Charge cuts dominate dwelling mortgage market | Australian Dealer Information

Information

Charge cuts dominate dwelling mortgage market

Get the newest from Canstar

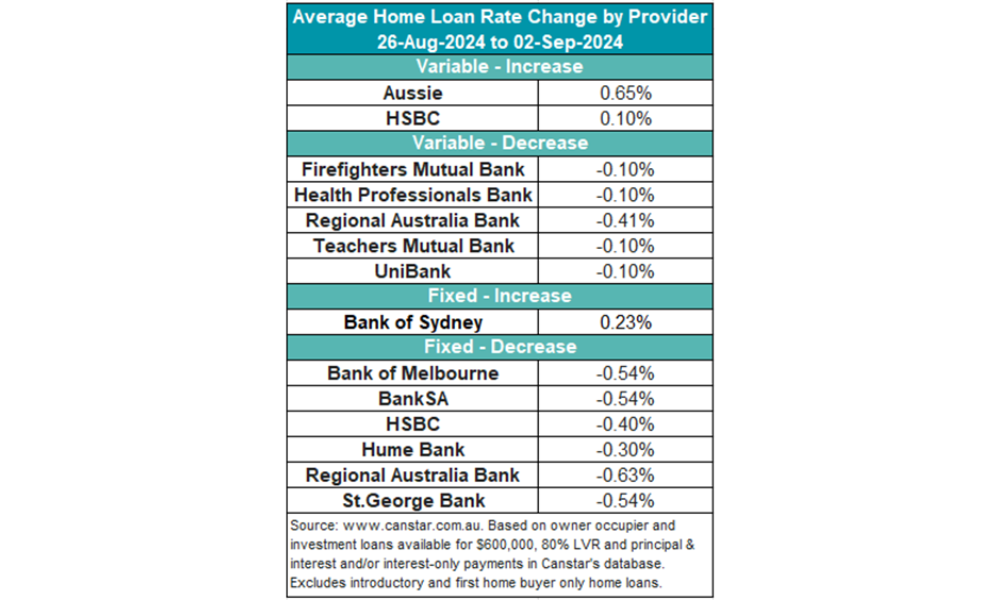

Canstar reported important motion within the dwelling mortgage market over the previous week, with six lenders slicing 196 owner-occupier and investor variable charges by a mean of 0.5%.

“Mounted charge cuts continued to dominate the adjustments within the dwelling mortgage market during the last week,” mentioned Sally Tindall (pictured above), Canstar knowledge insights director.

Few lenders up charges amid broad reductions

Whereas most lenders diminished charges, two lenders elevated three owner-occupier and investor variable charges by a mean of 0.28%. Financial institution of Sydney raised six fastened charges by 0.16%, displaying some resistance to the broader development of charge cuts.

Macquarie Financial institution surges in mortgage market

Macquarie Financial institution recorded a 1.6% improve within the worth of residential mortgages for July, displaying robust 13.4% development in comparison with a yr in the past. In distinction, NAB’s mortgage e book noticed a uncommon decline of $329 million, the primary drop since October 2020.

“This transfer was as anticipated, following Westpac’s sweeping fastened charge cuts a few weeks in the past on August 21,” Tindall mentioned.

See desk under for the abstract of charge adjustments for the August 26 to September 2 week.

Lowest variable charge nonetheless at 5.75%

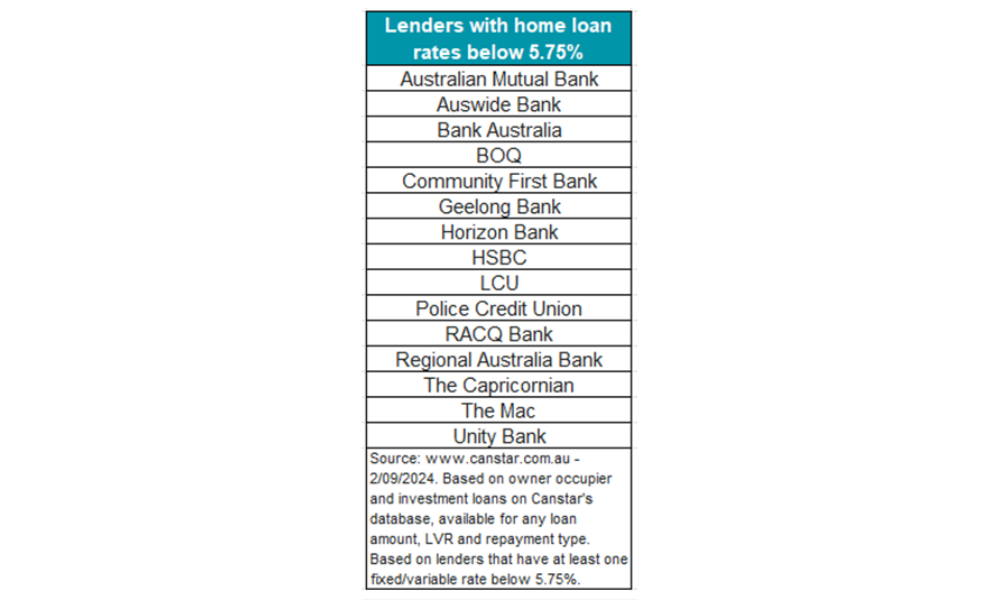

The bottom variable charge stays at 5.75%, provided by Abal Banking. At present, there are 33 charges under this mark on Canstar’s database, providing aggressive choices for debtors within the present market.

Under is the checklist of lenders providing variable charges at 5.75%.

To match the newest figures from that of the earlier week, click on right here.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day publication.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing checklist, it’s free!