Dealer, I sit up for sharing a number of high concepts for the upcoming week, together with entry and exit targets.

With a number of of the latest larger timeframe lengthy concepts taking part in out completely, together with a stretched market to the upside, the week forward emphasizes persistence and permitting charts to arrange favorably once more. To repeat an excellent analogy I heard this week, “let the prepare pull into the station”. As I outlined in my latest IA assembly, I’m monitoring a number of main sectors and leaders inside these sectors. So I gained’t repeat that record intimately. As a substitute, listed below are just some of my focuses for the upcoming week:

Consolidation Breakout in MVST: nice breakout above its latest 52-week highs. Spent most of final week discovering resistance close to $3.5 and consolidating above its 5-day SMA. With the Moody’s downgrade, we might get a niche down throughout the board. If it seems to be a nothingburger, and we see sharp reclaims, MVST will likely be on shut look ahead to a breakout above final week’s excessive.

Particularly, I’ll be trying to enter lengthy above Friday’s excessive, with a cease at LOD. My first goal can be 1-ATR to a measured transfer, so between $3.8 – $4 to take a chunk off, and commerce round a core trailing towards LOD. I’d be trying to maintain for a number of days, trailing towards LOD, and piecing out on extensions above VWAP.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

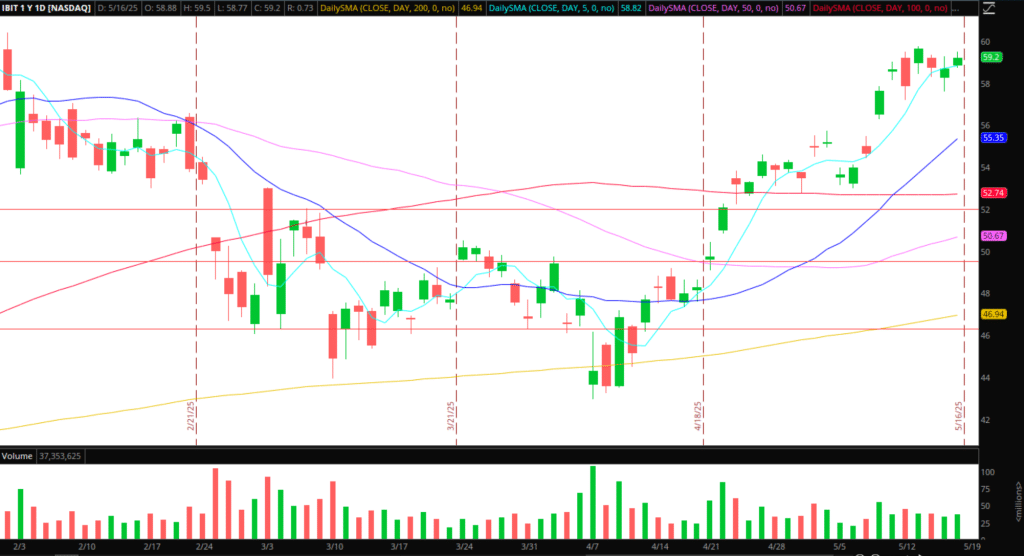

Consolidation Breakout in Bitcoin: Bitcoin is flagging throughout a number of timeframes. There are numerous autos to precise this concept, however I’ll give attention to IBIT. Particularly, I might search for an entry to the lengthy facet if we break above Friday’s excessive, close to $59.5, and add by $60. Main resistance close to $61 can be my first goal, with a $60 cease. Thereafter, I might maintain a core towards the day’s low for potential follow-through to the upside.

Alternatively, on the off likelihood we stuff and pull again, I might be open to intraday momentum shorts on a consolidation breakdown, focusing on intraday momentum to the draw back so long as we maintain under the $57.50s in IBIT and preserve decrease highs on the 5-minute under VWAP intraday.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Reset and Additional Construct in Tesla: The identical plan applies to a bunch of names I reviewed in my latest IA assembly. Improbable follow-through on the swing thought in Tesla and plenty of different names. Now, I must see a pullback and reset of the chart, establishing a contemporary entry to the lengthy facet for continuation. For instance, a pullback in Tesla towards $335 or the 5-day assist established and some range-bound days earlier than establishing a contemporary breakout lengthy entry after a interval of relaxation. The same plan was mentioned in HOOD and a number of other others in IA.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Pullback into Prior Resistance RKLB: After breaking out above prior resistance close to $23.7, I’m on the lookout for a secondary lengthy entry if we retest $23.7 – $24, discover assist, and ensure a better low towards Thursday’s low. If we do, and reclaim intraday / multi-day VWAP on a pullback, I’d look to get lengthy towards the LOD with Friday’s excessive as goal one, and trailing the remaining towards the day’s low for continuation over a number of days. Ideally, after a better low is confirmed, we base for just a few days, setting a better low and breakout entry throughout the each day timeframe.

