Can Margin Debt Assist Predict SPY’s Progress & Bear Markets?

Navigating the monetary markets requires a eager understanding of danger sentiment, and one often-overlooked dataset that gives worthwhile insights is FINRA’s margin debt statistics. Reported month-to-month, these figures observe the full debit balances in clients’ securities margin accounts—a key proxy for speculative exercise out there. Since margin accounts are closely used for leveraged trades, shifts in margin debt ranges can sign adjustments in total danger urge for food. Our analysis explores how this dataset may be leveraged as a market timing device for US inventory indexes, enhancing conventional trend-following methods that rely solely on value motion. Given the present uncertainty surrounding Trump’s presidency, margin debt information might function a warning system, serving to traders distinguish between market corrections and deeper bear markets.

Borrowing to speculate is a standard technique that may amplify each returns and dangers in monetary markets. One key measure of this leverage is margin debt—the full quantity traders borrow to purchase shares utilizing their holdings as collateral. A rise in margin debt usually alerts rising investor confidence and a willingness to tackle extra danger, which might drive inventory costs increased. Conversely, a decline in margin debt might point out danger aversion, deleveraging, or market uncertainty, doubtlessly resulting in decrease inventory costs. Given its robust connection to market sentiment and liquidity, margin debt can function a worthwhile indicator of inventory market actions. Due to this fact, our aim is to discover how margin debt may be utilized to foretell SPY value development by growing a scientific funding technique.

FINRA was the supply for margin debt information, and information may be simply obtained beginning in 1998. Due to this fact, we used SPY as a proxy for the inventory market efficiency from January 30, 1998, to December 31, 2024. FINRA studies margin debt statistics month-to-month, so all calculations on this article are primarily based on month-to-month information, and every particular person examined technique was rebalanced month-to-month, too.

Methodology

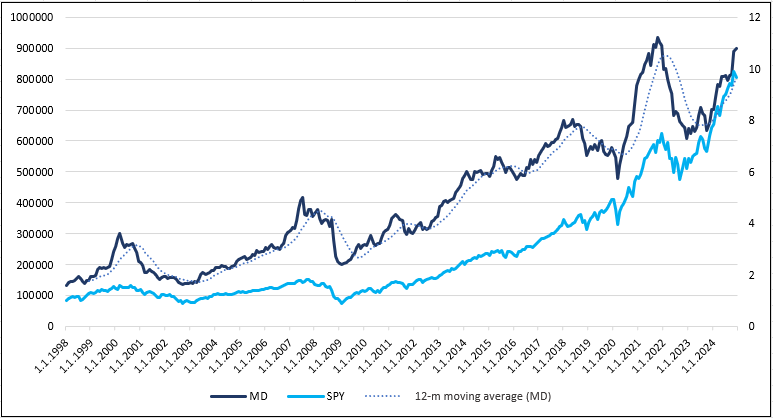

Much like our earlier market timing research (like Utilizing Inflation Knowledge for Systematic Gold and Treasury Funding Methods or Insights from the Geopolitical Sentiment Index made with Google Tendencies), we aimed firstly to know the habits of the brand new information set and visualization of the dataset helps with that:

Visible evaluation uncovers that the native peaks in margin debt appear to coincide in time with the native peaks within the SPY; nevertheless, on occasion, the margin debt peaks precede the SPY peaks by a number of months. The inventory market indexes are well-known for his or her trending habits, and trend-following guidelines work effectively on indexes. Due to this fact, our subsequent step was to attempt to use related trend-following guidelines additionally for the margin debt dataset and examine whether or not the alerts from the margin debt information outperform price-based alerts alone, alternatively, whether or not we will mix value and margin debt alerts to acquire methods with higher efficiency of return-to-risk rations then pure price-based pattern methods.

As we wish to examine the margin debt alerts (and the mixture of value + margin debt alerts) to price-based methods, we first should examine these price-based pattern methods to create a benchmark that we are going to then attempt to beat.

Our default “go to” price-based predictor for SPY is often a easy shifting common. We started with a 3-month shifting common and progressively elevated the window to 4, then 5 months, persevering with this course of till we reached a 12-month shifting common of SPY whole return (dividend & split-adjusted) value collection (normalized to start out at 1$ on January 30, 1998). On the finish of every month, the newest obtainable worth was in comparison with the shifting common. If the most recent SPY worth exceeded the shifting common, it signaled a SPY lengthy place for the following month. In any other case, we assumed that as an alternative of investing in a dangerous asset (SPY ETF), capital can be held in a low-risk asset represented by SHY ETF (iShares 1-3 12 months Treasury Bond ETF, a standard proxy for the low-risk, cash-like funding). This process was utilized to every shifting common interval. To find out how every pattern technique with every shifting common interval of SPY fared, we additionally visually in contrast particular person methods, following the method utilized in Methods to Enhance Commodity Momentum Utilizing Intra-Market Correlation. For higher perception, each month, the typical of all shifting averages was calculated to acquire the equally weighted common technique throughout every shifting common. This “common trend-following technique” is our proxy for the benchmark, and we wish to beat it with the utilization of the margin debt information.

Each numerical calculations and visible illustrations point out that SPY’s shifting averages are efficient predictors for SPY itself. The methods utilizing traits with medium size (6-12 months) all beat SPY on the efficiency foundation and return-to-risk foundation. Regardless that the efficiency of methods utilizing the 3-, 4-, and 5-month shifting averages are decrease than SPY’s, their normal deviation or most drawdown is considerably decrease than SPY’s and, due to this fact, have increased Sharpe and Calmar ratios. The typical of all the pattern methods additionally outperforms SPY in all elements (efficiency and return-to-risk measures, too).

