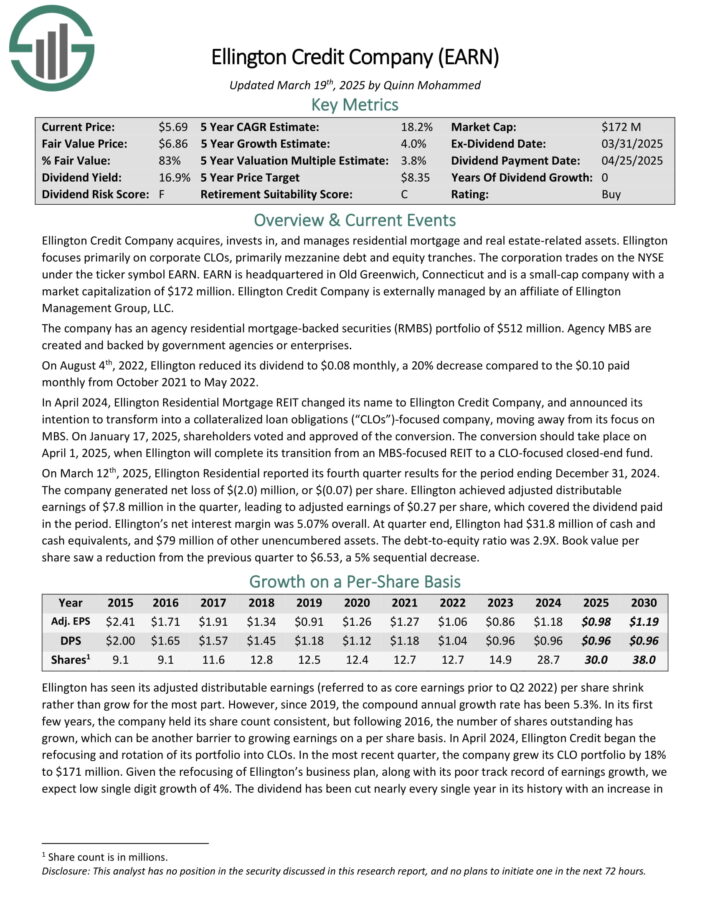

Undervalued Excessive Dividend Inventory #7: Ellington Credit score Co. (EARN) – P/E ratio of 5.9

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% total. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered property.

Click on right here to obtain our most up-to-date Certain Evaluation report on EARN (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #8: Sunoco LP (SUN) – P/E ratio of 6.2

