Design Selections in ML and the Cross-Part of Inventory Returns

Latest developments in machine studying have considerably enhanced the predictive accuracy of inventory returns, leveraging complicated algorithms to investigate huge datasets and establish patterns that conventional fashions usually miss. The most recent empirical examine by Minghui Chen, Matthias X. Hanauer, and Tobias Kalsbach exhibits that design selections in machine studying fashions, comparable to function choice and hyperparameter tuning, are essential to bettering portfolio efficiency. Non-standard errors in machine studying predictions can result in substantial variations in portfolio returns, highlighting the significance of sturdy mannequin analysis strategies. Integrating machine studying strategies into portfolio administration has proven promising leads to optimizing inventory returns and general portfolio efficiency. Ongoing analysis focuses on refining these fashions for higher monetary outcomes.

Present analysis exhibits substantial variations in key design choices, together with algorithm choice, goal variables, function remedies, and coaching processes. This lack of consensus leads to vital final result variations and hinders comparability and replicability. To handle these challenges, the authors current a scientific framework for evaluating design selections in machine studying for return prediction. They analyze 1,056 fashions derived from varied combos of analysis design selections. Their findings reveal that design selections considerably impression return predictions. The non-standard error from unsuitable selections is 1.59 instances increased than the usual error.

Key findings embody:

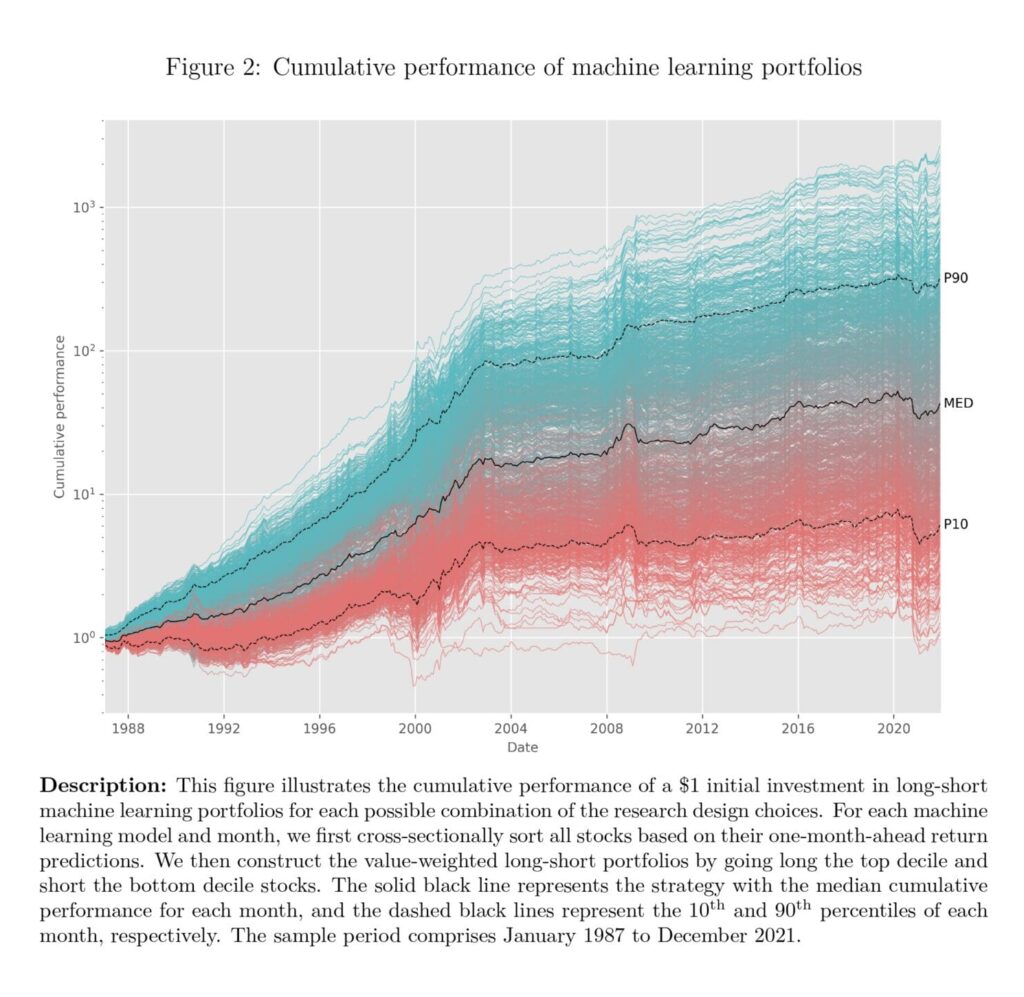

ML returns differ considerably throughout design selections (see Determine 2 beneath).

Non-standard errors arising from design selections exceed normal errors by 59%.

Non-linear fashions are likely to outperform linear fashions just for particular design selections.

The authors present sensible suggestions within the type of actionable steering for ML mannequin design.

The examine identifies probably the most influential design selections affecting portfolio returns. These embody post-publication remedy, coaching window, goal transformation, algorithm, and goal variable. Excluding unpublished options in mannequin coaching decreases month-to-month portfolio returns by 0.52%. An increasing coaching window yields a 0.20% increased month-to-month return than a rolling window.

Moreover, fashions with steady targets and forecast combos carry out higher, highlighting the significance of those design selections. The authors present steering on deciding on acceptable choices based mostly on financial results. They suggest utilizing irregular returns relative to the market because the goal variable to attain increased portfolio returns. Non-linear fashions outperform linear OLS fashions below particular situations, comparable to steady goal returns or increasing coaching home windows. The examine emphasizes the necessity for cautious consideration and rational justification of analysis design selections in machine studying.

Authors: Minghui Chen, Matthias X. Hanauer, and Tobias Kalsbach

Title: Design selections, machine studying, and the cross-section of inventory returns

Hyperlink: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5031755

Summary:

We match over one thousand machine studying fashions for predicting inventory returns, systematically various design selections throughout algorithm, goal variable, function choice, and coaching methodology. Our findings exhibit that the non-standard error in portfolio returns arising from these design selections exceeds the usual error by 59%. Moreover, we observe a considerable variation in mannequin efficiency, with month-to-month imply top-minus-bottom returns starting from 0.13% to 1.98%. These findings underscore the crucial impression of design selections on machine studying predictions, and we provide suggestions for mannequin design. Lastly, we establish the situations below which non-linear fashions outperform linear fashions.

As all the time, we current a number of bewitching figures and tables:

Notable quotations from the educational analysis paper:

“The primary findings of our examine will be summarized as follows: First, we doc substantial variation in top-minus-bottom decile returns throughout totally different machine studying fashions. For instance, month-to-month imply returns vary from 0.13% to 1.98%, with corresponding annualized Sharpe ratios starting from 0.08 to 1.82.Second, we discover that the variation in returns resulting from these design selections, i.e., the non-standard error, is roughly 1.59 instances increased than the usual error from the statistical bootstrapping course of.

[. . .] we contribute to research that present tips for finance analysis. For example, Ince and Porter (2006) supply tips for dealing with worldwide inventory market knowledge, Harvey et al. (2016) suggest the next hurdle for testing the importance of potential elements, and Hou et al. (2020) suggest strategies for mitigating the impression of small shares in portfolio types. By providing steering on design selections for machine learning- based mostly inventory return predictions, we assist scale back uncertainties in mannequin design and improve the interpretability of prediction outcomes.

[. . .] examine has vital implications for machine studying analysis in finance. A deeper understanding of the crucial design selections is crucial for optimizing machine studying fashions, thereby enhancing their reliability and effectiveness in predicting inventory returns. By addressing variations in analysis settings, our work helps researchers demon- strate the robustness of their findings and scale back non-standard errors in future research. This, in flip, permits for extra correct and nuanced interpretations of outcomes.

When predicting inventory returns utilizing machine studying algorithms, researchers and prac- titioners face a lot of vital methodological selections. We establish such variations in design selections in a number of revealed machine-learning research, all of which predict the cross-section of inventory returns. Extra particularly, these research embody Gu et al. (2020), Freyberger et al. (2020), Avramov et al. (2023), and Howard (2024) for U.S. market, Rasekhschaffe and Jones (2019) and Tobek and Hronec (2021) for world developed mar- kets, Hanauer and Kalsbach (2023) for rising markets, and Leippold et al. (2022) for the Chinese language market. In whole, we establish variations in seven widespread analysis design selections throughout these research, and we categorize them into 4 major varieties concerning the algorithm, goal, function, and coaching course of. Desk 1 summarizes the particular design selections of those research.

Subsequent, we examine the efficiency dispersion of the totally different machine-learning strate- gies ensuing from totally different design selections. Determine 2 exhibits the cumulative efficiency of the 1,056 long-short portfolios. Every line represents the efficiency of 1 particular set of analysis design selections.The determine exhibits that the variation in design selections results in a considerable variation in returns. A hypothetical $1 funding in 1987 results in a closing wealth starting from $0.94 (annual compounded return of -0.17%) to $2,652 (annual compounded return of 24.48%) in 2021. The perfect mannequin is related to design selections of Algorithm (ENS ML), Goal (RET-MKT, RAW), Function (No Put up Publication, No Function Choice), and Coaching (Increasing Window, ExMicro Coaching Pattern). Alternatively, the worst-performing mannequin is related to the design selections of Algorithm (RF), Goal (RET-CAPM, RAW), Function (Sure Put up Publication, Sure Function Choice), and Coaching (Rolling Window, All Coaching Pattern). The small print of the top- and bottom-performing fashions are documented in Appendix Desk B.2. Aside from that, we additionally observe that every one the machine studying fashions carry out worse in recent times, significantly after 2004, which aligns with the findings of Blitz et al. (2023).

Determine 4 exhibits the portfolio returns in a field plot with the imply, median, first quartile, third quartile, minimal, and most values.The algorithm selection accommodates eleven alternate options, comprising linear strategies (OLS, ENET), tree-based strategies (RF and GB), neural networks with one to 5 hidden layers (NN1-NN5), in addition to an ensemble of all neural networks (ENS NN) and an ensemble of all non-linear ML strategies (ENS ML). The outcomes present that the composite strategies exhibit increased imply and median portfolio returns than the opposite 9 particular person algorithms. Whereas our main focus is to not evaluate particular person algorithms, we discover that the neural networks (NN) show higher efficiency, whereas random forest (RF), on common, performs the worst.”

Are you on the lookout for extra methods to examine? Join our publication or go to our Weblog or Screener.

Do you wish to be taught extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing supply.

Do you wish to be taught extra about Quantpedia Professional service? Test its description, watch movies, overview reporting capabilities and go to our pricing supply.

Are you on the lookout for historic knowledge or backtesting platforms? Test our checklist of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a good friend