Revisiting Pragmatic Asset Allocation: Easy Guidelines for Complicated Occasions

Pragmatic Asset Allocation (PAA) represents a portfolio building strategy that seeks to steadiness the advantages of systematic trend-following with the realities confronted by semi-active buyers (primarily taxes and lack of time to handle positions). Constructing upon the insights offered in Quantpedia’s preliminary overview and later within the follow-up, we see clear potential on this framework—particularly for long-term buyers who’re on the lookout for a center floor between passive indexing and absolutely dynamic tactical allocation.

Our perspective on PAA emphasizes its practicality, particularly when applied with a quarterly rebalancing frequency. This slower rebalancing schedule helps reduce transaction prices and short-term noise whereas additionally contributing to tax effectivity—two elements which might be typically missed in backtests however critically necessary in real-world portfolio administration. We additionally admire the mannequin’s flexibility, permitting buyers to combine each pattern and risk-based indicators with out counting on overly complicated heuristics or frequent turnover.

Roughly a month in the past, we ran a check and filtered asset allocation methods from our Screener and appeared for those who carried out nicely on a YTD foundation. A kind of fashions that fared surprisingly nicely was the Pragmatic Asset Allocation mannequin, and given the difficult market situations thus far in 2025, with blended indicators throughout asset courses and elevated macroeconomic uncertainty, we consider it is a perfect time to revisit the PAA framework. This evaluation could assist make clear whether or not a practical, rules-based strategy can nonetheless maintain its floor—and even outperform—in a yr when many fashions have struggled.

Revisiting PAA mannequin in 2024 – 2025

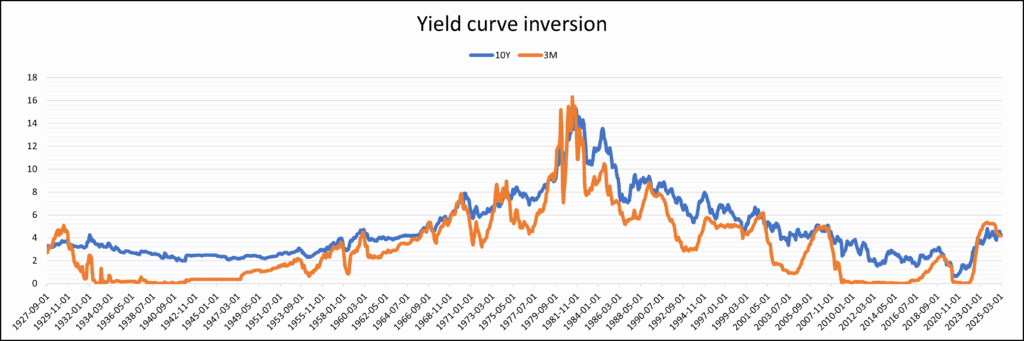

On this article, we revisit the PAA mannequin utilizing the identical approaches and methodology. As in earlier cases, we as soon as once more start with a close-up have a look at the yield curve inversion sign – the bottom of the mannequin’s construction.

In 2022, we noticed that 3-month yields had considerably jumped above the 10-year yield, and we have been curious how lengthy this inversion would final. On the time of writing our follow-up article, the length had reached 19 months — already a remarkably lengthy interval. Let’s take a more in-depth look.

The three-month yield was greater than the 10-year yield for a complete of 25 months, making it the longest yield curve inversion prior to now 100 years. Though the inversion briefly ended on the finish of 2024, the 2 yields at the moment are on the similar stage once more — signaling that the setting nonetheless is probably not optimum for equities into the long run (and we could enter the recession interval quickly).

This yr, investor confidence within the U.S. market has declined considerably resulting from political uncertainty surrounding Trump’s financial coverage selections. Shares have carried out poorly throughout the board, as we will observe in SPY’s efficiency proven in Determine 3.

Let’s now check out the PAA mannequin’s efficiency over the previous 5 years. As in our earlier article, we are going to study each the unique model of the PAA mannequin and a modified model with an adjusted yield curve (YC) sign. On this amended model, when the yield curve inverts, the present tranche is switched from dangerous belongings to the hedging portfolio or money — however the YC sign stays legitimate for less than 12 months.

In the long term, there was no vital distinction in efficiency, significantly up till the top of 2023. Since then, the 2 variations have been alternating in holding the lead in returns, however in the end, they normally converged to an analogous end result. That’s not stunning because the distinction in indicators is small and we acknowledged a number of occasions, that within the long-run, the efficiency of each variations will likely be very most likely practically the identical.

Nevertheless, within the quick run, there might be variations—the yr 2024 was higher for fairness markets, and 2025 is the yr of one other asset class: Gold.

Luckily, the PAA model utilizing the unique YC sign has a whole lot of Gold within the portfolio. Let’s assessment the present allocations (as reported in our Pragmatic Asset Allocation report, in Quantpedia’s Portfolio Evaluation part). For the reason that starting of 2025, it has been rising steadily, remaining largely unaffected by the current turmoil within the inventory market.

The PAA mannequin was, over the past quarter, roughly half allotted to gold, with a good portion in money and the rest in treasuries. This allocation proved extremely favorable within the current setting, because it averted publicity to the inventory market—leading to a worthwhile efficiency, as proven in Determine 7. Within the upcoming quarter, after greater than two years, the allocation to gold and money will likely be decreased and partially changed by positions in EEM and MSCI.

However, the PAA model with the amended YC sign, didn’t have nice begin in 2025. The fairness allocation that drastically boosted earnings in 2024 served as a drag on the efficiency in 2025.

As we will observe, the model with the amended YC sign was allotted primarily into U.S. tech shares (QQQ) and international equities (MSCI World), each of which have been impacted by the current turbulence within the inventory market. For the upcoming quarter, a smaller portion will likely be allotted to QQQ in favor of EEM. Nevertheless, resulting from extra diversified portfolio in comparison with SPY (extra non-US shares, small gold and money allocation), decline of this model of PAA has been extra reasonable, and as of the top of March, the return shouldn’t be as unfavourable as SPY’s.

What’s the principal takeaway?

We’ll merely recapitulate what we stated a yr earlier than – the sound long-term allocation mannequin is extra necessary than short-term variations within the portfolio construction. Within the quick time period, the efficiency of each PAA variations will barely differ; in the long run (many years), each variations will most likely carry out roughly the identical. Within the subsequent 3-6 months, the mannequin portfolios of each variations will come nearer to one another (and the fairness curves most likely, too). Our aim is for each variations of the mannequin to take care of a wholesome distance from the benchmark MSCI efficiency in the long run.

How will the long run appear to be? We have no idea. Nevertheless, semi-active fashions like PAA could also be a sensible selection, as stagflation dangers develop. Dynamic allocation permits them to shift from dangerous belongings to secure havens like gold or money when inflation rises and financial progress slows. Not like conventional portfolios, PAA adapts to market situations, serving to to scale back drawdowns and shield capital throughout risky durations. In a stagflationary setting, this flexibility could make a distinction.

Workforce Quantpedia

Are you on the lookout for extra methods to examine? Join our publication or go to our Screener or Weblog.

Do you wish to study extra about Quantpedia Premium service? Verify how Quantpedia works, our mission and Premium pricing supply.

Do you wish to study extra about Quantpedia Professional service? Verify its description, watch movies, assessment reporting capabilities and go to our pricing supply.

Are you on the lookout for historic knowledge or backtesting platforms? Verify our listing of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a buddy