Nevertheless, this isn’t a brand new truth. What pursuits us, nevertheless, is how methods primarily based on margin debt information will carry out as compared… Will they have the ability to obtain higher outcomes?

To find out whether or not the shifting common of margin debt is a greater predictor for SPY than its personal shifting common of value, we repeated the identical process and created methods primarily based on 10 totally different shifting averages of margin debt (3-month, 4-month, …, 12-month shifting averages). We additionally constructed an equally weighted technique combining these shifting averages and in contrast their efficiency to SPY’s efficiency.

The testing precept stays the identical: when the most recent obtainable margin debt worth was increased than its shifting common, we purchased SPY. In any other case, the capital was held in money. Nevertheless, margin debt information is often launched with a one-month lag, which means the purchase sign relies on month-old values, not like SPY’s shifting averages, which use real-time costs. So, for instance, for a shifting common calculation of the SPY on the finish of Could, we will use the value information from the tip of Could (as they’re identified on a tick-by-tick, second-to-second, minute-to-minute foundation). Alternatively, once we calculate the shifting common sign from the margin debt information, we use April because the final information level for the calculation on the finish of Could, as FINRA often distributes April’s information within the second half of Could and extra updated information should not obtainable at the moment.

At first look, there aren’t any clear visible variations between the fairness curves in Determine 2 and Determine 3. Due to this fact, numerical traits are extra informative. On common, return-to-risk measures from Desk 2 (methods utilizing margin debt information) exceed return-to-risk ratio measures of methods primarily based on value shifting averages alone. Due to this fact, we will conclude that, throughout our pattern, the margin debt methods have certainly profitably predicted SPY’s habits. Nevertheless, the value motion of SPY itself can also be a positive predictor. Due to this fact, within the subsequent half, we are going to mix these two predictors into one technique.

On this step, we determined to mix the 2 earlier methods and asses whether or not the mixed technique has higher market timing traits and outperforms particular person elements alone. Every shifting common interval of SPY was assigned the corresponding shifting common of margin debt for a similar interval. If the final obtainable information level of each information collection have been increased than their respective shifting averages on the identical time, we obtained a sign to spend money on SPY. In any other case, the capital was held within the risk-free asset (SHY ETF).

With this method, we created 10 new indicators, the 3-month shifting common of SPY mixed with the 3-month shifting common of margin debt, …, as much as the 12-month shifting averages of each. Equally weighted (common) technique of shifting common pairs was additionally constructed. As soon as once more, margin debt costs have been lagged by one month, whereas SPY costs have been updated at any given time.

Now, we will examine the ends in Desk 3 (mixed technique) with particular person predictors in Tables 1 & 2. On common, the return-to-risk measures of the mixed methods are increased than these of particular person elements, and this holds true primarily for the medium-term, 6-12-month horizons.

If we assessment the fairness curves of the mixed methods, we will see that over the past three years of the testing interval, SPY achieved increased returns than some mixed methods. In Desk 1 and Desk 2, we will see that shifting averages for shorter intervals, particularly 3-, 4-, and 5-month intervals, achieved decrease returns than the longer ones (6-12 months). This may be only a momentary setback, or it could recommend that longer time-frames (6-12 months) are higher suited as predictors for the underlying datasets. The 6- to 12-month interval can also be essentially the most used interval for trend-following predictors within the tutorial literature. For that reason, we determined to exclude 3- to 5-month interval from our ultimate mannequin.

The typical technique is now designed so that each month capital is equally distributed throughout seven methods utilizing the mixed shifting averages (the 6-month shifting common of SPY mixed with the 6-month shifting common of margin debt, …, as much as the 12-month shifting averages of each).

The thought of not constructing the ultimate technique on only one greatest parameter (for instance, 8-month shifting common), however averaging over extra parameters can also be supported by our findings from our older article – Methods to Select the Greatest Interval for Indicators. Our evaluation means that as an alternative of counting on a single indicator, a set of a number of indicators with totally different intervals ought to be used, as this method reduces the danger of underperformance in future intervals. If one indicator doesn’t carry out effectively within the out-of-sample interval, the others can compensate for its weak efficiency.

Earlier than we conclude, we might ask another query – Why not mix the very best shifting common interval of margin debt with the very best interval of the SPY’s shifting common? As proven in Determine 3, the 6-month shifting common of margin debt achieved considerably increased returns (and return-to-risk ratios) than different parameters. Nevertheless, we consider that this prevalence is only a stroke of luck and won’t be sustained sooner or later, and in the end, imply reversion will happen. Due to this fact, as soon as once more, we choose to unfold out bets within the portfolio amongst all the different parameters to have a extra secure mannequin.

Conclusion

Our expectations have been met— the margin debt dataset can certainly be used to foretell SPY’s value development. Whereas the shifting common of SPY alone serves as a powerful indicator, combining it with the shifting common of margin debt additional enhances its predictive energy. This impact is most pronounced for shifting averages with lengths between 6 and 12 months. The optimum method for mitigating the affect of attainable future imply reversion in returns is to distribute investments equally throughout a number of intervals of those mixed trend-following methods and make sure that if the efficiency of 1 specific shifting common interval declines, the others may also help maintain total profitability.

Creator: Sona Beluska, Quant Analyst, Quantpedia

Are you in search of extra methods to examine? Join our publication or go to our Weblog or Screener.

Do you wish to be taught extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you wish to be taught extra about Quantpedia Professional service? Test its description, watch movies, assessment reporting capabilities and go to our pricing provide.

Are you in search of historic information or backtesting platforms? Test our listing of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Bluesky, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a pal