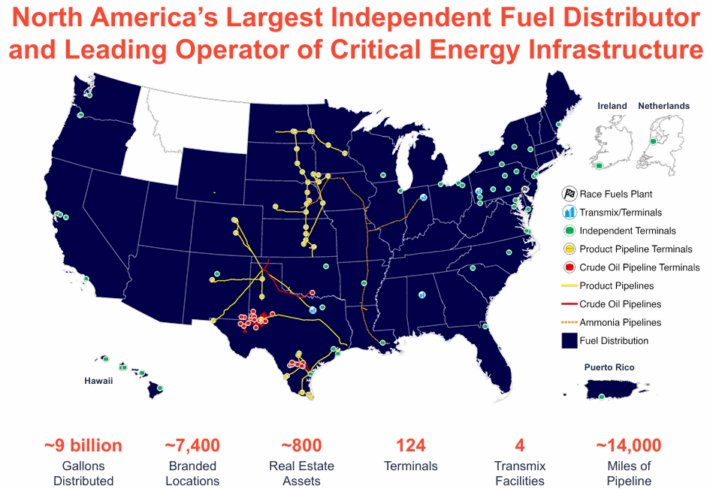

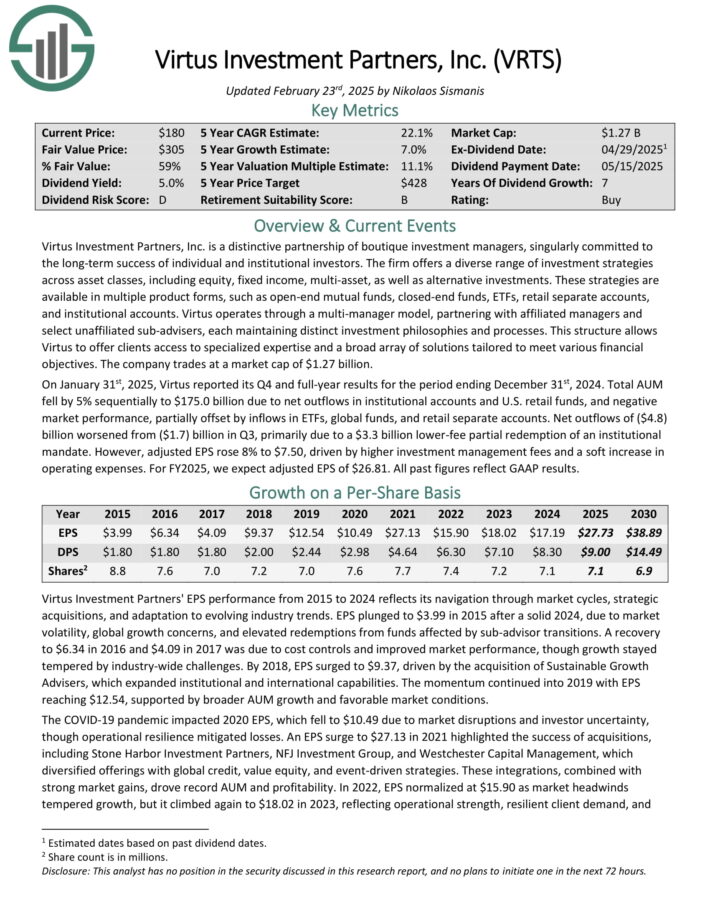

Sunoco is a grasp restricted partnership that distributes a variety of gasoline merchandise (wholesale and retail) and that’s lively in some adjoining industries corresponding to pipelines.

The wholesale unit purchases gasoline merchandise from refiners and sells these merchandise to each its personal and independently owned sellers.

Supply: Investor Presentation

Sunoco reported its fourth quarter earnings ends in February. The corporate reported that its revenues totaled $5.3 billion through the quarter, which was 7% lower than the revenues that Sunoco generated through the earlier 12 months’s quarter.

Gasoline costs are largely a movement by means of merchandise for Sunoco, since Sunoco’s prices decline as effectively when gasoline costs decline. Income modifications thus don’t essentially affect income to a big diploma.

Sunoco reported that its adjusted EBITDA was up 86% 12 months over 12 months, bettering to $439 million through the quarter. Distributable money flows totaled $261 million through the quarter, which was greater in comparison with the earlier 12 months’s quarter, and which equated to DCF of $2.19 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on SUN (preview of web page 1 of three proven beneath):

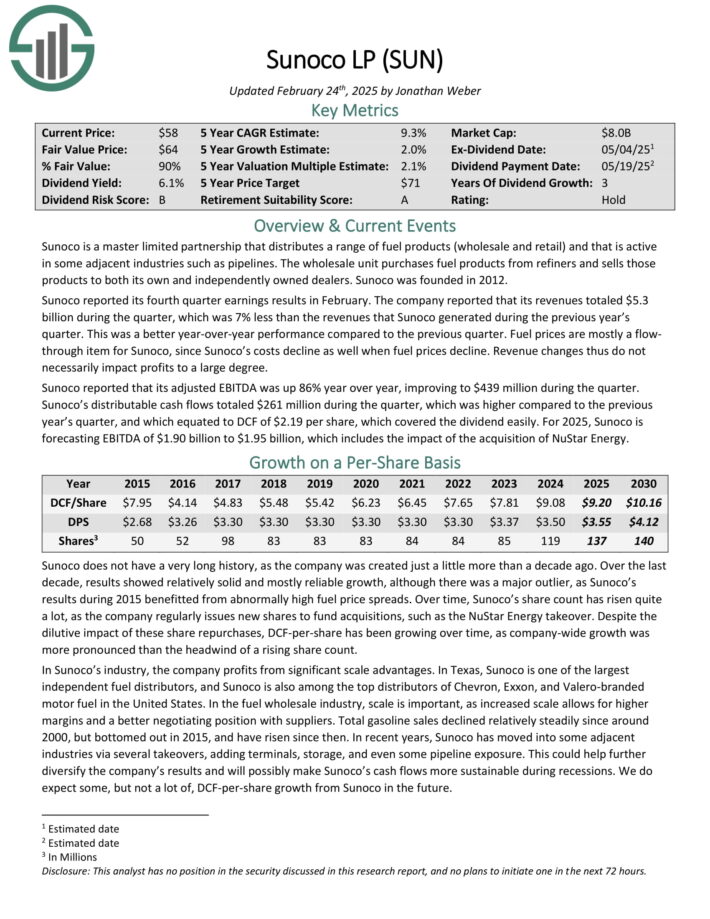

Undervalued Excessive Dividend Inventory #9: Macy’s Inc. (M) – P/E ratio of 6.4

Macy’s is a division retailer firm that operates brick and mortar shops, in addition to on-line shops below the Macy’s, Bloomingdale’s, and Bluemercury manufacturers.

Macy’s reported its fourth quarter earnings outcomes on March 6. The corporate reported that its revenues totaled $7.77 billion through the quarter, which was above what the analyst group forecasted, with the consensus estimate being overwhelmed by $13 million. Macy’s revenues have been down by 4% versus the earlier 12 months’s quarter.

Macy’s generated earnings-per-share of $1.80 through the fourth quarter, which represents a weaker consequence in comparison with the earlier 12 months’s interval. Outcomes light in 2023 and 2024, relative to the 2 robust years we noticed in 2021 and 2022.