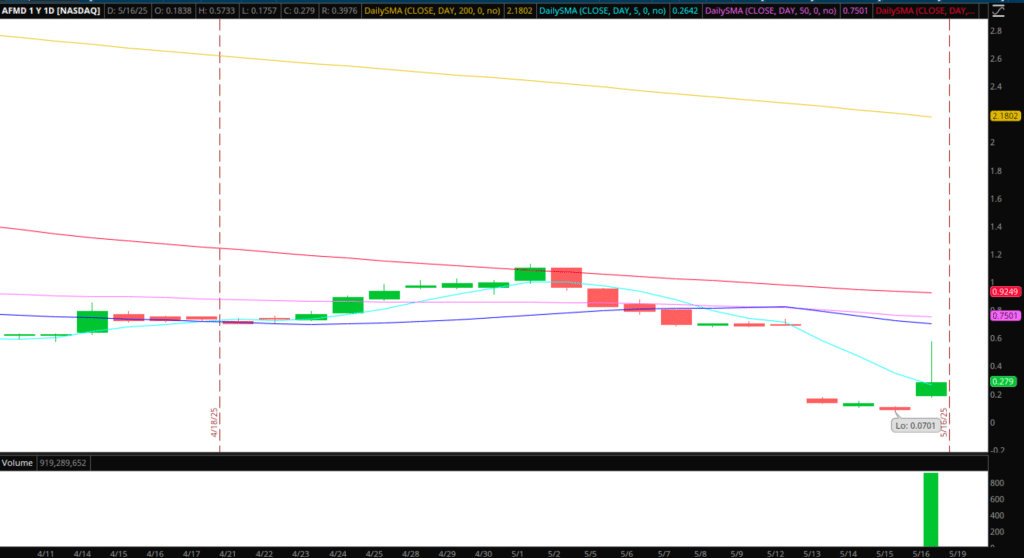

Pops to Quick in AFMD: Standout small-cap alternative on Friday. Buying and selling is to be suspended within the title on Could 20. Whereas uncertain, I’m hoping we get a possibility to re-short the title on a push again into .35 – .40c. If the inventory catches a bid again towards resistance and provide inside that vary, I’d look to quick towards the HOD and maintain for a transfer again into 0.20. With buying and selling to be suspended on Could 20, this both develops on Monday or it’s an keep away from.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

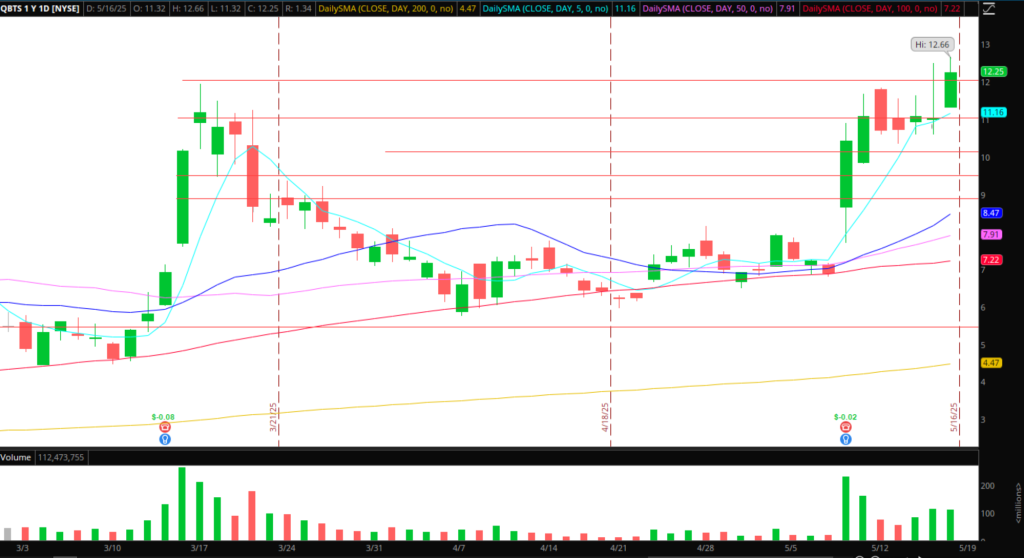

Failed Comply with-through in QBTS: QBTS continues to search out resistance at a big band of provide close to highs and $12. If I discover some failed follow-through by $12, and relative weak spot develops, I’d search for a starter quick towards the HOD. I’d solely look to dimension in if the inventory holds under $11.5 after which breaks under Friday’s low. At that time, I might decrease my cease to the 5-minute low excessive, piecing out on extension under VWAP, in the end focusing on a transfer towards the low $10s.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements reminiscent of liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures