The pullback in mega-cap, AI, and different tech shares has continued since we mentioned corrections and rotation in our latest market replace article. Whereas the pullback within the S&P 500 “SPX” (SP500) has been modest (3.5%), the Nasdaq 100 (6% decline), and particular high-quality tech shares, specifically, have felt the ache a lot worse. I singled out a couple of tech shares a number of weeks in the past that regarded “toppy.” Let’s have a look at how these and different favored high-flyers have carried out since then.

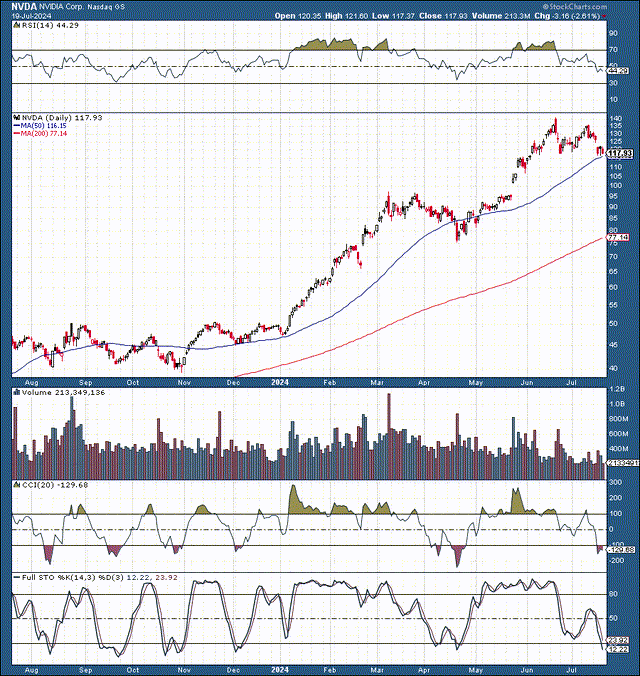

1. Nvidia (NVDA) – We got here fairly near calling a short-term high in our “near-term high article.” Nvidia was round $136, and the following day, it put in a blowoff high, reaching practically $141 intraday after which closing beneath the day before today’s value motion.

NVDA (StockCharts.com | Superior Monetary Charts & Technical Evaluation Instruments)

Nvidia has declined by about 18% from its latest ATH, and the shopping for alternative may very well be close to. Whereas I could also be barely early, I just lately elevated my Nvidia stake by about 30% (late final week). I additionally took appreciable short-term earnings across the time the inventory peaked. We have reached our preliminary buy-in zone, however the inventory could pull again extra. In a worst-case situation, Nvidia’s inventory could shut the hole within the $110-105 vary, probably dropping down to round $100 if markets overshoot to the draw back. In any case, the shopping for alternative is right here, or very shut, in my opinion.

Be aware: The latest technical sample is sort of equivalent to the sample we witnessed within the March and April pullback section earlier than Nvidia’s most up-to-date run-up.

Basically, Nvidia’s ahead P/E a number of has dropped to about 32. This valuation is comparatively cheap given its market-leading AI place, immense development prospects, and different favorable components.

2. Micron (MU) – Micron was buying and selling round $154 once I referred to as out the inventory the day it topped. Now, Micron is round $114, roughly 27% beneath its latest ATH.

MU (StockCharts.com | Superior Monetary Charts & Technical Evaluation Instruments)

Now, Micron just isn’t so overbought anymore. Actually, with its CCI round -230, and its RSI approaching 30, Micron is changing into oversold. I initiated a place in Micron just lately, at round $115, because the inventory is way more engaging right here. In a worse-case situation, we may nonetheless see a decline to round $110-100. Basically, Micron now trades beneath 12 occasions ahead EPS estimates and it may outperform estimates as a result of AI impact and different constructive elements.

3. Broadcom (AVGO) – The third inventory that I brazenly picked on was Broadcom, which was additionally across the day that it peaked round its pre-split adjusted $1,850.

AVGO (StockCharts.com | Superior Monetary Charts & Technical Evaluation Instruments)

Broadcom has additionally dropped into my “buy-in” zone (split-adjusted $160-150). Whereas I’ve not picked up Broadcom shares but, I’ll doubtless provoke a place on this AI juggernaut within the coming classes. The inventory has corrected by about 18%, closing the hole across the $150 degree. AVGO just isn’t overbought anymore and will consolidate right here earlier than persevering with to advance. Furthermore, Broadcom’s ahead P/E ratio is solely 26 now, which is comparatively cheap for this very good AI inventory in a long-term market-leading place.

Different Notable Pullbacks In The Tech Area:

Apple (AAPL): 6% Microsoft (MSFT): 8.5% Amazon (AMZN): 10% Alphabet (GOOG) (GOOGL): 8% Meta (META): 15% AMD (AMD): 19% Tesla (TSLA): 14% Dell (DELL): 32% Snap (SNAP): 17% SoundHound AI (SOUN): 24%

Be aware: These are notable as a result of they’re mega-cap shares, or I personal them in my portfolio. In full disclosure, I personal the shares talked about aside from Apple, Microsoft, and Broadcom. I plan to purchase Broadcom quickly (doubtless as we speak).

The Takeaway

Regardless of the main averages declining modestly, many high-quality tech shares have had appreciable pullbacks and corrections. Additionally, we should always think about that there’s substantial rotation into small and mid-caps, pharmaceutical and biotech, oil and vitality, industrials and supplies, and different badly crushed down and uncared for sectors. This phenomenon has enabled the most important averages to remain afloat regardless of their most vital tech parts going via appreciable pullbacks and corrections.

Due to this fact, we could not want to see the textbook pullbacks or corrections of 5-10% or extra vital within the main averages. Many frothy valuations have been reset to applicable ranges, and given the favorable basic backdrop, we may even see new highs as a substitute of extra lows as we transfer forward. The first elements to think about are:

Constructive earnings and steering. Declining inflation. Strong financial knowledge (mushy touchdown). The Fed slicing charges quickly.

Earnings Have Been Strong And May Get Even Higher

Earnings (Investing.com)

Most firms have reported stable earnings, beating high and backside line estimates to kick off earnings season. Furthermore, many firms have supplied stable steering, suggesting we may see extra stable outcomes from high tech and different bellwether firms in future weeks. This week, we are going to see earnings bulletins from Alphabet, Tesla, and different high-profile firms. Moreover, subsequent week, we enter the center of earnings season with high tech corporations like Microsoft, Meta, and others reporting earlier than the month ends. Due to this fact, the latest tech selloff may present a wonderful alternative to buy high tech at a reduction proper in time as earnings start.

Inflation Continues To Retreat

Truflation inflation (Unbiased, financial & monetary knowledge in actual time on-chain)

Truflation inflation, a non-government, real-time inflation gauge, illustrates inflation round 1.8%, at its lowest degree in years and trending properly beneath the Fed’s 2% goal fee. We additionally witnessed the latest CPI inflation are available in decrease than anticipated. Thus, the upcoming core-PCE inflation may fall decrease than the market expects. The PCE will come out this Friday, and there’s a excessive likelihood it’s going to come in favorably, cementing the speed lower for September.

The Fed – Possible To Lower Charges Quickly

Charge chances (CMEGroup.com)

The likelihood of a fee lower in September is now round 96%, considerably increased than the 66% likelihood roughly one month in the past. As we see inflation declining and the labor market softening, it is changing into evident that the Fed will doubtless lower charges quickly. This dynamic is very favorable for the market and high-quality shares as a result of a extra accessible financial setting will ease credit score circumstances, enhance lending, and spur financial development and investments. Moreover, the September lower will doubtless be the primary fee lower of many, and the door shall be open to QE down the road, implying the Fed could need to “tolerate” increased inflation sooner or later. The upcoming financial setting is very favorable for danger property, particularly high-quality development and AI-oriented shares.

The Backside Line: Stay Bullish On Excessive-High quality Shares

We have seen substantial pullbacks in lots of our favourite know-how and AI-related shares. Whereas we may even see extra transitory volatility, it’s a stable time to discover shopping for alternatives in high-quality tech, AI, and different engaging areas. The SPX is across the 5,600-5,500 help space and will decline to the 5,400-5,300 help zone in a worse-case “correction” situation. Regardless of this plausibility, I stay constructive on the SPX and shares typically within the intermediate and long run. Additionally, I’m protecting my year-end SPX goal vary at 6,000-6,200 regardless of the latest transitory setbacks.

shapecharge

Truflation