For 2025, earnings-per-share are actually forecasted to be between $2.05 and $2.25 in line with administration’s present steering, which signifies that the corporate’s earnings-per-share will possible proceed to drag again this 12 months on the again of weaker client sentiment that hurts Macy’s enterprise outlook.

Click on right here to obtain our most up-to-date Certain Evaluation report on M (preview of web page 1 of three proven beneath):

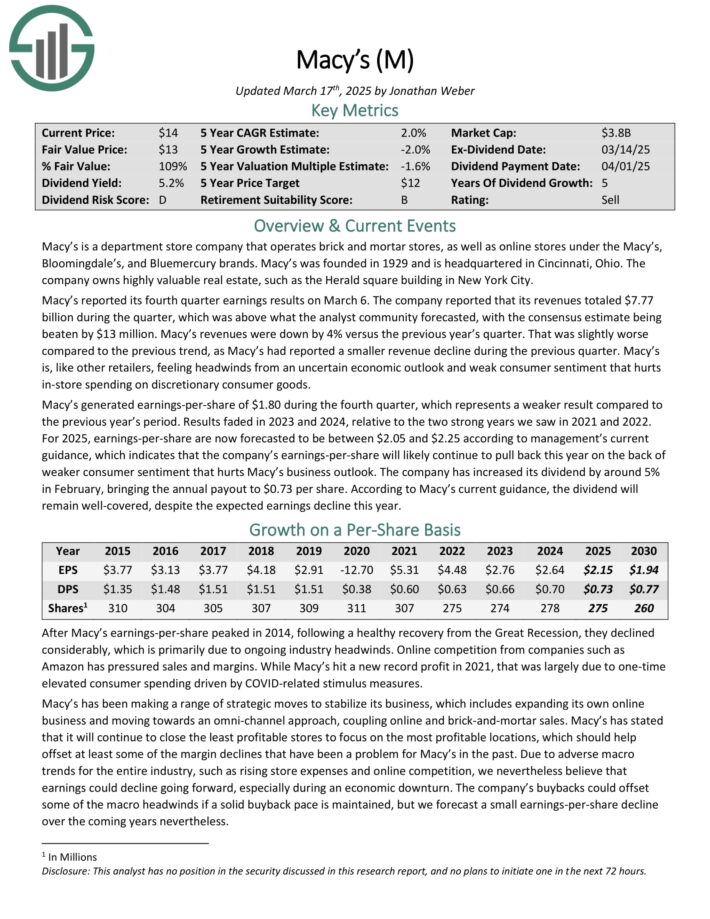

Undervalued Excessive Dividend Inventory #10: Virtus Funding Companions (VRTS) – P/E ratio of 6.4

Virtus Funding Companions, Inc. is a particular partnership of boutique funding managers, singularly dedicated to the long-term success of particular person and institutional traders.

The agency gives a various vary of funding methods throughout asset courses, together with fairness, mounted earnings, multi-asset, in addition to different investments.

These methods can be found in a number of product varieties, corresponding to open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates by means of a multi-manager mannequin, partnering with affiliated managers and choose unaffiliated sub-advisers, every sustaining distinct funding philosophies and processes.

This construction permits Virtus to supply purchasers entry to specialised experience and a broad array of options tailor-made to fulfill numerous monetary aims.

On January thirty first, 2025, Virtus reported its This fall and full-year outcomes for the interval ending December thirty first, 2024. Complete AUM fell by 5% sequentially to $175.0 billion because of internet outflows in institutional accounts and U.S. retail funds, and unfavorable market efficiency, partially offset by inflows in ETFs, international funds, and retail separate accounts.

Internet outflows of ($4.8) billion worsened from ($1.7) billion in Q3, primarily because of a $3.3 billion lower-fee partial redemption of an institutional mandate.

Nevertheless, adjusted EPS rose 8% to $7.50, pushed by greater funding administration charges and a comfortable enhance in working bills. For FY2025, we anticipate adjusted EPS of $26.81.

Click on right here to obtain our most up-to-date Certain Evaluation report on VRTS (preview of web page 1 of three proven beneath):

