Conflicting knowledge: Is wage progress cooling down or heating up? | Australian Dealer Information

Information

Conflicting knowledge: Is wage progress cooling down or heating up?

Why financial knowledge creates false prophets

Whereas the official ABS knowledge confirmed the Wage Worth Index (WPI) rose 0.8% in June quarter 2024, and 4.1% for the 12 months, the fact on the bottom is perhaps over double that, in accordance with payroll platform Employment Hero.

Employment Hero’s Month-to-month employment report discovered quarterly median wage progress was really up 2.0% and eight.8% over the 12 months, which in accordance with the corporate’s CEO and chief economist Ben Thompson, confirmed “wageflation is getting worse”.

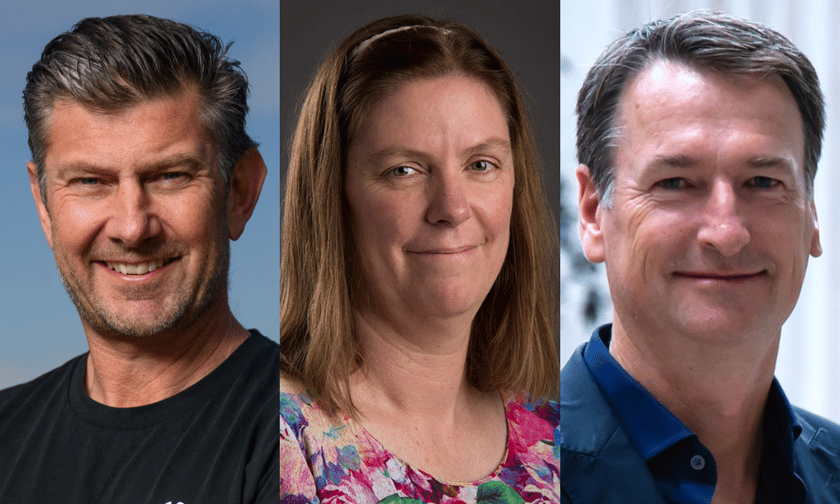

“It’s placing excessive stress on Australian small companies,” stated Thompson (pictured above left).

Thompson stated there’s a present lack of real-time transparency within the employment market and what somebody is price right this moment shouldn’t be essentially what they had been price yesterday.

“Because it stands, the information that employers and job seekers have entry to is both old-fashioned, unverified or not revealing the entire employment image,” he stated.

“That is very true with wage knowledge. Due to this the market is negotiating blindly.”

What the ABS wage progress knowledge says

Over the June quarter, personal sector wages grew by 0.7%, down from 0.9% within the March quarter 2024, in accordance with the ABS knowledge launched on Tuesday, the bottom quarterly rise since December 2021.

Annual wage progress within the personal sector was 4.1% in June quarter 2024, following three consecutive quarters at 4.2 % and better than the three.9 % progress recorded this time final 12 months.

Alternatively, public sector wages rose 0.9%, up from 0.6% within the March quarter 2024.

Michelle Marquardt (pictured above centre), ABS head of costs statistics, stated this was partly as a result of all Australian Public Service staff acquired pay will increase efficient March 14.

“This led to a bigger improve within the contribution Commonwealth jobs made to public sector wage progress. Pay rises for these jobs had beforehand been paid at completely different occasions throughout quarters relying on the timing of particular person company agreements,” she stated.

A separate NAB survey confirmed enterprise situations (which measure gross sales, employment and profitability) rose to 6 factors in July 2024 to be solely barely under their long-run common. Confidence declined two factors to at least one with falls throughout industries besides development and recreation.

Tim Keith (pictured above proper), managing director of Cap Area, a personal credit score funding supervisor and non-bank lender, stated each units of information spotlight the superb balancing act the central financial institution has in setting rates of interest subsequent month.

“Whereas the Reserve Financial institution of Australia (RBA) saved rates of interest on maintain in August, there may be nonetheless an opportunity that it may elevate rates of interest in September, given inflation stays sticky, wages progress continues to be comparatively excessive regardless of some cooling within the personal sector, and enterprise situations within the economic system stay sturdy,” he stated.

“If the RBA does elevate rates of interest once more, that will be beneficial for returns on personal credit score funds, that are sometimes floating fee and linked to market rates of interest.”

Whereas it’s troublesome to say how this knowledge will impression the RBA’s decision-making, analysts have made their predictions.

What the SmartWatch employment knowledge says

With the significance of the RBA’s determination in thoughts, Employment Hero’s newest SmartMatch Employment Report paints a special image.

From the July figures, the state with the best wage progress year-on-year is NSW (9.9%) and the state with the bottom is SA (6.7%).

State breakdowns

State

Median Hourly Price

Month-on-Month change

Yr-on-Yr change

ACT

$43.90

-0.1%

9.1%

NSW

$44.30

2.9%

9.9%

NT

$40.60

1.5%

9.4%

QLD

$41.80

3.1%

9.4%

SA

$40.0

3.5%

6.7%

TAS

$36.60

1.7%

7.3%

VIC

$41.80

1.8%

8.3%

WA

$41.0

1.8%

7.6%

At an business stage, Building and Commerce providers noticed the best year-on-year wage progress at 18.0%, adopted by Consulting and Technique at 14.0% and Actual Property and Property at 13.2%.

Among the many lowest wage progress had been industries reminiscent of Sport and Recreation (1.7%), Science and Expertise (2.8%), and Design and Structure (3.7%).

Full-time staff noticed the best year-on-year wage progress with 9.6%, part-time staff at 6.0% and casuals at 5.9%.

These aged 45-55 command the best hourly wage at $50.60 and noticed their wages improve by 12.0% year-on-year. These aged 14-17 noticed the weakest year-on-year progress at 5.0%.

Age

Median Hourly Price

Month-on-Month change

Yr-on-Yr change

14-17

$19.10

0.2%

5.0%

18-24

$34.20

2.1%

5.8%

25-44

$45.40

2.5%

8.6%

45-54

$50.60

2.0%

12.0%

55+

$44.40

2.0%

9.1%

Thompson stated the “ongoing wageflation” that Employment Hero’s 8.8% wage improve revealed was “an necessary metric that should be thought of by determination makers”, particularly when seen within the context of the RBA’s ongoing battle in opposition to inflation.

“The impacts of doubtless unsustainable wage progress should even be weighed in opposition to ASIC’s findings that enterprise failure charges are nearing recession ranges,” Thompson stated.

“By way of this month’s wage bounce, we suspect it may mirror the rise in minimal wages and awards that got here into impact on July 1.”

How the SmartMatch Employment Report differs from ABS knowledge

The median hourly wage knowledge included within the month-to-month SmartMatch Employment Report differs from what’s reported on by the ABS in a lot of methods.

For instance, the ABS’ Wage Worth Index, which is issued quarterly, relies on a pattern of 18,000 jobs drawn from 3,000 personal and public sector companies, in accordance with Thompson.

Survey invites are despatched to companies of all sizes, with each enterprise given an equal alternative to take part.

As compared, Thompson stated the SmartMatch wage knowledge is drawn straight from the 300,000 enterprise and over 2 million staff on the Employment Hero platform globally and is knowledgeable by real-time payroll knowledge.

“The SmartMatch Employment Report can be issued month-to-month to present the business an on-going and updated snapshot of employment in Australia,” he stated.

Moreover, whereas the ABS focuses on base pay, Employment Hero’s wage knowledge analyses the total compensation package deal which incorporates base pay, bonuses, commissions and different types or remuneration.

“This gives an alternate image of earnings and offers employers and job seekers a useful useful resource for making employment selections.”

Additional info on the methodology behind Employment Hero’s SmartMatch Employment Report and extra metrics might be discovered right here.

Studying tea leaves: The place are the false prophets now?

The contrasting figures from ABS and Employment Hero underscore the challenges in measuring and forecasting completely different features of the Australian economic system.

Whereas the ABS gives the authoritative benchmark, Employment Hero’s real-time knowledge gives a special perspective that highlights potential disparities in wage progress.

This divergence in knowledge highlights the complicated problem for the Reserve Financial institution of Australia (RBA) because it navigates its financial coverage selections.

The RBA should sift by way of numerous financial indicators, every probably pointing in several instructions, to find out essentially the most acceptable plan of action.

As RBA deputy governor Andrew Hauser famous in a current speech, predicting the exact path of financial coverage is fraught with uncertainty.

“It’s proper to wish to be assured that the central financial institution will convey inflation again to focus on and keep full employment: that’s the RBA’s mandate and we ought to be held to account for it,” Hauser stated to the Financial Society of Australia in Brisbane on Monday.

“However the coverage technique required to ship that end result, and the financial judgments that inform it, merely can’t be said with something like the identical diploma of certainty. These pretending in any other case are false prophets.”

On this context, the disparity between ABS and Employment Hero’s knowledge emphasises the necessity for a nuanced understanding of wage traits and their implications for broader financial coverage.

As companies, staff, and policymakers seek for that means among the many financial tea leaves, the problem stays to stability real-time knowledge with official metrics to craft a path ahead.