Merchants,

It was one other constructive week available in the market, with a pullback and relaxation interval towards the 50-day SPY. That was an excellent transfer, enabling a number of large-cap shares to additional construct earlier than breaking out for continuation. Names from final week’s watchlist, like HOOD and TESLA, each adopted by excellently to the upside, providing incredible R/R.

With glorious follow-through final week after a multi-day pullback and relaxation interval, I’m coming into this week a bit extra nimble. I’ll be on excessive alert for feedback and developments from the China—US commerce talks and earnings play, with many firms nonetheless reporting.

So, with that being stated, let’s get into a few of my prime focuses for the upcoming week, together with a number of large-cap and small-cap concepts.

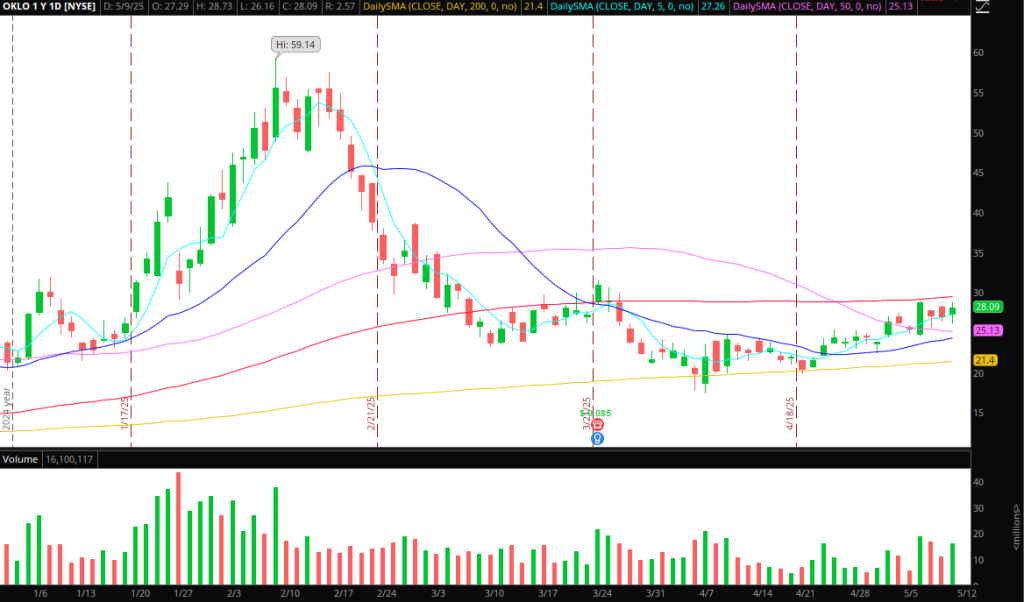

Consolidation Breakout in OKLO: Strong reclaim final week of its 50-day, and optimistic sector feedback. Just like the plan in HOOD from the earlier week, for instance, I’m searching for additional construct and consolidation breakout, or a gap drive entry above Friday’s excessive. For entry, I’d look to enter lengthy above Friday’s excessive with a LOD cease. Goal 1 is the latest pivot excessive of $31.5 and 1 ATR from the breakout level. Thereafter, I’d depart a core on trailing in opposition to both the LOD or maintain beneath VWAP, relying on the intraday motion and quantity.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