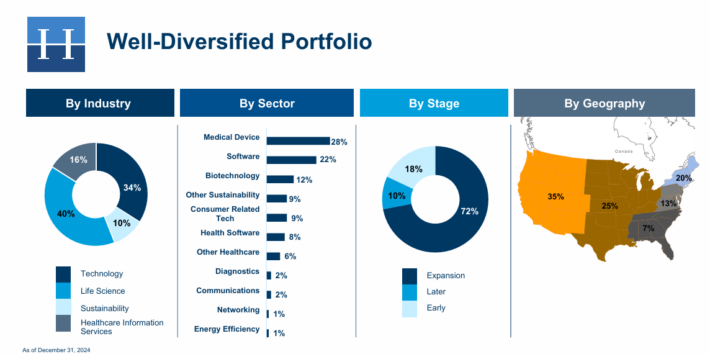

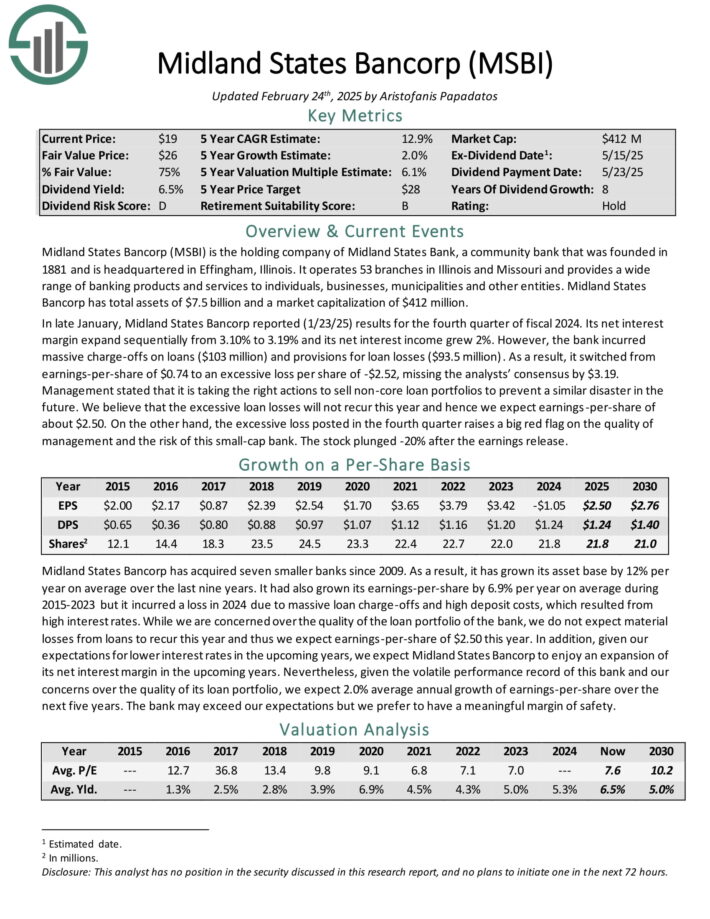

Undervalued Excessive Dividend Inventory #11: Horizon Expertise Finance (HRZN) – P/E ratio of seven.0

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

The corporate has generated engaging danger–adjusted returns by means of instantly originated senior secured loans and extra capital appreciation by means of warrants.

Supply: Investor Presentation

On March 4th, 2025, Horizon launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, complete funding earnings fell 16.7% year-over-year to $23.5 million, primarily because of decrease curiosity earnings on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in This fall of 2024 and This fall of 2023 was 14.9% and 16.8%, respectively.

Internet funding earnings per share (IIS) fell to $0.27, down from $0.45 in comparison with This fall-2023. Internet asset worth (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRZN (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #12: Vitality Switch LP (ET) – P/E ratio of seven.0

Vitality Switch owns and operates one of many largest and most diversified portfolios of power property in the USA.

Operations embrace pure fuel transportation and storage together with crude oil, pure fuel liquids, refined product transportation, and storage totaling 83,000 miles of pipelines.

Vitality Switch operates with a primarily fee-based mannequin, which considerably mitigates the sensitivity of the MLP to commodity costs.

In mid-February, Vitality Switch reported (2/11/25) monetary outcomes for the fourth quarter of fiscal 2024. The MLP continued to develop its volumes in all of the segments. Consequently, adjusted EBITDA grew 8% over the prior 12 months’s quarter.

Vitality Switch maintained a wholesome distribution protection ratio of 1.8 and raised the quarterly distribution by 0.8%, on high of the distribution hikes in every of the twelve earlier quarters.

Because of robust development within the demand for its networks, Vitality Switch supplied constructive steering for 2025, anticipating adjusted EBITDA $16.1 to $16.5 billion. This steering implies 5% development on the mid-point.

Click on right here to obtain our most up-to-date Certain Evaluation report on ET (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #13: Ford Motor Firm (F) – P/E ratio of seven.2

Ford Motor Firm was first integrated in 1903 and up to now 120 years, it has change into one of many world’s largest automakers. It operates a big financing enterprise in addition to its core manufacturing division, which produces a preferred assortment of automobiles, vans, and SUVs.

Ford posted fourth quarter and full-year earnings on February fifth, 2025, and outcomes have been higher than anticipated. Adjusted earnings-per-share got here to 39 cents, which was seven cents forward of estimates.

Income was up nearly 5% year-over-year for the quarter to $48.2 billion, which additionally beat estimates by $5.37 billion. The fourth quarter was the best income complete the corporate has ever produced.

Ford Blue elevated 4.2% to $27.3 billion in income for the fourth quarter, beating estimates of $25.9 billion. Mannequin e income was down 13% year-over-year to $1.4 billion, $400 million lower than anticipated.

Ford Professional income was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this 12 months, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free money movement of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ford (preview of web page 1 of three proven beneath):

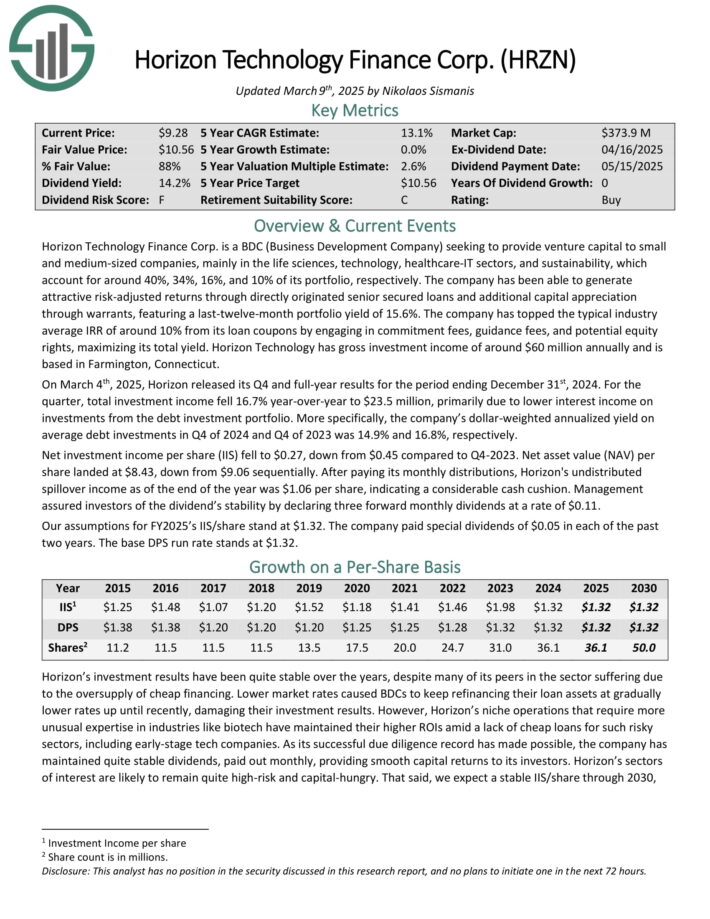

Undervalued Excessive Dividend Inventory #14: Canandaigua Nationwide Company (CNND) – P/E ratio of seven.2

Canandaigua Nationwide Company (CNC) is the mum or dad firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF).

The corporate gives a variety of economic companies, together with banking, lending, mortgage companies, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is concentrate on serving native communities by offering personalised monetary options to people, companies, and municipalities. CNC emphasizes group banking, specializing in reinvesting within the native economic system by means of a various lending portfolio.

Transferring ahead, we anticipate CNC’s EPS to develop at a CAGR of 5%. Observe that the corporate has elevated its dividend yearly since 2002, marking 22 years of consecutive annual dividend will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNND (preview of web page 1 of three proven beneath):

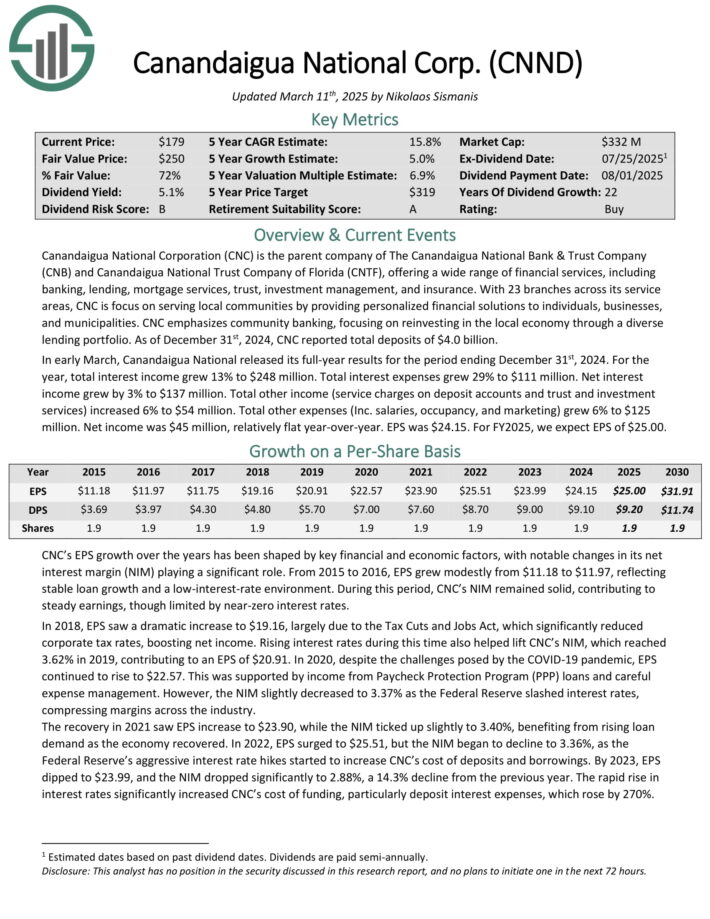

Undervalued Excessive Dividend Inventory #15: Midland States Bancorp (MSBI) – P/E ratio of seven.2

Midland States Bancorp (MSBI) is the holding firm of Midland States Financial institution, a group financial institution that was based in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and offers a variety of banking services and products to people, companies, municipalities and different entities. Midland States Bancorp has complete property of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) outcomes for the fourth quarter of fiscal 2024. Its internet curiosity margin increase sequentially from 3.10% to three.19% and its internet curiosity earnings grew 2%.

Nevertheless, the financial institution incurred large charge-offs on loans ($103 million) and provisions for mortgage losses ($93.5 million).

Consequently, it switched from earnings-per-share of $0.74 to an extreme loss per share of -$2.52, lacking the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. Consequently, it grew its asset base by 12% per 12 months on common over the past 9 years.

It had additionally grown its earnings-per-share by 6.9% per 12 months on common throughout 2015-2023 nevertheless it incurred a loss in 2024 because of large mortgage charge-offs and excessive deposit prices, which resulted from excessive rates of interest.

Click on right here to obtain our most up-to-date Certain Evaluation report on MSBI (preview of web page 1 of three proven beneath):

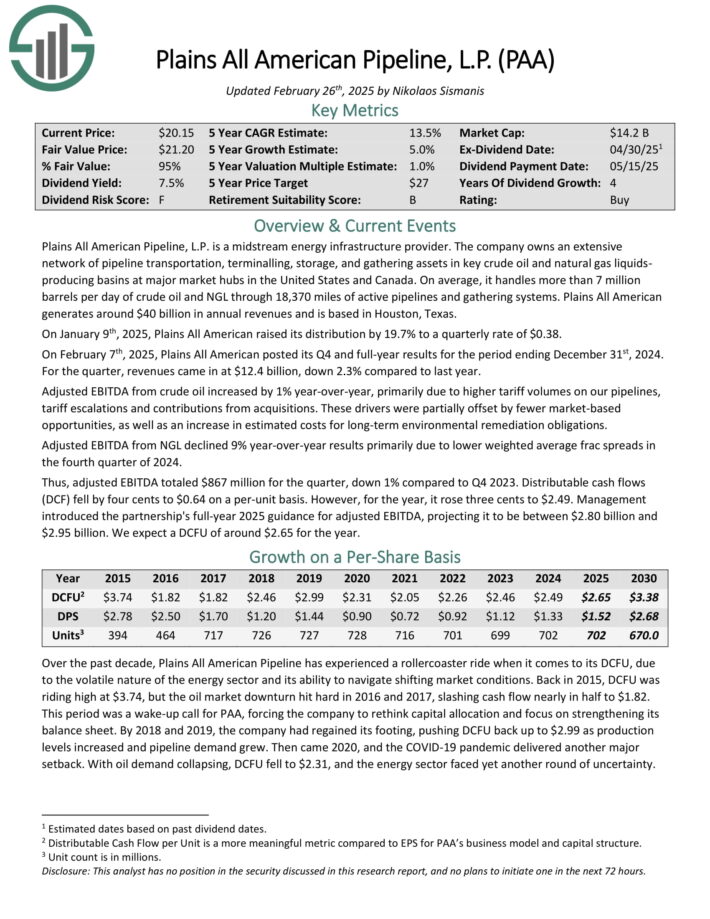

Undervalued Excessive Dividend Inventory #16: Plains All American LP (PAA) – P/E ratio of seven.6

Plains All American Pipeline, L.P. is a midstream power infrastructure supplier. The corporate owns an in depth community of pipeline transportation, terminaling, storage, and gathering property in key crude oil and pure fuel liquids-producing basins at main market hubs in the USA and Canada.

Supply: Investor Presentation

On February seventh, 2025, Plains All American posted its This fall and full-year outcomes for the interval ending December thirty first, 2024.

For the quarter, revenues got here in at $12.4 billion, down 2.3% in comparison with final 12 months. Adjusted EBITDA from crude oil elevated by 1% year-over-year, primarily because of greater tariff volumes on its pipelines, tariff escalations and contributions from acquisitions.

Adjusted EBITDA from NGL declined 9% year-over-year outcomes primarily because of decrease weighted common frac spreads within the fourth quarter of 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on PAA (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #17: Peoples Monetary Companies (PFIS) – P/E ratio of seven.8

Peoples Monetary Companies (PFIS) is the holding firm of Peoples Safety Financial institution and Belief Firm, a group financial institution that was based in 1905 and is headquartered in Scranton, Pennsylvania.

It operates 44 branches in Pennsylvania and offers numerous banking services and products to shoppers, municipalities and companies.

On July 1st, 2024, Peoples Monetary Companies accomplished its acquisition of FNCB Bancorp in an all-stock deal. As per the phrases of the deal, the shareholders of FNCB now personal ~29% of the mixed entity.