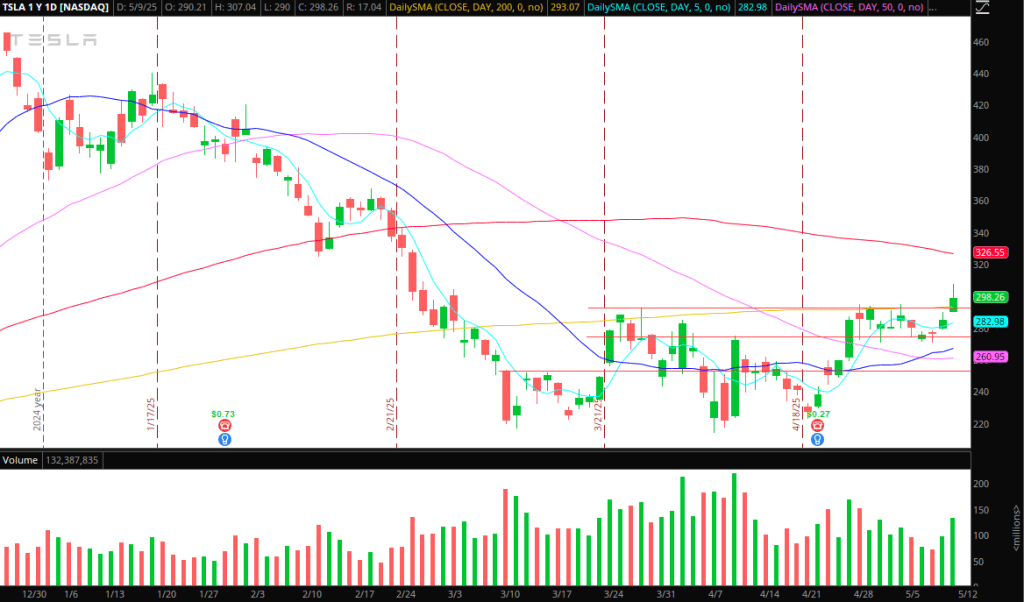

TSLA: Wonderful breakout Friday and measured transfer into the 1 ATR goal. I closed out the multi-day swing on Friday. Going ahead, I’ll search for intraday momentum if the inventory holds above $295 on dips and shows relative energy to the general market. If dips get purchased into $295, I’ll search for a protracted in opposition to the low, with targets between Friday’s key resistance areas, particularly $300 – $303 and $307. I’m open to holding a swing core once more if we maintain above VWAP and show relative energy for continuation above Friday’s excessive.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

HIMS: At this level, I’m treating this as a buying and selling car. Wonderful follow-through and momentum final week. With a maintain above its 5-day and $50, sturdy momentum, and excessive brief curiosity, this would possibly expertise additional upward momentum this week. Above Friday’s excessive, I’ll be searching for intraday momentum lengthy scalps, and stay lengthy biased. Ideally, this extends for a number of days to the upside earlier than establishing a possible A+ reversion alternative. Nonetheless a protracted approach to go for that to occur, however that’s what I might be fascinated about. Till that units up, both with a number of days of extension to the upside into $60 +, I’ll be targeted on momentum to the upside, till it extends or fails to carry above $50.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

Failed-Comply with Via Setups in Small-Scaps

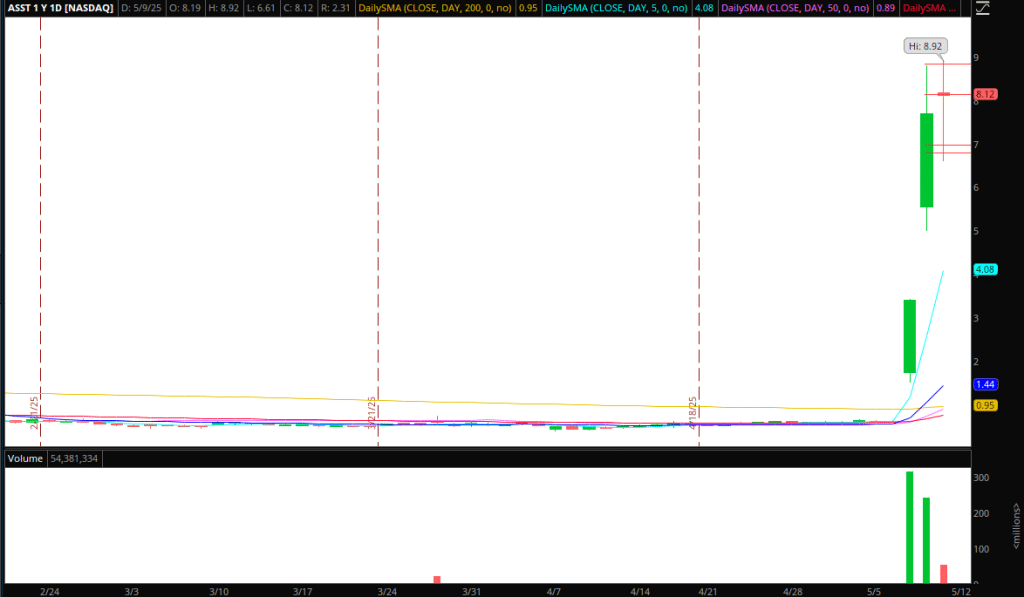

ASST: Strong uptrend break on Friday with failed follow-through into resistance ($8.8 – $9). Going ahead I’ll search for momentum beneath $7, or failed strikes and decrease highs towards resistance and provide close to $8.5 – $9 for intraday shorts.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