Because of the merger, the financial institution grew its complete property from $3.7 billion to $5.5 billion and thus it grew to become the fifth largest group financial institution in Pennsylvania.

In early February, Peoples Monetary Companies reported (2/6/24) monetary outcomes for the fourth quarter of fiscal 2024. Loans and deposits grew 40% and 28%, respectively, over the prior 12 months’s quarter, because of the acquisition of FNCB Bancorp.

Internet curiosity margin expanded impressively, from 2.30% within the prior 12 months’s quarter to three.25% because of the a lot greater internet curiosity margin of the acquired financial institution.

Click on right here to obtain our most up-to-date Certain Evaluation report on PFIS (preview of web page 1 of three proven beneath):

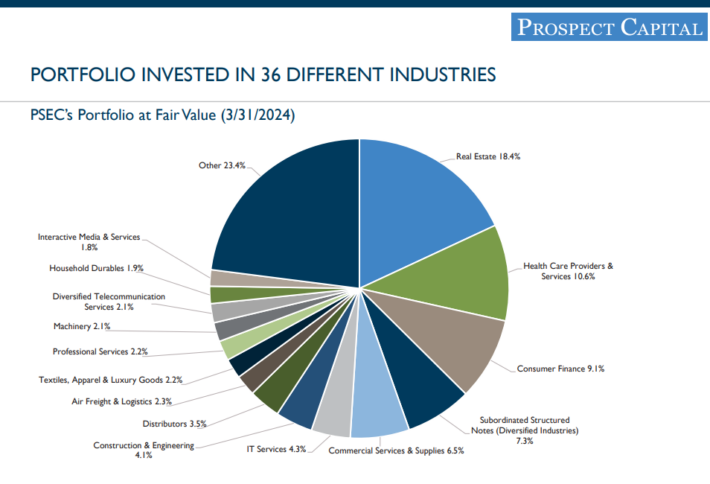

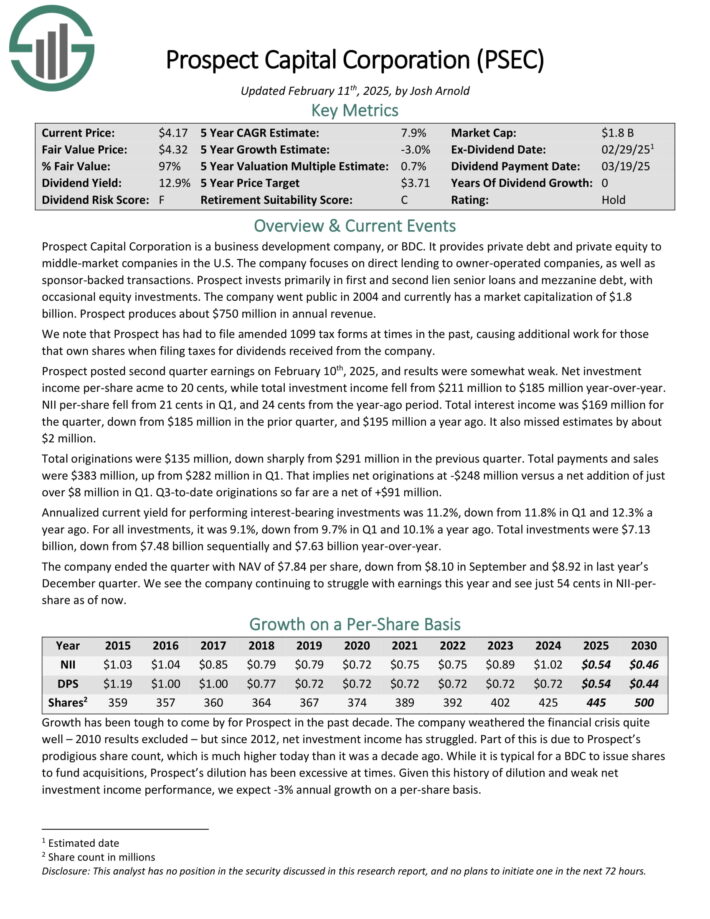

Undervalued Excessive Dividend Inventory #18: Prospect Capital (PSEC) – P/E ratio of seven.9

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect posted second quarter earnings on February tenth, 2025, and outcomes have been considerably weak. Internet funding earnings per-share acme to twenty cents, whereas complete funding earnings fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago interval. Complete curiosity earnings was $169 million for the quarter, down from $185 million within the prior quarter, and $195 million a 12 months in the past. It additionally missed estimates by about $2 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #19: Delek Logistics Companions LP (DLK) – P/E ratio of seven.9

Delek Logistics Companions, LP is a publicly traded grasp restricted partnership (MLP) headquartered in Brentwood, Tennessee.

Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a community of midstream power infrastructure property.

These property embrace roughly 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily positioned within the southeastern United States and west Texas.

The corporate’s operations are integral to Delek US’s refining actions, notably supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics offers companies corresponding to gathering, transporting, and storing crude oil, in addition to advertising and marketing, distributing, and storing refined merchandise for each Delek US and third-party prospects.

On February 25, 2025, Delek Logistics Companions (DKL) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved an adjusted EBITDA of roughly $107.2 million, a rise from $100.9 million in the identical interval of the earlier 12 months.

Distributable money movement was $69.5 million, with a protection ratio of roughly 1.2 occasions. The Gathering and Processing phase noticed an adjusted EBITDA of $66 million, up from $53.3 million in This fall 2023, primarily because of greater throughput from Permian Basin property and contributions from the H2O Midstream acquisition.

Click on right here to obtain our most up-to-date Certain Evaluation report on DKL (preview of web page 1 of three proven beneath):

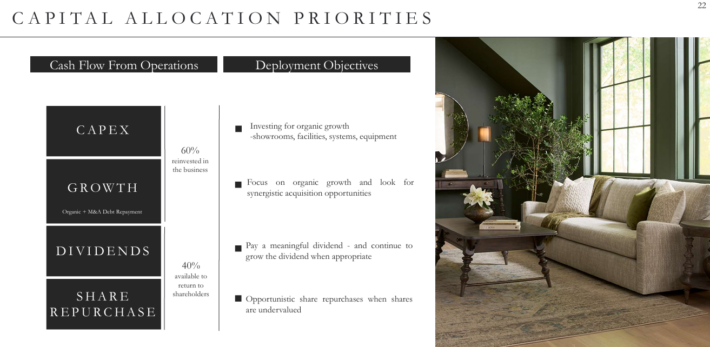

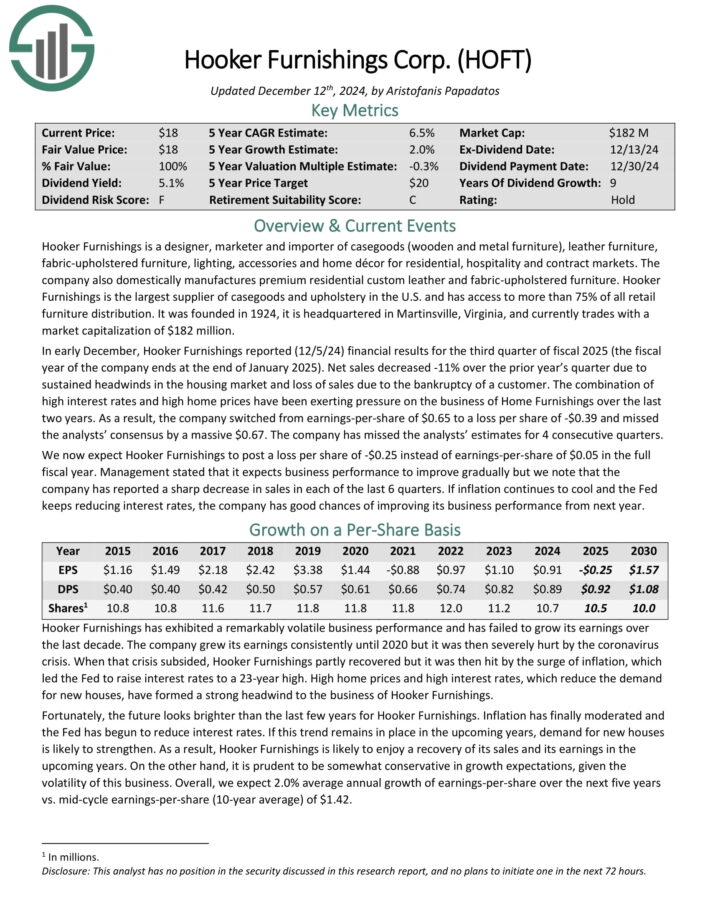

Undervalued Excessive Dividend Inventory #20: Hooker Furnishings Company (HOFT) – P/E ratio of seven.9

Hooker Furnishings is a designer, marketer and importer of casegoods (picket and metallic furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the most important provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

Supply: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) monetary outcomes for the third quarter of fiscal 2025. Internet gross sales decreased -11% over the prior 12 months’s quarter because of sustained headwinds within the housing market and lack of gross sales as a result of chapter of a buyer.

The mixture of excessive rates of interest and excessive residence costs have been exerting stress on the enterprise of House Furnishings over the past two years.

Consequently, the corporate switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by a large $0.67.

Click on right here to obtain our most up-to-date Certain Evaluation report on HOFT (preview of web page 1 of three proven beneath):

Ultimate Ideas

All of the above shares are buying and selling at remarkably low cost valuation ranges because of some enterprise headwinds. A few of them have been damage by excessive inflation or the most recent financial slowdown whereas others are going through their very own particular points.

Furthermore, all of the above shares are providing dividend yields above 5%. Consequently, they make it a lot simpler for traders to attend patiently for the enterprise headwinds to subside.

If you’re desirous about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.