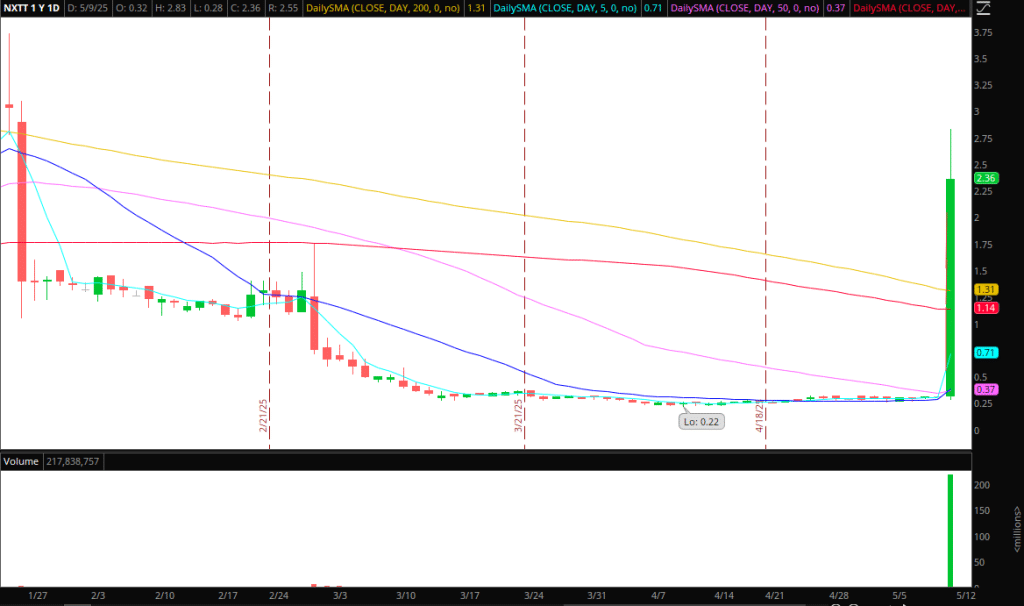

NXTT: This one caught shorts off guard Friday, and blew out within the AHs. After such an excessive transfer on day 1, whereas we’re in a robust small-cap cycle, I’m extra inclined to search for a brief going ahead. All of it will depend on the place this opens on Monday. Typically, I’ll now be targeted on failed strikes above $4, into $5, and arduous stuffs for a brief in opposition to the excessive, with both a 5-min decrease excessive path or brief in opposition to the HOD, relying on the motion. I’ve no real interest in shorting within the gap on any important hole down. Any $5 reclaim and push, I’ll be arms off ready for the bottom.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

SYTA: I’ll simply set alerts on this identify: $1.7 – $2 to observe value motion if we get again within the vary. If the inventory stuffs close to $2, I’d search for an intraday brief scalp.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

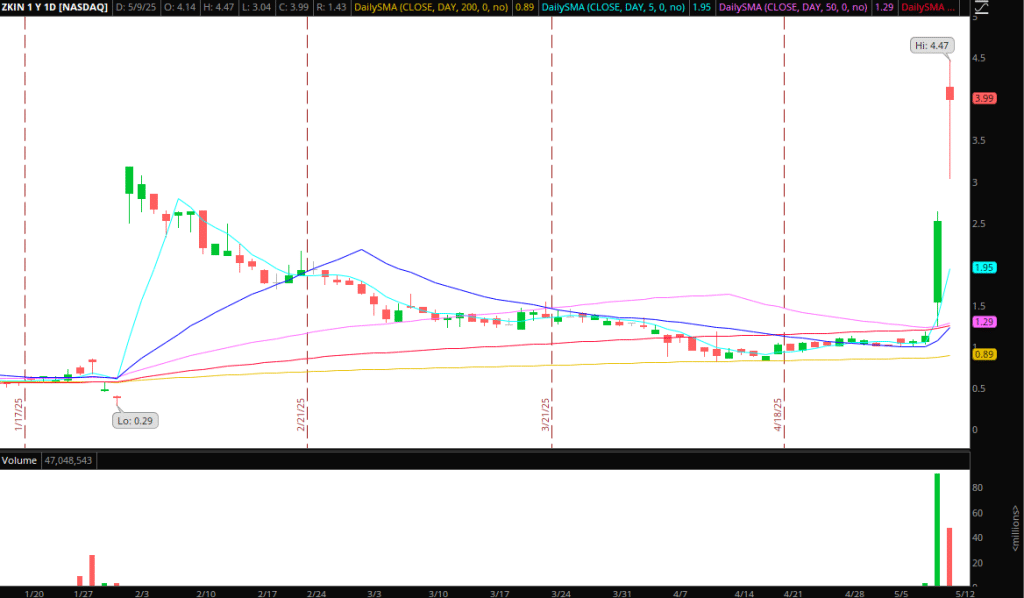

ZKIN: That is one other one I’ll have alerts for. If there is no such thing as a providing or hole down, I’ll monitor this for sideways motion and a possible liquidity entice for a squeeze greater.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements similar to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures